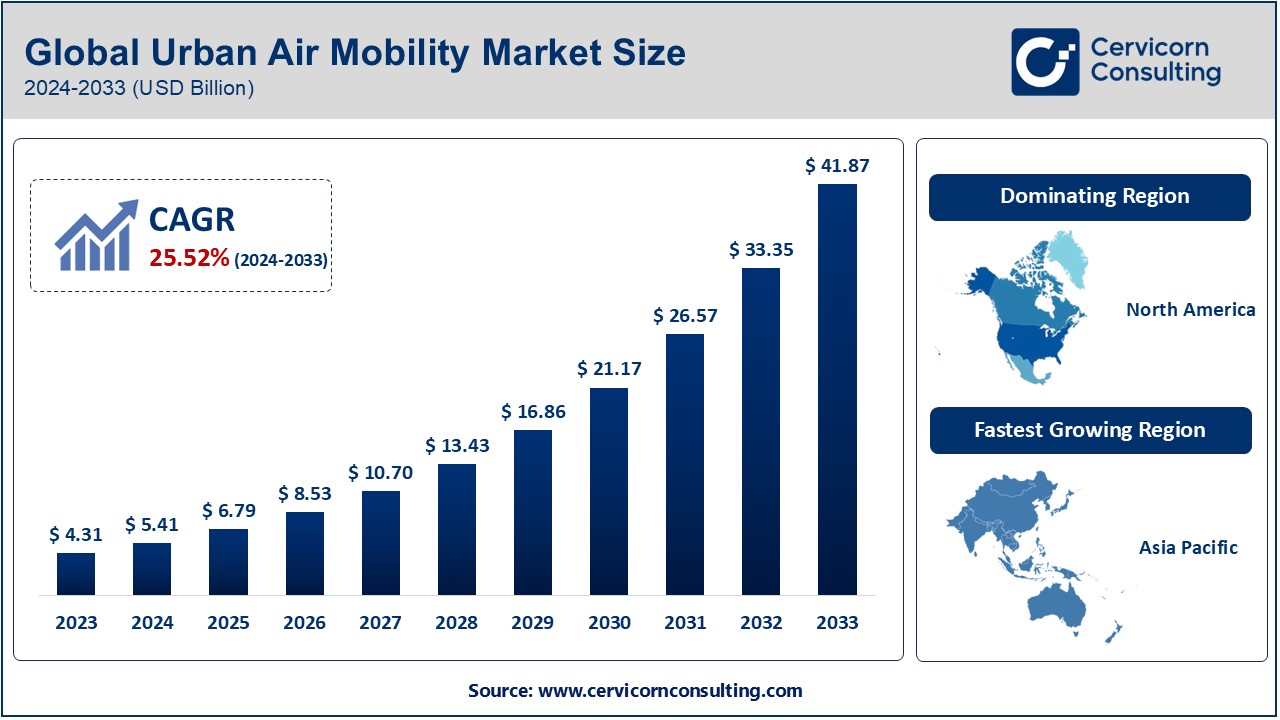

Urban Air Mobility Market Size to Hit USD 41.87 Billion Industry by 2033, Driven by eVTOL Innovations & Smart City Initiatives

Urban Air Mobility Market Size

The gobal urban air mobility market was worth USD 5.41 billion in 2024 and is anticipated to expand to around USD 41.87 billion by 2033, registering a compound annual growth rate (CAGR) of 25.52% from 2025 to 2034.

What is the Urban Air Mobility Market?

Urban Air Mobility (UAM) refers to the integration of aerial transportation systems into urban and suburban environments to facilitate the rapid movement of people and goods. UAM leverages advanced air mobility technologies, including electric vertical takeoff and landing (eVTOL) aircraft, to provide efficient, on-demand, and eco-friendly transportation solutions. This market spans a range of applications, from passenger transport to cargo delivery, emergency response, and urban surveillance, with the ultimate goal of reducing congestion in major metropolitan areas and improving mobility efficiency.

Why is Urban Air Mobility Important?

As urbanization accelerates globally, traditional transportation infrastructures are becoming increasingly congested, leading to inefficiencies, pollution, and extended travel times. UAM presents a revolutionary solution by utilizing vertical flight technologies, allowing for seamless integration into existing urban frameworks. It has the potential to reduce travel time significantly, lower carbon emissions, and enhance accessibility, particularly in areas with limited ground transport options. Furthermore, the development of autonomous and electric aviation solutions aligns with global sustainability goals, fostering a new era of smart mobility.

Urban Air Mobility Market Growth Factors

The UAM market is driven by several factors, including advancements in electric propulsion technology, increased investments in autonomous flight systems, urbanization trends, and growing environmental concerns. The adoption of artificial intelligence (AI) and data analytics to optimize flight operations and air traffic management further fuels market growth. Additionally, regulatory frameworks, government policies, and collaborations between aerospace companies and technology firms play a crucial role in accelerating the commercialization of UAM solutions. Public acceptance, infrastructure development, and safety concerns remain key challenges, but continued innovation and investment are expected to drive the market forward.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2432

Urban Air Mobility Market: Top Companies

1. Airbus

- Specialization: Aerospace manufacturing, eVTOL development

- Key Focus Areas: Passenger air mobility, electric and hybrid propulsion, autonomous flight

- Notable Features: Airbus CityAirbus NextGen, advanced safety and noise reduction technologies

- 2024 Revenue (approx.): $85 billion

- Market Share (approx.): 20%

- Global Presence: Strong foothold in Europe, North America, and Asia-Pacific

2. Boeing

- Specialization: Aerospace and defense, urban air mobility research

- Key Focus Areas: Autonomous air taxis, electric propulsion, integration with existing air traffic management

- Notable Features: Boeing NeXt program, collaboration with Wisk Aero for UAM solutions

- 2024 Revenue (approx.): $95 billion

- Market Share (approx.): 25%

- Global Presence: North America, Europe, Middle East, Asia-Pacific

3. Joby Aviation

- Specialization: eVTOL aircraft manufacturing, ride-sharing air transport

- Key Focus Areas: Fully electric aircraft, quiet urban flight, commercial air taxi services

- Notable Features: Joby eVTOL (five-seat aircraft, 150-mile range)

- 2024 Revenue (approx.): $500 million

- Market Share (approx.): 10%

- Global Presence: United States, initial expansion into Europe and Asia

4. Lilium

- Specialization: Electric jet-powered UAM solutions

- Key Focus Areas: High-speed air mobility, regional connectivity, zero-emission aircraft

- Notable Features: Lilium Jet, innovative ducted fan technology

- 2024 Revenue (approx.): $400 million

- Market Share (approx.): 8%

- Global Presence: Europe, North America, Middle East

5. Volocopter

- Specialization: Urban air taxi services, cargo drones

- Key Focus Areas: eVTOL aircraft, short-distance urban flights, infrastructure development

- Notable Features: Volocopter 2X, VoloCity, VoloDrone

- 2024 Revenue (approx.): $300 million

- Market Share (approx.): 7%

- Global Presence: Europe, Asia, limited operations in North America

Leading Trends and Their Impact

- Electrification of Air Mobility – The shift toward all-electric propulsion systems is reducing operational costs, emissions, and noise pollution, making UAM more sustainable and accessible.

- Integration of AI and Autonomy – AI-driven automation is enhancing safety, efficiency, and scalability of UAM solutions, reducing reliance on human pilots.

- Infrastructure Development – The expansion of vertiports and charging stations is crucial for the widespread adoption of UAM services.

- Collaboration with Ride-Sharing Platforms – Partnerships between aerospace firms and ride-sharing giants like Uber and Lyft are paving the way for seamless urban transport integration.

- Government Incentives and Regulations – Policymakers are increasingly supporting UAM through funding, regulatory frameworks, and air traffic management initiatives.

Successful Examples of Urban Air Mobility Around the World

- Dubai’s Autonomous Aerial Taxi – The Roads and Transport Authority (RTA) of Dubai has partnered with Volocopter to introduce autonomous air taxi services.

- Los Angeles Urban Air Mobility Partnership – Joby Aviation, in collaboration with NASA and local governments, is testing UAM solutions for future deployment.

- Germany’s UAM Initiatives – Lilium and Volocopter are leading the development of UAM infrastructure, supported by the German government.

- China’s eVTOL Advancements – EHang, a Chinese UAM company, has successfully conducted autonomous passenger flights in major cities.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- United States: The Federal Aviation Administration (FAA) is developing new airspace management frameworks for UAM operations. Investments from NASA and major aerospace firms support market expansion.

- Canada: Transport Canada is working on regulations for eVTOL aircraft to facilitate the adoption of UAM.

Europe

- Germany: The German government is funding multiple UAM projects, including the Lilium Jet and Volocopter initiatives.

- France: The Paris 2024 Olympics will serve as a launch platform for UAM pilot projects.

Asia-Pacific

- China: The Civil Aviation Administration of China (CAAC) is fast-tracking UAM regulations, and companies like EHang are leading the charge.

- Japan: The government is supporting UAM trials in preparation for commercial launch by 2025.

Middle East & Africa

- United Arab Emirates: Dubai’s Smart City initiative includes UAM as a key focus area, with government support for aerial taxi services.

- Saudi Arabia: The Vision 2030 plan incorporates UAM as part of its futuristic urban mobility strategy.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Video Games Market Expansion to USD 694.32 Bn Will Reshape Entertainment