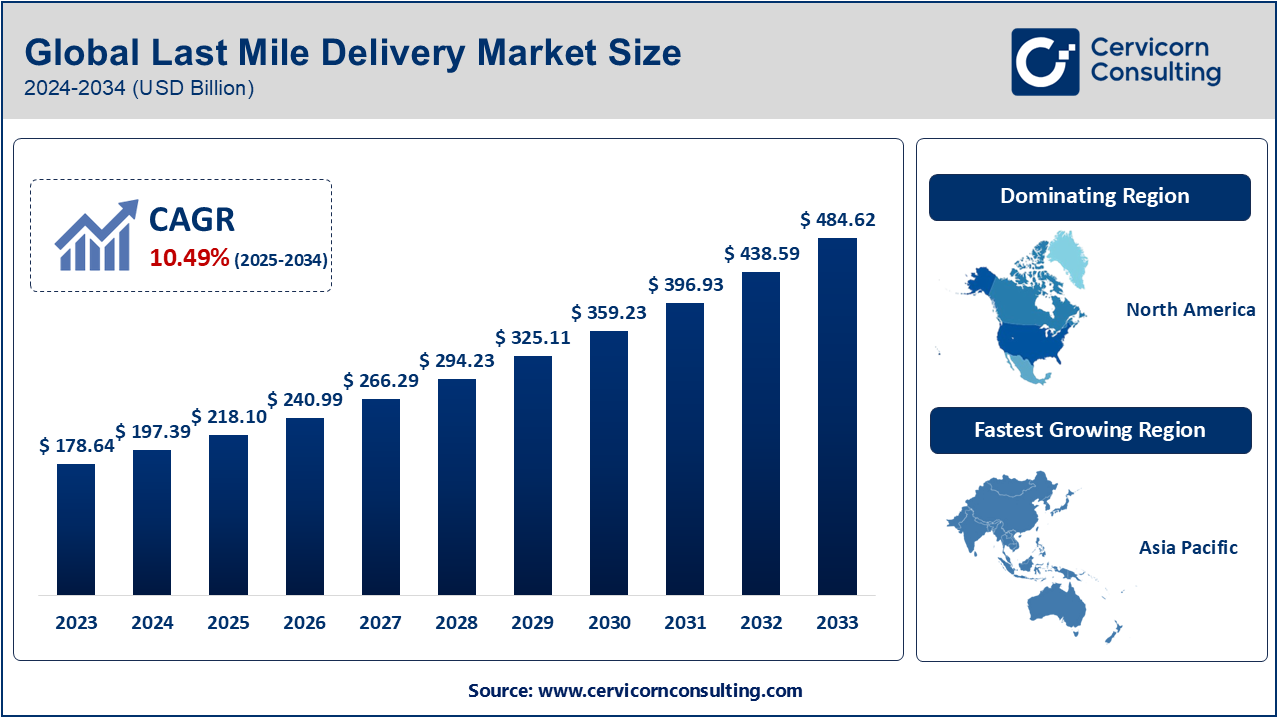

Last Mile Delivery Market Size Worth USD 484.62 Billion by 2034 | Growth Trends & Forecasts

Last Mile Delivery Market Size

The global last mile delivery market was worth USD 178.64 billion in 2024 and is anticipated to expand to around USD 484.62 billion by 2034, registering a compound annual growth rate (CAGR) of 10.49% from 2025 to 2034.

Understanding the Last Mile Delivery Market

The last mile delivery market refers to the final step in the delivery process, where goods are transported from a distribution center or facility to the end consumer’s location. This segment is crucial as it directly impacts customer satisfaction, delivery speed, and overall logistics efficiency. In 2024, the global last mile delivery market is valued at approximately USD 190 billion, with projections indicating growth to USD 343.12 billion by 2032, driven by factors such as the rapid expansion of e-commerce, increasing consumer demand for quick and efficient delivery, and technological advancements in logistics operations .

Importance of Last Mile Delivery

Last mile delivery is vital because it represents the final touchpoint between businesses and consumers. Efficient last mile solutions enhance customer satisfaction by ensuring timely and accurate deliveries. Moreover, as online shopping becomes more prevalent, the demand for reliable last mile services grows, making it a critical component for businesses aiming to maintain competitiveness in the digital marketplace.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2625

Top Companies in the Last Mile Delivery Market

Flirtey

- Specialization: Drone-based last mile delivery.

- Key Focus Areas: Developing autonomous drone delivery systems for various applications, including food and medical supplies.

- Notable Features: Pioneered the first FAA-approved drone delivery in the U.S.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Data not publicly disclosed.

- Global Presence: Primarily operating in the United States with plans for expansion.

Amazon Logistics

- Specialization: Comprehensive logistics and delivery services for Amazon orders.

- Key Focus Areas: Enhancing delivery speed and efficiency through technology and infrastructure investments.

- Notable Features: Utilizes a vast network of delivery stations, drivers, and advanced tracking systems.

- 2024 Revenue (approx.): Part of Amazon’s overall revenue; specific figures for Amazon Logistics are not separately disclosed.

- Market Share (approx.): Significant share in the e-commerce delivery segment, exact figures not publicly available.

- Global Presence: Operates in multiple countries, including the U.S., UK, Germany, and India.

Deutsche Post AG (DHL)

- Specialization: International express mail and logistics services.

- Key Focus Areas: Sustainable logistics solutions and global supply chain management.

- Notable Features: Investments in electric delivery vehicles and carbon-neutral shipping options.

- 2024 Revenue (approx.): DHL’s parent company, Deutsche Post AG, reported revenues exceeding €80 billion.

- Market Share (approx.): One of the leading global logistics providers, exact market share varies by region.

- Global Presence: Extensive operations in over 220 countries and territories worldwide.

XPO Logistics, Inc.

- Specialization: Supply chain solutions, including last mile logistics.

- Key Focus Areas: Providing technology-enabled transportation and logistics services.

- Notable Features: Utilizes advanced analytics and automation to optimize delivery routes and schedules.

- 2024 Revenue (approx.): Reported revenues around $7.7 billion.

- Market Share (approx.): Significant presence in North America, with growing operations in Europe.

- Global Presence: Operations primarily in the U.S. and Europe.

A1 Express Services Inc.

- Specialization: Same-day courier and delivery services.

- Key Focus Areas: Providing rapid delivery solutions for businesses and individuals.

- Notable Features: Offers a range of services, including scheduled deliveries and on-demand courier options.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Operates regionally within the U.S.; specific market share data not available.

- Global Presence: Primarily serves clients within the United States.

Leading Trends and Their Impact

- Autonomous Delivery Vehicles and Drones: Companies are increasingly adopting autonomous vehicles and drones to enhance delivery efficiency and reduce labor costs. For instance, Zipline has completed over 1.3 million deliveries in the U.S., showcasing the potential of drone technology in last mile logistics.

- Artificial Intelligence (AI) and Route Optimization: AI-driven route optimization tools are becoming essential for improving delivery times and reducing operational costs. These technologies analyze traffic patterns, weather conditions, and delivery windows to determine the most efficient routes.

- Sustainability Initiatives: Environmental concerns are prompting companies to invest in eco-friendly delivery options, such as electric vehicles and bike couriers. For example, FedEx plans to have its entire parcel pickup and delivery fleet converted to electric vehicles by 2040.

- Micro-Fulfillment Centers: The establishment of small-scale warehouses in urban areas allows for faster and more efficient deliveries by bringing inventory closer to consumers.

Successful Examples Around the World

- Zipline in the U.S.: Zipline’s drone delivery service has successfully completed over 1.3 million deliveries, primarily focusing on medical supplies and food delivery, demonstrating the viability of drone technology in last mile logistics.

- Wing in Australia and the U.S.: Wing, a subsidiary of Alphabet, has expanded its drone delivery services, completing over 200,000 commercial deliveries in countries like Australia and the U.S., highlighting the growing acceptance of drone deliveries in urban settings.

- Cainiao in China: Cainiao, Alibaba’s logistics arm, is revolutionizing deliveries through automated delivery carts and a comprehensive logistics strategy, aiming to deliver packages within 72 hours globally at minimal costs.

Regional Analysis and Government Initiatives

- North America: Holding approximately 37.7% of the market share in 2025, North America leads in last mile delivery services, driven by the rise of e-commerce and consumer demand for fast shipping options. Initiatives like Amazon’s Hub Delivery program collaborate with small businesses to enhance delivery capabilities.

- Asia Pacific: Emerging as the fastest-growing market, countries like India and China are experiencing significant growth in last mile delivery services due to rapid urbanization and increasing online shopping. Local logistics companies are investing in innovative delivery models to cater to evolving consumer needs.

- Europe: European countries are focusing on sustainable delivery methods, with investments in electric vehicles and regulations promoting eco-friendly logistics solutions.

- Government Policies: Governments worldwide are implementing policies to support the growth of last mile delivery services, including investments in infrastructure, regulatory frameworks for autonomous vehicles and drones, and incentives for sustainable practices.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: E-Commerce Market Trends, Top Companies, and Regional Insights by 2034