Fertility Services Market Size & Growth Outlook 2024–2034

Fertility Services Market Size

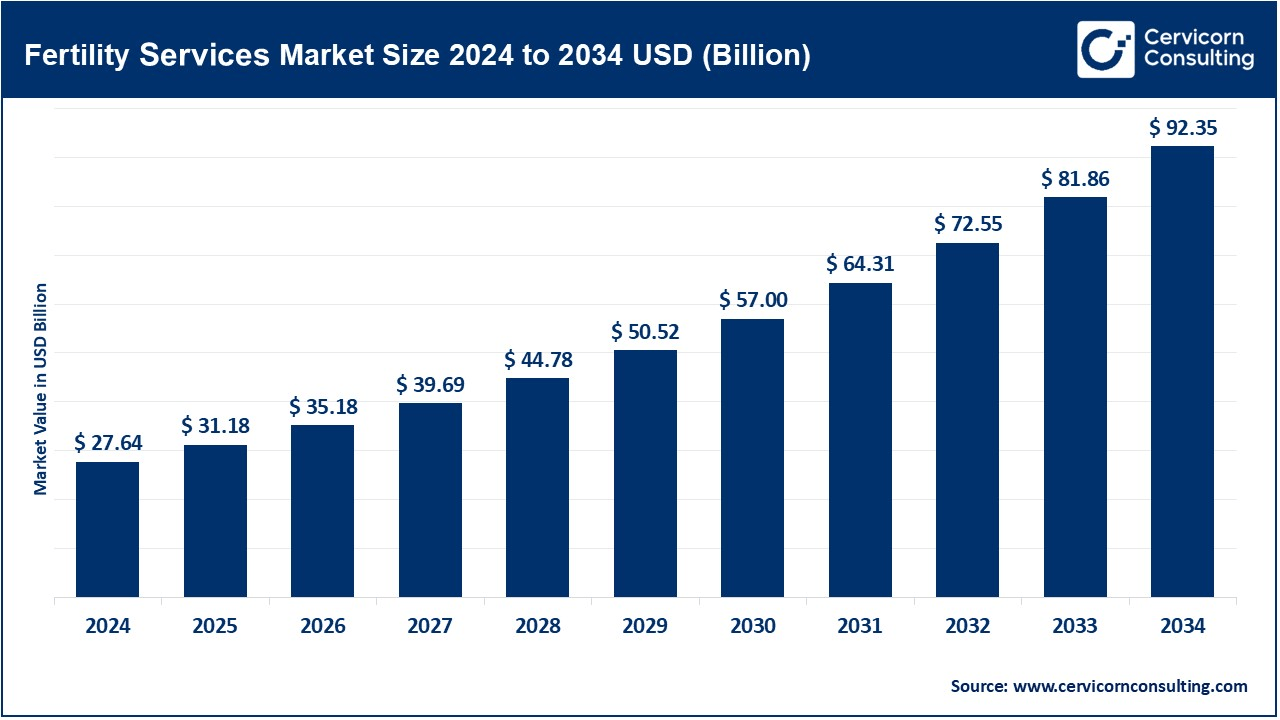

The global fertility services market was worth USD 27.64 billion in 2024 and is anticipated to expand to around USD 92.35 billion by 2034, registering a compound annual growth rate (CAGR) of 12.82% from 2025 to 2034.

What is the Fertility Services Market?

The fertility services market encompasses a broad array of medical services and assisted reproductive technologies (ART) designed to aid individuals and couples in achieving pregnancy. This includes in-vitro fertilization (IVF), intrauterine insemination (IUI), egg and sperm donation, fertility preservation techniques, surrogacy, hormonal treatments, and counseling services. Fertility clinics, hospitals, and diagnostic centers globally offer these services to address a growing population affected by infertility, a condition defined as the inability to conceive after a year or more of regular unprotected intercourse. The market integrates medical diagnostics, laboratory technologies, pharmaceuticals, and patient-centered care to address reproductive challenges.

Why is the Fertility Services Market Important?

The rising global prevalence of infertility—affecting approximately 1 in 6 people during their lifetime—has brought fertility services to the forefront of modern healthcare. Socioeconomic changes, including delayed parenthood due to career prioritization, urbanization, and evolving family structures, have also heightened demand. Moreover, medical conditions like polycystic ovary syndrome (PCOS), endometriosis, low sperm count, and obesity contribute significantly to reproductive health issues. The fertility services market plays a vital role in supporting individuals across all gender identities, sexual orientations, and relationship statuses. It also intersects with ethical, legal, and cultural considerations, particularly in areas such as surrogacy and gamete donation. This market is pivotal in reshaping societal norms around conception, offering hope to millions while pushing the boundaries of medical innovation.

Fertility Services Market Growth Factors

The fertility services market is experiencing exponential growth, driven by a combination of rising infertility rates due to lifestyle disorders, growing awareness of ART procedures, expanding insurance coverage in developed and emerging markets, and technological advancements such as AI in embryo selection, time-lapse imaging, and cryopreservation. Additionally, societal shifts including delayed marriages, career-focused lifestyles, increased acceptance of single-parent and LGBTQ+ families, and a growing medical tourism sector in countries like India and Thailand have further contributed to demand. Furthermore, government initiatives supporting reproductive health, along with strategic mergers and acquisitions among leading players, have reinforced infrastructure and accessibility, fueling market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2614

Top Companies in the Fertility Services Market

1. Olympus Corporation

- Specialization: Diagnostic imaging, endoscopy, and advanced medical devices used in reproductive surgeries.

- Key Focus Areas: Hysteroscopy systems, laparoscopic equipment for fertility surgeries, and precision imaging for diagnostic procedures.

- Notable Features: Integration of high-definition visualization technology with surgical instruments enhances the precision of ART-related surgeries.

- 2024 Revenue: Estimated at $6.9 billion (medical segment), with reproductive health contributing significantly via diagnostic endoscopy tools.

- Market Share: Approximately 5–7% in the fertility equipment sub-segment.

- Global Presence: Strong presence in Asia-Pacific, North America, and Europe, with manufacturing hubs in Japan, the U.S., and Germany.

2. The Cooper Companies Inc.

- Specialization: Women’s health, fertility, and vision care.

- Key Focus Areas: Fertility diagnostics, genetic testing, and embryo freezing technologies via its CooperSurgical division.

- Notable Features: Offers a full suite of IVF lab instruments, including embryo culture media, vitrification systems, and PGT-A solutions.

- 2024 Revenue: Estimated at $3.6 billion, with CooperSurgical contributing around $1.5 billion.

- Market Share: Estimated 9–11% in the global fertility solutions space.

- Global Presence: Extensive reach in North America, Europe, Australia, and emerging markets.

3. Instituto Bernabeu

- Specialization: IVF treatments, fertility preservation, and reproductive genetics.

- Key Focus Areas: Personalized medicine in fertility, recurrent miscarriage diagnostics, and egg donation programs.

- Notable Features: Pioneered embryonic genetics integration with IVF for recurrent pregnancy loss; renowned for high success rates.

- 2024 Revenue: Estimated at $120–140 million, driven largely by European medical tourism.

- Market Share: Holds a dominant regional share in Southern Europe (Spain, Italy).

- Global Presence: Clinics in Spain, Italy, and UK, with clients from over 50 countries.

4. Virtus Health

- Specialization: Assisted reproductive services, day hospitals, and pathology.

- Key Focus Areas: IVF, ICSI, donor programs, and fertility preservation.

- Notable Features: Among the top three IVF providers in Australia; also operates in Ireland and Denmark.

- 2024 Revenue: Expected at $400–450 million, with international markets contributing 35%.

- Market Share: Approx. 5–6% in the ANZ region.

- Global Presence: Strong footprint in Australia, Ireland, and Nordic countries.

5. CooperSurgical, Inc.

- Specialization: Reproductive genomics and surgical products for women’s health.

- Key Focus Areas: IVF, cryopreservation, PGT, lab instruments, and donor sperm/egg services.

- Notable Features: Acquired several fertility tech firms; offers comprehensive lab-to-clinic fertility solutions.

- 2024 Revenue: Roughly $1.5 billion, as part of The Cooper Companies.

- Market Share: Around 10% globally in fertility lab solutions.

- Global Presence: Operations in over 20 countries, including U.S., UK, Australia, and Japan.

Leading Trends and Their Impact

1. Artificial Intelligence and Automation

AI is revolutionizing embryo selection through image-based grading, leading to higher implantation rates and lower chances of multiple pregnancies. Automation in cryopreservation and sperm analysis also minimizes human error and accelerates processing time.

2. Oncofertility and Fertility Preservation

Rising cancer survivorship has led to increased demand for gamete preservation prior to chemotherapy or radiotherapy. Many clinics now offer oocyte vitrification and ovarian tissue freezing as routine services.

3. Rise in LGBTQ+ and Single Parent Fertility Services

Growing inclusivity and changing laws have expanded fertility offerings to same-sex couples and single individuals, especially in North America and Western Europe.

4. Cross-Border Reproductive Care (CBRC)

High costs and legal restrictions in some countries have fueled medical tourism. Countries like India, Czech Republic, and Thailand are becoming hubs for low-cost, high-quality fertility care.

5. Genetic Screening and Personalized Reproductive Medicine

Preimplantation genetic testing (PGT-A, PGT-M) is enabling personalized treatment plans and reducing miscarriage rates. This trend also supports embryo banking and delayed parenthood.

Successful Examples Around the World

- Spain: Clinics like Instituto Bernabeu and IVI-RMA Global have become global destinations for fertility treatments, with high success rates and liberal laws on egg/sperm donation.

- United States: Home to advanced clinics such as CCRM and Boston IVF, where AI-powered embryo grading and cutting-edge research have set global benchmarks.

- India: Institutions like Nova IVF and Apollo Fertility serve both domestic and international patients due to cost-efficiency, English-speaking staff, and advanced equipment.

- Australia: Virtus Health and Monash IVF offer world-class services with strong insurance frameworks and government support.

- Scandinavia: Countries like Denmark offer highly regulated and inclusive fertility services, with robust donor programs and government reimbursements.

Regional Analysis and Government Initiatives

North America

- United States: High adoption of ART with nearly 330,000 ART cycles in 2023. No federal insurance mandate, but 20+ states have some form of IVF coverage.

- Canada: Government-funded IVF for the first cycle in provinces like Ontario. Surrogacy laws favorable compared to the U.S.

Europe

- Western Europe: Progressive ART regulations in Spain, Belgium, and Denmark. Government subsidies for certain procedures are common.

- Eastern Europe: Growing as a low-cost destination for IVF. Ukraine and Czech Republic known for donor egg programs.

Asia-Pacific

- India: Rapidly expanding market due to low-cost IVF, skilled professionals, and a growing middle class. The 2021 ART Regulation Act has standardized practices.

- China: Government has recently relaxed family planning rules. Public hospitals now offer subsidized IVF.

- Japan: Aging population has led to increased support for fertility treatments, with national subsidies now covering ART cycles.

Middle East & Africa

- UAE and Israel are regional fertility hubs. Israel provides one of the most comprehensive IVF insurance schemes globally.

- South Africa: Home to world-class clinics attracting European and American patients seeking donor services and IVF.

Latin America

- Countries like Argentina, Brazil, and Mexico are experiencing demand due to cost advantages and skilled providers. Government funding is limited but private clinics are growing.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Full-Service CRO Market Trends, Growth Drivers, and Global Outlook 2024–2034