Dental Service Organization Market Trends, Growth, and Key Insights (2025-2034)

Dental Service Organization Market Overview

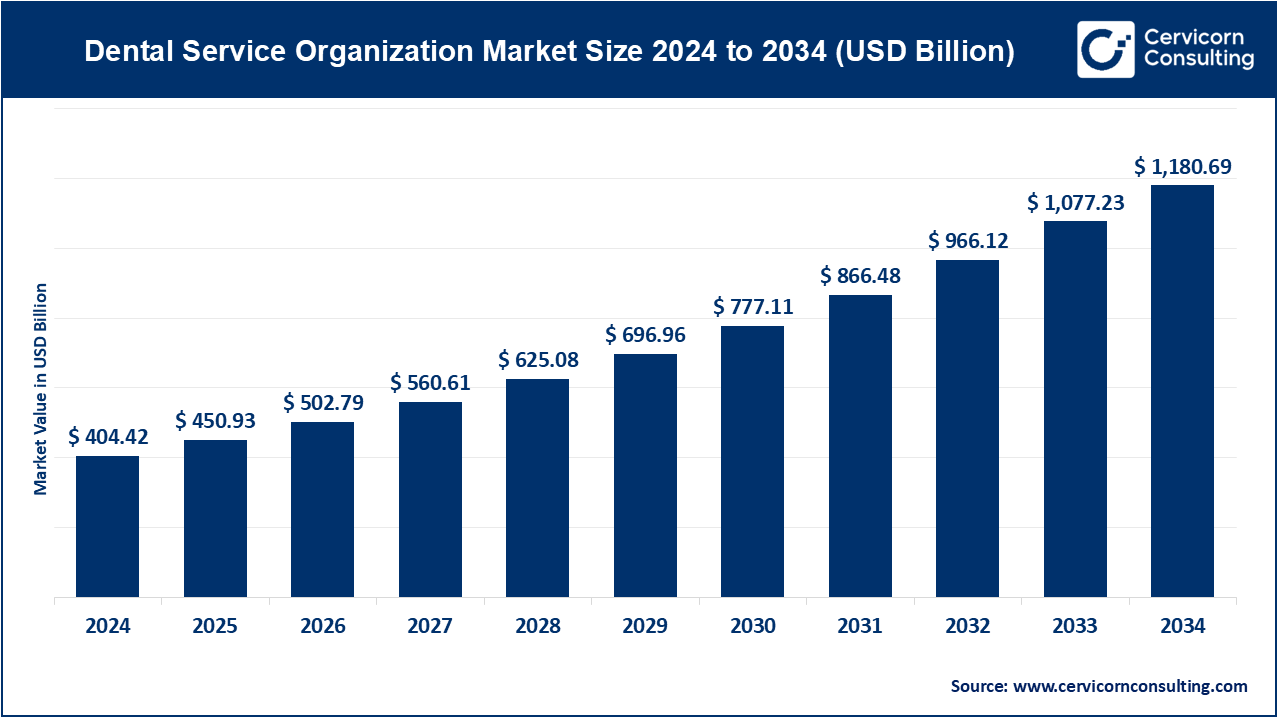

The global dental service organization market was valued at USD 404.42 billion in 2024 and is expected to exceed USD 1,180.69 billion by 2034, registering a CAGR of 11.5% from 2025 to 2034. Multiple factors, including the increasing demand for cost-effective dental care, advancements in dental technology, and the rising prevalence of oral health issues fuel the dental service organization market growth. Additionally, changing consumer expectations for seamless, high-quality services and a focus on preventive care are driving market expansion. The support provided by DSOs for compliance with complex healthcare regulations also enhances their appeal among dental practitioners.

Understanding the Dental Service Organization Market

The dental service organization market represents a rapidly growing segment of the dental healthcare industry. DSOs are entities that manage the business and administrative aspects of dental practices, allowing dentists to focus exclusively on providing clinical care. These organizations handle tasks such as human resources, marketing, billing, compliance, and supply chain management. This business model provides scalability, efficiency, and consistency across multiple locations, making it an attractive choice for independent dental practices looking to streamline operations and enhance patient care.

Importance of the Dental Service Organization Market

The importance of the dental service organization market lies in its ability to bridge the gap between operational efficiency and high-quality dental care. DSOs enable smaller practices to leverage economies of scale, access advanced technologies, and navigate regulatory complexities with greater ease. By alleviating administrative burdens, they allow dentists to focus on delivering better patient outcomes. Additionally, DSOs play a crucial role in expanding access to dental care, particularly in underserved regions, by providing the infrastructure and resources needed for new practice establishments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2341

Top Companies in the Global Dental Service Organization Market

1. Aspen Dental Management, Inc. (ADMI)

- Specialization: General dentistry, orthodontics, oral surgery.

- Key Focus Areas: Patient-centered care, accessibility, and affordability.

- Notable Features: Offers comprehensive support services, from IT infrastructure to marketing.

- 2024 Revenue (Approx.): $1.2 billion.

- Market Share (Approx.): 15%.

- Global Presence: Over 1,000 locations across the U.S.

2. Heartland Dental

- Specialization: Full-service dentistry including implants, oral hygiene, and orthodontics.

- Key Focus Areas: Professional training for dentists, patient satisfaction.

- Notable Features: Focus on doctor-led clinics with extensive continuing education programs.

- 2024 Revenue (Approx.): $1.5 billion.

- Market Share (Approx.): 18%.

- Global Presence: Over 1,600 offices in the U.S.

3. Pacific Dental Services (PDS)

- Specialization: General dentistry and specialty dental services.

- Key Focus Areas: Integrating digital solutions and patient-first strategies.

- Notable Features: Emphasis on the use of advanced dental technologies such as CAD/CAM and CBCT.

- 2024 Revenue (Approx.): $1.3 billion.

- Market Share (Approx.): 16%.

- Global Presence: Active in multiple states across the U.S.

4. Smile Brands Inc.

- Specialization: Comprehensive dental care, including cosmetic dentistry.

- Key Focus Areas: Expanding access to care, patient experience.

- Notable Features: Multi-brand strategy with Smile Brands, Bright Now! Dental, and others.

- 2024 Revenue (Approx.): $900 million.

- Market Share (Approx.): 11%.

- Global Presence: Over 700 affiliated offices in the U.S.

5. Dental Care Alliance (DCA)

- Specialization: Multi-specialty practices including pediatrics and periodontics.

- Key Focus Areas: Strategic growth and collaborative partnerships.

- Notable Features: Focus on innovative practice management and training programs.

- 2024 Revenue (Approx.): $800 million.

- Market Share (Approx.): 10%.

- Global Presence: More than 330 affiliated practices in 20 states.

Leading Trends and Their Impact

- Digital Transformation: Technologies like AI, 3D printing, and teledentistry are revolutionizing patient diagnostics and care delivery. DSOs adopting these innovations are setting benchmarks in operational efficiency and patient satisfaction.

- Focus on Preventive Care: There’s a shift toward preventive dentistry, driven by increased awareness of oral health’s impact on overall well-being. DSOs are leading this change by promoting regular check-ups and hygiene services.

- Consolidation: Smaller practices are merging into DSOs to benefit from shared resources and expertise, resulting in market consolidation and the creation of robust networks.

- Patient-Centric Models: Emphasizing personalized care and seamless service delivery, DSOs are leveraging data analytics to tailor treatment plans and enhance patient engagement.

Successful Examples of DSOs Globally

- Bupa Dental Corporation (Australia and New Zealand): As one of the largest DSOs in the region, Bupa operates over 240 practices, offering integrated care that combines general dentistry with specialty services. Their focus on digital health solutions has set them apart.

- Colosseum Dental Group (Europe): Operating in 11 countries, including the UK and Germany, Colosseum Dental Group excels in providing affordable and accessible dental care. They are known for their commitment to clinical excellence and robust training programs.

- InterDent (U.S.): Specializing in comprehensive multi-specialty care, InterDent’s success is attributed to its patient-first approach and extensive network of over 175 affiliated practices across the U.S.

Regional Analysis

North America

- Government Initiatives and Policies: Incentives for expanding dental care access in underserved areas, including rural regions, have bolstered the DSO market. The Affordable Care Act’s emphasis on preventive care has also played a role.

- Market Dynamics: The U.S. dominates the global DSO market, driven by a high concentration of DSOs and strong demand for advanced dental care services.

Europe

- Government Initiatives and Policies: Public health campaigns and subsidies for dental care in countries like the UK and Germany support market growth.

- Market Dynamics: The growing trend of privatization in healthcare is paving the way for DSOs to expand across the region.

Asia-Pacific

- Government Initiatives and Policies: Increased healthcare spending in countries like China and India, coupled with oral health awareness campaigns, is fostering market growth.

- Market Dynamics: The region is witnessing rapid DSO adoption, driven by a burgeoning middle class and demand for quality dental care.

Latin America

- Government Initiatives and Policies: Efforts to improve oral healthcare access in countries like Brazil and Mexico are providing growth opportunities for DSOs.

- Market Dynamics: Though at a nascent stage, the DSO market in this region is poised for significant growth, supported by urbanization and improved healthcare infrastructure.

Middle East and Africa

- Government Initiatives and Policies: Investment in healthcare infrastructure and public-private partnerships are driving the dental care sector.

- Market Dynamics: Limited but growing DSO presence, with increasing interest from global players looking to enter the market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Dental Services Market Trends, Growth, and Key Insights (2024-2033)