Connected Health and Wellness Solutions Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Connected Health and Wellness Solutions Market Size

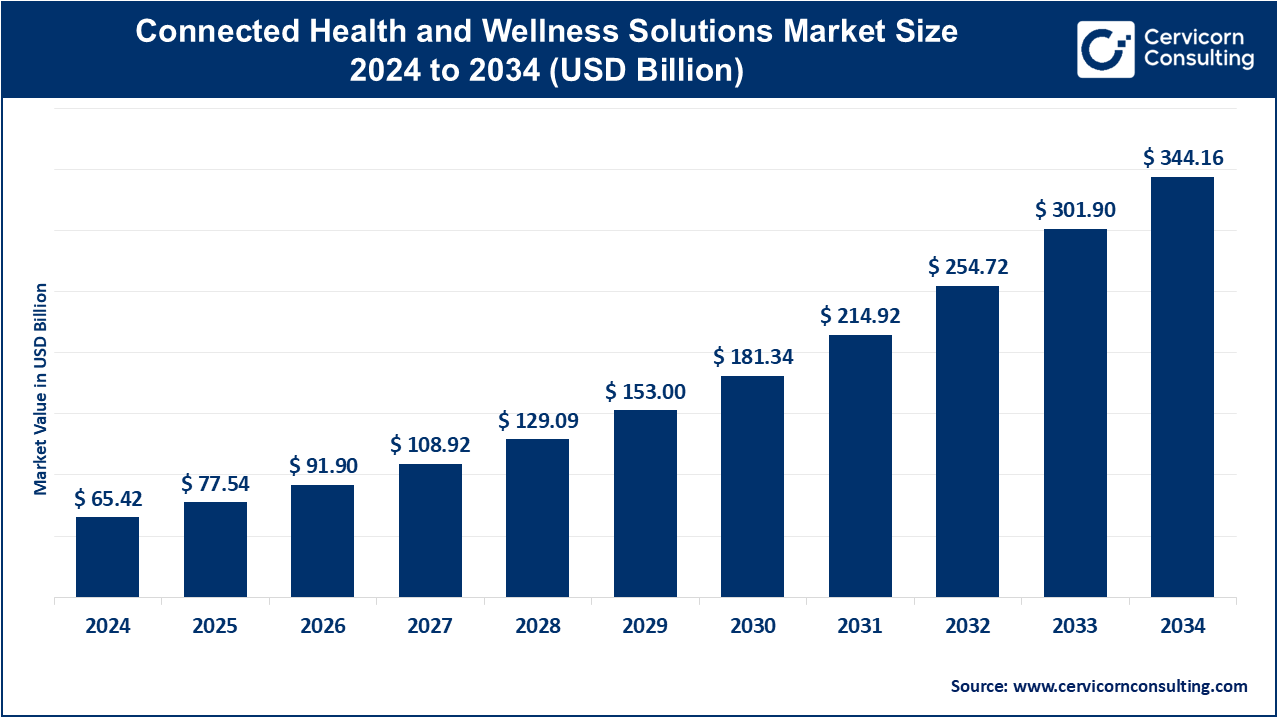

The global connected health and wellness solutions market size was worth USD 65.42 billion in 2024 and is anticipated to expand to around USD 344.16 billion by 2034, registering a compound annual growth rate (CAGR) of 18.06% from 2025 to 2034.

What Is the Connected Health and Wellness Solutions Market?

The connected health and wellness solutions market consists of digital tools that collect, integrate, and analyse health-related data from individuals and patients. These tools include consumer wearables (smartwatches, fitness trackers), medical-grade remote patient monitoring devices (blood pressure cuffs, ECG patches, glucose monitors), health and wellness mobile applications, telehealth platforms, digital therapeutics, and back-end cloud-based analytics solutions.

Essentially, the market enables:

- Continuous health tracking

- Remote consultations

- Data-driven preventive care

- Personalised health interventions

- Virtual disease management

- Decentralised clinical trials

The ecosystem includes technology companies, medical device manufacturers, software providers, payers, healthcare institutions, research organizations, and wellness solution developers. Their interconnected offerings help convert raw sensor data into insights, behavioural nudges, clinical decisions, and population health interventions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2415

Why Is This Market Important?

- Prevention over cure

Connected health devices allow early detection of abnormalities — such as heart rhythm irregularities, sleep disorders, blood sugar fluctuations, and activity issues — before symptoms escalate. - Efficient chronic disease management

Continuous monitoring helps clinicians remotely track patients with diabetes, hypertension, cardiovascular conditions, COPD, or obesity. This reduces hospitalizations and improves therapy adherence. - Empowered consumers

Real-time health insights, personalized coaching, goal tracking, and gamified wellness features increase user engagement and responsibility. - Healthcare system transformation

Telehealth and remote monitoring reduce burden on overstretched medical systems, improve appointment efficiency, and expand access to underserved populations. - Valuable research data

Wearables and mobile health apps generate large-scale, real-world datasets essential for clinical trials, public health initiatives, and AI model development.

Connected Health & Wellness Solutions Market — Growth Factors

The market is driven by rising chronic disease prevalence, aging populations requiring long-term monitoring, increasing consumer interest in fitness and wellness wearables, declining sensor and connectivity costs, and the seamless integration of consumer devices with clinical workflows. Additionally, digital-first healthcare models, telehealth reimbursement policies, AI adoption in health analytics, and the expansion of remote clinical trials accelerate market uptake. Supportive national digital transformation initiatives, regulatory guidelines for digital health technologies, and strong funding from technology giants and venture capital further drive growth. Together, these factors create sustained global momentum for connected health innovation and adoption.

Company Profiles: Specialization, Focus Areas, Revenues, Market Share & Global Presence

1. Apple Inc.

Specialization:

Premium smartwatches and health sensors (ECG, heart rate, fall detection, blood oxygen), integrated fitness and health platforms.

Key Focus Areas:

- Early detection of cardiac anomalies

- Health records integration

- Apple Fitness+ and wellness coaching

- Seamless Apple Health ecosystem

- Privacy-first data architecture

Notable Features:

Apple Watch is considered one of the most accurate consumer-grade wearables, offering medical-grade ECG and clinically validated AFib detection.

2024 Revenue:

Apple’s overall revenue exceeded USD 390 billion in 2024 (health revenue not broken out).

Market Share:

Apple continues to lead the global smartwatch market by revenue and premium device adoption.

Global Presence:

Extensive worldwide presence with strong penetration in North America, Europe, China, and APAC.

2. Google (Alphabet Inc.) — incl. Fitbit

Specialization:

Digital health AI, cloud platforms, Android/Pixel devices, Fitbit wearables and wellness analytics.

Key Focus Areas:

- Sensor technology + cloud AI integration

- Activity, cardiovascular, and sleep tracking

- Enterprise wellness platforms

- Interoperability via APIs

- AI-assisted health insights

Notable Features:

Fitbit provides long-lasting battery life, user-friendly wellness dashboard, and an established global community.

2024 Revenue:

Alphabet’s total revenue is in the hundreds of billions (health and Fitbit revenue not broken out). Fitbit historically generated approximately USD 1 billion annually before integration into Alphabet.

Market Share:

Fitbit holds a notable share in fitness trackers and value wearables.

Global Presence:

Distributed across 100+ countries through retail, online, and Android ecosystems.

3. Samsung Electronics

Specialization:

Galaxy Watch series, advanced sensors, smartphones, and Samsung Health platform.

Key Focus Areas:

- Wearable hardware innovation

- Health monitoring features

- Integration across Samsung ecosystem

- Partnerships for telehealth and wellness

Notable Features:

Highly competitive smartwatch design, ECG and blood pressure monitoring (in selected regions), and strong Android compatibility.

2024 Revenue:

Samsung Electronics reported over USD 230 billion in revenue for 2024.

Market Share:

Ranks among the top global wearable manufacturers, often holding second position in smartwatch shipments.

Global Presence:

Strong footprint in Asia-Pacific, Europe, North America, and the Middle East.

4. Fitbit (Brand Under Alphabet)

Specialization:

Fitness trackers, sleep monitoring, heart rate tracking, and digital coaching.

Key Focus Areas:

- Affordable and lightweight wearables

- Long battery life

- Activity and wellness analytics

- Corporate wellness integrations

Notable Features:

Fitbit pioneered modern fitness tracking and maintains strong customer loyalty, especially in the budget and mid-range segments.

2024 Revenue:

Fitbit’s individual revenue is not separately reported since acquisition; historical revenue approximated USD 1 billion.

Market Share:

Holds a significant share in global fitness band categories.

Global Presence:

Strong user base in North America and Europe, expanding in Asia.

5. Philips Healthcare

Specialization:

Medical-grade connected devices, hospital monitoring systems, remote ICU solutions, telehealth, and clinical workflows.

Key Focus Areas:

- Enterprise remote patient monitoring

- Critical care and ICU connectivity

- Sleep and respiratory care devices

- Integrated care pathways

Notable Features:

One of the most trusted clinical monitoring and telehealth platform providers globally.

2024 Revenue:

Philips reported multi-billion-dollar revenue in its Connected Care and Precision Diagnosis segments.

Market Share:

Holds leading share in hospital remote patient monitoring.

Global Presence:

Strong presence in Europe, North America, and over 100 countries worldwide.

Leading Trends and Their Impact

1. Advanced and Miniaturized Sensors

Wearables now include ECG, SpO₂, skin temperature, HRV, and even early glucose-monitoring trials.

Impact: Higher-quality clinical data and deeper health insights.

2. AI-Augmented Health Intelligence

AI transforms raw streams into heart rhythm alerts, sleep scoring, respiratory trend analysis, and risk predictions.

Impact: More personalized, real-time care.

3. Regulatory Maturity

Governments are issuing guidelines for digital health technologies, remote monitoring, and AI tools.

Impact: Faster approvals and more clinical use cases, but higher compliance requirements.

4. Interoperability & Unified Health Records

FHIR APIs, health data networks, and cloud integration enable device data to flow into EHRs and national health systems.

Impact: Clinicians gain more complete patient histories.

5. Subscription-Based Wellness Ecosystems

Paid services like Apple Fitness+, Fitbit Premium, and Samsung Health subscriptions are rising.

Impact: Recurring revenue and higher customer retention.

6. Decentralized Trials & Remote Care Models

Connected sensors are used for e-consent, continuous data collection, and medication adherence monitoring.

Impact: Reduced trial costs and broader patient diversity.

Successful Global Examples

Apple Heart Study

Millions of Apple Watch users contributed heart rhythm data to identify atrial fibrillation patterns — showing the scalability of consumer-device-based screening.

Fitbit Corporate Wellness Programs

Employers use Fitbit devices to reduce burnout, improve employee health, and cut healthcare costs through step challenges and behaviour-change gamification.

Philips Tele-ICU Deployments

Philips’ eICU program has enabled hospitals to centrally monitor multiple ICU locations, reducing mortality rates and improving workflow efficiency.

India’s Ayushman Bharat Digital Mission

The nationwide digital health ID system (ABHA) and Health Facility Registries have accelerated connected care adoption among both public and private providers.

European Health Data Space Efforts

EU-wide frameworks are promoting cross-border health data use, creating opportunities for interoperable digital health solutions.

Global Regional Analysis — Policies and Government Initiatives Shaping the Market

North America

United States

- FDA is advancing digital health frameworks, including guidance on software as a medical device (SaMD), clinical-grade wearables, and digital endpoints.

- Medicare and private payers have adopted reimbursement codes for remote patient monitoring and telehealth.

- State-level parity laws have increased telemedicine coverage.

Canada

- Provinces are rolling out virtual care frameworks and EHR interoperability, boosting connected monitoring programs.

Europe

European Union

- The European Health Data Space (EHDS) is establishing a unified framework for digital health data exchange.

- EU MDR regulations require stringent safety and effectiveness evidence for medical-grade wearables and AI tools.

- Telemedicine adoption is supported through national digital health strategies (France, Germany, Nordics).

Asia-Pacific

China

- Strong digital health governance, including telemedicine regulations and national “Internet + Healthcare” initiatives.

- Massive investment in AI-health partnerships and public-private health monitoring platforms.

India

- The Ayushman Bharat Digital Mission (ABDM) is enabling patient IDs, health registries, and telemedicine adoption at scale.

- Growing demand for affordable wearables and mobile-first health services.

Japan & South Korea

- Pioneers in sensor innovation, robotics, and geriatric care technologies.

- Government-backed programs support remote monitoring for aging populations.

Latin America & Africa

- Mobile-first telemedicine and connected health solutions are expanding rapidly due to high smartphone penetration.

- Government-backed digital health blueprints (Brazil, Kenya, South Africa) are improving interoperability and digital access.

Key Regulatory Themes Worldwide

- Privacy & Security Laws: GDPR in Europe, HIPAA in the U.S., and evolving national data protection laws worldwide.

- Interoperability Requirements: Standardized APIs, national health IDs, unified health data networks.

- Clinical Evidence Requirements: More rigorous validation for AI-enabled health tools and medical-grade sensors.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI Data Centre Market Growth Drivers, Trends, Key Players and Regional Insights by 2035