Generic Drugs Market Growth, Trends and Forecast from 2024 to 2033

Generic Drugs Market Size

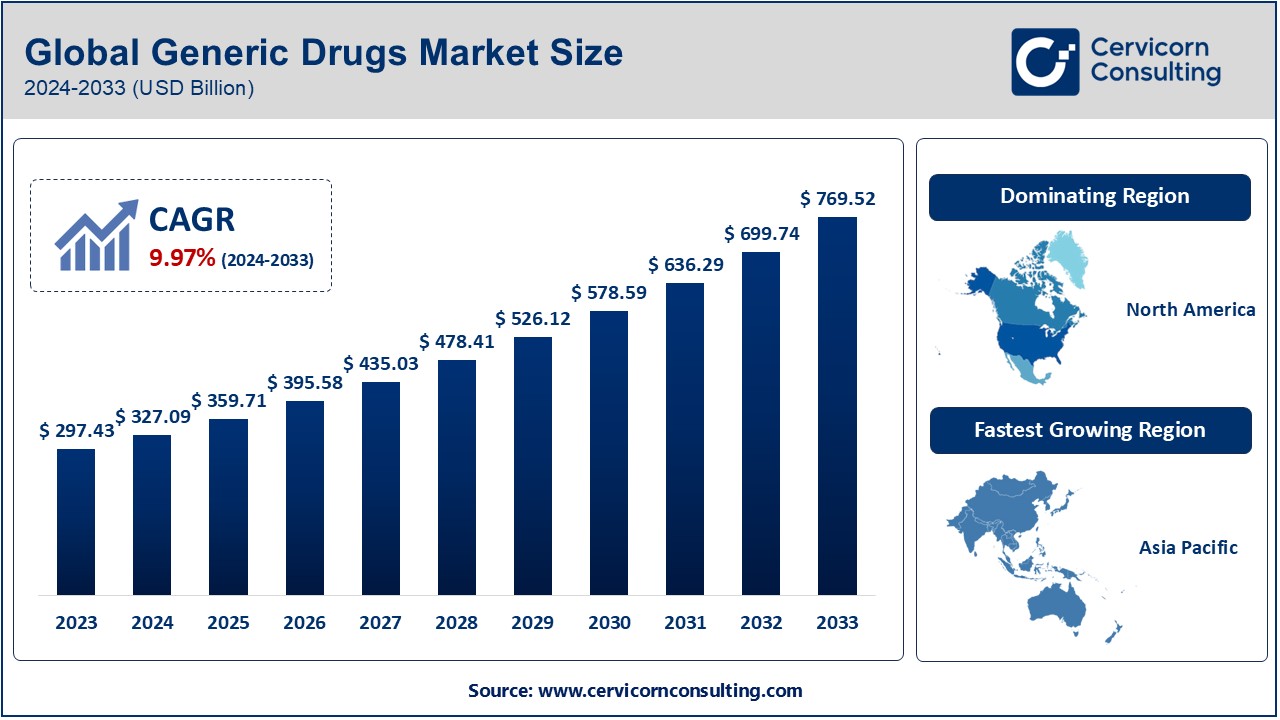

The gobal generic drugs market was worth USD 327.09 billion in 2024 and is anticipated to expand to around USD 769.52 billion by 2033, registering a compound annual growth rate (CAGR) of 9.97% from 2024 to 2033.

What is the Generic Drugs Market?

The generic drugs market comprises pharmaceutical products that are bioequivalent to brand-name drugs in terms of dosage, strength, route of administration, quality, performance, and intended use but are sold at a lower price. These drugs become available once the patent on the original brand-name drug expires, allowing multiple manufacturers to produce them, thereby increasing competition and reducing costs for consumers. The market is a crucial segment of the global pharmaceutical industry, playing a significant role in enhancing access to affordable medications for patients worldwide.

Why is the Generic Drugs Market Important?

Generic drugs are essential for several reasons. They help lower healthcare costs by providing cost-effective alternatives to expensive brand-name medications, improving accessibility for patients. Additionally, they contribute to reducing the financial burden on national healthcare systems and insurance providers. The generic drugs market also drives innovation by enabling pharmaceutical companies to reinvest in research and development (R&D) for new therapies. With rising healthcare expenditures and growing global disease burdens, the importance of generic drugs continues to expand.

Growth Factors of the Generic Drugs Market

The growth of the generic drugs market is driven by several factors, including the rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, which require long-term medication. Increasing patent expirations of blockbuster drugs create opportunities for generic manufacturers to enter the market. Additionally, supportive government initiatives, favorable regulatory policies, and efforts to reduce healthcare costs further accelerate market expansion. The growing geriatric population, increased healthcare awareness, and technological advancements in drug formulation and manufacturing also contribute to the industry’s growth. Furthermore, mergers, acquisitions, and collaborations among generic drug manufacturers enhance their global reach and market penetration.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2433

Top Companies in the Generic Drugs Market

- Mylan N.V.

- Specialization: Development, manufacturing, and distribution of generic and specialty pharmaceuticals.

- Key Focus Areas: Generic medications, biosimilars, over-the-counter (OTC) products, active pharmaceutical ingredients (APIs).

- Notable Features: Strong pipeline of biosimilars, robust manufacturing capabilities.

- 2024 Revenue (approx.): $12.5 billion

- Market Share (approx.): 7%

- Global Presence: North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Abbott Laboratories

- Specialization: Pharmaceuticals, diagnostics, medical devices, and nutrition.

- Key Focus Areas: Branded generics, diagnostics, medical nutrition, diabetes care.

- Notable Features: Strong presence in emerging markets, focus on high-quality generic formulations.

- 2024 Revenue (approx.): $14 billion

- Market Share (approx.): 8%

- Global Presence: Extensive presence in over 150 countries.

- ALLERGAN

- Specialization: Pharmaceuticals, medical aesthetics, and biosimilars.

- Key Focus Areas: Generic drugs, ophthalmology, dermatology, and neuroscience.

- Notable Features: Diverse product portfolio, strong presence in specialty and generic medicines.

- 2024 Revenue (approx.): $10.3 billion

- Market Share (approx.): 6%

- Global Presence: North America, Europe, Asia-Pacific, Latin America.

- Teva Pharmaceutical Industries Ltd.

- Specialization: Generic and specialty medicines, biosimilars, and active pharmaceutical ingredients.

- Key Focus Areas: Central nervous system (CNS) disorders, oncology, respiratory diseases.

- Notable Features: Largest generic drug manufacturer, extensive R&D investments.

- 2024 Revenue (approx.): $17 billion

- Market Share (approx.): 10%

- Global Presence: Over 60 countries worldwide.

- Eli Lilly and Company

- Specialization: Pharmaceuticals, biotechnology, and generics.

- Key Focus Areas: Diabetes, oncology, immunology, neuroscience.

- Notable Features: Strong biologics and biosimilars segment, advanced R&D capabilities.

- 2024 Revenue (approx.): $9.8 billion

- Market Share (approx.): 5%

- Global Presence: Americas, Europe, Asia-Pacific.

Leading Trends and Their Impact on the Generic Drugs Market

- Biosimilars Expansion: The increasing acceptance of biosimilars as cost-effective alternatives to biologics is reshaping the generic drug market. Companies investing in biosimilars gain a competitive advantage.

- Regulatory Reforms: Streamlined regulatory approvals in major markets like the U.S., Europe, and China are accelerating the introduction of generic drugs.

- Digital Transformation: The adoption of AI, big data, and digital tools in drug manufacturing and supply chain management is enhancing efficiency.

- Vertical Integration: Companies are increasingly integrating vertically, acquiring API manufacturers to secure supply chains and reduce production costs.

- Rising Healthcare Expenditures: Government policies emphasizing cost containment and generic drug adoption are driving market growth.

Successful Examples of the Generic Drugs Market Worldwide

- India: The world’s largest provider of generic drugs, supplying over 40% of generic demand in the U.S. and 25% in the UK.

- United States: The Hatch-Waxman Act facilitated the rapid expansion of the generic drug industry, with over 90% of prescriptions filled by generics today.

- Europe: Countries like Germany and the UK have implemented robust pricing policies favoring generics to reduce healthcare costs.

- China: Government initiatives such as volume-based procurement (VBP) policies have dramatically boosted the use of generics, making medications more affordable.

Regional Analysis and Government Initiatives

- North America: The U.S. FDA’s generic drug user fee amendments (GDUFA) have streamlined approval processes, encouraging more generic drug production. Canada is also actively promoting generics to curb healthcare spending.

- Europe: The European Medicines Agency (EMA) supports faster approvals and widespread generic drug adoption to reduce dependency on high-cost brand-name drugs.

- Asia-Pacific: India’s ‘Pharma Vision 2020’ and China’s drug pricing reforms are expanding their generic drug markets.

- Latin America: Brazil and Mexico have introduced generic substitution policies, enhancing access to cost-effective medications.

- Middle East & Africa: Governments in the UAE and South Africa are implementing favorable policies to boost local generic drug manufacturing and reduce dependency on imports.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Radiopharmaceuticals Market Transforming Modern Medicine 2024