India Data Center Cooling Market Revenue, Trends, and Strategic Insights by 2035

India Data Center Cooling Market Size

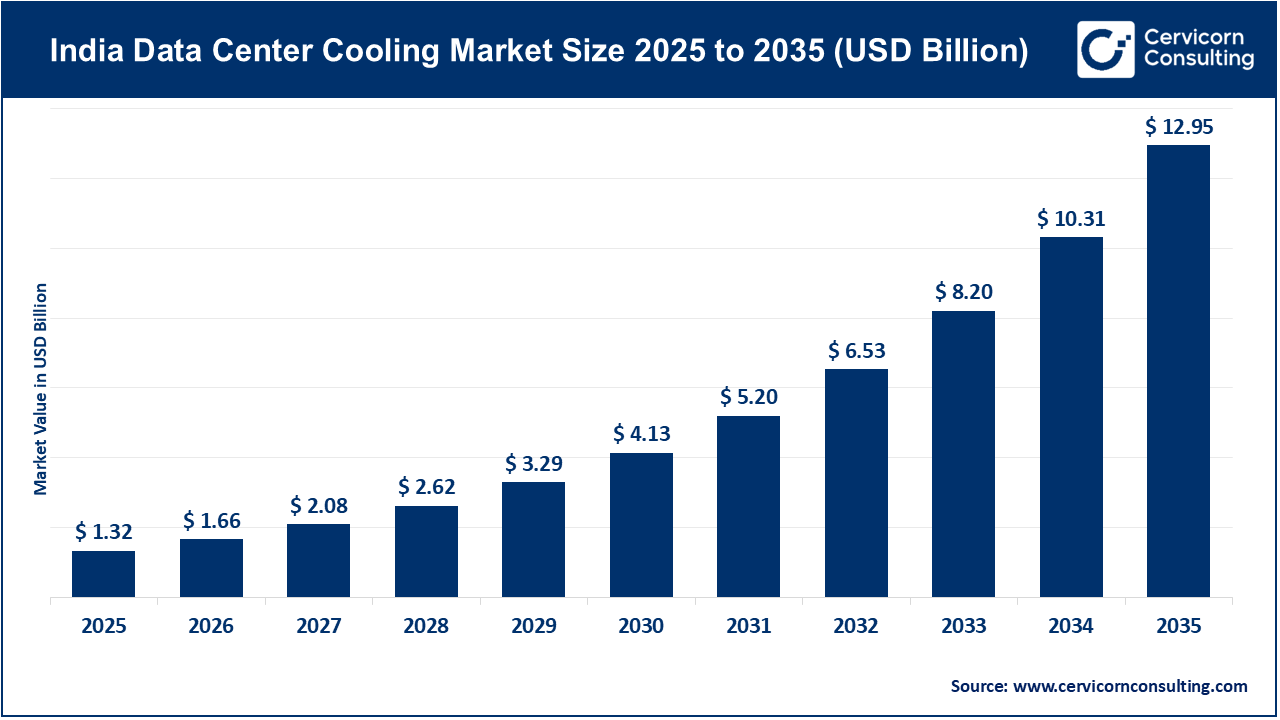

The India data center cooling market size was worth USD 1.32 billion in 2025 and is anticipated to expand to around USD 12.95 billion by 2035, registering a compound annual growth rate (CAGR) of 25.7% from 2026 to 2035.

India Data Center Cooling Market — Growth Factors

The India data center cooling market is experiencing rapid expansion driven by a confluence of macroeconomic, technological, and regulatory forces: the nation’s accelerated digital transformation and surge in cloud adoption and IT infrastructure are compelling enterprises and hyperscale operators to build more data centers, which in turn drives demand for efficient and scalable cooling systems capable of handling higher heat output from densely packed servers; India’s tropical and warm climate necessitates robust mechanical cooling to maintain optimal operating temperatures and prevent downtime, reinforcing demand for advanced solutions.

Government initiatives such as Digital India, data localization mandates, and investment incentives for digital infrastructure and green data centers are fostering market growth; sustainability imperatives and rising electricity costs make energy‑efficient and low‑carbon cooling technologies like liquid cooling, hybrid systems, and free cooling increasingly attractive; finally, megatrends such as the rollout of 5G, IoT expansion, AI‑driven computing workloads, and high‑performance computing (HPC) applications are boosting rack power densities, necessitating next‑generation thermal management solutions that traditional air cooling cannot efficiently support.

What is the India Data Center Cooling Market?

The India data center cooling market encompasses the range of technologies, systems, and services used to regulate temperature, humidity, and airflow within data center facilities to ensure optimal performance of servers, networking equipment, and storage hardware. Data centers inherently generate vast amounts of heat due to continuous computing processes, and without effective cooling, hardware overheating can lead to system failures, reduced equipment lifespan, or costly service interruptions.

Cooling solutions include traditional air‑based systems (like precision air conditioning and CRAH/CRAC units), liquid cooling methods (including direct‑to‑chip and immersion cooling), economizers, hybrid cooling architectures, monitoring and management systems, and airflow optimization technologies designed to maintain performance and reduce energy consumption. With India’s data center footprint growing rapidly, advanced cooling systems are becoming indispensable to support high‑density racks, hyperscale deployments, and sustainability goals.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2888

Why Is the India Data Center Cooling Market Important?

The India data center cooling market is important for several strategic reasons:

- Operational Reliability: Proper thermal management prevents overheating, which protects sensitive hardware, maintains uptime, and reduces the risk of system failure across mission‑critical applications.

- Energy Efficiency and Cost Control: Cooling systems can account for up to 40% or more of a data center’s total energy use, so improving cooling efficiency directly reduces operational costs and improves profit margins.

- Sustainability and ESG Goals: India and global operators are under pressure to reduce carbon emissions and energy consumption. Efficient cooling solutions help lower Power Usage Effectiveness (PUE) and contribute to ESG targets, which are increasingly mandated by regulators and investors.

- Support for Digital Growth: As cloud computing, AI, big data analytics, e‑commerce, and mobile penetration rise, demand for data center capacity grows. Effective cooling is foundational to safely scaling this infrastructure.

- Global Competitiveness: India is becoming a significant regional hub for data centers, making advanced cooling technologies critical for attracting hyperscale investment and ensuring competitiveness in the Asia‑Pacific data infrastructure landscape.

Company Profiles — Key Players in the India Data Center Cooling Market

Below is a snapshot of selected global companies, along with their specialization, key focus areas, notable features, 2024 revenue, market share context, and global presence as they relate to the data center cooling ecosystem.

Fujitsu Ltd

- Specialization: Fujitsu is a Japanese technology company offering computing hardware, servers, and advanced thermal management solutions, including liquid cooling technologies that capture server heat and improve efficiency.

- Key Focus Areas: Liquid cooling for scale‑out servers, reducing energy cost, enabling waste heat reuse, and supporting higher server densities.

- Notable Features: Solutions that can capture 60–80% of server heat, return high‑temperature coolant suitable for reuse, and reduce traditional cooling dependency.

- 2024 Revenue: Fujitsu’s total company revenue exceeded tens of billions USD globally, but specific cooling revenue figures are not publicly segmented.

- Market Share & Presence: Competes globally in data center solutions and has a presence in India through infrastructure services and hardware supply channels.

Hitachi Ltd / Johnson Controls Hitachi (Joint Presence)

- Specialization: Hitachi’s involvement in cooling comes predominantly through its joint venture with Johnson Controls, focusing on HVAC and air conditioning technologies for commercial, institutional, and data center markets.

- Key Focus Areas: Air conditioning systems, precision cooling, HVAC integration for critical environments.

- Notable Features: Strong AC and cooling portfolio with global operations; legacy brand with deep engineering expertise.

- 2024/2025 Revenue & Market Share: Hitachi Ltd’s total corporate revenue is diversified across many sectors; the HVAC/cooling joint venture contributes to overall cooling system supply but specific market share in India’s data center cooling segment is part of broader industry shipments.

- Global Presence: Operates in Asia, Europe, Americas, and India, with manufacturing and distribution networks globally.

Johnson Controls International PLC

- Specialization: Irish multinational focused on building systems, HVAC, and data center cooling, including investments in liquid cooling innovators.

- Key Focus Areas: Smart and sustainable HVAC systems, liquid cooling technology investments, integrated cooling and facility management for data centers.

- Notable Features: Strategic investment in liquid cooling tech, broad HVAC portfolio, integration with building automation.

- 2024/2025 Revenue: Approximately $6.44 billion in revenue, supported by strong demand in data center segments.

- Market Share & Global Presence: Significant global player in cooling and HVAC, with presence in Europe, Americas, Asia, and India.

Mitsubishi Electric Corporation / Mitsubishi Electric Hydronics & IT Cooling Systems

- Specialization: Mitsubishi Electric’s subsidiaries produce hydronic systems, chillers, and commercial-grade cooling solutions for data centers and HVAC applications.

- Key Focus Areas: High-efficiency chillers, air conditioning units, variable refrigerant flow (VRF) systems, and data center cooling solutions.

- Notable Features: Large manufacturing facility in Chennai underscores commitment to India’s cooling market growth, including data center cooling segments.

- 2024 Revenue: Reported substantial AC and HVAC revenue in India (~₹4,200 crore in FY25).

- Global Presence: Operates in Japan, Asia, Europe, the Americas, and India, with supply channels and service networks worldwide.

Dell Technologies Inc

- Specialization: Dell is a major IT hardware and solutions provider, including servers and storage optimized for high-performance and hyperscale workloads. While not a primary cooling vendor, Dell’s infrastructure products influence cooling requirements through rack density and partnership recommendations for thermal solutions.

- Key Focus Areas: High-density compute systems, edge data center servers, integrated rack designs compatible with advanced cooling architectures.

- Notable Features: Server and hardware footprint drives demand for advanced cooling, often bundled or certified with third-party vendors.

- 2024 Revenue: Over $90 billion in global revenue across all businesses.

- Market Share & Presence: Substantial global footprint across infrastructure sectors, with deployment in large data center environments worldwide, including India.

Leading Trends and Their Impact

The India data center cooling market is being shaped by several compelling trends, each with significant implications:

1. Shift to Liquid and Immersion Cooling

Liquid-based cooling solutions — including direct-to-chip and immersion cooling — are rapidly gaining traction due to superior heat rejection, lower energy consumption, and better support for high-density computing deployments (AI/HPC workloads). Server densities in hyperscale centers are pushing traditional air cooling toward its limits.

Impact:

- Improved energy efficiency (lower PUE)

- Enables higher compute densities

- Reduces total operational cost

2. Sustainability and Energy Efficiency Focus

Operators are prioritizing eco-friendly cooling systems (free cooling, hybrid architectures) and renewable integration to reduce carbon footprints and comply with tightening regulations on data center energy use.

Impact:

- Drives adoption of advanced cooling tech

- Enhances India’s appeal for green data center investments

3. Hyperscale and Edge Data Center Expansion

Large hyperscale cloud facilities in cities like Mumbai, Chennai, and Hyderabad demand scalable cooling solutions, while edge data centers require modular systems tailored to dispersed networks.

Impact:

- Expands market segments for modular and micro cooling solutions

- Creates niche demands for flexible thermal management designs

4. Smart and AI-Enabled Cooling Controls

AI and IoT integrated into cooling systems enable real-time thermal optimization, predictive maintenance, and adaptive airflow adjustments, boosting performance and energy savings.

Impact:

- Reduced downtime

- Optimized thermal operations

- Lower long-term costs

Successful Examples of Data Center Cooling Around the World

Google (Hamina, Finland)

Google’s data center uses seawater cooling, a sustainable method that harnesses local seawater for thermal management, significantly reducing electricity use and environmental impact compared to traditional mechanical cooling.

Key Learning: Utilization of local natural resources can dramatically enhance efficiency and sustainability.

NTT (Navi Mumbai, India & APAC)

NTT deployed liquid immersion cooling and direct-contact liquid cooling technologies in Navi Mumbai, marking one of the largest implementations of such systems in the APAC region.

Key Learning: Immersion cooling significantly enhances energy efficiency for high-density racks.

Equinix and Digital Realty (Global)

These global colocation leaders implement hybrid cooling and advanced air management strategies across facilities to achieve low PUE scores and high uptime performance.

Key Learning: Modular deployments and integrated monitoring can deliver both performance and sustainability benefits at scale.

Policies Shaping the India Data Center Cooling Market

Several policy and regulatory trends are transforming the cooling landscape:

Digital India & Data Localization Laws

Policies promoting onshore data storage and digital services expansion are stimulating construction of new data centers, which correlates with higher demand for associated cooling infrastructure.

Energy Efficiency and Carbon Emissions Regulations

Stricter norms for energy use and emission control encourage adoption of advanced cooling systems, which consume less power and produce lower emissions than legacy cooling methods.

Green Data Center Initiatives

State-level incentives, subsidies for renewable energy integration, and incentives for setting up data center parks with cutting-edge cooling tech amplify market growth, particularly in states like Maharashtra and Tamil Nadu.

Infrastructure Investment Schemes

Direct funding — such as allocations to develop data center parks with efficient cooling technologies — lowers barriers for developers and accelerates modernization of cooling systems across facilities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: E-Commerce Packaging Market Revenue, Trends, and Strategic Insights by 2035