Water and Wastewater Treatment Market Growth Insights, Trends, and Top Companies (2025-2034)

Water and Wastewater Treatment Market Overview

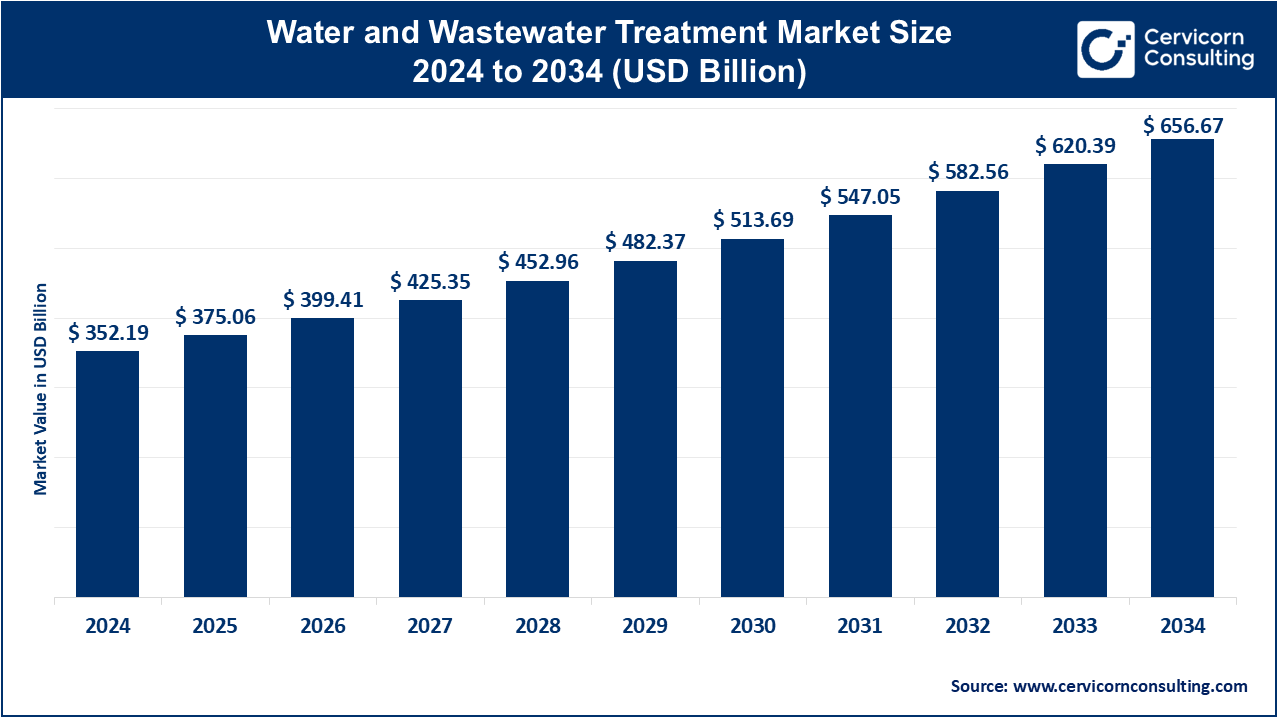

The global water and wastewater treatment market was valued at USD 352.19 billion in 2024 and is projected to grow to approximately USD 656.67 billion by 2034, with a compound annual growth rate (CAGR) of 6.42% from 2025 to 2034.

The market is driven by increasing water scarcity, stringent government regulations on wastewater discharge, advancements in treatment technologies, rising public awareness about water conservation, and investments in infrastructure development. Urbanization and industrialization in emerging economies further amplify the need for efficient water management systems.

Understanding the Water and Wastewater Treatment Market

The water and wastewater treatment market refers to the comprehensive processes and solutions aimed at improving water quality and managing wastewater to ensure it meets environmental and health standards. This market encompasses a broad range of technologies, services, and products designed to treat water for domestic, industrial, agricultural, and municipal use while efficiently managing and recycling wastewater.

Why Is the Water and Wastewater Treatment Market Important?

Water is a fundamental resource, essential for life, economic activities, and environmental health. With growing global populations, rapid urbanization, and industrial expansion, the demand for clean water has surged. Simultaneously, the volume of wastewater generated by human and industrial activities has increased, posing risks to ecosystems and public health. Effective water and wastewater treatment ensures access to clean water, reduces waterborne diseases, minimizes environmental pollution, and promotes sustainable water management practices, making it critical to the planet’s future.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2334

Global Water and Wastewater Treatment Market Top Companies

Below is an overview of some of the leading companies in the global water and wastewater treatment market, their specializations, key focus areas, notable features, approximate 2023 revenue, market share, and global presence:

1. Veolia Environnement S.A.

- Specialization: Comprehensive water management, resource recovery, and sustainable solutions.

- Key Focus Areas: Municipal and industrial water treatment, desalination, circular economy initiatives.

- Notable Features: Advanced technologies in membrane filtration, energy-efficient wastewater systems.

- 2024 Revenue (Approx.): $34 billion.

- Market Share (Approx.): 10%.

- Global Presence: Operations in over 50 countries, strong presence in Europe, North America, and Asia.

2. Suez S.A.

- Specialization: Water distribution, wastewater treatment, and smart water solutions.

- Key Focus Areas: Digital water solutions, recycling, and sustainable infrastructure.

- Notable Features: Leadership in smart water technologies, strong research and development.

- 2024 Revenue (Approx.): $21 billion.

- Market Share (Approx.): 7%.

- Global Presence: Extensive operations in Europe, Asia, and Africa.

3. Ecolab Inc.

- Specialization: Water hygiene, energy technologies, and services.

- Key Focus Areas: Industrial water treatment, water efficiency, and safety systems.

- Notable Features: Innovative water reuse technologies, partnerships with global industries.

- 2024 Revenue (Approx.): $14 billion.

- Market Share (Approx.): 5%.

- Global Presence: Operates in more than 170 countries, with a strong focus on North America and Europe.

4. Xylem Inc.

- Specialization: Innovative water technologies and smart infrastructure.

- Key Focus Areas: Digital water solutions, advanced pump systems, water analytics.

- Notable Features: IoT-enabled water management systems, sustainability-driven innovations.

- 2024 Revenue (Approx.): $8 billion.

- Market Share (Approx.): 4%.

- Global Presence: Strong presence in the Americas, Europe, and the Asia-Pacific region.

5. Danaher Corporation

- Specialization: Water quality instrumentation and environmental solutions.

- Key Focus Areas: Testing and monitoring water quality, water disinfection, laboratory solutions.

- Notable Features: Cutting-edge analytical instruments, robust market penetration.

- 2024 Revenue (Approx.): $30 billion.

- Market Share (Approx.): 9%.

- Global Presence: Operations across North America, Europe, and Asia-Pacific, with a growing footprint in emerging markets.

Leading Trends and Their Impact

- Digital Water Solutions: The integration of IoT, AI, and big data analytics is revolutionizing water and wastewater treatment processes. Real-time monitoring and predictive analytics enhance operational efficiency, reduce costs, and optimize resource usage.

- Decentralized Water Treatment: As urban populations grow, decentralized systems are gaining traction for their scalability, efficiency, and ability to meet localized water demands.

- Circular Economy: The shift towards a circular economy in water management emphasizes recycling and reusing wastewater. This trend supports sustainable practices, particularly in industrial sectors.

- Desalination Technologies: Innovations in desalination, such as reverse osmosis and energy recovery systems, are making seawater a viable source of freshwater.

- Regulatory Compliance: Stricter regulations on industrial wastewater discharge are pushing industries to adopt advanced treatment technologies, driving market growth.

Successful Examples of Water and Wastewater Treatment

1. Singapore’s NEWater Initiative

Singapore has implemented one of the world’s most advanced water recycling programs, transforming wastewater into potable water. NEWater plants use microfiltration, reverse osmosis, and UV disinfection to produce high-quality recycled water, meeting up to 40% of the country’s water needs.

2. Orange County Water District, California

The district operates the Groundwater Replenishment System (GWRS), the world’s largest water purification system for indirect potable reuse. It supplies over 100 million gallons of purified water daily, addressing water scarcity in the region.

3. Thames Water, United Kingdom

Thames Water utilizes advanced sludge treatment technologies to generate renewable energy from wastewater. Its anaerobic digestion plants produce biogas, reducing the utility’s carbon footprint.

4. Saudi Arabia’s Desalination Plants

With limited freshwater resources, Saudi Arabia has invested heavily in desalination. The Ras Al Khair desalination plant is one of the largest in the world, providing drinking water to millions.

Regional Analysis: Government Initiatives and Policies Shaping the Market

1. North America

Governments in the United States and Canada are prioritizing water infrastructure investments. Initiatives like the Water Infrastructure Finance and Innovation Act (WIFIA) in the U.S. provide low-cost loans for large water projects, while Canada’s “Investing in Canada Plan” funds water and wastewater infrastructure.

2. Europe

The European Union’s Water Framework Directive (WFD) mandates member states to achieve “good” status for all water bodies. Countries like Germany and the Netherlands lead in wastewater treatment, with stringent standards driving technology adoption.

3. Asia-Pacific

Rapid urbanization in countries like China and India has spurred government-backed programs. China’s “Water Ten Plan” focuses on improving water quality, while India’s AMRUT scheme supports urban wastewater management projects.

4. Middle East and Africa

Water scarcity drives significant investment in desalination and wastewater reuse. The UAE’s Water Security Strategy 2036 aims to ensure sustainable water management, while South Africa’s National Water and Sanitation Master Plan addresses water quality and access.

5. Latin America

Brazil and Mexico are investing in modernizing water infrastructure to meet growing urban demands. Partnerships with private players are emerging as governments seek efficient solutions to address water pollution and scarcity.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Paints and Coatings Market Trends & Insights by 2033