Public Safety and Security Market Trends, Market Share & CAGR Insights by 2034

Public Safety and Security Market Size

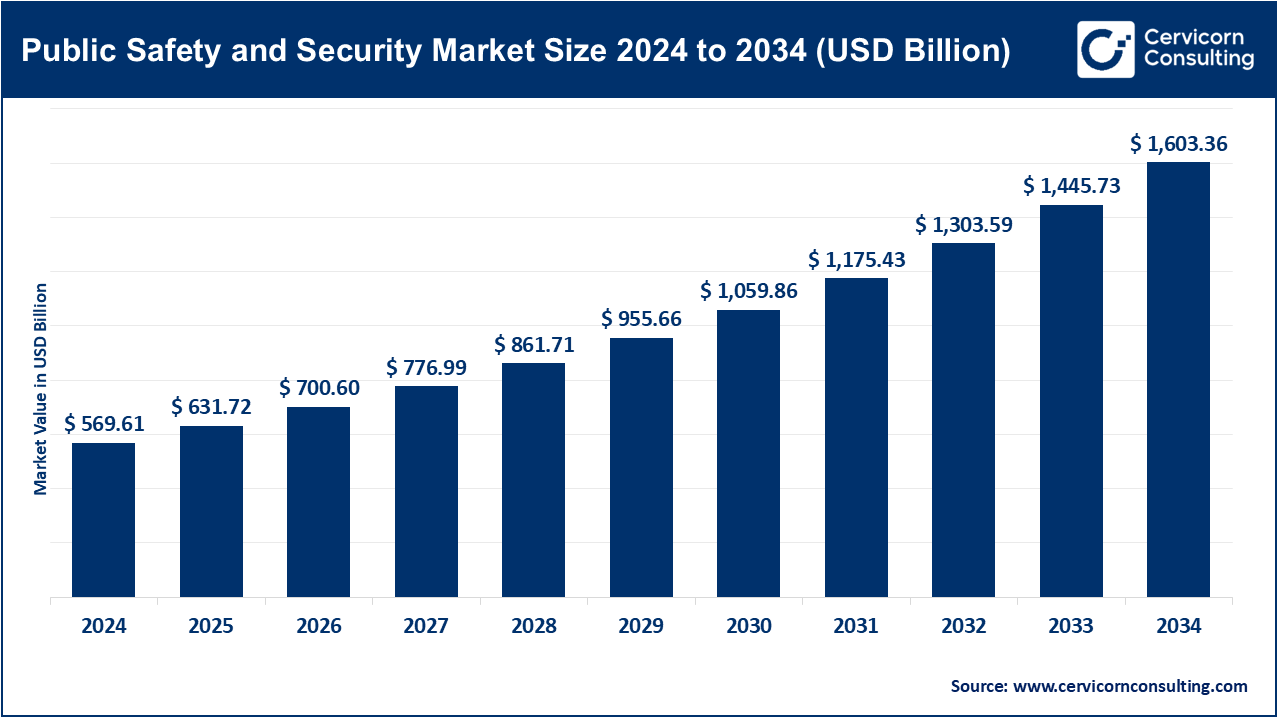

The global public safety and security market size was worth USD 569.61 billion in 2024 and is anticipated to expand to around USD 1,603.36 billion by 2034, registering a compound annual growth rate (CAGR) of 11.32% from 2025 to 2034.

What Is the Public Safety and Security Market?

The public safety and security market refers to a range of technologies, services, and systems designed to protect citizens, infrastructure, and institutions. These include emergency communication systems, video surveillance, cyber defense, biometric authentication, access control, and disaster response platforms. Solutions serve both government agencies and private sectors such as transportation, utilities, and finance, ensuring safe and secure environments for daily operations and crisis management.

Why Is It Important?

Public safety and security are foundational to a functioning society. Without them, governments struggle to respond to emergencies, protect digital and physical infrastructure, or maintain trust among citizens. These systems prevent and mitigate the effects of crime, terrorism, cyber threats, and natural disasters. They also support real-time intelligence and coordination for first responders, ensure legal compliance in high-risk environments, and enhance public confidence through visible and effective security measures.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2664

Growth Factors

The growth of the public safety and security market is fueled by increasing global threats, technological advancement, and smart city initiatives. The rise in cyberattacks, terrorist activities, urban crime, and climate disasters has driven government spending toward modernized safety solutions. Additionally, the integration of AI, IoT, 5G, cloud platforms, and edge computing enables real-time, data-driven decision-making. As cities become smarter, the demand for predictive surveillance, automated incident response, and biometric verification continues to rise. Regulatory frameworks such as GDPR and Zero Trust security principles are also compelling organizations to invest in secure, privacy-conscious solutions.

Top Public Safety and Security Companies in 2024

Motorola Solutions, Inc.

- Specialization: Mission-critical communications, video security, and command center software.

- Key Focus: Public safety LTE, incident management, and emergency communications.

- Notable Products: Avigilon surveillance, CommandCentral suite.

- 2024 Revenue: ~$9.6 billion

- Global Presence: Strong in North America, expanding in Europe and Asia-Pacific.

Cisco Systems, Inc.

- Specialization: Secure networking, threat detection, and video surveillance.

- Key Focus: Public sector cybersecurity, IP surveillance, and resilient network infrastructure.

- Notable Products: Cisco Meraki Cameras, Talos threat intelligence.

- 2024 Revenue: Over $60 billion

- Global Presence: Worldwide with strong government and enterprise reach.

Honeywell International Inc.

- Specialization: Infrastructure and industrial safety, access control, building security.

- Key Focus: Airport security, integrated control centers, and environmental safety.

- Notable Products: Pro-Watch, MAXPRO VMS.

- 2024 Revenue: ~$35 billion

- Global Presence: Strong in North America, Europe, and the Middle East.

NEC Corporation

- Specialization: Smart surveillance, biometric security, AI for law enforcement.

- Key Focus: Facial recognition, public event monitoring, immigration security.

- Notable Products: NeoFace biometric platform.

- 2024 Revenue: ~$22 billion

- Global Presence: Japan, Southeast Asia, growing in the U.S. and Europe.

Thales Group

- Specialization: Cybersecurity, border security, defense communications.

- Key Focus: Biometric identity, C4ISR systems, encrypted communications.

- Notable Products: CipherTrust, biometric identity systems via IDEMIA JV.

- 2024 Revenue: ~$22 billion

- Global Presence: Europe, Asia-Pacific, and Middle East.

Leading Trends and Their Impact

Artificial Intelligence (AI) and Machine Learning

AI enables predictive policing, anomaly detection, and automated threat response. Facial recognition and object tracking are being embedded into city surveillance systems to identify threats in real time.

Smart Cities and Integrated Platforms

Public safety solutions are now integrated into urban ecosystems—traffic systems, utilities, and law enforcement data—enhancing situational awareness and coordination across city departments.

Cybersecurity and Zero Trust Architecture

As attacks on critical infrastructure increase, Zero Trust frameworks are being implemented across public systems to limit lateral movement and protect sensitive data.

Biometric Identity Management

Biometric verification through facial, fingerprint, or iris recognition is being used in airports, public offices, and borders, ensuring both security and user convenience.

IoT and 5G-Enabled Surveillance

5G supports high-speed data transmission for real-time video, wearable sensors for responders, and connected devices for situational data in emergencies.

Privacy-Centric Regulations

Governments are enforcing new standards for ethical AI use, surveillance, and data privacy. Solutions must be compliant and include transparency mechanisms.

Successful Use Cases Around the World

- Paris Olympics 2024: France deployed AI-enabled surveillance and emergency coordination systems to secure international events.

- EUCCS: The European Union Critical Communication System ensures seamless interagency communication across borders.

- Marrakech Platform: A regional counter-terrorism training and coordination center for African nations.

- China’s Security Export Model: Chinese firms provide surveillance and biometric technology to developing nations under a global security cooperation model.

- NorthSeal Coalition: An intergovernmental agreement between European countries to protect maritime and energy infrastructure with shared data and drone surveillance.

Global and Regional Analysis

North America

- Market Share: ~38–47%

- Key Drivers: Homeland security funding, cyber readiness, smart city projects.

- Initiatives: DHS grants, counter-ransomware legislation, Canada’s national cybersecurity program.

Europe

- Market Share: Second-largest globally.

- Key Drivers: Border control tech, GDPR compliance, digital sovereignty policies.

- Initiatives: EUCCS rollout, anti-terrorism funding, facial recognition regulation in the UK.

Asia-Pacific

- Growth Rate: CAGR ~11–14%

- Key Drivers: Urbanization, smart infrastructure, geopolitical tensions.

- Initiatives: India’s ICCCs, China’s citywide facial recognition, Japan’s emergency broadcast overhaul.

Latin America

- Key Drivers: Organized crime, emergency response modernization.

- Initiatives: Biometric public transport in Brazil, crime mapping platforms in Colombia.

Middle East & Africa

- Key Drivers: Border security, climate-related emergencies, and terrorism threats.

- Initiatives: Smart policing in UAE, Africa’s counter-terror centers, Morocco-led regional safety pacts.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

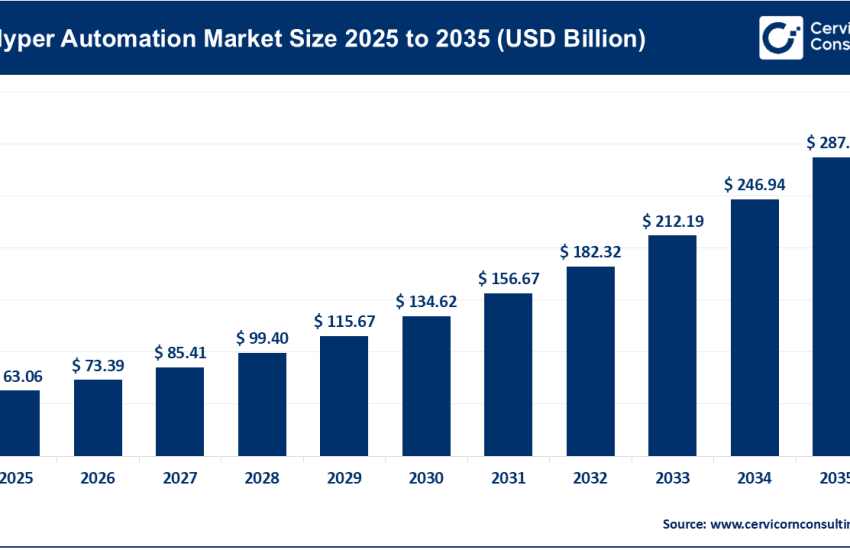

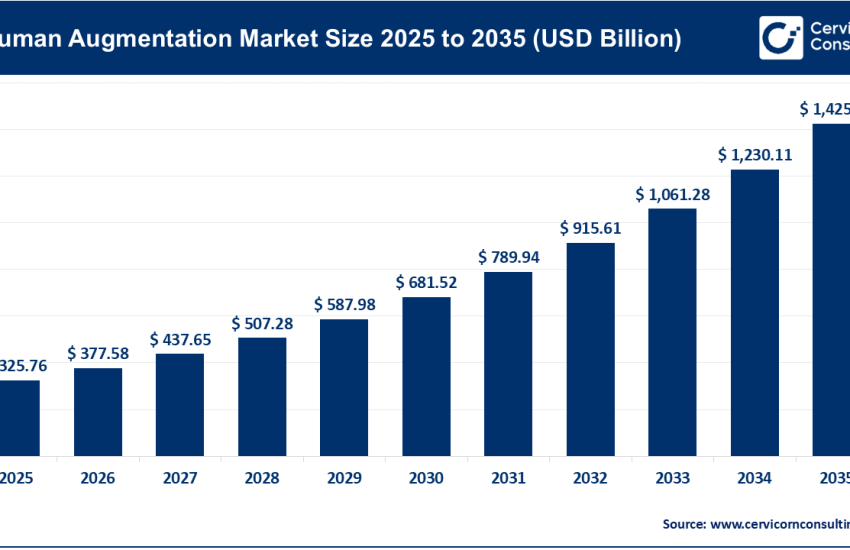

Read Report: Agentic AI Market Size, Share, and Strategic Forecast through 2034