Point-of-Care Molecular Diagnostics Market Top Players, Trends & Regional Insights by 2034

Point-of-Care Molecular Diagnostics Market Size

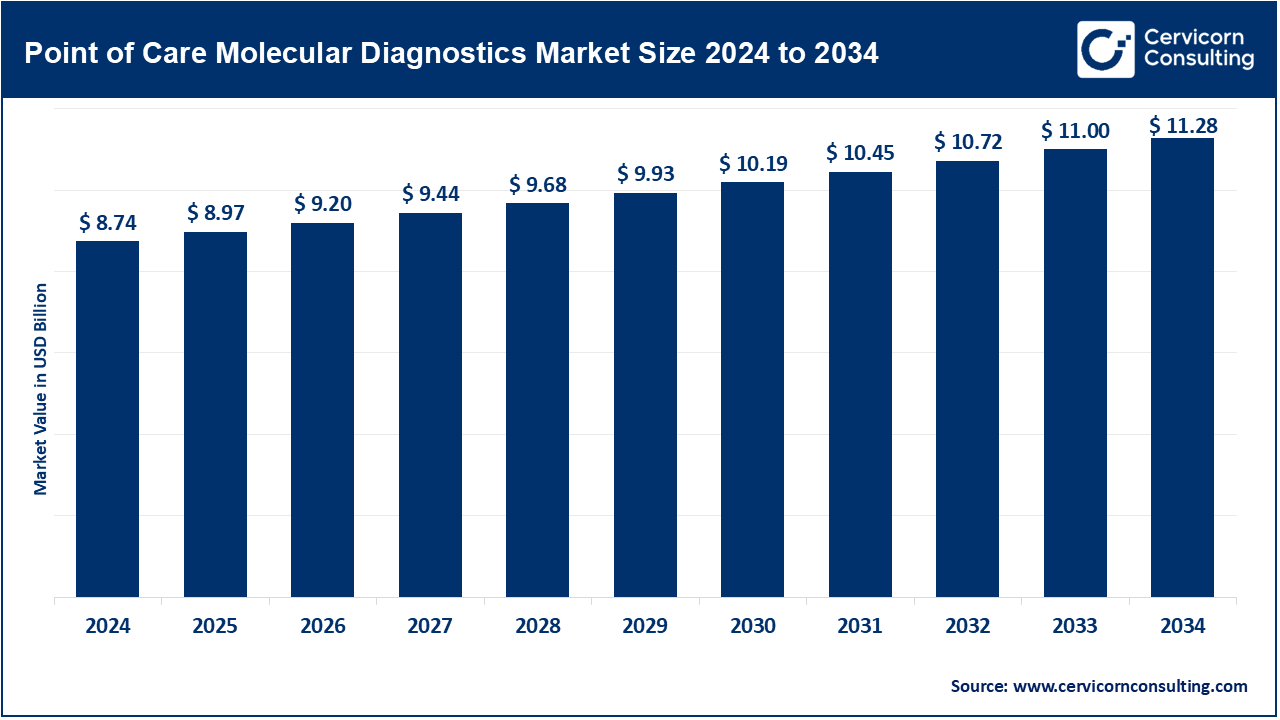

The global point-of-care molecular diagnostics market was worth USD 8.74 billion in 2024 and is anticipated to expand to around USD 11.28 billion by 2034, registering a compound annual growth rate (CAGR) of 2.58% from 2025 to 2034.

What Is the Point-of-Care Molecular Diagnostics Market?

The Point-of-Care (POC) Molecular Diagnostics Market refers to the segment of the diagnostics industry that delivers rapid, accurate, and actionable results at or near the site of patient care, such as clinics, emergency rooms, physician’s offices, or even home settings. Unlike traditional laboratory-based diagnostics that require centralized infrastructure, transportation of samples, and longer wait times, POC molecular diagnostics leverage miniaturized devices and automated processes to detect specific genetic material (RNA/DNA) from pathogens or human cells, providing real-time disease diagnosis and monitoring.

The molecular component sets it apart from regular POC tests, as these diagnostics utilize nucleic acid amplification techniques (like PCR, LAMP, or isothermal amplification) to ensure high specificity and sensitivity. Their utility ranges across a broad spectrum of applications such as infectious diseases (COVID-19, influenza, HIV), oncology, genetic disorders, cardiovascular diseases, and more.

Why Is the Point-of-Care Molecular Diagnostics Market Important?

The significance of the POC molecular diagnostics market lies in its ability to revolutionize healthcare delivery, particularly in low-resource settings and in emergency situations where every second counts. These tests facilitate early diagnosis, quick clinical decision-making, better patient management, and ultimately improved health outcomes. During the COVID-19 pandemic, POC molecular diagnostics became the frontline defense, allowing governments and institutions to scale up testing while minimizing hospital visits.

The importance is also amplified by its decentralized testing capability, reducing patient load on hospitals, and offering cost-effectiveness in the long run. Its role is increasingly vital in managing global health burdens, ensuring equity in healthcare, and enabling real-time disease surveillance, particularly in rural or underdeveloped regions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2603

Growth Factors Driving the Market

The growth of the point-of-care molecular diagnostics market is being driven by increased demand for rapid diagnostics, rising prevalence of infectious and chronic diseases, technological advancements in microfluidics and biosensors, integration of AI in diagnostics, growing investment from governments and private players, and the expanding availability of mobile healthcare solutions. The COVID-19 pandemic served as a catalyst for market acceleration, increasing public and institutional awareness, while government initiatives such as public-private partnerships and emergency use authorizations (EUAs) for POC diagnostic devices further contributed to market proliferation.

Top Companies in the Point-of-Care Molecular Diagnostics Market

1. F. Hoffmann-La Roche AG

- Specialization: Roche specializes in molecular diagnostics for oncology, infectious diseases, and women’s health.

- Key Focus Areas: Real-time PCR instruments, personalized healthcare, point-of-care virology testing.

- Notable Features: Cobas Liat System is a leading POC platform with CLIA-waived status for flu and COVID-19.

- 2024 Revenue: Estimated $17.9 billion from diagnostics division; POC molecular diagnostics a key contributor.

- Market Share: Roche holds ~18–20% of the global POC molecular diagnostics market.

- Global Presence: Strong footprint in Europe, North America, Asia-Pacific; distribution in 100+ countries.

2. Abbott Laboratories

- Specialization: Infectious disease testing, molecular diagnostics, immunoassays.

- Key Focus Areas: Rapid molecular testing, chronic disease detection, COVID-19 diagnostics.

- Notable Features: ID NOW platform — ultra-rapid (under 15 min) molecular diagnostic tool.

- 2024 Revenue: ~$13.5 billion from diagnostics; ID NOW accounts for significant sales.

- Market Share: Approximately 15–17% globally in POC molecular diagnostics.

- Global Presence: Operates in over 160 countries, with dominant presence in the U.S., Latin America, and Europe.

3. QIAGEN

- Specialization: Sample-to-insight solutions for molecular diagnostics and research.

- Key Focus Areas: Tuberculosis, HPV, and COVID-19 diagnostics.

- Notable Features: QIAstat-Dx system combines multiplex PCR with easy-to-use cartridges.

- 2024 Revenue: ~$2.5 billion total revenue; diagnostics division contributes ~60%.

- Market Share: Roughly 7–9% share of the POC molecular segment.

- Global Presence: Strong in Europe and North America; expanding footprint in Asia.

4. Bayer AG

- Specialization: Historically strong in healthcare, now pivoting diagnostics through partnerships.

- Key Focus Areas: Diabetes management, POC testing collaborations.

- Notable Features: Collaborated with Siemens Healthineers for POC tech integration.

- 2024 Revenue: Diagnostics revenue from joint ventures and tech transfers estimated ~$1.2 billion.

- Market Share: Indirect but influential through collaborative innovation (~3–5%).

- Global Presence: Global presence through healthcare partnerships and tech licensing.

5. Nova Biomedical

- Specialization: POC testing for critical care and infectious diseases.

- Key Focus Areas: Blood gas analyzers, glucose meters, respiratory infection testing.

- Notable Features: StatStrip and StatSensor POC platforms.

- 2024 Revenue: ~$700 million (projected); primarily from U.S. and Europe.

- Market Share: Smaller niche segment (~2–4%) with strong reliability ratings.

- Global Presence: Active in over 100 countries, especially strong in hospital-based testing.

Leading Trends and Their Impact on the Point-of-Care Molecular Diagnostics Market

1. Miniaturization and Portability

Advancements in microfluidics, nanoengineering, and biosensor integration are enabling handheld molecular diagnostic devices that can be deployed anywhere—from rural health centers to patient homes.

Impact: Reduced infrastructure dependency and improved access in remote areas.

2. AI and Machine Learning Integration

AI algorithms are being incorporated for faster result interpretation, epidemiological trend mapping, and predictive diagnostics.

Impact: Enhances diagnostic accuracy and facilitates real-time decision-making.

3. Multiplex Testing

Devices capable of detecting multiple pathogens in a single sample (e.g., SARS-CoV-2, influenza A/B, RSV) are gaining traction.

Impact: Improves clinical efficiency, especially during seasonal outbreaks.

4. Telehealth Integration

POC molecular diagnostics are increasingly being paired with telemedicine platforms, allowing clinicians to receive and interpret results remotely.

Impact: Supports remote monitoring, chronic care, and pandemic preparedness.

5. Regulatory Acceleration and EUA Models

The pandemic introduced emergency use authorization (EUA) frameworks, speeding up product approval.

Impact: Shortens time to market and encourages innovation from startups and tech firms.

Successful Examples Around the World

1. United States: Abbott’s ID NOW COVID-19 Test

Deployed across thousands of pharmacies and airports, ID NOW became a cornerstone of U.S. pandemic response, delivering results in 13 minutes.

2. Germany: QIAGEN’s QIAstat-Dx

Used extensively in European hospitals, this platform provided multiplex respiratory panel diagnostics, reducing hospital congestion.

3. India: MolBio’s Truenat Platform

Adopted by India’s national health mission for tuberculosis and COVID-19 testing, enabling real-time screening in rural and tribal regions.

4. Africa: GeneXpert by Cepheid (Now Danaher)

Although not POC in the strictest sense, its decentralized deployment for HIV, TB, and Ebola in Africa provided a model for mobile POC labs.

5. Japan: Fujirebio’s Automated Systems

Used for point-of-care cancer marker detection; helped in early detection and outpatient monitoring.

Global Regional Analysis and Government Initiatives

North America

- Market Share: Dominates global POC molecular diagnostics (~40%).

- Government Initiatives: U.S. FDA’s EUA, NIH’s RADx (Rapid Acceleration of Diagnostics), CDC’s infectious disease surveillance initiatives.

- Key Countries: U.S., Canada.

Europe

- Market Share: ~25–28%, driven by high healthcare standards and pandemic readiness.

- Policies: EU IVDR regulation impacting diagnostic device classification; funding via Horizon Europe.

- Key Countries: Germany, UK, France, Netherlands.

Asia-Pacific

- Market Share: Rapid growth (~20–22%) driven by infectious disease burden and technological adoption.

- Initiatives: India’s Ayushman Bharat for universal health coverage; China’s “Healthy China 2030” strategy emphasizing early diagnosis.

- Key Countries: China, India, Japan, South Korea.

Latin America

- Market Share: ~5–7%; challenged by healthcare disparities but growing due to public-private initiatives.

- Policies: Brazil’s SUS supporting decentralized diagnostics; regional investments in pandemic preparedness.

- Key Countries: Brazil, Mexico, Argentina.

Middle East & Africa

- Market Share: ~4–6%, with massive potential for growth.

- Programs: WHO-supported initiatives in TB and HIV testing; African CDC and local governments deploying mobile labs.

- Key Countries: South Africa, UAE, Nigeria, Kenya.

By examining the current landscape, it is evident that the Point-of-Care Molecular Diagnostics Market is not only a transformative force in medical diagnostics but also a crucial enabler of healthcare equity, emergency preparedness, and precision medicine. Global companies and governments are aligning efforts to make POC molecular tools more accessible, affordable, and intelligent—shaping the future of diagnostics across the world.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Blockchain-Based Electronic Health Record Market Set for 30.2% CAGR Growth, Hitting USD 14.85 Billion by 2034