Plastic Injection Molding Market Growth: Projections 2024-2033

Plastic Injection Molding Market Size and Growth Projections

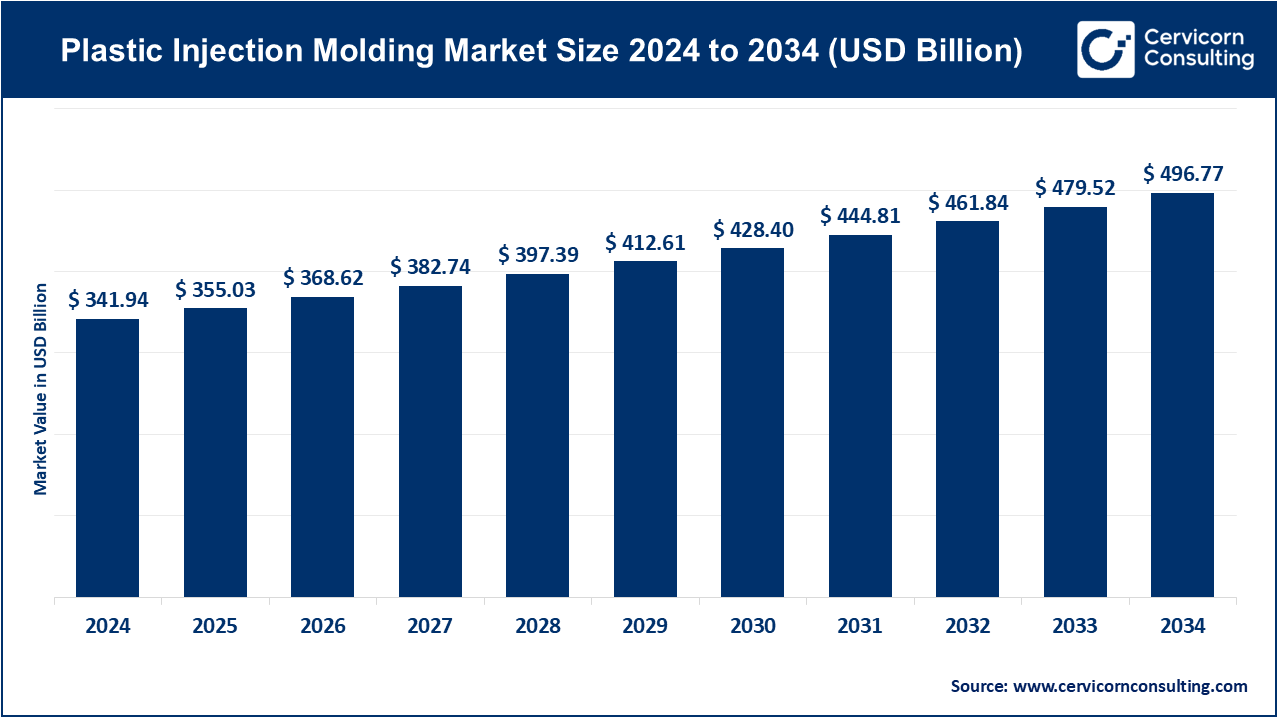

The global plastic injection molding market was valued at USD 341.94 billion in 2024 and is expected to grow to USD 355.03 billion in 2025, reaching approximately USD 496.77 billion by 2034, with a compound annual growth rate (CAGR) of 3.81% from 2025 to 2034. The growth of the plastic injection molding market is driven by advancements in automation, smart technologies, and customization, allowing for faster production and tailored products. The rising demand for high-performance materials in industries like healthcare, automotive, and aerospace further fuels market expansion. Additionally, the adoption of Industry 4.0 technologies and sustainability initiatives enhances efficiency, reducing waste and meeting consumer demand for eco-friendly solutions.

Leading Companies

| Company | Specialization | Key Focus Areas | Notable Features | 2023 Revenue (approx.) | Market Share (approx.) | Global Presence |

|---|---|---|---|---|---|---|

| ExxonMobil Corporation | Materials for plastic production | Petrochemicals, polymers, and plastics manufacturing | Global leader in petrochemical production and material innovation | $413.7 billion (total) | ~5% (plastics sector) | 60+ countries |

| BASF SE | High-performance plastics and polymers | Automotive, packaging, and construction materials | Focus on sustainable plastic solutions and innovative polymers | $92.6 billion (total) | ~8% (plastics sector) | 80+ countries |

| DuPont de Nemours, Inc. | Specialty materials, including engineering plastics | Automotive, electronics, and industrial applications | Known for advanced materials and R&D in plastic engineering | $23.7 billion (total) | ~4% (plastics sector) | 40+ countries |

| Dow, Inc. | Chemical manufacturing and plastic resins | Packaging, automotive, and construction plastics | Leader in high-performance resins and sustainable plastic materials | $57 billion (total) | ~9% (plastics sector) | 140+ countries |

| Huntsman International LLC. | Specialty chemicals and advanced plastics | Aerospace, automotive, and industrial applications | Known for performance chemicals and plastic innovations | $10.5 billion (total) | ~3% (plastics sector) | 30+ countries |

| Magna International, Inc. | Automotive components and injection molded plastics | Automotive industry, particularly for lightweight plastic components | Supplier of plastic parts for automotive applications | $41.5 billion (total) | ~3.5% (plastics sector) | 30+ countries |

| IAC Group | Automotive interior and exterior parts | Automotive interior systems, door panels, dashboards | Leading supplier of plastic injection-molded automotive parts | $3 billion (total) | ~2% (plastics sector) | 20+ countries |

| Kreate | Custom plastic injection molding | Consumer products, electronics, industrial components | Focuses on providing custom plastic solutions for various sectors | Private company, revenue unknown | N/A | Primarily US-based |

| Eastman Chemical Company | High-performance polymers and materials | Automotive, consumer electronics, and industrial applications | Known for innovation in sustainable plastic materials and coatings | $14 billion (total) | ~3% (plastics sector) | 100+ countries |

| INEOS Group | Petrochemical products and engineering plastics | Automotive, electronics, and healthcare packaging | Major player in chemicals, specializing in polyolefins and plastics | $75.6 billion (total) | ~6% (plastics sector) | 25+ countries |

| LyondellBasell Industries Holdings B.V. | Polyolefins, polypropylene, and plastic resins | Packaging, automotive, and durable goods | Global leader in plastics, chemicals, and refining | $45.8 billion (total) | ~10% (plastics sector) | 100+ countries |

| SABIC | Chemicals, plastics, and agricultural solutions | Automotive, packaging, and construction plastics | Focus on circular economy and sustainable material development | $45.5 billion (total) | ~7% (plastics sector) | 50+ countries |

| Berry Global, Inc. | Packaging and protective solutions using injection molding | Consumer goods, food packaging, medical applications | Leader in sustainable packaging solutions | $20.4 billion (total) | ~4% (plastics sector) | 60+ countries |

| Master Molded Products Corporation | Custom injection molded parts and components | Automotive, electronics, consumer goods | Known for precision manufacturing of custom plastic components | Private company, revenue unknown | N/A | Primarily US-based |

| LACKS ENTERPRISES, INC. | Automotive plastic injection molding | Automotive industry, primarily exterior and interior plastic parts | Specializes in plastic automotive parts and finishing processes | Private company, revenue unknown | N/A | Primarily US-based |

| The Rodon Group | High-volume plastic part production | Consumer products, electronics, and medical devices | Emphasis on high-volume, cost-effective injection molding services | Private company, revenue unknown | N/A | Primarily US-based |

| Heppner Molds | Mold design, fabrication, and plastic injection molding | Consumer products, industrial applications, and automotive parts | Focus on precision molding and quick turnaround times | Private company, revenue unknown | N/A | Primarily US-based |

| HTI Plastics Inc. | Custom injection molded plastic products | Consumer products, industrial components, and medical applications | Specializes in advanced injection molding and high-quality products | Private company, revenue unknown | N/A | Primarily US-based |

| Rutland Plastics | Custom injection molding services | Automotive, medical, and consumer products | Known for tailored solutions for various industries | Private company, revenue unknown | N/A | Primarily UK-based |

| AptarGroup, Inc. | Dispensing systems and high-quality plastic components | Personal care, pharmaceuticals, food packaging | Innovation in dispensing solutions and precision molding | $3.7 billion (total) | ~2.5% (plastics sector) | 20+ countries |

| Coastal Plastic Molding, Inc. | Custom injection molding and product design | Consumer products, automotive, and industrial sectors | Focus on high-precision custom molding solutions | Private company, revenue unknown | N/A | Primarily US-based |

Get a Free Sample: https://www.cervicornconsulting.com/sample/2452

What strategies are leading companies in the plastic injection molding market using to expand their operations?

Mergers and Acquisitions

- Definition: Mergers and acquisitions (M&A) are strategic moves where companies combine or purchase other companies to strengthen their position in the market.

- Purpose: Companies pursue M&A to expand their market presence, increase operational efficiency, gain new customer bases, and improve their competitive advantage. For example, Biomerics’ merger with Precision Concepts allowed them to expand their manufacturing footprint, which now spans 1.2 million square feet across 13 locations. This enables the company to offer more scalable and diverse services while improving manufacturing capacity.

- Reshoring Manufacturing: M&A is often used to support reshoring efforts—bringing back manufacturing operations to home regions, such as the United States, from overseas. This shift is beneficial for reducing dependence on international supply chains, minimizing shipping costs, and providing more localized production, which resonates with consumers’ growing preference for domestic-made goods.

Geographic Expansion

- Definition: Geographic expansion refers to the strategy of entering new regional markets to reach untapped customer bases and increase revenue streams.

- Purpose: Firms seek regional growth to access emerging markets, with a special focus on the Asia-Pacific region, which represented over 40% of global revenue in 2023. This area is rapidly industrializing, particularly in sectors like automotive and electronics. By establishing local manufacturing plants or distribution centers, companies can reduce transportation costs, adapt more quickly to regional market demands, and cater to local consumer preferences.

- Asia-Pacific Growth: For example, the booming automotive and electronics industries in Asia-Pacific provide companies with the opportunity to increase market share in one of the world’s most dynamic and fastest-growing regions.

Technological Advancements

- Definition: Technological advancements involve integrating new, cutting-edge technologies to improve operational efficiency and product quality.

- Purpose: Companies are investing heavily in automation, robotics, and specialized machinery such as hybrid injection molding machines to boost manufacturing efficiency and produce high-quality, intricate plastic components. These innovations are crucial for sectors like automotive, healthcare, and electronics, where there’s a growing demand for lightweight and complex components.

- Application-Specific Materials: For instance, Sabic’s introduction of materials tailored for specific applications allows them to diversify their product offerings, cater to specialized demands, and increase their competitiveness in industries like automotive, healthcare, and energy.

Sustainability Efforts

- Definition: Sustainability efforts refer to a company’s initiatives aimed at minimizing its environmental impact and offering products that align with eco-friendly principles.

- Purpose: Companies are adopting sustainable practices to meet regulatory requirements and respond to the growing consumer demand for environmentally conscious products. This includes the development of recyclable products, bio-based plastics, and waste-minimization techniques. These efforts not only improve a company’s environmental footprint but also enhance its brand image by aligning with consumer values focused on sustainability.

- Market Competitiveness: For example, offering recyclable or bio-based plastic products allows companies to tap into the growing market for sustainable goods, positioning them as industry leaders in green technologies and materials.

Strategic Partnerships

- Definition: Strategic partnerships involve collaborations between two or more companies, often from different sectors, to combine resources and capabilities.

- Purpose: By forming partnerships with other manufacturers, technology providers, or research institutions, companies can share knowledge, access new technologies, and expand their market reach. These partnerships allow firms to leverage complementary strengths, access new customer bases, and improve their product or service offerings.

- Resource Sharing: For example, a partnership between a plastics manufacturer and a robotics firm may lead to the integration of advanced automation in manufacturing processes, improving efficiency and product quality.

Market Diversification

- Definition: Market diversification refers to a strategy where companies expand their product portfolio or enter new industries to reduce reliance on a single market.

- Purpose: Companies are diversifying their product offerings to serve various industries like consumer goods, electronics, and medical devices. This strategy allows companies to reduce risk by tapping into different sectors, each with its own demand dynamics. For example, a company traditionally focused on automotive plastic components might branch out into medical device manufacturing to capture a share of the growing healthcare market.

- Specialized Plastic Components: The demand for specialized plastic components in different industries (e.g., medical devices, consumer goods) opens up opportunities for companies to innovate and cater to niche markets, thus broadening their revenue streams.

What are the leading trends in plastic injection molding market?

- Automation and Smart Technologies

The adoption of automation is revolutionizing the injection molding process, improving both efficiency and precision. Collaborative robots (cobots) are progressively taking over tasks previously performed by human workers, resulting in faster cycle times and increased production rates. Technologies like sensor monitoring, artificial intelligence (AI), and digital twin systems are enabling real-time optimization and quality control throughout the process. - Customization

Rising consumer demand for personalized products is driving the need for customization. Manufacturers are utilizing advanced molding techniques to produce tailored components for specific applications, such as lightweight automotive parts and specialized medical devices. This shift towards individualized products is influencing both product design and manufacturing processes. - Advanced Materials

There is a growing use of high-performance materials like PEEK (polyether ether ketone) and bioresorbable plastics. These materials offer exceptional properties, including greater strength, chemical resistance, and biocompatibility, making them ideal for demanding applications in industries like healthcare and aerospace. - Micro-Molding

Micro-molding is gaining attention as the demand for miniaturized components increases, especially in industries like medical devices and electronics. This technique enables the production of extremely small, precise parts, facilitating the creation of innovative products that require compact and intricate designs. - Industry 4.0 Integration

The integration of Industry 4.0 technologies is transforming the plastic injection molding sector. Smart manufacturing practices incorporating IoT (Internet of Things), AI, and machine learning are becoming the norm. These technologies support real-time monitoring, predictive maintenance, and automated quality control, leading to increased productivity and reduced downtime. - Sustainability Initiatives

Sustainability continues to be a key focus for the industry, with manufacturers increasingly adopting environmentally friendly practices. This includes the development of recyclable materials and processes designed to minimize waste. The shift towards sustainable injection molding is driven by regulatory requirements and consumer demand for eco-conscious products. - Emerging Applications

The injection molding market is expanding due to new applications in industries such as electric vehicles (EVs) and healthcare. In particular, the demand for lightweight components in EVs is growing rapidly as manufacturers strive to improve energy efficiency.