Plant-Based Protein Market Drivers, Trends, Key Players and Regional Insights by 2035

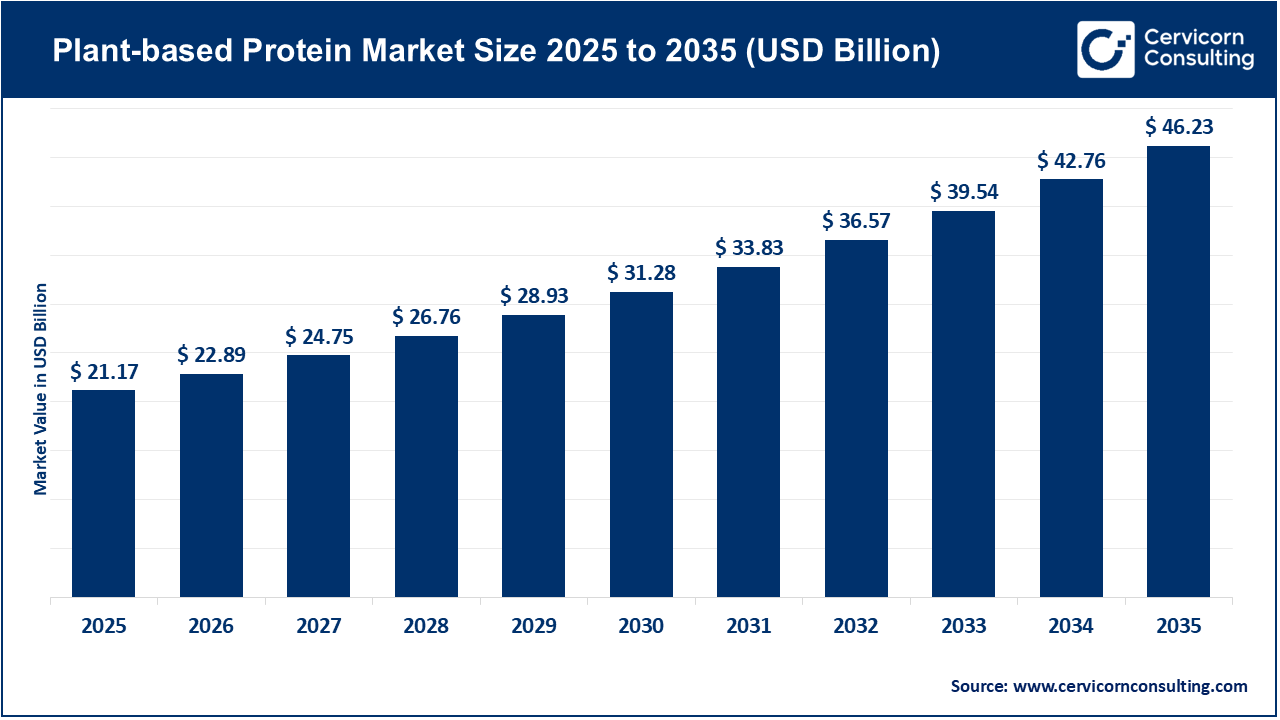

Plant-Based Protein Market Size

The global plant-based protein market size was worth USD 21.17 billion in 2025 and is anticipated to expand to around USD 46.23 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% from 2026 to 2035.

Plant-Based Protein Market Growth Factors

Several key factors underpin the robust expansion of the plant-based protein market. Rapidly increasing health consciousness among global consumers is driving demand for protein sources perceived as healthier alternatives to traditional animal proteins, as plant-based proteins tend to be lower in saturated fat and cholesterol while offering essential nutrients such as fiber, vitamins, and minerals. Environmental sustainability concerns — especially regarding livestock’s contribution to greenhouse gas emissions, deforestation, and water footprint — have amplified interest in plant proteins as a lower-impact alternative. Technological advancements in processing and formulation, including dry and wet fractionation, high-moisture extrusion, and precision fermentation, have improved protein functionality and sensory appeal, broadening their application in innovative foods and beverages.

Additionally, flexitarian diets, rising vegan and vegetarian populations, enhanced e-commerce access, and expanding distribution channels have collectively contributed to market momentum, making plant-based proteins widely available and attractive to diverse consumer segments.

Why the Plant-Based Protein Market is Important

The plant-based protein market’s importance stems from its intersection with major global trends — health, sustainability, food security, and economic development. Nutritionally, plant proteins offer viable alternatives for individuals seeking to manage weight, reduce chronic disease risk, or follow personalized diets such as vegetarian, vegan, or flexitarian.

Environmentally, they represent a more resource-efficient protein source that can help mitigate climate change impacts associated with conventional animal agriculture. From a global food security perspective, plant proteins contribute to diversifying food systems in regions vulnerable to meat supply volatility or resource constraints. Economically, the plant-based protein industry is spawning new value chains, jobs, and export opportunities — from producers of pea and soy proteins in North America and Europe to emerging specialty ingredient manufacturers in the Asia Pacific.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2885

Key Companies Shaping the Plant-Based Protein Market

Here’s an overview of major players — focusing on their specialization, key focus areas, notable features, 2024 revenue where available, market share context, and global presence.

Glanbia plc

Specialization & Focus Areas: Glanbia is an Irish global nutrition company with divisions including Glanbia Nutritionals and Glanbia Performance Nutrition. It supplies plant-based protein ingredients to food and supplement manufacturers while also marketing branded protein products.

Notable Features: Strong expertise in sports nutrition and functional ingredients; partnerships with brands to develop high-quality plant proteins; global distribution across multiple regions.

2024 Revenue: Total group revenue neared USD 3.8 billion in 2024, driven by volume increases, pricing strategies, and acquisitions.

Market Share & Global Presence: Glanbia’s plant-based protein offerings are distributed in over 130 countries, with a strong presence in North America, Europe, and Asia Pacific.

Kerry Inc.

Specialization & Focus Areas: Kerry is a global taste and nutrition leader that provides plant-based protein ingredients, flavor systems, and texturizing solutions for food producers. Its portfolio supports alternative meat, dairy replacements, snacks, and beverages.

Notable Features: Strong R&D investment, innovation in clean-label and sensory solutions for plant proteins.

2024 Revenue: Kerry recorded approximately €6.9–8.0 billion in continuing revenue across its business segments.

Market Share & Global Presence: Kerry operates in more than 150 countries with global ingredient capabilities and cross-segment application expertise in plant proteins.

Archer-Daniels-Midland Co. (ADM)

Specialization & Focus Areas: ADM is a major multinational agricultural processor and ingredient supplier with extensive operations in plant proteins, including soy and pea isolates used by food and beverage manufacturers globally.

Notable Features: Large supply chain network (over 270 plants globally), strong commodity origination and formulation expertise.

2024 Revenue: ADM’s overall revenue was around USD 18.5 billion.

Market Share & Global Presence: ADM is considered one of the largest providers of plant protein ingredients by volume, supplying global food brands across regions.

Royal Avebe UA

Specialization & Focus Areas: Royal Avebe is a Dutch cooperative known for starch and protein solutions derived from potatoes, including protein isolates for food and feed.

Notable Features: Sustainable potato-based protein products and differentiation as an alternative source.

2024 Revenue & Presence: Royal Avebe serves markets in Europe and beyond with its functional potato protein ingredients.

Cargill Inc.

Specialization & Focus Areas: Cargill is a global agribusiness giant supplying proteins, including plant-based nutrition ingredients, and partnering with food tech companies to scale plant protein products.

Notable Features: Vast supply chain, commodity trading reach, and involvement in alternative protein innovation.

2024 Revenue: Cargill’s total group revenue was reported near USD 160 billion.

Market Share & Global Presence: Cargill has a significant global footprint, trading and supplying ingredients across continents and integrating plant protein into its food solutions networks.

Leading Trends and Their Impact

Technological Innovation & Product Development

Advanced processing technologies — such as dry and wet fractionation, high-moisture extrusion, precision fermentation, and enzymatic treatments — are enhancing plant protein functionality (texture, taste, solubility) to better mimic animal-derived proteins, broadening their use in meat analogues, dairy alternatives, and functional nutrition products.

Clean Label & Functional Foods

Consumers increasingly prefer clean-label and functional foods. Manufacturers are responding by developing fortified and clean-label plant proteins, sometimes combining multiple sources (e.g., pea, soy, rice) to deliver complete amino acid profiles and enhanced health claims.

Sports & Performance Nutrition

Plant proteins are gaining traction among athletes and active consumers, driven by evidence of benefits in muscle recovery and performance. This is stimulating growth in ready-to-drink beverages, protein powders, and nutrition bars tailored to sports nutrition.

Expansion in Emerging Markets

While North America and Europe currently dominate, Asia Pacific and Latin America are experiencing faster adoption due to rising disposable incomes, urbanization, growing health awareness, and e-commerce expansion.

Successful Global Examples

United States

A mature market with extensive product diversity — plant-based burgers, dairy alternatives, protein snacks — benefiting from strong retail infrastructure, investment in innovation, and endorsements by major foodservice chains.

Europe

Countries like Germany, France, and the UK lead adoption of plant protein products. Though regulatory debates influence the sector, consumer interest in sustainability and health drives demand.

China

China is growing as both a producer and consumer market, driven by changing diets and increased demand for pea proteins, with shifting export dynamics shaping the supply chain.

Asia Pacific

Rising vegan and flexitarian lifestyles in China, India, Japan, and Australia support plant protein product growth, supplemented by government initiatives promoting sustainable and healthy diets.

Global & Regional Analysis: Government Initiatives & Policies

United States

Recent revisions to U.S. dietary guidance emphasize plant proteins’ role in healthy diets, encouraging product development and consumer uptake.

Europe

European countries balance support for alternative proteins with agricultural protections — including labeling regulations for plant-based products — affecting marketing practices.

Canada & Singapore

Canada and Singapore have implemented specific labeling requirements for plant-based products, requiring terms or disclaimers that clarify protein sources for consumers.

Australia & New Zealand

Food safety standards for plant proteins are continually refined to ensure quality and consumer confidence, indirectly supporting market growth.

India

India’s regulatory stance on plant-based dairy and protein labeling has evolved through legal challenges, with ongoing policy developments influencing market clarity and product acceptance.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: U.S. In Vitro Diagnostics Market Growth Drivers, Trends, Key Players and Regional Insights by 2035