India Petrochemicals Market Growth Trends, Top Companies, Global Insights and Adoption

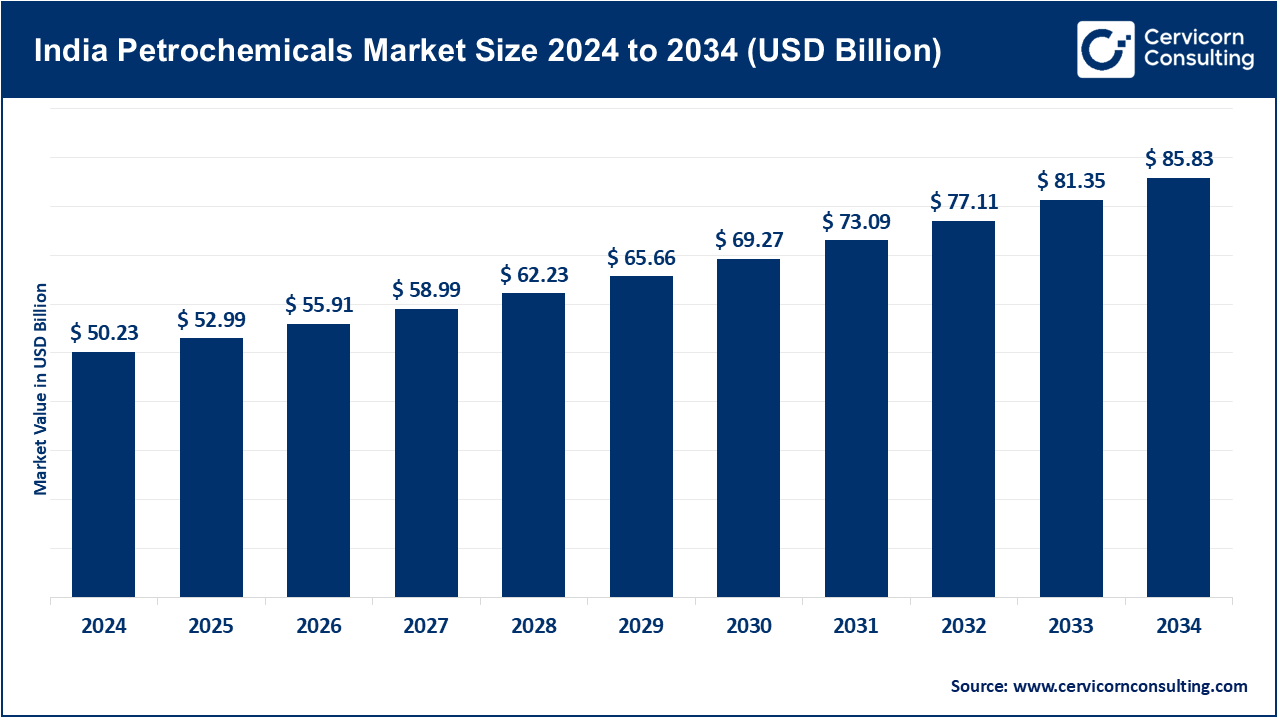

India Petrochemicals Market Size

India Petrochemicals Market Overview

The India petrochemicals market stands as one of the most dynamic and rapidly expanding segments within the global chemicals industry. Petrochemicals, derived primarily from crude oil and natural gas, form the backbone of numerous industries such as plastics, textiles, packaging, automotive, agriculture, construction, healthcare, and consumer goods. In 2024, India’s petrochemical industry is positioned as a critical contributor to the national economy, not just as a revenue generator but also as an enabler of industrial growth and modernization.

The market has evolved rapidly, supported by rising domestic demand, favorable government policies, increasing capacity expansions, and growing investments from both public and private enterprises. With India aiming to become a global hub for manufacturing and energy, petrochemicals serve as a vital bridge to achieving this ambition.

The India petrochemicals market is expected to grow steadily in the coming years, driven by industrialization, urbanization, and rising consumer demand. India’s position as one of the fastest-growing economies in the world is directly linked with the expansion of its petrochemical industry. From the production of synthetic fibers for the textile industry to fertilizers for agriculture and polymers for packaging, petrochemicals are indispensable to everyday life. The sector also contributes significantly to India’s trade balance, as it accounts for a substantial share of exports while simultaneously reducing the reliance on imports by expanding domestic production capacities.

Moreover, the industry is undergoing a transformation with the integration of sustainability practices, green chemistry, and circular economy initiatives, aligning with global environmental goals.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2726

What is the India Petrochemicals Market?

The India petrochemicals market comprises a wide range of chemical products obtained from petroleum and natural gas. These include olefins such as ethylene and propylene, aromatics like benzene and toluene, and derivatives such as plastics, synthetic fibers, and elastomers. Petrochemicals are processed into polymers, fibers, detergents, adhesives, coatings, and other industrial and consumer products. In India, the petrochemical industry is structured across upstream, midstream, and downstream value chains. The upstream segment involves crude oil and natural gas processing, the midstream focuses on refining and cracking, and the downstream involves conversion into end-use products.

India’s petrochemical industry has a diversified production base, with state-owned enterprises, private companies, and multinational corporations playing a crucial role. Domestic availability of raw materials, coupled with competitive production costs, provides India with an edge in global petrochemicals manufacturing. Additionally, the government’s push for “Make in India,” along with policies to attract foreign direct investment (FDI), has bolstered the market’s development.

Why is the India Petrochemicals Market Important?

The importance of the India petrochemicals market lies in its extensive applications and economic significance. Firstly, it acts as the backbone of industrial growth, as petrochemical derivatives are used in sectors ranging from packaging and construction to automotive and healthcare. Secondly, it supports agricultural productivity through the production of fertilizers, films, and irrigation pipes. Thirdly, petrochemicals enable import substitution by meeting domestic requirements, thereby conserving foreign exchange. Fourthly, the industry generates substantial employment opportunities both directly and indirectly. Finally, it contributes to India’s global competitiveness by serving as a critical export sector.

Furthermore, as India works toward achieving net-zero emissions by 2070, the petrochemical sector plays a dual role. On one hand, it faces challenges in terms of sustainability and carbon footprint, while on the other, it is innovating with bio-based feedstocks, recycling initiatives, and green chemistry. This balance of industrial growth with sustainability makes the market strategically important for India’s long-term development goals.

Growth Factors of the India Petrochemicals Market

The growth of the India petrochemicals market is driven by a confluence of factors including rapid industrialization, rising demand for plastics and polymers across automotive, packaging, and consumer goods industries, increasing use of synthetic fibers in textiles, growing fertilizer demand in agriculture, favorable government initiatives promoting domestic manufacturing, significant foreign direct investments, capacity expansion projects by major players, advancements in refinery-petrochemical integration, the emergence of circular economy models, increasing adoption of green and bio-based petrochemicals, and rising exports due to India’s cost competitiveness in global markets.

India Petrochemicals Market Top Companies

Reliance Industries Limited (RIL)

Reliance Industries is the largest player in India’s petrochemicals market, operating one of the world’s largest refining and petrochemicals complexes in Jamnagar, Gujarat. The company specializes in polymers, polyesters, fiber intermediates, elastomers, and aromatics. Its key focus areas include integration of refining with petrochemicals, sustainability initiatives, and capacity expansions. Notable features include its advanced R&D capabilities and world-scale plants. In 2024, Reliance’s petrochemicals revenue is estimated at around USD 28 billion, with a dominant domestic market share of nearly 35%. Its global presence spans over 100 countries, making it a leading international supplier of petrochemical products.

Indian Oil Corporation Limited (IOCL)

Indian Oil Corporation operates one of the most integrated refining and petrochemical businesses in India. Its specialization lies in polymers, aromatics, and synthetic fibers. The company’s key focus areas include refinery integration, expansion of naphtha cracker units, and adoption of green energy solutions. A notable feature of IOCL is its strong distribution network and focus on circular economy practices. IOCL reported petrochemicals revenue of approximately USD 11 billion in 2024, holding nearly 15% of the domestic market share. The company exports to regions including Southeast Asia, Africa, and the Middle East.

Haldia Petrochemicals Limited

Haldia Petrochemicals is a leading producer of polymers and chemicals in Eastern India. Its specialization is in polyethylene, polypropylene, and butadiene. The company’s focus areas include technological collaborations, expansion of production capacities, and export-oriented growth. A notable feature is its advanced naphtha cracker plant with a capacity of 700,000 metric tons per annum. In 2024, the company’s revenue from petrochemicals stood at around USD 3.5 billion, with a domestic market share of 4%. It exports to over 20 countries, with a strong presence in South Asia and Africa.

Bharat Petroleum Corporation Limited (BPCL)

Bharat Petroleum has been expanding its petrochemical footprint through integrated refinery-petrochemical complexes. It specializes in polymers, aromatics, and propylene derivatives. The company’s focus areas include backward integration, sustainability, and value-added petrochemicals. A notable feature of BPCL is its Kochi Refinery’s Propylene Derivatives Petrochemical Project (PDPP). Its petrochemicals revenue in 2024 is estimated at USD 4.2 billion, with a 6% domestic market share. BPCL exports to multiple global regions, including Europe and the Middle East.

GAIL (India) Limited

GAIL is a major producer of polyethylene and other polymer products, with specialization in gas-based petrochemicals. Its key focus areas include integration of natural gas with petrochemicals and expansion of polyethylene capacities. A notable feature is its large-scale petrochemical plant at Pata, Uttar Pradesh. GAIL’s petrochemicals revenue in 2024 is approximately USD 2.8 billion, with a 5% market share. It exports to Asia-Pacific, Africa, and Latin America.

Finolex Industries Limited

Finolex Industries specializes in polyvinyl chloride (PVC) resins and pipes, with a strong focus on agricultural and infrastructure applications. Its key focus areas include expanding PVC capacities and strengthening rural distribution. Notable features include being India’s largest PVC pipe manufacturer. Its 2024 petrochemicals revenue is estimated at USD 1.2 billion, with a 3% market share. The company exports PVC products to Asia and Africa.

Supreme Petrochem Ltd

Supreme Petrochem is the market leader in polystyrene and styrenics in India. Its specialization includes expandable polystyrene, specialty polymers, and thermoplastic elastomers. The company’s focus areas include product diversification and global expansion. Notable features include strong R&D capabilities and a wide specialty product range. Its petrochemicals revenue in 2024 is approximately USD 950 million, with a 2% domestic market share. The company exports to over 100 countries.

Mangalore Refinery and Petrochemicals Ltd (MRPL)

MRPL, a subsidiary of ONGC, operates a large refinery with integrated petrochemical facilities. Its specialization includes aromatics and polypropylene. The company focuses on refinery integration, value-added petrochemicals, and sustainability. A notable feature is its large aromatics complex. In 2024, MRPL’s petrochemicals revenue stood at USD 2.1 billion, with a 4% market share. Its global presence includes Asia-Pacific and the Middle East.

ONGC Petro additions Limited (OPaL)

OPaL is one of India’s largest integrated petrochemical complexes, located at Dahej, Gujarat. Its specialization includes polymers, benzene, butadiene, and other petrochemical derivatives. Focus areas include world-scale operations, technological integration, and global exports. Notable features include advanced manufacturing technology and large production capacity. Its revenue in 2024 is estimated at USD 3 billion, with a 5% domestic market share. OPaL exports to Asia, Europe, and Africa.

LyondellBasell Industries

As a global petrochemicals leader, LyondellBasell operates in India through joint ventures and collaborations. Its specialization includes polyolefins, polypropylene, and advanced polymers. The company’s key focus areas include innovation, sustainability, and expanding India operations. A notable feature is its global expertise and technological leadership. In 2024, its India-related petrochemicals revenue is estimated at USD 1.5 billion, with about 2% of the domestic market share. LyondellBasell has a global presence in over 120 countries.

Leading Trends and Their Impact

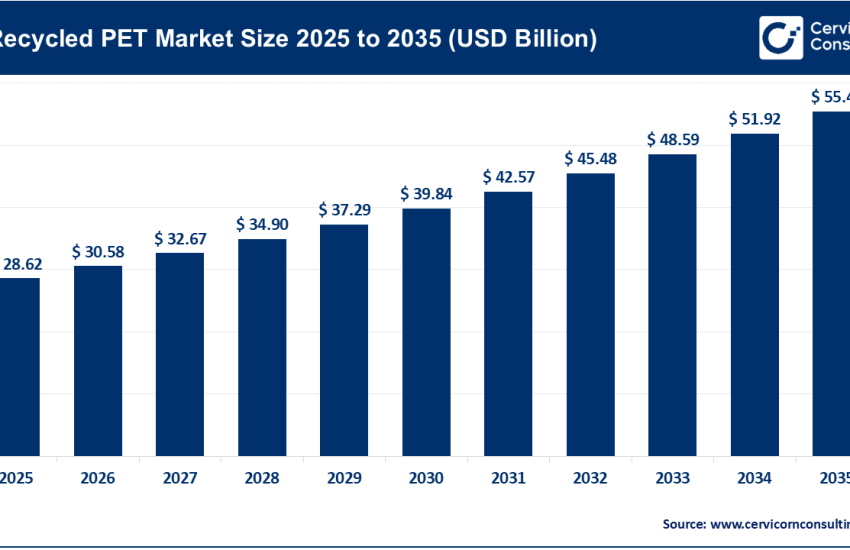

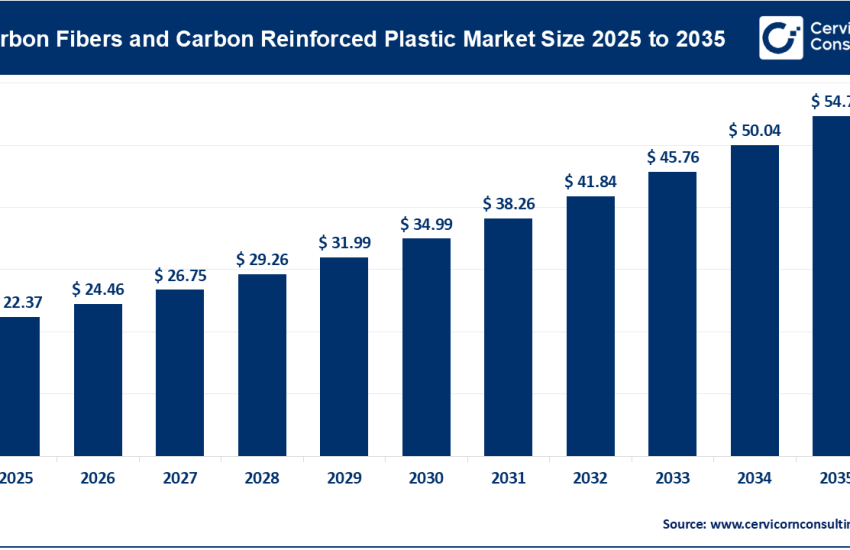

The India petrochemicals market is undergoing several transformative trends. Firstly, sustainability and circular economy initiatives are driving investments in plastic recycling and bio-based petrochemicals. Secondly, digitalization and automation in petrochemical plants are enhancing operational efficiency. Thirdly, integration of refineries with petrochemicals is improving economies of scale. Fourthly, demand for high-performance and specialty chemicals is increasing across automotive, electronics, and healthcare sectors. Fifthly, India’s growing middle class and rising disposable incomes are boosting consumption of petrochemical-derived consumer goods. Finally, global players are entering joint ventures and collaborations to capitalize on India’s growth potential.

These trends are reshaping the competitive landscape by compelling companies to innovate, adopt cleaner technologies, and explore new business models. They also position India as a strong global player, capable of competing with petrochemical giants from the Middle East, China, and the United States.

Successful Examples of India Petrochemicals Market Around the World

Several success stories highlight India’s impact on the global petrochemicals market. Reliance Industries’ Jamnagar complex is a world-renowned example of scale and integration, exporting petrochemical products worldwide. Indian Oil’s petrochemical exports to Southeast Asia and Africa showcase the global demand for Indian products. Haldia Petrochemicals has successfully established a strong presence in South Asia, while OPaL has emerged as a major exporter of polymers. These companies exemplify how India’s petrochemical industry has moved beyond domestic markets to play a significant role globally.

Global Regional Analysis and Government Initiatives

Regionally, the India petrochemicals market is integrated with global supply chains. Exports primarily target Asia-Pacific, Africa, the Middle East, and Europe. Domestically, western India, particularly Gujarat, serves as the hub for petrochemical production due to proximity to ports and refineries. Southern and northern India are emerging as significant growth regions, supported by new investments and industrial clusters.

Government initiatives play a pivotal role in shaping the market. The “Make in India” program encourages local manufacturing, while the Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs) policy aims to establish world-class infrastructure for the sector. Tax incentives, FDI liberalization, and environmental regulations are also shaping investment flows. Additionally, India’s commitment to achieving net-zero emissions has prompted the petrochemical sector to invest in green technologies and renewable energy integration.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Fast Fashion Market Growth Trends, Top Companies, Global Insights and Adoption