Green Chemicals Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

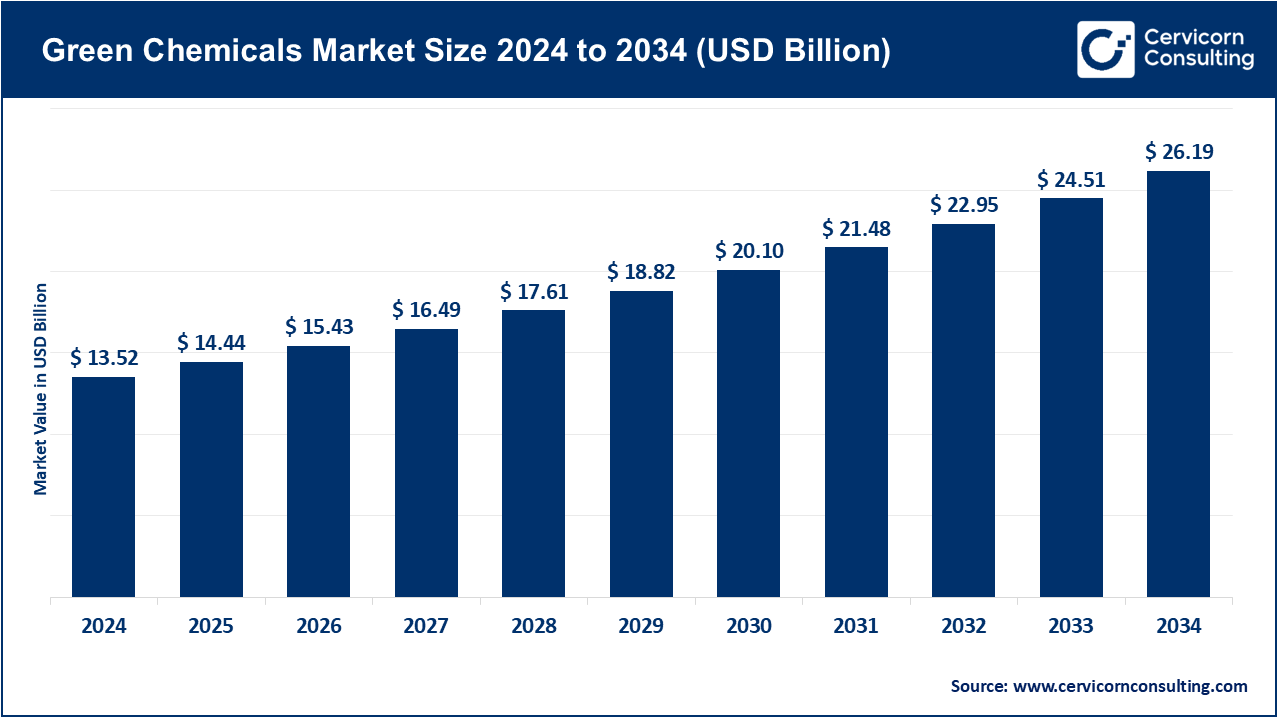

Green Chemicals Market Size

What is the green chemicals market?

The green chemicals market refers to production and commercialization of chemicals, intermediates, materials and additives that are sourced, manufactured, or processed using routes with reduced environmental impact compared to conventional petrochemical pathways. That includes bio-based feedstocks (plant sugars, fats, oils, fermentation products), chemicals derived from waste streams, processes with lower energy/GHG intensity (e.g., electrified synthesis, greener catalysts), and products designed for end-of-life circularity (biodegradable polymers, recyclable formulations). The market spans ingredients for plastics (biopolymers), solvents, surfactants, specialty chemicals for personal care and food, industrial intermediates, and green process technologies.

Growth factors

The green chemicals market is propelled by a bundled set of growth factors: strengthening regulatory frameworks (carbon pricing, single-use plastics bans, stricter chemical safety and biodegradability rules), corporate sustainability and procurement mandates (scope-3 targets, supplier green procurement), falling costs and scale-up of bio-refineries and bioprocessing technologies, rising availability of sustainable feedstocks (agricultural residues, waste oils, engineered sugars), innovation in catalysis and process electrification that improves economics and reduces emissions, consumer demand for greener end-use products (from packaging to cosmetics), and growing investor appetite for decarbonizing chemical supply chains — all of which make green alternatives increasingly competitive and expand addressable markets across industries from packaging to agriculture and personal care.

Why is the green chemicals market important?

- Climate impact reduction — Chemicals and materials represent a significant portion of industrial GHG emissions and embodied carbon in products; greening chemical production is essential to achieve economy-wide decarbonization goals.

- Resource resilience — Moving away from finite fossil feedstocks to diversified biomass and waste streams reduces exposure to oil price volatility and supply shocks.

- Regulatory compliance & market access — Companies using greener inputs are better positioned to meet evolving regulations (e.g., packaging mandates, biodegradability requirements) and procurement criteria from large retailers and brand owners.

- Circular economy enablement — Green chemicals often integrate with circular strategies (compostable polymers, recyclable chemistries, recycling-friendly additives), enabling closed-loop product systems.

- Innovation & new value chains — The shift sparks R&D, new bio-refinery investments, regional economic opportunities (agro-industrial clusters), and value capture for farmers and waste processors.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2735

Green Chemicals Market — Top company profiles

Each company entry lists: Company, Specialization, Key Focus Areas, Notable Features, 2024 Revenue (topline), Market Share (qualitative), Global Presence.

1) Dow (Dow Inc.)

- Company: Dow

- Specialization: Broad chemicals and advanced materials including performance plastics, coatings, intermediates and process technologies.

- Key focus areas: Transitioning selected product lines to lower-carbon feedstocks, offering circular solutions (mechanical and chemical recycling enablement), collaboration on bio-monomers and sustainable additives for plastics.

- Notable features: Very large global manufacturing and R&D footprint; strong position in commodity and specialty chemistries that makes Dow a pivotal partner for brand owners shifting to recycled/green content.

- 2024 revenue: Dow reported full-year net sales of approximately $43.0 billion for 2024.

- Market share: Major global player—Dow’s share in specifically labeled “green chemicals” depends on product line, but its scale makes it a dominant supplier of enabling materials and transition solutions.

- Global presence: Extensive manufacturing and sales across the Americas, Europe, Asia Pacific and Middle East.

2) ADM (Archer Daniels Midland Company)

- Company: Archer Daniels Midland (ADM)

- Specialization: Agricultural processing, fermentation-derived ingredients, bio-based intermediates (sugars, starches, oils), and increasingly biochemicals and biomaterials.

- Key focus areas: Scaling bio-based feedstocks, developing fermentation and enzyme capabilities to produce platform molecules for plastics, surfactants and solvents.

- Notable features: Deep vertical integration with agricultural supply chains gives ADM an advantage in feedstock security and cost; strategic partnerships with biotech firms accelerate pathway commercialization.

- 2024 revenue: ADM’s full-year 2024 revenues were reported at roughly $85.5 billion.

- Market share: A leading raw-material supplier for bio-based chemical production; its market share in the green chemicals subsegments is significant because of feedstock volumes.

- Global presence: Large processing footprint across the Americas, Europe, Asia, and Africa; global trading and service operations.

3) BASF

- Company: BASF SE

- Specialization: Wide range of specialty and performance chemicals, catalysts, intermediates and agricultural solutions.

- Key focus areas: Development of bio-based and lower-emission product lines, investment in renewable feedstock routes, catalyst and process optimization to reduce energy intensity, and solutions to enable recycling.

- Notable features: Massive R&D capabilities and broad portfolio across sectors (automotive, coatings, agriculture, construction), enabling BASF to commercialize green alternatives at scale.

- 2024 revenue: BASF’s consolidated financial figures for 2024 reflect multi-tens of billions in sales.

- Market share: One of the global leaders in specialty chemicals and an important incumbent in sustainable chemistry initiatives.

- Global presence: Manufacturing and R&D facilities worldwide with particularly strong positions in Europe, North America and expanding presence in Asia.

4) Cargill

- Company: Cargill, Incorporated

- Specialization: Agribusiness, food ingredients, specialty oils, and bio-intermediates used for bio-based chemicals and materials.

- Key focus areas: Converting agricultural commodities and co-products into higher-value green chemical precursors, developing sustainable sourcing and traceability, and investments in bio-refinery capacity.

- Notable features: Privately held, enormous scale in commodity handling and processing, active in piloting bio-based routes and feedstock circularity.

- 2024 revenue: Cargill reported approximately $160 billion in annual revenue for fiscal 2024.

- Market share: Major feedstock supplier and processor whose scale makes it a de-facto anchor for many green chemical supply chains.

- Global presence: Very large global footprint—processing and trading operations in North and South America, Europe, Africa and Asia.

5) Corbion

- Company: Corbion N.V.

- Specialization: Bio-based lactic acid, polylactic acid (PLA) and other biodegradable polymers and intermediates for food, medical and packaging markets.

- Key focus areas: Scaling PLA polymer production, fermentation efficiency, ingredient solutions for food and pharma, and enabling biodegradable/compostable packaging solutions.

- Notable features: Pure-play biobased polymer company with focused expertise in lactic acid chemistry and downstream PLA value chains—positioned as a leading supplier in compostable plastics.

- 2024 revenue: Corbion reported sales of €1,288.1 million in 2024.

- Market share: A leading specialist in lactic-acid derived polymers (PLA), with meaningful share in compostable packaging segments.

- Global presence: Manufacturing and sales focused in Europe, with growing operations and partnerships in Asia and the Americas.

Leading trends and their impact

- Scale-up of bio-refineries and bioprocessing — Larger commercial plants reduce unit costs, making bio-monomers and bio-solvents cost-competitive. This drives substitution in packaging, coatings and surfactants.

Impact: Accelerates uptake by brand owners and enables price parity in commoditized applications. - Chemical recycling and hybrid circular solutions — Combining mechanical recycling with chemical depolymerization allows recovery of traditionally hard-to-recycle streams.

Impact: Expands feedstock base for green chemicals and reduces demand for virgin fossil feedstocks. - Electrification and green hydrogen in process heat — Replacing fossil fuels in heat-intensive steps with electricity/renewable H2 lowers scope-1 emissions for producers.

Impact: Improves lifecycle emissions profiles and helps meet corporate and regulatory carbon targets. - Biomass waste valorization — Technologies converting agricultural residues, food waste and used cooking oils into platform molecules reduce competition with food crops.

Impact: Mitigates sustainability concerns and improves feedstock circularity. - Policy-driven demand signals — EPR (extended producer responsibility), recycled content mandates and single-use restrictions create guaranteed demand for greener inputs.

Impact: De-risks investments in green chemistry and encourages retrofitting existing plants. - Digitalization & process intensification — AI-driven process optimization and intensified reactors (e.g., continuous fermentation) improve yields and reduce CAPEX/OPEX.

Impact: Faster commercialization cycles and improved margins for green chemical producers.

Successful examples around the world

- PLA packaging adoption (Europe & North America) — Companies like Corbion and downstream converters scaled PLA for compostable food packaging and disposable cutlery; several municipalities and events adopted compostable streams with success, showing feasibility at scale.

- Bio-based surfactants from plant oils (Southeast Asia & EU) — Producers converted palm and coconut oil fractions into biodegradable surfactants for detergents and personal care, supplying brands keen to replace linear, non-degradable chemistries.

- Circular solvents and chemical recycling pilots (Japan, EU, US) — Industrial pilots for chemical recycling of mixed plastics yielded feedstock oils used to make virgin-grade monomers and additives, enabling brand owners to claim recycled content without compromising quality.

- Agricultural co-product valorization (Latin America, US) — ADM, Cargill and others work with farmers/processors to convert starches, oils and residues into building blocks for green adhesives, plastics and industrial chemicals — creating integrated regional value chains.

Global regional analysis: Government initiatives & policies shaping the market

North America

- Policy environment: Incentives for clean energy, grant programs for biorefineries, state-level recycled content mandates and procurement guidelines.

- Notable initiatives: Public funding for bioeconomy pilot projects; tax credits for sustainable manufacturing. These support scale-up of domestic green chemical production and attract private capital (especially in the United States and Canada).

Europe

- Policy environment: The EU’s Green Deal, circular economy action plan, Packaging and Packaging Waste Regulation (PPWR) and chemicals strategy push both supply and demand for greener chemistries.

- Notable initiatives: Recycled content mandates, eco-design rules and strict single-use plastic restrictions create robust market pull for bioplastics, biodegradable formulations and chemical recycling solutions. The region is a hotbed for compostable packaging adoption and technology pilots. (EU policy pressure is a major accelerator for green chemistry adoption.)

Asia-Pacific

- Policy environment: Mixed across countries—rapid industrial growth coupled with increasing regulatory ambition (China’s industrial decarbonization goals, waste management policies in India, and bioeconomy roadmaps in Japan and South Korea).

- Notable initiatives: National subsidies for bio-refinery installations, industrial symbiosis programs, and investments in sustainable feedstock logistics. Local feedstocks (palm, cassava, sugarcane) underpin regional green chemical projects.

Latin America

- Policy environment: Opportunity rich due to biomass availability (sugarcane, soy, residues) but variable regulatory sophistication. Governments are beginning to pilot bio-based chemical projects and incentives for rural industrialization.

- Notable initiatives: Public-private partnerships to develop agro-industrial clusters and value capture for agricultural residues.

Middle East & Africa

- Policy environment: Historically fossil-feedstock centric but changing: Gulf countries are exploring bioeconomy diversification and green hydrogen; some African nations pursue small-scale bio-refineries tied to rural development.

- Notable initiatives: Strategic investments in renewable feedstocks and green hydrogen-enabled chemistry which could create next-generation low-carbon export sectors.

How policy shapes investment and adoption

- Mandates & standards (demand side): Recycled content and biodegradability standards create guaranteed demand and reduce commercial risk for new entrants.

- Financial incentives (supply side): Grants, tax rebates, low-interest loans and feedstock support make capital-intensive biorefineries bankable.

- Procurement & public sector buying: Government procurement of green products creates anchor customers that accelerate market formation.

- R&D & collaboration funding: Public grants for pre-commercial scale R&D reduce technical risk and speed technology transfer to industry.

Practical considerations for downstream adopters (brands, converters, formulators)

- Lifecycle assessment (LCA) rigor — Not all “bio” claims are equal; LCA helps ensure meaningful carbon and environmental benefits.

- Supply chain traceability — Secure sustainable feedstocks (Certified feedstock, RSPO/ISCC where applicable) to avoid reputational risks.

- End-of-life systems — If using compostable polymers, verify municipal composting infrastructure and consumer labeling to avoid contamination.

- Technical fit & performance parity — Early testing and co-development with suppliers is crucial to match performance of incumbent materials.

- Cost pathway planning — Expect initial cost premium in early adoption phases; plan for scale-up and blended content strategies to manage transition.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Battery Cell Component Market Growth Factors, Key Players, and Global Presence by 2034