Digital Biomarkers Market Revenue, Global Presence, and Strategic Insights by 2034

Digital Biomarkers Market Size

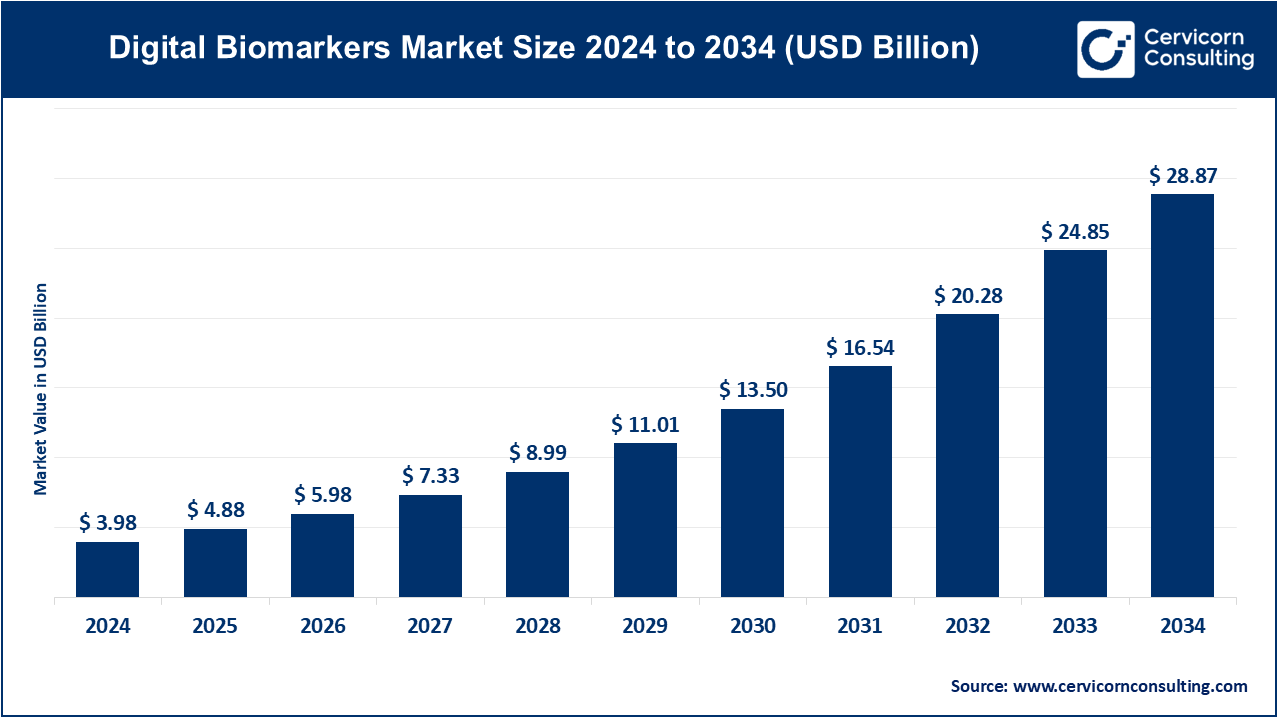

The global digital biomarkers market size was worth USD 3.98 billion in 2024 and is anticipated to expand to around USD 28.87 billion by 2034, registering a compound annual growth rate (CAGR) of 21.91% from 2025 to 2034.

What Is the Digital Biomarkers Market?

The digital biomarkers market includes all technologies and solutions designed to collect, analyze, validate, and apply digital physiological and behavioral data in healthcare and research. It includes:

- Hardware: Wearables, implantables, sensors, smartphone-based tools, and connected medical devices.

- Software & AI: Signal processing systems, analytics engines, machine-learning models, and clinical-decision algorithms.

- Platforms & Cloud Services: Data ingestion systems, digital endpoints platforms, secure health-data clouds, real-world evidence engines.

- Services: Clinical validation, regulatory strategy, data management, trial enablement, remote patient monitoring services.

Users of digital biomarkers include pharmaceutical companies, CROs, healthcare providers, payers, academic researchers, insurers, telehealth vendors, and technology platforms. Their applications span decentralized clinical trials, chronic disease management, remote monitoring, early disease detection, digital therapeutics, neurological monitoring, cardiology screening, and mental health analytics.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2416

Why Is the Digital Biomarkers Market Important?

The market is becoming central to modern healthcare for several reasons:

1. Continuous, Objective Data

Traditional biomarkers (lab tests, imaging) offer snapshots. Digital biomarkers capture continuous and real-world signals, providing deeper insights into patient physiology and behavior.

2. Improved Clinical Trial Sensitivity

Digital biomarkers detect subtle changes earlier than conventional endpoints, enabling shorter trials, fewer participants, and more accurate efficacy assessment.

3. Remote Monitoring at Scale

Chronic conditions—cardiovascular, respiratory, metabolic, or neurological—benefit greatly from continuous remote data that alerts clinicians before symptoms worsen.

4. Patient-Centric Healthcare

Patients generate data passively with less burden and higher engagement, shifting care models from reactive to preventive.

5. Accelerating Precision Medicine

Digital biomarkers enable personalized treatment pathways, predicting which therapies work best for each patient.

6. Economic & System Efficiency

Longitudinal monitoring reduces unnecessary hospital visits, improves adherence tracking, and lowers overall healthcare costs.

Digital Biomarkers Market Growth Factors

The digital biomarkers market is growing rapidly due to the widespread adoption of clinical-grade and consumer wearables, increasing investment by pharmaceutical and biotechnology companies in digital endpoints, rising demand for remote patient monitoring, and the expansion of AI and machine-learning technologies that enable richer interpretation of continuous physiological data. Government-backed digital health programs, growing acceptance of real-world evidence in regulatory decisions, the shift toward value-based care, and increasing prevalence of chronic and neurological disorders further accelerate adoption. Additionally, improving device accuracy, increasing smartphone penetration, and global expansion of telehealth infrastructure are creating high-value opportunities for digital biomarker solutions across both developed and emerging markets.

Company Profiles

Feel Therapeutics

Specialization:

Mental health–focused digital biomarkers and digital therapeutics, leveraging wearable signals and behavioral analytics.

Key Focus Areas:

- Stress and emotional-state detection

- AI-based mental health assessments

- Real-time interventions and behavior guidance

- Enterprise and clinical wellness platforms

Notable Features:

Proprietary emotional biomarkers derived from electrodermal activity (EDA), heart rate variability (HRV), sleep analytics, and activity patterns.

2024 Revenue & Market Share:

As a privately funded growth-stage company, detailed 2024 revenue is not publicly disclosed. It holds a specialized niche in mental-health digital biomarkers.

Global Presence:

Operations in the U.S. and Europe, active in clinical collaborations, employer health programs, and digital therapeutics partnerships.

Amgen Inc.

Specialization:

A global biopharmaceutical leader integrating digital biomarkers into clinical development across multiple therapeutic areas.

Key Focus Areas:

- Digital endpoints in clinical trials

- Neurology, oncology, metabolic disorders, and cardiovascular programs

- Real-world monitoring for treatment adherence and safety

Notable Features:

Strong R&D capacity and global clinical trial network enable large-scale validation of digital biomarkers and integration into trial workflows.

2024 Revenue & Market Share:

Amgen reported revenue exceeding $33 billion, giving it substantial resources and influence in adopting and validating digital biomarkers.

Global Presence:

Operations in more than 100 countries, with broad participation in multinational trials and digital-health collaborations.

Verily Life Sciences LLC

Specialization:

Data-intensive precision health company developing connected diagnostics, analytics platforms, and digital biomarker solutions.

Key Focus Areas:

- Multi-signal biomarker discovery

- Large-scale longitudinal studies

- Digital clinical trial platforms

- Hardware–software integrated health tools

Notable Features:

Advanced analytics platform, engineering expertise, and strong ecosystem integrations enable end-to-end digital biomarker research.

2024 Revenue & Market Share:

As a private Alphabet subsidiary, revenue is not publicly broken out; historically the company has maintained partnerships generating substantial multi-hundred-million-dollar annual activity.

Global Presence:

Active across North America, Europe, and Asia through research collaborations, trial platforms, and innovation partnerships.

Brainomix

Specialization:

AI-driven imaging biomarkers focused primarily on stroke and neurological diseases.

Key Focus Areas:

- Automated CT/MRI analysis

- Imaging biomarkers for stroke severity, perfusion, and damage

- Clinical decision support

Notable Features:

Widely adopted in hospitals for fast imaging interpretation, improving stroke triage and treatment times. Recognized for its validated imaging biomarkers.

2024 Revenue & Market Share:

Exact 2024 revenue not publicly available; the company has closed major funding rounds supporting European and global expansion.

Global Presence:

Strong footprint in the UK and Europe with expanding deployments in North America, Asia, and Middle Eastern hospital systems.

Empatica

Specialization:

Clinical-grade wearable devices and multi-signal digital biomarkers for neurology and chronic disease monitoring.

Key Focus Areas:

- Epilepsy seizure detection

- Respiratory, cardiac, and autonomic nervous system monitoring

- Clinical trials integration

- Regulated biomarker development

Notable Features:

Multiple FDA-cleared digital biomarkers and wearable platforms make Empatica one of the few companies with regulatory-validated biosignal tools.

2024 Revenue & Market Share:

As a private company, detailed financials are not disclosed; however, its regulatory approvals and neuroscience focus position it as a leader in clinical-grade wearables.

Global Presence:

Active across the U.S., Europe, and Asia through healthcare, academic, and biopharma partnerships.

Leading Trends in the Digital Biomarkers Market and Their Impact

1. FDA and Global Regulatory Clarity is Accelerating Adoption

Regulators are increasingly releasing guidance documents that define the validation requirements for digital health technologies and digital endpoints. This is reducing uncertainty for developers and making digital biomarkers viable for pivotal trials.

Impact: Faster approvals, fewer regulatory hurdles, more investment into digital endpoint development.

2. Biopharma Demand for Digital Endpoints

Pharmaceutical companies are increasingly using digital biomarkers to improve sensitivity, reduce sample sizes, and measure symptoms that traditional tools fail to capture.

Impact: Digital biomarkers are becoming standard in neurology, oncology, metabolic disorders, and cardiovascular research.

3. AI is Transforming Signal Processing

Machine learning enables extraction of subtle biomarkers from raw physiological data—speech, gait, sleep, gesture patterns, and more.

Impact: More predictive biomarkers, earlier disease detection, and better real-time risk scoring.

4. Consumer Devices Transition to Medical-Grade Tools

Wearables are rapidly adding regulatory pathways and medical-grade functionalities.

Impact: Broader adoption, increased data availability, improved evidence generation.

5. Interoperability and Standards

Healthcare standards such as FHIR and open sensor APIs are improving data sharing across devices and platforms.

Impact: Lower integration costs and faster real-world deployment.

6. Ethical, Privacy & Equity Considerations

Governments and associations are emphasizing responsible data use and algorithmic fairness.

Impact: Companies must prioritize privacy-by-design and transparent algorithms.

Successful Examples of Digital Biomarkers Around the World

1. Wearable Heart Monitoring for Atrial Fibrillation

Consumer and clinical wearables have enabled large-scale AFib detection, leading to earlier intervention and millions of users having access to ECG-grade tools at home.

2. Empatica’s Epilepsy Monitoring

Empatica’s clinical-grade wearables and FDA-cleared biomarkers are used in hospitals, at-home monitoring, and clinical trials.

3. Brainomix’s AI Stroke Biomarkers

Imaging biomarkers allow faster stroke triage and have shown real-world impact in reducing treatment delays and improving outcomes.

4. Digital Biomarkers in Mental Health

Companies like Feel Therapeutics and others worldwide are turning physiology and behavior data into stress, mood, and resilience biomarkers used in workplace programs and research studies.

5. Neurology Digital Endpoints

Gait analysis, tremor measures, and speech biomarkers are gaining traction in Parkinson’s, Alzheimer’s, MS, and ALS research programs globally.

Global Regional Analysis (Including Government Initiatives & Policy)

North America (U.S. & Canada)

- Strong regulatory guidance for digital endpoint usage in clinical trials.

- Deep adoption by pharmaceutical companies integrating digital biomarkers in trials.

- Medicare and private payers expanding reimbursement for remote monitoring.

- Significant NIH and federal grants for digital biomarker innovation.

Europe (EU + UK)

- Strict data privacy (GDPR) shaping the design of biomarker platforms.

- EU Medical Device Regulation (MDR) affecting digital biomarker validation pathways.

- NHS digital transformation initiatives supporting remote monitoring and early detection.

- Wide adoption of imaging biomarkers, including stroke AI solutions.

Asia-Pacific

- Japan, South Korea, Singapore, and Australia leading in digital health regulation and wearables adoption.

- National remote-care initiatives boost digital biomarker deployment.

- Fast-growing smartphone penetration drives scalable digital health solutions.

Latin America

- Gradual adoption, mainly in private hospitals and global research collaborations.

- Governments piloting telehealth-based chronic disease monitoring to reach underserved regions.

- Rising interest from digital health startups.

Middle East & Africa

- UAE and Saudi Arabia heavily investing in digital health ecosystems.

- AI-enabled hospital systems adopting imaging biomarkers.

- Broader regions face infrastructure and regulatory challenges but benefit from global partnerships.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Amino Acids Market Revenue, Global Presence, and Strategic Insights by 2034