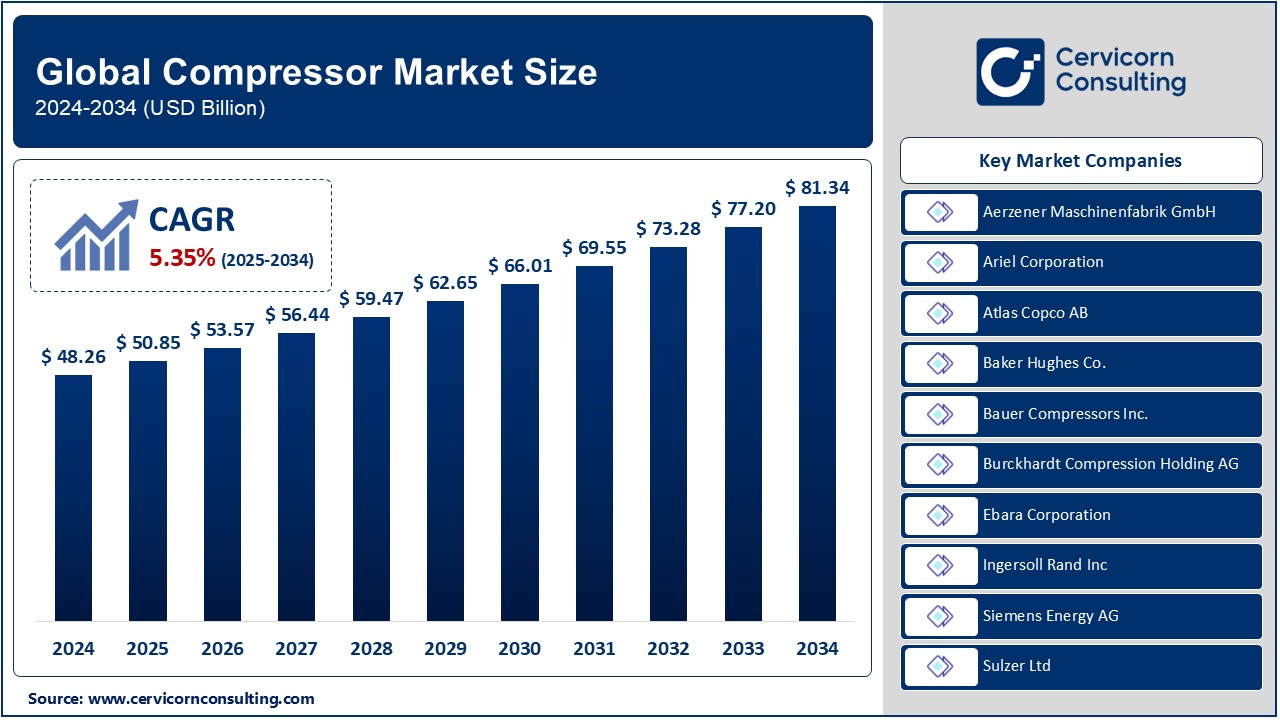

Compressor Market Size to Reach USD 81.34 Billion by 2034

Compressor Market Size

The global compressor market was worth USD 48.26 billion in 2024 and is anticipated to expand to around USD 81.34 billion by 2034, registering a compound annual growth rate (CAGR) of 5.35% from 2025 to 2034.

What is the Compressor Market?

The compressor market encompasses the global trade, manufacturing, and distribution of mechanical devices designed to compress gases and liquids to increase their pressure. Compressors are integral to various industries, including oil and gas, manufacturing, healthcare, HVAC (Heating, Ventilation, and Air Conditioning), power generation, and food and beverage. These devices range from small, portable air compressors used in automotive repair to large, industrial-scale machines vital for natural gas processing and petrochemical industries.

Why is the Compressor Market Important?

Compressors play a critical role in ensuring operational efficiency and reliability in diverse industries. They are essential for driving pneumatic tools, enabling refrigeration, powering turbines, and maintaining industrial processes. As the backbone of industrial systems, compressors facilitate energy transfer, enhance production capacities, and contribute significantly to global economic activities. Their importance is underscored by their widespread applications in essential industries like healthcare (for medical-grade air), energy (for gas transportation and storage), and environmental systems (for wastewater treatment).

Growth Factors Driving the Compressor Market

The growth of the compressor market is fueled by advancements in industrialization, the expansion of the oil and gas industry, the rising adoption of energy-efficient technologies, and increased demand for HVAC systems in emerging economies. Additionally, innovations in compressor technology, such as oil-free compressors and energy-efficient variable speed drives (VSDs), coupled with government regulations aimed at reducing carbon footprints, are propelling market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2531

Compressor Market Top Companies

1. Aerzener Maschinenfabrik GmbH

- Specialization: Manufacturer of rotary lobe blowers, screw compressors, and turbo blowers.

- Key Focus Areas: Industrial gas processing, wastewater treatment, and pneumatic conveying systems.

- Notable Features: Energy-efficient and low-maintenance compressors designed for sustainability.

- 2024 Revenue (Approx.): $850 million.

- Market Share (Approx.): 2.5%.

- Global Presence: Operations in over 50 countries, with strong distribution networks in Europe, Asia-Pacific, and North America.

2. Ariel Corporation

- Specialization: Reciprocating compressors for natural gas applications.

- Key Focus Areas: Oil and gas exploration, gas transmission, and storage.

- Notable Features: Robust designs tailored for high-pressure applications and harsh environments.

- 2024 Revenue (Approx.): $1.2 billion.

- Market Share (Approx.): 3.5%.

- Global Presence: Dominant in North America, with expanding operations in the Middle East and Africa.

3. Atlas Copco AB

- Specialization: Compressors, vacuum solutions, and air treatment systems.

- Key Focus Areas: General industrial applications, healthcare, and construction.

- Notable Features: Advanced oil-free compressors, VSD technology, and digital monitoring solutions.

- 2024 Revenue (Approx.): $12 billion.

- Market Share (Approx.): 18%.

- Global Presence: Active in over 180 countries, with a strong focus on sustainability and innovation.

4. Baker Hughes Co.

- Specialization: Centrifugal and reciprocating compressors for oil and gas industries.

- Key Focus Areas: LNG production, pipeline operations, and petrochemical processing.

- Notable Features: High-capacity compressors optimized for energy efficiency and reliability.

- 2024 Revenue (Approx.): $24 billion.

- Market Share (Approx.): 12%.

- Global Presence: Strong footprint in North America, Europe, and Asia-Pacific, with notable projects in the Middle East.

5. Bauer Compressors Inc.

- Specialization: High-pressure compressors for industrial and breathing air applications.

- Key Focus Areas: Firefighting, scuba diving, and industrial manufacturing.

- Notable Features: Compact designs and focus on safety and reliability.

- 2024 Revenue (Approx.): $500 million.

- Market Share (Approx.): 1.5%.

- Global Presence: Strong market position in North America and Europe, with growing influence in Asia-Pacific.

Leading Trends and Their Impact

1. Energy Efficiency and Sustainability

The shift towards eco-friendly and energy-efficient compressors is reshaping the market. Innovations such as oil-free compressors and VSDs are reducing operational costs and environmental impacts, aligning with global sustainability goals.

2. Digitalization and IoT Integration

Smart compressors equipped with IoT-enabled monitoring systems provide real-time data on performance, predictive maintenance, and energy consumption. This trend is enhancing operational efficiency and reducing downtime.

3. Increased Demand for Oil-Free Compressors

Industries like healthcare and food and beverage are driving the demand for oil-free compressors, which ensure contamination-free operations and meet stringent regulatory standards.

4. Expansion in Emerging Economies

Rapid industrialization in regions like Asia-Pacific and Latin America is creating significant growth opportunities for compressor manufacturers. Governments’ focus on infrastructure development and energy projects further boosts demand.

5. Focus on Compact and Portable Compressors

Portable and compact compressors are gaining traction in construction, automotive, and small-scale industrial applications due to their versatility and ease of use.

Successful Examples in the Compressor Market

- Atlas Copco’s ZR/ZT Oil-Free Air Compressors These compressors have revolutionized the market by offering 100% oil-free air for critical applications in healthcare, electronics, and food industries, ensuring compliance with ISO 8573-1 CLASS 0 standards.

- Baker Hughes’ LNG Projects Baker Hughes has successfully implemented high-capacity centrifugal compressors in major LNG facilities worldwide, contributing to efficient gas liquefaction and energy transportation.

- Ariel Corporation’s Reciprocating Compressors Ariel’s compressors are a cornerstone in the natural gas industry, providing reliable solutions for gas transmission and storage, particularly in North America and the Middle East.

- Bauer Compressors’ Breathing Air Systems Widely used in firefighting and scuba diving, Bauer’s compressors have set industry standards for safety and performance, ensuring reliable breathing air supply in critical situations.

Regional Analysis Including Government Initiatives and Policies Shaping the Market

1. North America

The compressor market in North America is driven by advancements in the oil and gas sector, robust manufacturing activities, and stringent energy efficiency regulations. The U.S. government’s incentives for adopting energy-efficient technologies, coupled with shale gas exploration, are bolstering market growth.

2. Europe

Europe’s focus on reducing carbon emissions and enhancing energy efficiency is shaping the compressor market. EU regulations promoting the use of eco-friendly compressors, along with investments in renewable energy projects, are key drivers. Germany, as an industrial hub, leads in compressor manufacturing and adoption.

3. Asia-Pacific

Rapid industrialization, urbanization, and infrastructure development in countries like China and India are fueling the demand for compressors. Government initiatives such as “Make in India” and “China Manufacturing 2025” aim to boost industrial output, thereby creating opportunities for compressor manufacturers.

4. Latin America

The region’s growing focus on oil and gas exploration and infrastructure development is driving the compressor market. Brazil’s offshore oil projects and Mexico’s investments in energy and manufacturing sectors are noteworthy contributors.

5. Middle East and Africa

The compressor market in the Middle East is primarily driven by oil and gas projects, with significant investments in LNG facilities and pipeline infrastructure. In Africa, government initiatives aimed at industrialization and energy production are creating growth opportunities for compressor manufacturers.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Roller Bearings Market Winning Strategies for Growth 2025