Carbon Credit Market Size, Key Insights, Trends, and Forecasts by 2034

Table of Contents

ToggleCarbon Credit Market Size and Growth

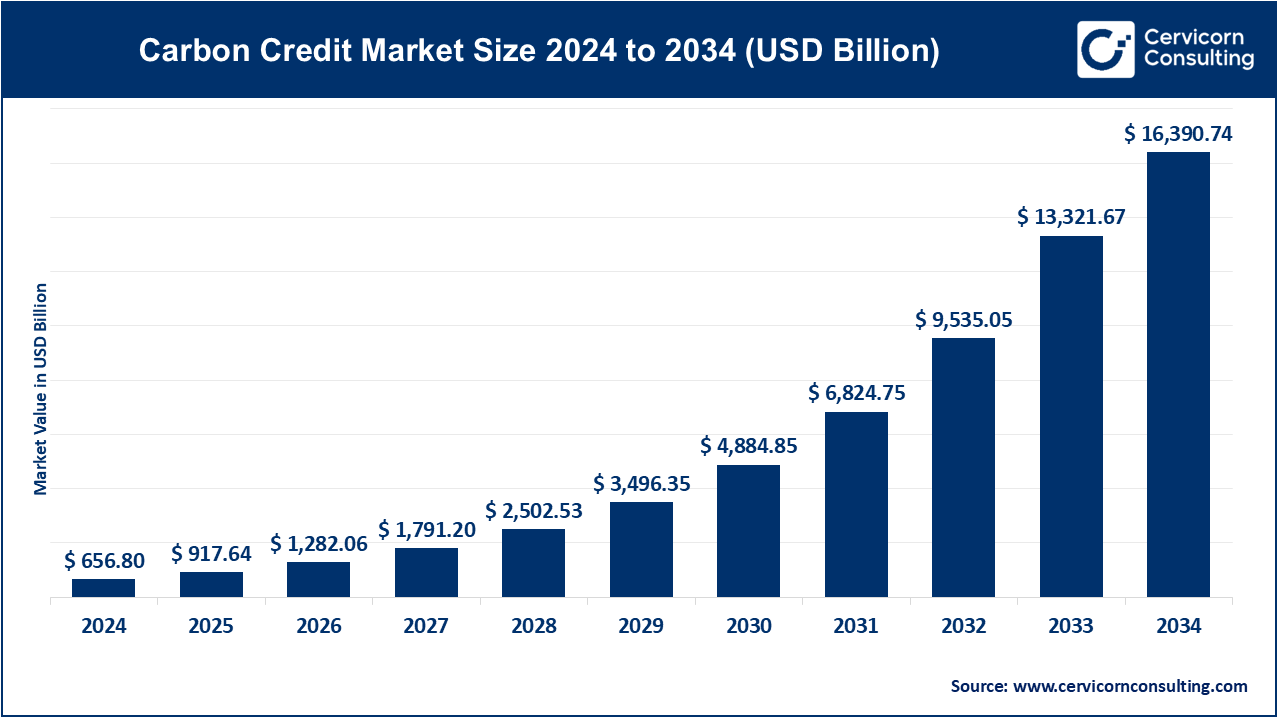

The global carbon credit market size was valued at approximately USD 656.8 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 37.95%, reaching about USD 16,390.74 billion by 2034.

Carbon Credit Market Definition

The carbon credit market is a mechanism designed to reduce greenhouse gas (GHG) emissions. It operates on a “cap-and-trade” system where governments or regulatory bodies set a cap on emissions, and entities that emit less than their quota can sell their unused credits to others exceeding their limits. This system incentivizes companies to reduce emissions by making it financially beneficial.

How do Carbon Credits Work?

Carbon credits are a market-based mechanism designed to reduce greenhouse gas (GHG) emissions and mitigate climate change. Each carbon credit represents the right to emit one metric ton of carbon dioxide (CO₂) or an equivalent amount of another greenhouse gas. These credits are typically used by companies, governments, or other entities that are required to limit their emissions under regulatory frameworks or wish to voluntarily offset their environmental impact.

The system operates on a “cap-and-trade” principle in regulated markets. Governments or regulatory bodies set a cap on the total amount of emissions allowed for industries or sectors. Companies that emit less than their allocated limit can sell their surplus allowances as carbon credits to those that exceed their quotas. This creates a financial incentive for companies to reduce emissions, as emitting beyond the cap requires purchasing additional credits, which can be costly. At the same time, companies that adopt greener technologies or practices benefit financially by selling their unused credits.

In voluntary carbon markets (VCM), organizations or individuals purchase credits to offset their carbon footprint, often as part of corporate social responsibility (CSR) initiatives or to meet sustainability goals. These credits are generated through verified emission reduction projects, such as renewable energy installations, reforestation, methane capture, or energy efficiency programs. Each project undergoes rigorous verification by recognized standards like Verra or the Gold Standard to ensure the emission reductions are real, additional, and permanent.

Carbon credits also play a crucial role in global climate agreements, such as the Kyoto Protocol and Paris Agreement. Through international trading mechanisms, countries can meet their climate targets by purchasing credits from projects in other regions. For example, developed countries might finance emission reduction projects in developing nations, facilitating a global flow of funds toward sustainable development.

While the concept is promising, the carbon credit market faces challenges such as inconsistent standards, the risk of double counting (claiming the same credit by multiple parties), and market volatility. However, advancements in technology, such as blockchain for transparent tracking, are helping to address these issues. As awareness of climate change grows, carbon credits are becoming an essential tool for transitioning to a low-carbon economy.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2462

What are the types of carbon credits market?

Compliance Markets

Compliance markets are regulated systems where governments or international bodies set mandatory emission reduction targets for certain industries or sectors. The key feature of compliance markets is their cap-and-trade mechanism, where a limit (or cap) is set on the total amount of greenhouse gas emissions allowed from participating entities. Each company within the market is allocated a certain number of carbon allowances or credits, each representing one metric ton of CO₂ or its equivalent. Companies are required to either stay within their allocated allowances or purchase additional credits from other companies that have reduced their emissions below their allocated cap.

If a company exceeds its emission limit, it must purchase additional credits to cover the excess emissions, thus creating a financial incentive to reduce emissions and innovate in cleaner technologies. Conversely, companies that emit fewer pollutants than their allowance can sell the excess credits to others. This allows businesses to meet their environmental targets in the most cost-effective way possible.

Examples of compliance markets include:

- European Union Emissions Trading System (EU ETS): Launched in 2005, the EU ETS is one of the world’s most established and largest carbon trading markets. It covers a wide range of sectors, including energy, industry, and aviation, within the European Union.

- China’s Emissions Trading System (ETS): In 2021, China introduced the world’s largest carbon market, covering the emissions of the country’s power sector, which is a significant source of global greenhouse gas emissions. This move marks China’s commitment to meeting its climate targets and reducing carbon emissions.

Voluntary Markets

Voluntary markets allow companies, individuals, and other organizations to purchase carbon credits on a voluntary basis, often as part of their sustainability efforts or corporate social responsibility (CSR) initiatives. Unlike compliance markets, participation in voluntary markets is not mandated by government regulations. Instead, entities choose to buy carbon credits to offset their emissions, which means they are compensating for the carbon they emit by supporting projects that reduce or capture greenhouse gases elsewhere.

In the voluntary carbon market, credits are typically generated by projects designed to mitigate climate change, such as reforestation, renewable energy development, methane capture, or carbon sequestration initiatives. These projects are generally verified by third-party standards like Verra’s VCS or the Gold Standard, which ensure the emission reductions are genuine, additional (i.e., they wouldn’t have happened without the project), and permanent.

While smaller than compliance markets, voluntary markets have been growing rapidly. They are especially popular among companies and individuals aiming to meet their Net-Zero or carbon neutrality goals. Voluntary markets are not driven by regulatory requirements but by growing consumer demand for environmentally responsible practices.

Key features of voluntary markets:

- Flexibility: Entities can choose to offset emissions based on their own sustainability goals.

- Project Variety: Credits come from a wide range of projects, including renewable energy, forest conservation, sustainable agriculture, and waste management.

- Certification Standards: Voluntary credits are generally verified through recognized certification bodies, ensuring high integrity and transparency.

Why are carbon credit markets important?

Drives Greenhouse Gas (GHG) Reductions

- Emission Limits: By placing a price on carbon emissions, these markets incentivize companies to reduce their GHG output.

- Economic Signal: They make carbon-intensive activities more expensive, encouraging a shift to cleaner technologies and practices.

- Scalable Impact: Carbon credits finance projects worldwide, leading to broader emissions reductions.

Supports Transition to a Low-Carbon Economy

- Encourages Innovation: The cost of compliance or voluntary offsets motivates companies to innovate and adopt sustainable practices, such as renewable energy or energy-efficient processes.

- Global Collaboration: Facilitates partnerships between developed and developing nations, as high-emission countries finance mitigation projects in lower-emission regions.

Provides Economic Incentives for Sustainability

- Monetizes Carbon Reductions: Projects like reforestation or renewable energy generation can earn revenue by selling carbon credits.

- Attracts Investment: Carbon credits provide funding for clean energy projects, particularly in regions where such investments might otherwise be financially unviable.

Aligns with Global Climate Goals

- Supports Paris Agreement: Carbon credit markets help countries and corporations meet their commitments to the Paris Agreement, which aims to limit global warming to 1.5°C above pre-industrial levels.

- Corporate Net-Zero Goals: Companies can offset emissions they cannot eliminate, aligning with net-zero or carbon-neutral objectives.

Encourages Conservation and Biodiversity

- Preservation of Natural Resources: Many projects focus on preserving forests, wetlands, and grasslands, which act as natural carbon sinks.

- Biodiversity Protection: Protecting ecosystems through carbon credit projects safeguards wildlife habitats and promotes ecological balance.

Promotes Global Equity

- Economic Development in Emerging Markets: Developing countries often host carbon credit projects, benefiting from investments in renewable energy, infrastructure, and environmental conservation.

- Access to Funding: Marginalized communities gain financial support for sustainable development initiatives.

Provides a Framework for Accountability

- Measurement and Transparency: Carbon credits must meet strict standards (e.g., Verra, Gold Standard) to ensure reductions are measurable, verifiable, and additional.

- Corporate Responsibility: Participation in the carbon credit market demonstrates corporate commitment to sustainability and ESG (Environmental, Social, and Governance) goals.

Encourages Behavioral Change

- Consumer Awareness: Carbon offsets raise awareness about climate change and encourage individuals and businesses to take responsibility for their environmental impact.

- Market Transformation: As costs rise for high-emission activities, businesses and consumers are incentivized to choose low-carbon alternatives.

Mitigates Climate Change Risks

- Financial Risk Reduction: Companies and investors exposed to carbon regulations can mitigate risks by engaging in carbon credit markets.

- Adaptation and Resilience: Revenues from carbon credits often support projects enhancing community resilience to climate impacts.

Bridging the Gap

- Complement to Direct Reductions: While reducing emissions at the source is essential, carbon credits allow entities to address residual emissions that are hard to eliminate.

- Short-Term Solution for Hard-to-Decarbonize Sectors: Industries like aviation and heavy manufacturing can use credits while transitioning to greener technologies.

Which companies are leading in the carbon credit market?

- Verra: Verra is a global leader in certifying carbon offset projects and operates the Verified Carbon Standard (VCS) program, ensuring high-quality emission reductions.

- Gold Standard: The Gold Standard certifies carbon offset projects that meet high environmental and social impact criteria, focusing on sustainable development goals (SDGs).

- Carbon Trust: Carbon Trust helps businesses and governments reduce their carbon emissions by providing advisory services and certification for carbon management.

- Climeworks: Climeworks specializes in direct air capture technology to remove CO₂ from the atmosphere and offers carbon removal credits to offset emissions.

- Carbon Clean Solutions: Carbon Clean Solutions focuses on developing and deploying carbon capture technologies to reduce industrial CO₂ emissions and offers carbon credits.

- NativeEnergy: NativeEnergy develops carbon offset projects that support renewable energy and community-based initiatives, helping clients achieve their sustainability goals.

- Ecologi: Ecologi offers businesses and individuals the opportunity to offset their carbon emissions by supporting reforestation and renewable energy projects.

- South Pole: South Pole is a global sustainability solutions provider that develops carbon offset projects and provides advisory services to help businesses achieve climate goals.

- Verde Impact: Verde Impact works with businesses to reduce their carbon footprint and invest in projects that generate high-quality carbon offsets.

- Pachama: Pachama uses AI and satellite technology to monitor and verify carbon sequestration projects, providing carbon credits from reforestation efforts.

- EcoAct: EcoAct supports companies in reducing their carbon footprint by offering carbon offset solutions and climate action advisory services for sustainability.

Read Report: Management System Certification Market Size, Growth Projections, and Key Trends 2024-2033

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us