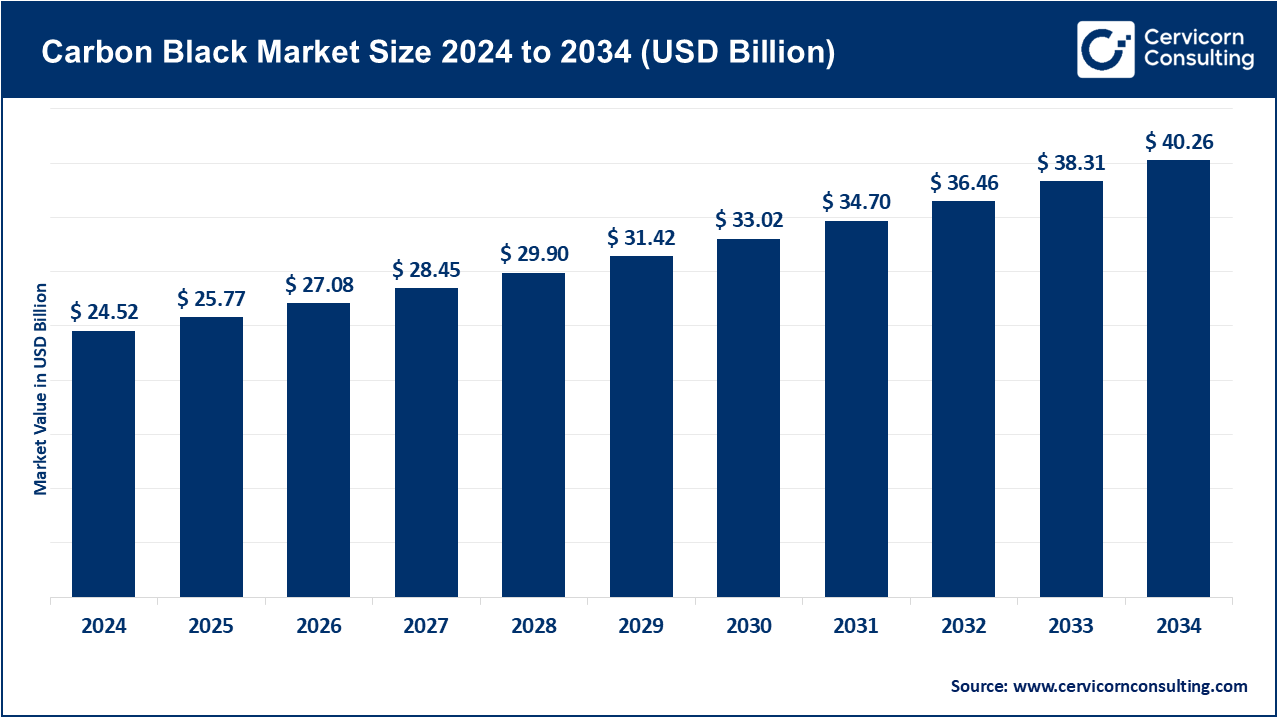

Carbon Black Market Key Players, Trends, and Global Outlook by 2034

Carbon Black Market Size

What is the carbon black market?

The carbon black market covers the global production, sale and downstream use of carbon black — a fine, nearly pure elemental carbon produced by incomplete combustion or thermal decomposition of hydrocarbons. Industrial grades (often called furnace black, channel black or thermal black) are used as a reinforcing filler in rubber (particularly tires), while specialty grades supply pigment, UV protection, conductivity and antistatic properties for plastics, paints, inks, batteries, cables and electronics. The market therefore spans feedstock & manufacturing (furnace/thermal/acetylene processes), specialty processing (post-treatment, pelletizing, surface treatments), distribution and numerous end-use sectors (automotive tires, industrial rubber, plastics, coatings, printing inks, batteries and emerging circular applications).

Why is carbon black important?

Carbon black is a small but indispensable ingredient in modern industry. In tires and rubber it acts as the primary reinforcing filler that provides durability, wear resistance and grip; in plastics and coatings it provides color strength and UV protection; in electronics and batteries specialty conductive blacks enable conductivity and static control. Its unique combination of surface area, structure and conductivity means many engineered products would underperform or fail without appropriately specified carbon black. Because carbon black manufacturing is energy- and emissions-intensive and closely tied to global automotive and plastics demand, the market is both an indicator of industrial activity and a focus for sustainability and circularity efforts (e.g., reclaimed carbon black, low-CO₂ manufacturing routes).

Carbon Black Market Growth Factors

Demand for carbon black is being driven by several interlocking factors: steady growth in global tire production (passenger, light-truck and specialty tires) and non-tire rubber goods; rising plastics and coatings production that uses carbon black as pigment and UV stabilizer; accelerating adoption of specialty conductive blacks in EV battery components, cables and electronics; increasing regulatory and corporate emphasis on circularity and low-emission manufacturing which is pushing investment into recovered/reclaimed carbon black and low-carbon production routes; feedstock and supply-chain dynamics (oil/gas prices, feedstock switching) that affect pricing and margins; and geographic shifts in demand toward Asia-Pacific (industrialisation and vehicle production) combined with regional policy drivers like carbon pricing and emissions performance standards that are reshaping capital investments.

These drivers interact with cyclical auto markets and raw-material volatility, producing steady mid-single-digit growth annually for the near term while opening a higher-growth specialty segment tied to electronics, coatings and sustainability products.

Carbon Black Market — Top Companies

Cabot Corporation

- Company / Specialization: Cabot Corporation (NYSE: CBT) is a leading specialty chemicals and performance materials company; one of its core businesses is specialty and reinforcement carbon blacks used in tires, industrial rubber, plastics and coatings.

- Key focus areas: Specialty carbons (high-performance blacks for electronics and plastics), sustainability (circular black products), R&D for low-emissions processes and product innovation (e.g., circular masterbatches).

- Notable features: Large global manufacturing footprint, emphasis on speciality grades and circular solutions (products such as REPLASBLAK® and EVOLVE™ sustainable lines).

- 2024 revenue (company-wide): Around USD 3.99 billion in fiscal 2024.

- Market share: Consistently among the top three global carbon black manufacturers.

- Global presence: Operations across North America, Europe, Asia-Pacific and Latin America.

Orion Engineered Carbons S.A.

- Company / Specialization: Orion (NYSE: OEC) is a global specialty carbon company supplying rubber carbon blacks (for tires and industrial rubber) and specialty carbons for paints, coatings and plastics.

- Key focus areas: Specialty products, cost optimization, customer service to tire and non-tire OEMs, and operational efficiency.

- Notable features: Balanced portfolio between rubber and specialty grades.

- 2024 revenue: About USD 1.88 billion in 2024 net sales.

- Market share: Among the top five to eight global producers.

- Global presence: Manufacturing assets and customer networks across the Americas, Europe and Asia.

Birla Carbon

- Company / Specialization: Part of the Aditya Birla Group, Birla Carbon is one of the world’s largest carbon black producers, with strength in both rubber and specialty markets.

- Key focus areas: Sustainability (Continua™ circular materials, pyrolysis oil trials), R&D for post-treatment and specialty products.

- Notable features: Strong sustainability roadmap, acquisitions such as Nanocyl to expand specialty capabilities, and post-treatment facility expansions.

- 2024 revenue: Reported through parent group disclosures; not always separated for Birla Carbon, but estimated in the multi-billion-dollar range.

- Market share: Among the top three to six global carbon black producers.

- Global presence: Facilities in Asia, the Americas, Europe and Africa.

Continental Carbon Company

- Company / Specialization: Continental Carbon is a North American manufacturer with a strong focus on tire and industrial carbon blacks.

- Key focus areas: Tire blacks, specialty industrial blacks and North American customer relationships.

- Notable features: Legacy supplier with deep ties to U.S. tire and rubber industries.

- 2024 revenue: Estimated at USD 70–80 million, as the company is privately held.

- Market share: Primarily a regional player with smaller global share compared to multinationals.

- Global presence: Concentrated in North America.

Tokai Carbon Co., Ltd.

- Company / Specialization: A diversified Japanese company producing carbon black, graphite electrodes, fine carbons, friction materials and more.

- Key focus areas: Diversification into advanced carbon products for batteries and industrial uses.

- Notable features: Exposure to multiple carbon material markets beyond rubber.

- 2024 revenue: Around JPY 350 billion (~USD 2.4–2.6 billion), company-wide.

- Market share: Significant in Asia, especially in specialty segments.

- Global presence: Manufacturing and sales in Asia, North America and Europe.

Leading trends and their impact

- Shift to specialty & conductive blacks: Driven by EV batteries, electronics and high-performance plastics, this segment is growing faster than general rubber blacks, improving margins.

- Circularity & reclaimed carbon black (rCB): Tire pyrolysis and recycling are developing into credible commercial pathways, with companies introducing certified circular carbon black lines.

- Decarbonization & low-carbon production: Companies are investing in energy-efficient and alternative feedstock technologies to reduce lifecycle emissions.

- Regional policy & carbon pricing: Regulations in China, India, the EU and the U.S. are increasing compliance costs but also pushing innovation and modernization.

- Raw material & feedstock volatility: Oil and gas feedstock swings continue to affect production costs and influence price negotiations with customers.

Successful examples around the world

- Birla Carbon’s Patalganga facility (India): Demonstrates innovation in post-treatment technology and circular material use.

- Cabot’s REPLASBLAK® and EVOLVE™ series: Shows how sustainable product lines can capture demand in plastics and coatings.

- Orion’s specialty strategy: Balancing between specialty carbons and rubber products has stabilized financial performance even during cyclical downturns.

Global regional analysis — government initiatives and policies

Asia-Pacific

- China: The largest carbon black market globally. Policies such as energy-efficiency standards and the national emissions trading system are reshaping operations and favoring producers that modernize.

- India: Developing carbon market rules and emission targets are driving efficiency improvements. Birla Carbon has aligned its local investments accordingly.

- Japan: Companies like Tokai Carbon are moving into advanced carbon products under strict environmental regulations.

Europe

- The European Union’s Green Deal and chemical safety rules (like REACH and nanoform reporting) are reshaping demand for sustainable and traceable carbon black products. Customers increasingly prefer low-emission and recyclable materials.

North America

- The U.S. Environmental Protection Agency (EPA) continues to enforce strict hazardous air pollutant and emissions controls, impacting plant operations. Companies are investing in compliance and sustainability to maintain competitiveness.

Latin America, Middle East & Africa

- These regions are more demand-driven, with growth in tire, rubber and plastics markets. Brazil has seen circular carbon black initiatives, while other countries explore renewable and recycling-oriented policies that indirectly affect the carbon black industry.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Obesity Clinical Trials Market Revenue, Global Presence, and Strategic Insights by 2034