Aerospace and Defense Market Revenue, Market Share & Future Trends by 2034

Aerospace and Defense Market Size

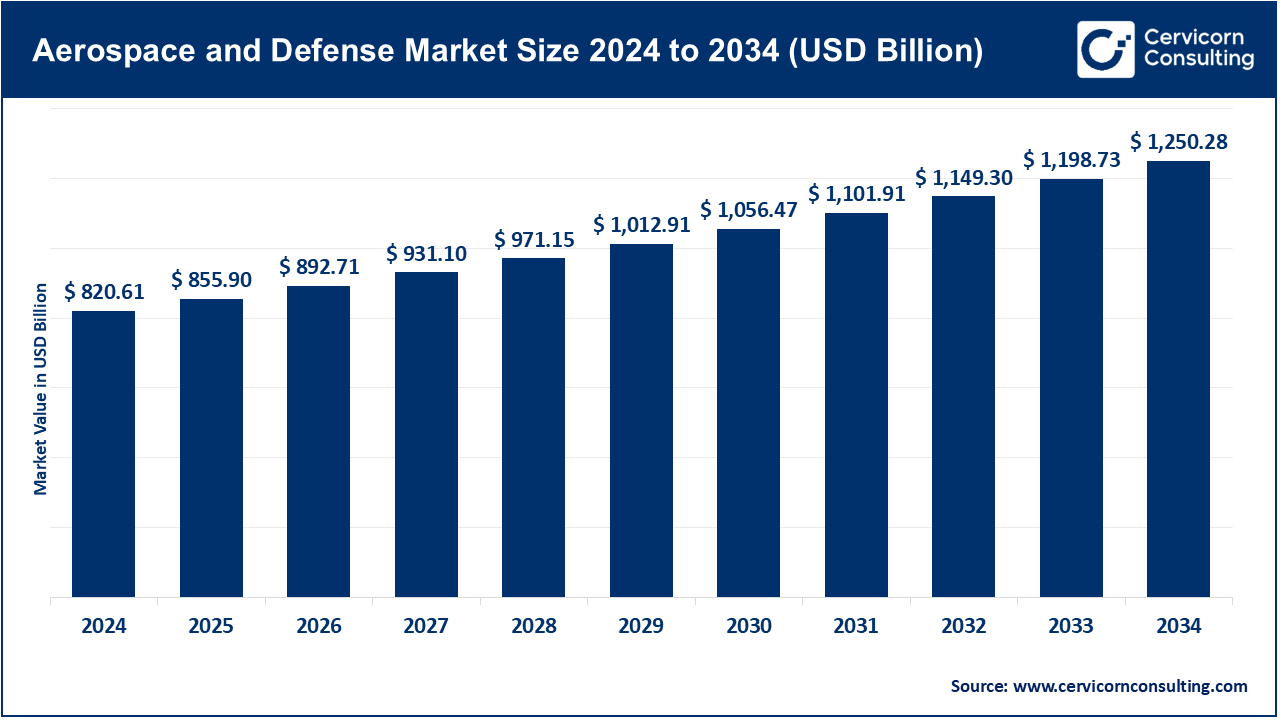

The global aerospace and defense market size was worth USD 820.61 billion in 2024 and is anticipated to expand to around USD 1,250.28 billion by 2034, registering a compound annual growth rate (CAGR) of 6.5% from 2025 to 2034.

What is the Aerospace and Defense Market?

The aerospace and defense market encompasses the development, production, and maintenance of aircraft (commercial and military), satellites, space exploration vehicles, defense systems, and associated support infrastructure. It is divided into two main segments: Aerospace, which includes civil aviation and space exploration, and Defense, which includes military systems, weapons, intelligence systems, and support services. Major stakeholders in this market include governments, defense contractors, commercial airlines, space agencies, and private space companies.

Why is the Aerospace and Defense Market Important?

- National Security: Ensuring a country’s sovereignty and readiness in the face of threats.

- Economic Impact: Employing millions of workers worldwide and contributing significantly to GDP through exports.

- Technological Advancement: Fueling innovation in areas such as autonomous systems, AI, and advanced materials.

- Global Connectivity: Through commercial aviation and satellite-based communications.

- Space Exploration: Enabling scientific discoveries and new commercial opportunities.

Aerospace and Defense Market Growth Factors

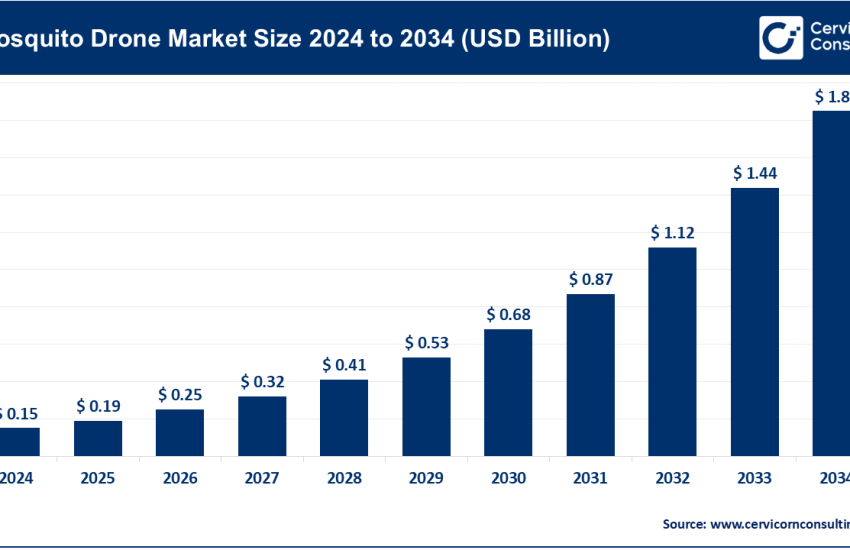

The aerospace and defense market is experiencing robust growth driven by several interlinked factors including increasing geopolitical tensions and defense spending, modernization of aging military fleets, rising global demand for air travel, the rapid emergence of commercial space exploration and satellite deployment, advancements in cyber warfare and AI-driven defense systems, and significant investments in unmanned aerial vehicles (UAVs) and autonomous combat systems. Moreover, governments worldwide are prioritizing indigenization, strengthening space capabilities, and enhancing national security infrastructures, further propelling market growth across both emerging and developed economies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2681

Top Companies in the Aerospace and Defense Market

1. Northrop Grumman Corp

- Specialization: Aerospace systems, cyber, autonomous systems, C4ISR, missile defense.

- Key Focus Areas: Defense technology, advanced radar, hypersonics, space systems.

- Notable Features: Builder of the B-21 Raider and James Webb Telescope components.

- 2024 Revenue: ~$41.2 billion

- Market Share: ~4.2%

- Global Presence: Strong in North America, NATO partnerships.

2. General Dynamics

- Specialization: Combat vehicles, IT systems, naval ships, munitions, aerospace.

- Key Focus Areas: Gulfstream jets, cybersecurity, battlefield AI systems.

- Notable Features: M1 Abrams tank, Gulfstream aircraft, Virginia-class submarines.

- 2024 Revenue: ~$43.8 billion

- Market Share: ~4.5%

- Global Presence: Operates in 70+ countries.

3. Raytheon Technologies

- Specialization: Aerospace systems, missile defense, precision weapons, avionics.

- Key Focus Areas: Patriot missiles, radar, thermal optics, AI integration.

- Notable Features: Result of Raytheon and UTC merger, innovation in hypersonics.

- 2024 Revenue: ~$76.9 billion

- Market Share: ~7.9%

- Global Presence: Customers in 100+ countries.

4. Airbus Group SE

- Specialization: Commercial aircraft, helicopters, space systems, defense programs.

- Key Focus Areas: Eurofighter, Ariane launch systems, sustainability.

- Notable Features: A350 leader, Galileo GPS partner, key EU defense contributor.

- 2024 Revenue: ~$79.3 billion

- Market Share: ~8.1%

- Global Presence: Europe, APAC, Latin America expansions.

5. The Boeing Company

- Specialization: Commercial aircraft, defense, space systems.

- Key Focus Areas: F/A-18, Chinook, Starliner spacecraft.

- Notable Features: Top U.S. exporter, NASA partner, global defense leader.

- 2024 Revenue: ~$83.6 billion

- Market Share: ~8.6%

- Global Presence: Operations in 65+ countries.

Leading Trends and Their Impact

- Commercial Space Boom: Growth in satellite internet, reusable rockets, and lunar missions.

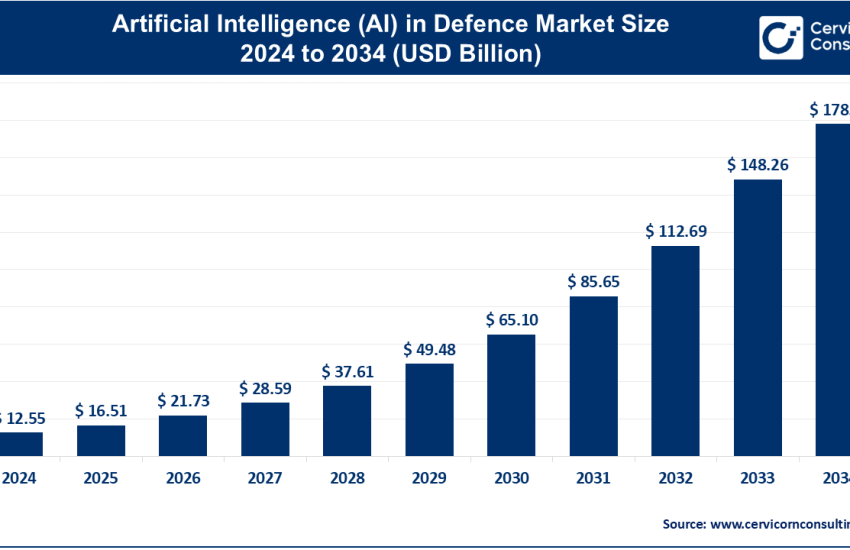

- Defense Digitization and AI: Predictive monitoring, autonomous systems, AI-driven defense tools.

- Electrification and Sustainability: Electric aircraft, SAFs, and low-carbon aviation innovation.

- Hypersonic & Directed Energy Weapons: Competitive edge in high-speed defense systems.

- Cybersecurity as a Defense Pillar: Integration into all modern military assets.

Successful Examples Around the World

- U.S.: F-35 program, SpaceX Starlink, Space Force operations.

- EU: Eurofighter Typhoon, Ariane 6 rockets, Galileo GPS.

- India: HAL Tejas, ISRO’s Chandrayaan-3, Gaganyaan mission.

- China: J-20 stealth jet, Tiangong station, UAVs and naval power.

- Israel: Iron Dome, UAV exports, electronic warfare solutions.

Global Regional Analysis & Government Initiatives

North America

- Drivers: Largest global defense budget, private space sector boom.

- Policies: U.S. National Defense Strategy, CHIPS Act.

- Initiatives: Hypersonics, Space Force, AI in defense.

Europe

- Drivers: NATO modernization, EU defense spending.

- Policies: EDF, EU Green Deal (aviation).

- Initiatives: FCAS, Eurodrone, Galileo program.

Asia-Pacific

- Drivers: Maritime tensions, air force upgrades.

- Policies: India’s DPP, China’s Military-Civil Fusion.

- Initiatives: AUKUS pact, Japan’s F-X, ISRO missions.

Latin America

- Drivers: MRO demand, fleet upgrades.

- Policies: Brazil’s defense industrial programs.

- Initiatives: Embraer KC-390, regional satellite programs.

Middle East & Africa

- Drivers: Drone warfare, missile defense needs.

- Policies: Saudi Vision 2030, UAE Space Strategy.

- Initiatives: Barak system (Israel), Turkish drone exports.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: 3D Printing in Defence Market Size to Reach USD 18.36 Billion by 2034