Plug-In Hybrid Electric Vehicles Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Plug-In Hybrid Electric Vehicles Market Size

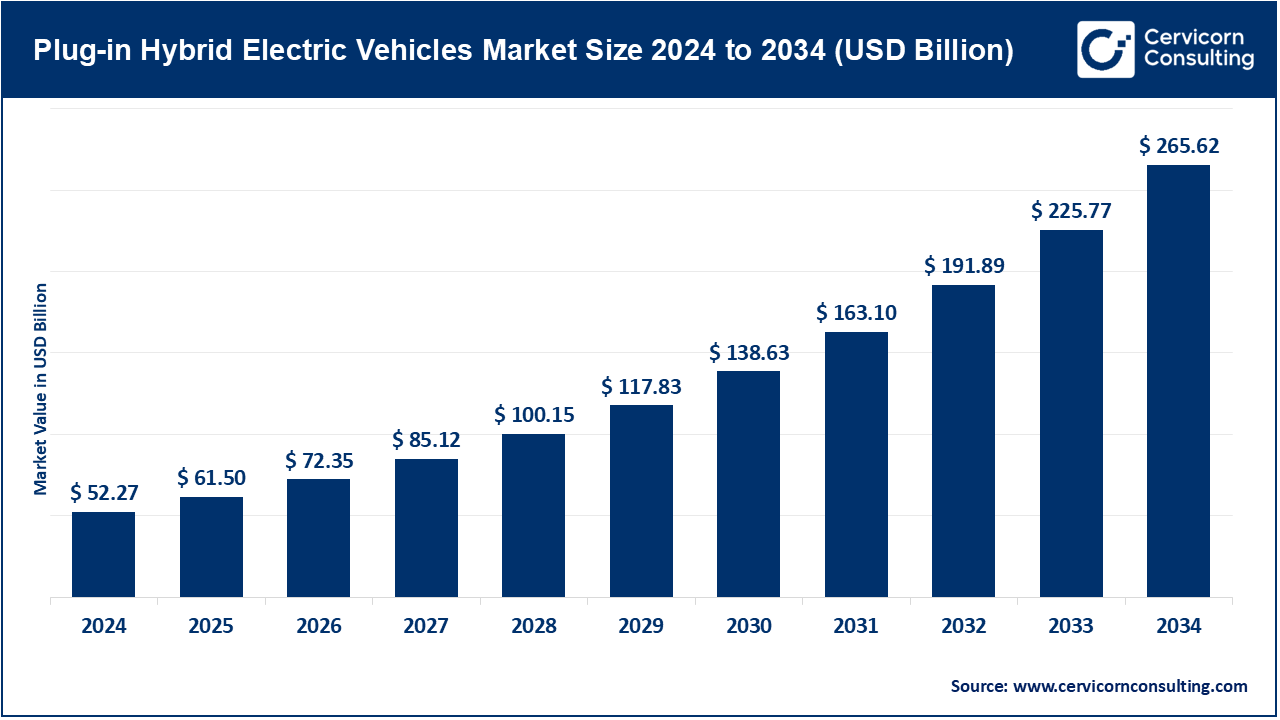

The global plug-in hybrid electric vehicles market size was worth USD 52.27 billion in 2024 and is anticipated to expand to around USD 265.62 billion by 2034, registering a compound annual growth rate (CAGR) of 17.65% from 2025 to 2034.

Plug-In Hybrid Electric Vehicles Market Growth Factors

The growth of the PHEV market is fueled by a combination of economic, technological, and environmental factors. Declining battery prices and improvements in energy density have made PHEVs more affordable and capable of achieving longer electric ranges. Consumers are increasingly drawn to vehicles that reduce fuel costs and carbon emissions while retaining the flexibility of gasoline power for long-distance travel. Government incentives, subsidies, and regulatory pressures on automakers to meet stringent CO₂ and fuel-efficiency targets are also driving adoption. In many regions, PHEVs offer a pragmatic middle ground—delivering electric mobility benefits without complete dependence on public charging infrastructure.

Additionally, growing corporate fleet electrification, rising urban pollution concerns, and advancements in charging technology are accelerating the global market. With automakers rolling out diverse models across luxury, performance, and mass-market segments, the plug-in hybrid vehicle market continues to expand rapidly across all major regions.

What Is the Plug-In Hybrid Electric Vehicle Market?

The PHEV market encompasses all vehicles and supporting industries that integrate electric and combustion powertrains. These vehicles can be recharged from the electric grid and switch seamlessly between electric-only and hybrid driving modes. The market includes automakers designing and manufacturing PHEVs, suppliers producing batteries, inverters, motors, and control systems, and service providers offering charging, software, and fleet solutions. Typically, PHEVs provide electric-only driving ranges between 20 and 80 kilometers, depending on model and battery capacity. Beyond passenger cars, the market includes commercial PHEVs in logistics and public transport sectors. This segment sits between traditional hybrid electric vehicles (HEVs) and fully battery-electric vehicles (BEVs), appealing to consumers who want environmental benefits without sacrificing range flexibility.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2791

Why Is the PHEV Market Important?

The importance of the plug-in hybrid electric vehicle market lies in its ability to facilitate the global transition toward zero-emission mobility. While BEVs are the long-term goal, many markets still face infrastructure and affordability challenges. PHEVs offer a critical stepping stone, helping governments and industries reduce emissions immediately while preparing for broader BEV adoption. They also allow automakers to balance compliance with emission standards and profitability during the transition.

For consumers, PHEVs deliver the best of both worlds—electric driving for daily commutes and a fuel engine for long-distance travel. In regions where charging networks are sparse, PHEVs make electrified mobility viable today. The technology also spurs battery innovation, energy management software development, and charging ecosystem growth, making it a cornerstone of modern transportation policy.

Plug-In Hybrid Electric Vehicles Market — Top Companies

1. BYD Company Ltd.

Specialization: BYD is a global leader in new energy vehicles, producing both BEVs and PHEVs across multiple categories.

Key Focus Areas: Affordable electrification, large-scale manufacturing, vertical integration in battery production, and global expansion.

Notable Features: BYD’s proprietary Blade Battery technology enhances safety and efficiency. Its DM-i and DM-p hybrid systems underpin many of China’s top-selling PHEV models.

2024 Revenue: Approximately USD 107 billion.

Market Share: BYD captured one of the largest shares of the global plug-in market, driven by its dominance in China’s booming EV sector.

Global Presence: Headquarters in China with growing operations and exports to Europe, Southeast Asia, and Latin America.

2. Tesla, Inc.

Specialization: Although Tesla is fully electric and does not currently produce PHEVs, it serves as a benchmark competitor influencing plug-in market evolution.

Key Focus Areas: High-volume BEV production, autonomous driving software, and energy storage integration.

Notable Features: Strong global brand, proprietary Supercharger network, and over-the-air software updates.

2024 Revenue: Approximately USD 97.7 billion.

Market Share: A leading share in global BEV sales; while Tesla does not sell PHEVs, its innovations drive the broader plug-in vehicle ecosystem.

Global Presence: Manufacturing plants in the U.S., China, and Germany, with worldwide sales.

3. BMW Group

Specialization: A pioneer in premium PHEV development, BMW integrates hybrid technology across sedans, SUVs, and performance vehicles.

Key Focus Areas: Luxury electrification, performance hybridization, and CO₂ compliance through diversified electric offerings.

Notable Features: Offers models such as the BMW X5 xDrive50e and 330e, combining luxury interiors with substantial electric-only range.

2024 Revenue: Approximately €142 billion.

Market Share: Strong in Europe’s premium hybrid segment and expanding globally.

Global Presence: Manufacturing and R&D hubs across Europe, North America, and Asia.

4. Mercedes-Benz Group AG

Specialization: Focused on premium hybrid and all-electric vehicles under the Mercedes-EQ brand.

Key Focus Areas: Electrified luxury, performance innovation, and sustainable mobility solutions.

Notable Features: Advanced plug-in systems with high battery capacity, refined interiors, and integration with Mercedes’ digital ecosystems.

2024 Revenue: Approximately €145 billion.

Market Share: Major player in the global luxury PHEV market, with strong European sales.

Global Presence: Global network across Europe, the Americas, and Asia.

5. Ford Motor Company

Specialization: Produces plug-in hybrid and battery-electric vehicles for mainstream and commercial markets.

Key Focus Areas: Electrified SUVs, trucks, and commercial fleets.

Notable Features: The Ford Escape PHEV and plug-in Transit vans combine utility with reduced emissions.

2024 Revenue: Approximately USD 185 billion.

Market Share: Increasing PHEV footprint in North America and Europe.

Global Presence: Operations across more than 100 countries with significant investments in U.S. EV manufacturing.

Leading Trends and Their Impact

1. Dual-Strategy Electrification

Automakers are increasingly adopting dual strategies—producing both BEVs and PHEVs to diversify risk and satisfy consumer preferences. BYD and BMW exemplify this, ensuring a wide model mix that captures various income segments and driving needs. This trend is accelerating the electrification of traditional vehicle platforms.

2. Regulatory and Incentive-Driven Growth

Government policies remain a defining growth driver. Tax credits, rebates, and CO₂ compliance standards shape which vehicles thrive. In the U.S., the Inflation Reduction Act provides up to $7,500 in credits for qualifying plug-in vehicles, influencing automaker sourcing and assembly decisions. In Europe, strict fleet-average emission rules make PHEVs essential for manufacturers to meet compliance targets.

3. Real-World Emission Accountability

Recent studies revealed that some PHEVs underperform in real-world conditions due to infrequent charging, prompting policymakers to reconsider incentive structures. This scrutiny encourages automakers to improve electric ranges, user engagement, and hybrid system efficiency, making next-generation PHEVs more practical and eco-friendly.

4. Expanding Charging Infrastructure

Improved charging access is reducing range anxiety, enabling more efficient use of PHEVs. The rise of public fast chargers and home charging solutions supports plug-in adoption and enhances driver convenience.

5. Fleet Electrification

Corporate and government fleets are increasingly transitioning to plug-in vehicles. PHEVs serve as a viable entry point for organizations with mixed driving cycles and limited charging infrastructure. Their ability to lower operating costs while maintaining uptime positions them as an attractive short- to mid-term solution.

6. Technological Convergence

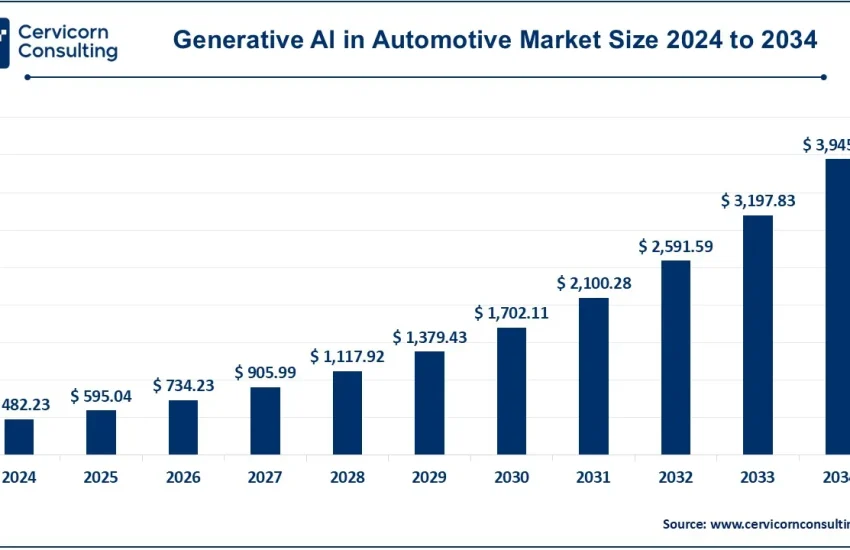

The integration of smart connectivity, over-the-air software updates, and energy management systems is making PHEVs more efficient and user-friendly. Automakers are leveraging artificial intelligence to optimize hybrid powertrain performance and energy consumption.

Successful Examples of Plug-In Hybrid Vehicles Worldwide

Mitsubishi Outlander PHEV:

Among the world’s best-selling plug-in hybrid SUVs, the Outlander combines practical range, family-friendly utility, and affordability. Its strong sales in Europe and North America demonstrate the model’s widespread appeal.

Toyota Prius Prime:

A globally recognized plug-in hybrid, the Prius Prime popularized plug-in technology for everyday users. Its fuel efficiency, reliability, and accessible price point made it a cornerstone of mainstream electrification.

BMW X5 xDrive50e:

BMW’s flagship PHEV SUV offers extended electric range and high performance, targeting premium customers who value both sustainability and luxury. Its success underscores growing demand for high-end electrified vehicles.

Volvo XC90 Recharge:

As part of Volvo’s electrification strategy, the XC90 Recharge represents the brand’s commitment to transitioning toward an all-electric future while maintaining the versatility of hybrid powertrains.

Hyundai Tucson and Kia Sorento Plug-In Hybrids:

These models have gained popularity across Europe and North America by blending affordability, practicality, and electric range suitable for most daily commutes.

These examples illustrate that success in the PHEV market hinges on aligning technology, range, price, and consumer expectations within local policy frameworks.

Global and Regional Analysis

China

China dominates global PHEV sales, accounting for a significant share of worldwide plug-in deliveries. Robust government policies—such as purchase subsidies, tax exemptions, and preferential registration rules—have accelerated adoption. Domestic leaders like BYD, Li Auto, and Geely have benefited immensely from supportive infrastructure and consumer acceptance. Although the government plans to gradually phase out subsidies, strong consumer momentum and the rapid buildout of charging networks ensure continued growth. Exports from China to Southeast Asia, Europe, and Latin America are expanding rapidly.

Europe

Europe remains one of the most mature PHEV markets, driven by stringent CO₂ emission targets and diverse incentive programs. Countries such as Germany, the Netherlands, Norway, and the UK have historically supported PHEV adoption through tax breaks and low-emission zones. However, as BEV infrastructure improves, some nations are reducing PHEV incentives to focus on full-electric models. Despite this, PHEVs remain essential for manufacturers to meet short-term emission compliance while offering consumers transitional solutions.

United States

The U.S. market is undergoing a policy-led resurgence in plug-in vehicle sales. The Inflation Reduction Act of 2022 revitalized the segment by introducing long-term tax credits and encouraging domestic battery manufacturing. PHEVs appeal to suburban and rural consumers who value range flexibility, and fleet operators benefit from lower lifecycle costs. States like California, New York, and Colorado have additional local rebates and zero-emission mandates, further boosting adoption.

Asia-Pacific (Excluding China)

Japan, South Korea, and India are emerging as important PHEV markets. Japan’s automotive giants—Toyota, Honda, and Mitsubishi—have strong hybrid legacies and are increasingly pivoting toward plug-in technologies. South Korea’s Hyundai and Kia are expanding exports of PHEV SUVs, while India’s government-backed initiatives such as FAME II encourage the development of localized hybrid technologies to meet emission-reduction goals.

North America (Canada & Mexico)

Canada offers federal and provincial incentives for PHEVs, with urban centers prioritizing electrification. Mexico is gradually adopting plug-in technologies through government partnerships and regional emission regulations. Together, these markets create a North American corridor of electrified vehicle growth.

Middle East & Latin America

These regions are at an early stage of PHEV adoption but show growing interest as oil-exporting countries diversify their economies. Governments are beginning to introduce clean transportation targets and incentives for hybrid vehicle imports. Latin American markets like Chile and Brazil are witnessing pilot programs for fleet electrification.

Government Initiatives and Policies Shaping the Market

Subsidies and Tax Incentives

Many governments provide direct purchase incentives, import-duty exemptions, and tax reductions to lower the upfront cost of PHEVs. These measures stimulate consumer demand and accelerate manufacturer investment.

Emission Regulations

The tightening of CO₂ emission norms in regions such as the EU and China pushes automakers to introduce PHEVs to comply with fleet-average standards. PHEVs are particularly valuable in markets where full electrification is not yet feasible.

Infrastructure Development

Investment in public and private charging stations supports the plug-in ecosystem. Governments are funding highway fast-charging networks and residential charger subsidies, making daily charging easier for PHEV owners.

Local Manufacturing and Sourcing Rules

Policies like the U.S. Inflation Reduction Act require domestic battery component sourcing, influencing where automakers establish factories. These incentives are transforming supply chains, creating new regional hubs for EV production.

Public Sector Procurement

Government fleets adopting PHEVs signal commitment to cleaner mobility. Municipalities often use plug-in hybrids for law enforcement, logistics, and utility fleets due to their operational flexibility and reduced emissions.

Challenges and Future Outlook

Despite impressive growth, the PHEV market faces several challenges. Real-world emission discrepancies and consumer charging habits could impact the technology’s environmental credibility. As BEV infrastructure expands, some regulators may gradually reduce PHEV incentives. Battery recycling and lifecycle sustainability are also under scrutiny. However, advances in battery chemistry, increased electric range, and improved integration with smart grids promise to enhance PHEV performance and relevance.

For automakers, PHEVs remain a critical bridge technology—offering compliance advantages, profitability, and consumer flexibility. In the near term, strong growth is expected in markets balancing electrification with infrastructure constraints. By 2030, PHEVs will continue to play an essential role alongside BEVs, forming a dual-track approach to decarbonizing transportation.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Minimally Invasive Surgery Market Revenue, Global Presence, and Strategic Insights by 2034