In Vitro Fertilization (IVF) Services Market Size, Share & Growth Forecast to 2034

In Vitro Fertilization (IVF) Services Market Size and Growth

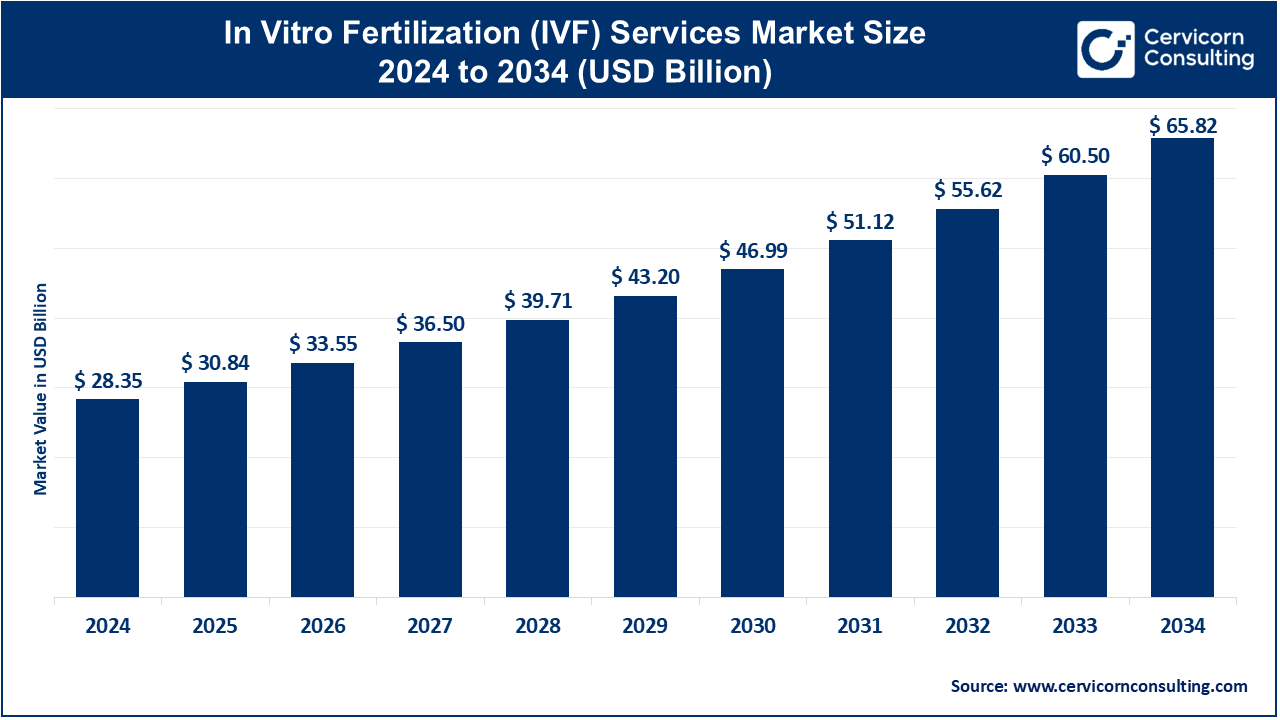

The global in vitro fertilization (IVF) services market is experiencing robust growth, driven by factors such as increasing infertility rates, delayed childbearing, lifestyle changes, and advancements in reproductive technologies. In 2024, the market is valued at approximately USD 28.35 billion and is projected to reach USD 65.82 billion by 2034, growing at a CAGR of 8.78%. Technological innovations, including AI-driven embryo selection, preimplantation genetic testing (PGT), and improved cryopreservation techniques, have enhanced IVF success rates and accessibility. Additionally, government initiatives and favorable reimbursement policies in various regions are contributing to market expansion.

What is the In Vitro Fertilization (IVF) Services Market?

The IVF services market encompasses medical procedures and associated services aimed at assisting individuals and couples in achieving pregnancy through assisted reproductive technology (ART). This includes ovarian stimulation, egg retrieval, fertilization in a laboratory setting, embryo culture, and embryo transfer into the uterus. The market comprises fertility clinics, hospitals, surgical centers, and clinical research institutes offering these services.

Why is it Important?

Infertility affects a significant portion of the global population, with approximately 17.5% of adults experiencing infertility . The IVF services market plays a crucial role in addressing this issue by providing effective solutions for individuals and couples facing fertility challenges. Moreover, the market’s growth contributes to advancements in reproductive medicine, increased access to fertility treatments, and the potential to alleviate the emotional and psychological burden associated with infertility.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2618

Top Companies in the IVF Services Market

-

Vitrolife AB

-

Specialization: IVF culture media and cryopreservation solutions.

-

Key Focus Areas: Embryo culture media, time-lapse systems, and cryopreservation products.

-

Notable Features: Emphasis on research and development to enhance IVF success rates.

-

2024 Revenue (approx.): Data not specified.

-

Market Share (approx.): Data not specified.

-

Global Presence: Operations in over 100 countries.

-

-

Cook Medical

-

Specialization: Medical devices for reproductive health.

-

Key Focus Areas: Embryo transfer catheters, oocyte retrieval needles, and sperm processing media.

-

Notable Features: Innovative product development and global distribution network.

-

2024 Revenue (approx.): Data not specified.

-

Market Share (approx.): Data not specified.

-

Global Presence: Presence in more than 135 countries.

-

-

Merck KGaA

-

Specialization: Pharmaceuticals and life sciences, including fertility treatments.

-

Key Focus Areas: Hormonal therapies, fertility drugs, and IVF lab equipment.

-

Notable Features: Comprehensive portfolio of fertility-related products.

-

2024 Revenue (approx.): Data not specified.

-

Market Share (approx.): Data not specified.

-

Global Presence: Operations in over 70 countries.

-

-

Thermo Fisher Scientific, Inc.

-

Specialization: Laboratory equipment and services, including IVF lab solutions.

-

Key Focus Areas: Cryopreservation systems, incubators, and lab consumables.

-

Notable Features: Advanced technologies for IVF laboratories.

-

2024 Revenue (approx.): Data not specified.

-

Market Share (approx.): Data not specified.

-

Global Presence: Global operations with a strong presence in North America and Europe.

-

-

Esco Micro Pte Ltd

-

Specialization: Controlled environment laboratory equipment.

-

Key Focus Areas: IVF workstations, incubators, and laminar flow cabinets.

-

Notable Features: Focus on quality and innovation in laboratory equipment.

-

2024 Revenue (approx.): Data not specified.

-

Market Share (approx.): Data not specified.

-

Global Presence: Presence in over 100 countries.

-

Leading Trends and Their Impact

-

Technological Advancements: The integration of AI and machine learning in embryo selection has improved IVF success rates by enabling more accurate assessments of embryo viability .

-

Personalized Medicine: Tailoring IVF treatments based on individual genetic profiles and health conditions has enhanced treatment efficacy and patient satisfaction.

-

Telemedicine: The adoption of telehealth services for consultations and follow-ups has increased accessibility to IVF treatments, especially in remote areas.

-

Regulatory Support: Government initiatives and favorable policies have facilitated the growth of the IVF market by improving access to fertility treatments .

Successful Examples of IVF Services Around the World

-

India: The country has witnessed a significant increase in demand for IVF services due to factors like delayed marriages, rising infertility rates, and increased awareness. The average cost of IVF services in India ranges from USD 1,000 to USD 3,000, making it an attractive destination for fertility tourism .

-

United Kingdom: Despite a decline in NHS-funded IVF procedures, the UK remains a prominent player in the IVF market, with a well-established network of fertility clinics and ongoing advancements in reproductive technologies.

-

United States: The U.S. is one of the largest markets for IVF globally, driven by high adoption rates, cutting-edge technologies, and advanced regulatory frameworks. Clinics such as Boston IVF, CCRM (Colorado Center for Reproductive Medicine), and Shady Grove Fertility have been pioneers in innovation and patient care. The average IVF cycle costs range from $12,000 to $15,000, excluding medications and genetic testing, but the high success rates and comprehensive treatment packages make the U.S. a global benchmark.

-

Japan: Japan has one of the highest numbers of IVF cycles annually. With significant government support and a cultural shift toward late parenthood, IVF is widely accepted and subsidized in many cases. The Japan Society of Obstetrics and Gynecology (JSOG) has implemented registries and regulations that ensure high standards across IVF clinics.

-

Australia: Australia’s IVF market is characterized by government-subsidized healthcare, strict regulation, and high success rates. Companies such as Monash IVF and Virtus Health offer comprehensive fertility services. The government’s Medicare program supports IVF services, making them more accessible for citizens and permanent residents.

-

Middle East (UAE, Israel): Countries like the UAE and Israel are investing heavily in medical tourism for IVF. Israel, in particular, offers one of the most generous public funding schemes for IVF globally—providing up to two children per woman under 45 through subsidized IVF treatments. Meanwhile, the UAE has become a hub for international fertility treatments due to its high-tech clinics and relaxed regulatory framework for international patients.

Regional Analysis and Government Initiatives

North America

-

United States & Canada: The U.S. IVF market is mature and well-established. While not universally covered by insurance, states like Massachusetts and Illinois mandate insurance coverage for IVF under specific conditions. Canada’s public healthcare supports IVF to a limited extent (e.g., Quebec had a public funding model until recently). Increasing awareness and LGBTQ+ inclusivity are driving growth.

Europe

-

Western Europe: Countries like the UK, Germany, France, and Spain have comprehensive public and private IVF services. The UK’s NHS covers up to three IVF cycles under certain conditions, although funding has seen reductions in recent years. Spain has become a hotspot for cross-border reproductive care, especially for egg donation and IVF, due to its liberal laws and high success rates.

-

Eastern Europe: Nations such as Ukraine, the Czech Republic, and Russia are increasingly involved in fertility tourism due to lower costs and emerging private sector investments. Government policies are more supportive than in the past, although quality standards vary across clinics.

Asia-Pacific

-

India: With one of the highest infertility rates globally and growing awareness, India’s IVF market is expanding rapidly. It benefits from affordability and advanced services, attracting both domestic and international patients. The Assisted Reproductive Technology (Regulation) Act, 2021 aims to regulate the industry by setting standards for clinics and embryologists.

-

China: With the relaxation of the one-child policy and an aging population, the IVF market is poised for exponential growth. The Chinese government has included IVF treatments in provincial healthcare plans in some regions, and private clinics are seeing huge demand spikes.

-

Japan & South Korea: Japan subsidizes up to ¥300,000 per IVF cycle for women under 43. South Korea offers national health insurance coverage for infertile couples undergoing IVF, a response to the country’s critically low birth rate.

Middle East & Africa

-

UAE, Israel, and Saudi Arabia: The UAE is positioning itself as a leading IVF tourism destination, with luxury medical centers offering holistic fertility care. Israel remains a global leader in IVF funding and cycle rates per capita. Saudi Arabia is investing in women’s healthcare and fertility infrastructure as part of Vision 2030 reforms.

-

Africa: IVF services remain limited to urban areas and private clinics due to affordability issues and a lack of public infrastructure. South Africa and Nigeria lead the continent in IVF services, catering to both local and diaspora demand.

Latin America

-

Brazil, Argentina, and Mexico: These countries are seeing a surge in demand for ART due to shifting family norms and growing fertility awareness. Brazil is a regional leader in IVF services, with high-quality clinics offering competitive pricing and success rates.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Healthcare CRM Market Size, Growth Trends, Leading Companies, and Regional Insights by 2034