6G Market Size, Forecast & Key Players 2027–2034

6G Market Size

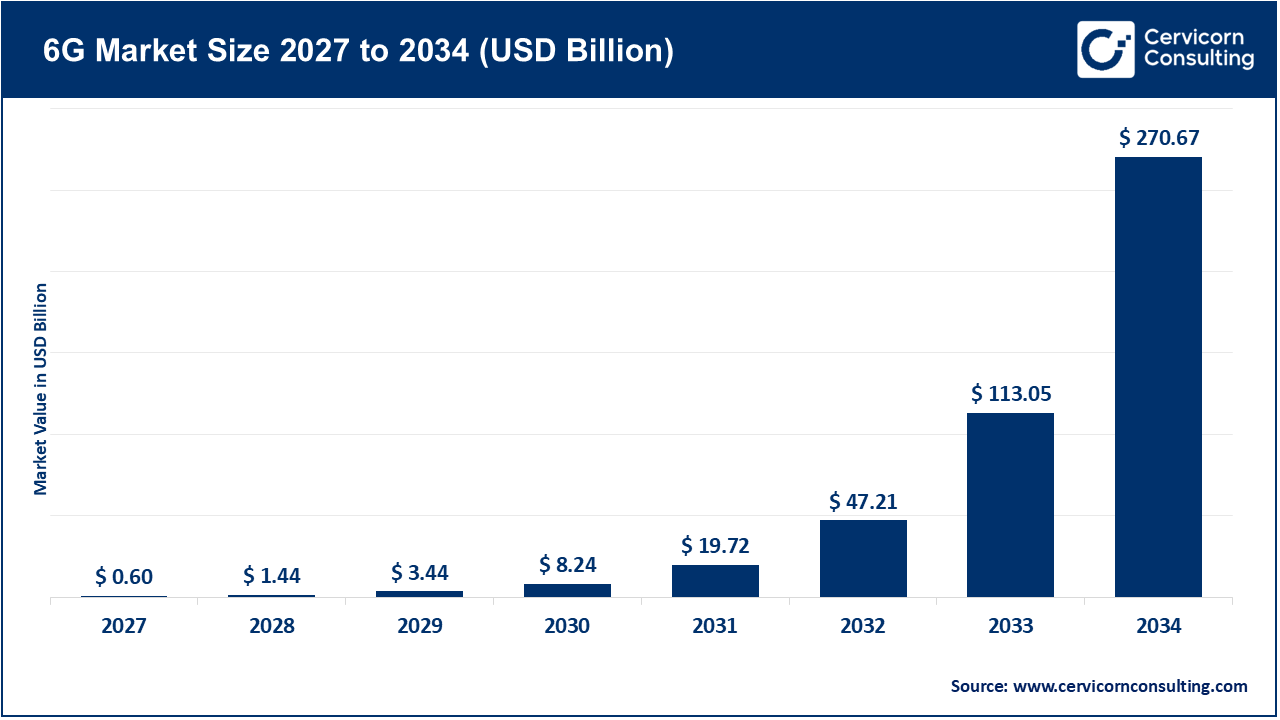

The global 6G market size was worth USD 0.60 billion in 2027 and is anticipated to expand to around USD 270.67 billion by 2034, registering a compound annual growth rate (CAGR) of 114.4% from 2027 to 2034.

What is the 6G Market?

The 6G market refers to the global ecosystem of technologies, infrastructure, services, research efforts, and commercial innovations surrounding the upcoming sixth generation of wireless mobile networks. It includes hardware (such as terahertz transceivers, advanced antennas, base stations), software (AI-driven network orchestration, security stacks, virtualization), services (deployment, management, consultancy), research initiatives, standards development, and emerging applications.

This market comprises all value chain players—from chipmakers and equipment manufacturers to service providers and software integrators—preparing for the next wave of hyper-connected applications. Its primary goal is developing and eventually commercializing the ultra‑high capacity, ultra‑low latency, AI-empowered wireless systems that go beyond 5G.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2658

6G Market: Growth Factors

The growth of the 6G market is fueled by several converging trends: booming data demand; the exponential proliferation of connected IoT and smart devices; surging investments in AI, edge computing, digital twins, autonomous systems, and holographic communications; global government and regulatory support; race for national competitiveness; and projected year-on-year revenue growth with CAGRs ranging from 24 % to nearly 77 % across different analyses.

Why is 6G Important?

- Dramatically Enhanced Performance – With projected speeds up to terabits/sec and latency as low as 0.1 ms, 6G enables real-time decision-making in critical sectors, including autonomous vehicles, robotics, telemedicine, and industrial automation.

- AI-Native Networks – 6G will embed AI at its core, facilitating self‑optimizing, predictive, and secure networks using advanced analytics and threat detection.

- Advanced Sensing & Holography – Integrated sensing systems supporting immersive applications—like holographic communications and spatial intelligence—will redefine entertainment, healthcare, and education.

- Security & Quantum-Resilience – With quantum-resistant encryption and pervasive AI‑driven cybersecurity, 6G is designed to protect critical systems and data, vital across financial, defense, and critical infrastructure sectors.

- Socioeconomic Impact – Expected to drive smart urban infrastructure, rural connectivity, industrial efficiency, and bolster national competitiveness. Governments in Asia, Europe, and North America are launching multi-billion‑dollar programs and spectrum policies to secure leadership.

Top 6G Companies & Their Focus Areas

Let’s explore the major players and their roles in shaping the 6G market.

1. IBM

- Specialization: Enterprise AI, cloud and hybrid infrastructure, edge computing, quantum-safe encryption

- Key Focus Areas: AI-native networks, secure network orchestration, integration of telecom and enterprise cloud stacks

- Notable Features: Edge-first deployments with Red Hat/OpenShift, advanced analytics, hybrid cloud management

- 2024 Revenue: ~$60.5 billion

- Market Share/Presence: Strong presence in global telecom software and consulting, partnering with carriers

2. ZTE Corporation

- Specialization: Radio access networks, terahertz communications, 5G/6G infrastructure hardware

- Key Focus Areas: High-speed wireless modules, AI-enabled access points, IP network backbone

- Notable Features: 800 Gbps data modules, AI-powered home broadband equipment

- 2024 Revenue: Estimated $15–20 billion

- Market Share: Among top-tier radio network equipment suppliers

- Global Presence: Strong in China, APAC, MENA, LATAM; expanding globally

3. Intel

- Specialization: Semiconductor chips, processors, FPGAs for network edge and 6G devices

- Key Focus Areas: Terahertz-capable silicon, edge AI accelerators, network processing units

- Notable Features: High-performance chips for computing at the network edge

- 2024 Revenue: ~$63.0 billion

- Market Share: Market leader in server and PC chips, expanding into network infrastructure

- Global Presence: Manufacturing and R&D in US, Ireland, Israel, China; global supply chain

4. Telefonaktiebolaget LM Ericsson

- Specialization: Telecom infrastructure (RAN/core), 6G prototype systems, software-defined and slicing technologies

- Key Focus Areas: Network slicing, terahertz trials, cognitive/self-driving networks

- Notable Features: 3 Gbps prototypes, Network Slicing, AI-driven orchestration

- 2024 Revenue: $9.5 billion

- Market Share: ~30‑40 % global RAN share

- Global Presence: 180+ countries; strong in Europe, Americas, APAC, Middle East, Africa

5. Microsoft

- Specialization: Cloud services (Azure), edge computing, AI-as-a-service, Azure for Operators

- Key Focus Areas: AI-driven network functions, edge-cloud telecom startup support, IoT endpoint integration

- Notable Features: Azure edge footprint for operator deployment

- 2024 Revenue: ~$198 billion

- Market Share: Dominant in enterprise cloud; increasingly entering telecom edge and OSS/BSS domains

- Global Presence: Worldwide Azure regions; telecom partnerships across US, Europe, Asia

Leading Trends & Their Impact

1. AI-Native Network Management

AI will oversee network design, operations, security, and maintenance. Expect predictive analytics, adaptive beamforming, and real-time threat mitigation.

2. Terahertz & mmWave Spectrum

Frequencies from 30 GHz up to 3 THz promise Tbps throughput but pose propagation and hardware challenges. New materials and smart beamforming will play a critical role.

3. Integrated Sensing & Spatial Intelligence

Networks will be equipped with environmental sensors, enabling robotic navigation, smart infrastructure, and spatially aware services.

4. Network Slicing & Virtualization

6G will support multiple virtual networks running on the same physical infrastructure, customized to different applications (e.g., autonomous cars vs. telehealth).

5. Quantum-Safe Security

Quantum-resistant cryptography and real-time AI threat detection are being developed to ensure secure data flows in sensitive environments.

6. Edge Computing

Edge nodes will perform real-time computation close to end-users, enabling ultra-low latency and AI workloads at the source of data generation.

7. Global Policy & Spectrum Regulation

Governments are forming alliances (e.g., Next G Alliance, Bharat 6G Alliance) and allocating 6G-friendly spectrum in the terahertz range to stay competitive.

Successful 6G Examples Around the World

Even before full-scale commercialization, numerous 6G pilot projects and milestones are being achieved:

- China: Successfully launched experimental 6G satellites and demonstrated 100 Gbps communications using laser technology.

- South Korea: Government-led programs have achieved terabit-per-second prototype transmissions in lab environments.

- India: Through the Bharat 6G Alliance, India is promoting indigenous development and testbeds for advanced 6G research.

- Europe: Over €250 million invested via Smart Networks and Services Joint Undertaking (SNS JU), with pilot platforms launched across Spain, Germany, and Finland.

- United States & Canada: Next G Alliance unites major tech and telecom firms to lead research and commercial frameworks. Government support for spectrum trials and security frameworks is growing.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: IoT Market Expansion From USD 1.16 Trillion in 2024 to USD 3.72 Trillion by 2034