Viral Vectors and Plasmid DNA Manufacturing Market Leaders & Insights by 2034

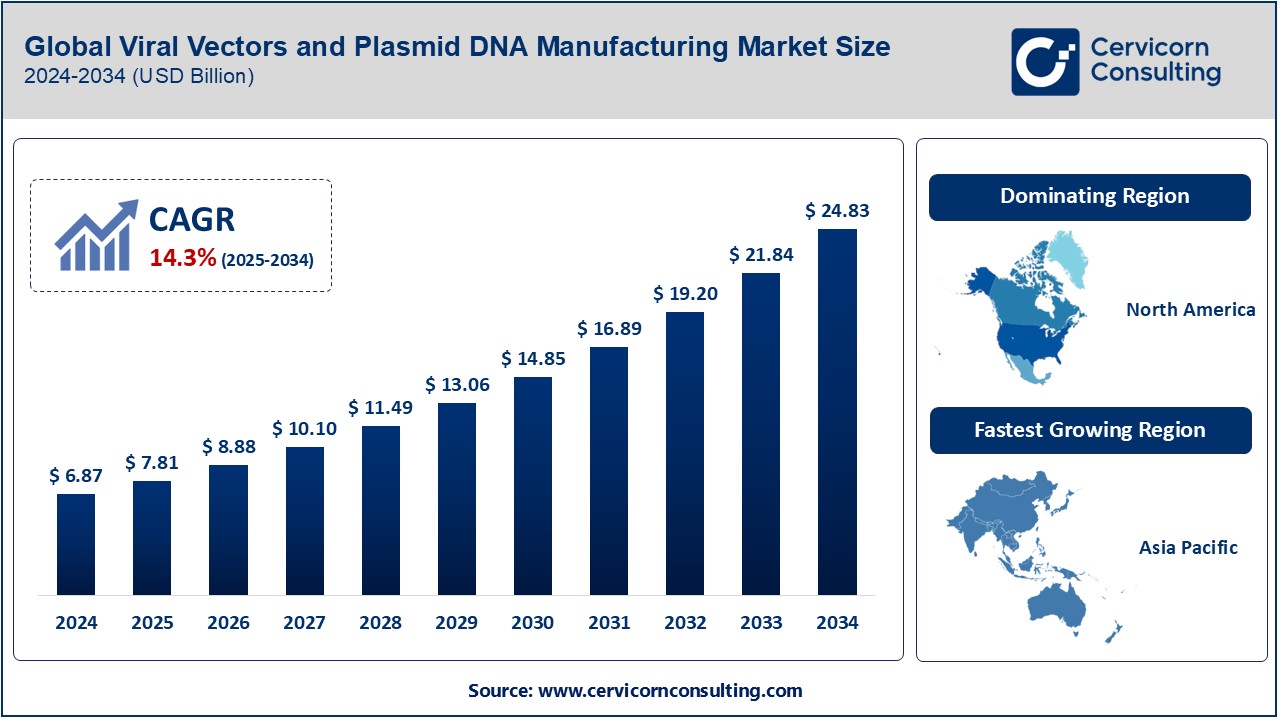

Viral Vectors and Plasmid DNA Manufacturing Market Size

The global viral vectors and plasmid DNA manufacturing market was worth USD 6.87 billion in 2024 and is anticipated to expand to around USD 24.83 billion by 2034, registering a compound annual growth rate (CAGR) of 20.16% from 2025 to 2034.

What is the Viral Vectors and Plasmid DNA Manufacturing Market?

The viral vectors and plasmid DNA manufacturing market revolves around the production of biological agents used in gene therapy, vaccines, and cell-based therapies. Viral vectors are engineered viruses utilized to deliver genetic material into cells, while plasmid DNA serves as a critical component in the production of therapeutic agents and gene editing applications. This market plays a pivotal role in advancing precision medicine, gene editing, and the development of vaccines, particularly for emerging diseases.

Why is it Important?

The significance of this market lies in its centrality to groundbreaking medical advancements. Viral vectors and plasmid DNA are instrumental in treating genetic disorders, cancers, and infectious diseases. They form the backbone of innovative therapies like CAR-T cell therapy and are integral to the manufacturing of mRNA-based vaccines. With the rise of personalized medicine and an increased focus on rare diseases, the demand for efficient and scalable manufacturing processes has surged, making this market indispensable to modern healthcare.

Viral Vectors and Plasmid DNA Manufacturing Market Growth Factors

The viral vectors and plasmid DNA manufacturing market is propelled by multiple factors, including the growing prevalence of chronic and genetic disorders, increased investments in gene and cell therapy research, and advancements in bioprocessing technologies. The success of mRNA vaccines during the COVID-19 pandemic has further validated the market’s potential. Additionally, favorable government initiatives, rising adoption of advanced therapies, and a robust pipeline of gene therapy products contribute to the market’s exponential growth trajectory. With increasing regulatory approvals and heightened demand for scalable production methods, the market is set for significant expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2500

Viral Vectors and Plasmid DNA Manufacturing Market Top Companies

1. Merck KGaA

- Specialization: Biopharmaceutical manufacturing solutions, including viral vectors and plasmid DNA production.

- Key Focus Areas: Gene therapy, monoclonal antibodies, and vaccine development.

- Notable Features: Proprietary Mobius® single-use manufacturing systems.

- 2023 Revenue (approx.): $24 billion.

- Market Share (approx.): 12%.

- Global Presence: Strong footprint in Europe, North America, and Asia-Pacific, with state-of-the-art facilities in Germany and the US.

2. Lonza

- Specialization: Custom manufacturing and development services for biologics, including viral vectors and plasmid DNA.

- Key Focus Areas: Cell and gene therapy, biopharmaceuticals, and small molecule APIs.

- Notable Features: Integrated solutions spanning preclinical to commercial stages.

- 2023 Revenue (approx.): $6.3 billion.

- Market Share (approx.): 10%.

- Global Presence: Facilities in Switzerland, the US, Singapore, and China, catering to a global clientele.

3. FUJIFILM Diosynth Biotechnologies

- Specialization: Contract development and manufacturing services for advanced therapies and biologics.

- Key Focus Areas: Viral vectors, monoclonal antibodies, and recombinant proteins.

- Notable Features: State-of-the-art gene therapy production facilities and advanced bioprocessing capabilities.

- 2023 Revenue (approx.): $1.8 billion.

- Market Share (approx.): 6%.

- Global Presence: Operations in the US, UK, and Denmark, with significant investments in capacity expansion.

4. Thermo Fisher Scientific

- Specialization: Comprehensive solutions for viral vector and plasmid DNA manufacturing.

- Key Focus Areas: Gene therapy, diagnostics, and vaccine production.

- Notable Features: GMP-compliant manufacturing facilities and scalable production platforms.

- 2023 Revenue (approx.): $45 billion.

- Market Share (approx.): 15%.

- Global Presence: A global leader with operations across North America, Europe, and Asia-Pacific.

5. Cobra Biologics

- Specialization: Gene therapy manufacturing, including viral vectors and plasmid DNA.

- Key Focus Areas: Clinical and commercial production of ATMPs (Advanced Therapy Medicinal Products).

- Notable Features: Expertise in AAV, lentiviral vectors, and plasmid DNA production.

- 2023 Revenue (approx.): $450 million.

- Market Share (approx.): 4%.

- Global Presence: Facilities in the UK and Sweden, with collaborations worldwide.

Leading Trends and Their Impact

- Rise of mRNA Technology: The success of mRNA-based COVID-19 vaccines has underscored the importance of scalable plasmid DNA production, driving investments in advanced manufacturing platforms.

- Adoption of Single-Use Technologies: Single-use bioreactors and systems are gaining traction due to their cost-efficiency and reduced risk of cross-contamination, streamlining viral vector production.

- Increased Outsourcing: Biopharma companies are increasingly outsourcing manufacturing to CDMOs (Contract Development and Manufacturing Organizations) to focus on R&D, boosting market growth.

- Regulatory Support: Accelerated regulatory approvals for gene therapies and vaccines have created a favorable environment for market players to innovate and scale production.

- Automation and Digitalization: The integration of AI and IoT in manufacturing processes enhances efficiency and reduces production timelines, marking a significant trend in the industry.

Successful Examples Around the World

- BioNTech and Pfizer Collaboration: The rapid development and manufacturing of the Comirnaty® COVID-19 vaccine demonstrated the potential of efficient plasmid DNA production and viral vector technology.

- Novartis’ Zolgensma: Approved for treating spinal muscular atrophy (SMA), Zolgensma is a landmark in gene therapy, showcasing the power of AAV-based viral vectors.

- Bluebird Bio’s Lentiglobin: Targeting beta-thalassemia, this therapy highlights the advancements in lentiviral vector manufacturing.

- Oxford-AstraZeneca Vaccine: Leveraging adenoviral vector technology, this vaccine was pivotal in the global fight against COVID-19.

Regional Analysis

North America

- Market Highlights:

- Dominates the market due to advanced healthcare infrastructure and significant investments in gene therapy research.

- Presence of leading companies like Thermo Fisher Scientific and Lonza.

- Government Initiatives:

- The US FDA’s breakthrough therapy designation encourages innovation in gene therapies.

- NIH funding for advanced biomanufacturing facilities.

Europe

- Market Highlights:

- Strong focus on cell and gene therapy research, with notable contributions from countries like Germany and the UK.

- Companies like Merck KGaA and Cobra Biologics play a significant role.

- Government Initiatives:

- EU Horizon 2020 and Horizon Europe programs provide funding for advanced therapies.

- Regulatory harmonization across member states boosts market growth.

Asia-Pacific

- Market Highlights:

- Rapidly emerging as a hub for biopharma manufacturing, driven by investments in countries like China, India, and South Korea.

- Local companies are collaborating with global players to expand capabilities.

- Government Initiatives:

- Policies promoting biotech innovation, such as China’s “Made in China 2025” and India’s “Biotechnology Industry Research Assistance Council (BIRAC).”

Latin America

- Market Highlights:

- Increasing adoption of gene therapies and vaccines, albeit at a slower pace than developed regions.

- Countries like Brazil are investing in local biomanufacturing capabilities.

- Government Initiatives:

- Public-private partnerships to boost biotech research and development.

Middle East & Africa

- Market Highlights:

- Gradual growth, driven by increasing awareness and investments in advanced therapies.

- UAE and South Africa are key markets in the region.

- Government Initiatives:

- Efforts to establish regional biopharma hubs and attract foreign investments.

Government Initiatives and Policies Shaping the Market

Governments worldwide are actively promoting biopharmaceutical advancements through funding, regulatory support, and public-private collaborations. Policies aimed at accelerating clinical trials, reducing regulatory bottlenecks, and incentivizing research are pivotal. Examples include the US’s Orphan Drug Act, which encourages the development of treatments for rare diseases, and Europe’s Advanced Therapy Medicinal Products (ATMP) Regulation, which streamlines the approval process for innovative therapies. These initiatives not only foster innovation but also ensure that patients have timely access to cutting-edge treatments.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Tissue Dissociation Market Growth, Trends, and Key Players by 2034