Point-of-Care Diagnostics Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Point-of-Care Diagnostics Market Size

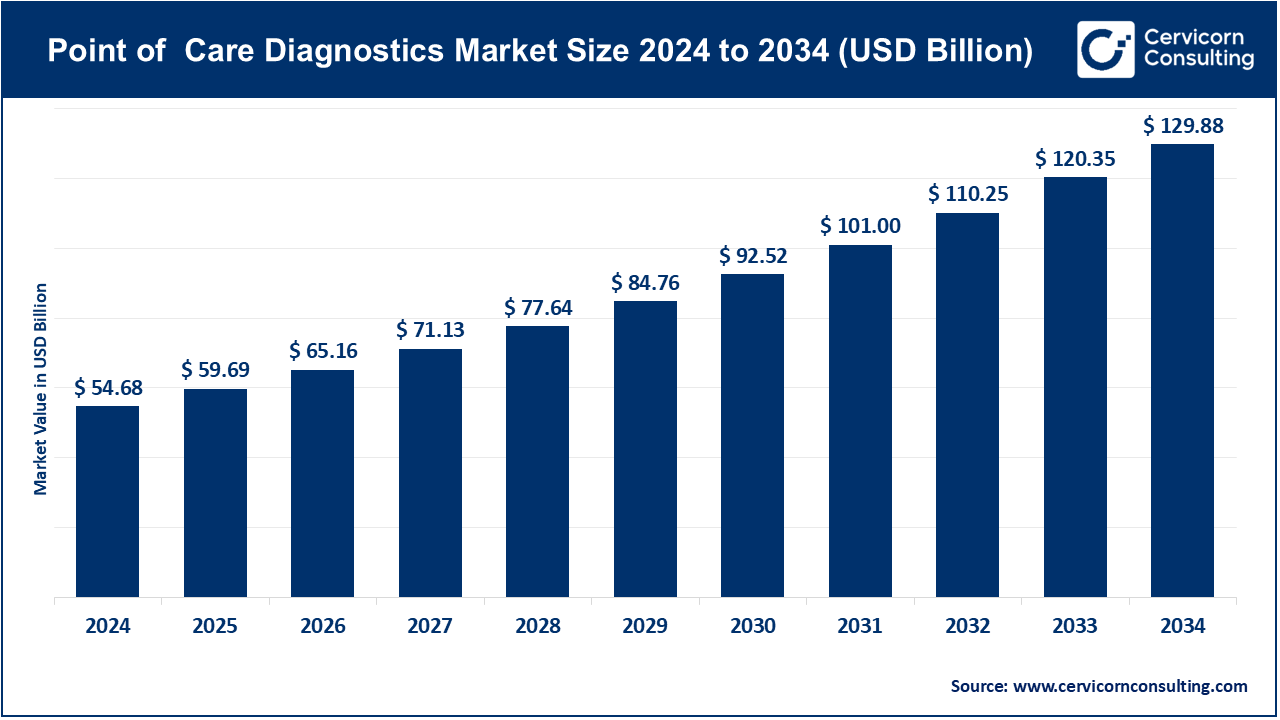

The global point-of-care diagnostics market size was worth USD 54.68 billion in 2024 and is anticipated to expand to around USD 129.88 billion by 2034, registering a compound annual growth rate (CAGR) of 9.04% from 2025 to 2034.

Point-of-Care Diagnostics Market Growth Factors

The POC diagnostics market is propelled by several mutually reinforcing factors, including the rising burden of chronic diseases that require frequent and decentralized monitoring, increasing demand for rapid decision-making in emergency and primary-care settings, expanding consumer preference for self-testing and at-home diagnostics, and continuous technological advancements such as microfluidics, miniaturized molecular platforms, digital connectivity, and smartphone-enabled testing. Post-pandemic investment in decentralized healthcare systems, improved awareness of self-testing, and favorable regulatory pathways—such as faster approvals for over-the-counter (OTC) tests and simplified CLIA-waiver processes—have further accelerated adoption. Additionally, growth in emerging economies, improved public-health programs, and government-led screening initiatives have massively expanded market reach across both developed and resource-limited regions.

What Is the Point-of-Care Diagnostics Market?

The POC diagnostics market comprises devices, consumables, assays, analyzers, and software used to deliver diagnostic results at or near the site of patient care rather than in centralized laboratories. These include:

- Lateral-flow rapid tests (e.g., antigen, pregnancy, HIV)

- Portable meters (glucometers, hemoglobin meters)

- Rapid molecular diagnostic platforms (PCR-equivalent technologies run in clinics)

- Portable blood-gas and chemistry analyzers

- Home-based self-testing kits integrated with apps

- Digital/connected POC devices sending data to EHRs or cloud dashboards

Market valuations vary across analytical sources, but all agree that POC diagnostics have become a critical pillar of modern healthcare, driven heavily by pandemic-induced adoption, rising consumerization of health technology, and the need for speed and convenience in clinical workflows.

Why Point-of-Care Diagnostics Are Important

Point-of-care diagnostics radically shorten the turnaround time between sample collection and result interpretation. This enables immediate treatment decisions, which is crucial for infectious diseases, acute conditions, and chronic illness management. In resource-constrained regions, POC devices eliminate dependency on centralized laboratory infrastructure and trained personnel, enabling equitable access to testing. For home users, POC systems enhance autonomy and adherence, reducing the burden on healthcare systems. Additionally, digital connectivity enables continuous monitoring, population-level surveillance, remote healthcare, and early disease detection — key priorities in the era of telehealth and preventive care. POC diagnostics also improve clinical workflows by reducing bottlenecks, lowering hospital admissions, and enabling real-time public-health response.

Top Companies in the Point-of-Care Diagnostics Market

Below are the leading players shaping the global POC diagnostics landscape, including their specialization, focus areas, notable features, approximate 2024 revenue (overall company-level figures), market positioning, and global presence.

1. Abbott Laboratories

Specialization:

Abbott dominates several POC segments, particularly continuous glucose monitoring (CGM), handheld glucose meters, rapid infectious disease testing, and decentralized molecular diagnostics.

Key Focus Areas:

- Diabetes care (FreeStyle portfolio)

- Rapid antigen tests and flu/respiratory diagnostics

- ID NOW rapid molecular platform

- Remote monitoring and patient-connected solutions

Notable Features:

- One of the largest global installed bases of POC devices

- Highly trusted for reliability and consumer usability

- Strong penetration into pharmacies, hospitals, and home-use markets

2024 Revenue: Approx. $42 billion (company level).

Market Share & Global Presence:

Abbott is consistently ranked among the largest POC manufacturers globally, with strong presence across North America, Europe, Asia-Pacific, Latin America, and emerging markets. Its diabetes and infectious-disease POC products are used in >100 countries.

2. Roche Diagnostics

Specialization:

Roche is a dominant explorer in molecular and immunodiagnostics, offering both laboratory and advanced point-of-care solutions.

Key Focus Areas:

- Molecular POC testing (cobas Liat)

- Infectious disease detection

- Companion diagnostics integrated across care settings

Notable Features:

- Extensive R&D resources

- Strong integration between lab-grade and near-patient devices

- Partnerships supporting public-health programs and screening

2024 Revenue: Approx. CHF 60+ billion, with Diagnostics forming a significant portion.

Market Share & Global Presence:

Roche’s diagnostics portfolio is used across the globe, and its POC products are increasingly adopted in hospitals, urgent care settings, and decentralized medical facilities.

3. Siemens Healthineers

Specialization:

A major global player offering imaging, laboratory diagnostics, and robust point-of-care testing devices.

Key Focus Areas:

- Blood-gas analyzers

- Portable chemistry/immunoassay systems

- Integrated diagnostics and workflow solutions

Notable Features:

- Deep relationships with hospital networks

- Focus on digital ecosystems and enterprise solutions

- Durable, reliable analyzers for critical care environments

2024 Revenue: Approx. €22.4 billion.

Market Share & Global Presence:

Active in 70+ countries, Siemens Healthineers has a strong foothold in high-income healthcare systems and is expanding its POC offerings into emerging markets.

4. Becton, Dickinson and Company (BD)

Specialization:

Known globally for specimen collection systems, consumables, and an expanding diagnostics portfolio.

Key Focus Areas:

- Sample collection

- Point-of-care diagnostic enablers

- Rapid testing solutions via acquisitions and partnerships

Notable Features:

- Strong supply-chain and hospital integration

- Expertise in clinical workflows

- Growing presence in decentralized testing

2024 Revenue: Approx. $20.2 billion.

Market Share & Global Presence:

BD products are sold in virtually every healthcare setting worldwide. While not as specialized in POC devices as competitors, its influence in diagnostic workflows strengthens its market positioning.

5. Thermo Fisher Scientific

Specialization:

A diversified giant in life sciences, instrumentation, and specialty diagnostics, with select offerings relevant to POC and near-patient testing.

Key Focus Areas:

- Molecular diagnostics

- Specialty diagnostic assays

- Lab systems supporting decentralized testing

- Strategic refocus and portfolio optimization

Notable Features:

- Massive global supply footprint

- Consistent product innovation and acquisitions

- Strong support for public-health laboratories

2024 Revenue: Approx. $42.8 billion.

Market Share & Global Presence:

While its POC footprint is smaller than Abbott or Roche, Thermo Fisher plays a critical role in technologies that enable near-patient molecular testing and diagnostics innovation globally.

Leading Trends Shaping the Point-of-Care Diagnostics Market

1. Rise of At-Home and OTC Testing

Consumer-driven healthcare is reshaping diagnostics. The widespread familiarity with COVID-19 home tests has accelerated adoption of at-home diagnostics for fertility, allergies, chronic disease management, and infectious conditions.

Impact:

Retail pharmacies, e-commerce platforms, and telehealth providers are becoming central diagnostic delivery channels.

2. Miniaturized Molecular Diagnostics

Recent innovations allow PCR-equivalent sensitivity in handheld devices using isothermal amplification or compact cartridges.

Impact:

Clinics and urgent care centers now deliver lab-quality results within minutes, transforming disease management and antimicrobial stewardship.

3. Connected and Digital Health Integration

POC devices now often incorporate Bluetooth/WiFi connectivity, app integration, cloud dashboards, or EHR upload capabilities.

Impact:

Facilitates remote care, chronic disease management, and real-time surveillance — essential for national health programs and pandemic preparedness.

4. Regulatory Evolution

Governments have modernized regulatory pathways to support decentralized testing. For example:

- Simplified waivers for point-of-care usage

- Expedited approvals for at-home test kits

- Stricter post-market monitoring

- New frameworks for digital and AI-enabled diagnostics

Impact:

Manufacturers face a balance of faster market access but higher evidence and usability requirements.

5. Price Pressure and New Business Models

Health systems and consumers demand affordable testing. Companies are introducing:

- Subscription-based testing

- Device-leasing models

- Integrated services bundled with telehealth

- Low-cost reagent refill systems

Impact:

Cost-effective, accessible diagnostics promote mass adoption in both emerging and developed markets.

Successful Real-World Examples of Point-of-Care Diagnostics

1. COVID-19 Rapid Tests (Global)

Rapid antigen and molecular POC tests became a cornerstone of pandemic response, enabling millions of tests per day outside traditional laboratories.

2. Glucometers & Continuous Glucose Monitoring

Products from Abbott, Roche, and other companies have empowered diabetic patients to track glucose anywhere, dramatically improving clinical outcomes and scaling to hundreds of millions of users globally.

3. Decentralized Tuberculosis (TB) Testing in India & High-Burden Countries

Rapid molecular tests deployed at peripheral health centers have drastically reduced time to diagnosis and treatment initiation, particularly in rural and underserved areas.

4. HIV Community Testing Programs (Sub-Saharan Africa)

POC HIV tests allowed mass screening campaigns with immediate counseling and linkage to care — a major milestone in public health interventions.

These examples demonstrate how POC diagnostics can be life-saving, scalable, and cost-effective across varied healthcare environments.

Global Regional Analysis & Government Initiatives

North America

Market Dynamics:

High healthcare spending, advanced infrastructure, and robust reimbursement systems make the U.S. one of the most lucrative POC markets.

Government Initiatives:

- Support for OTC diagnostic approvals

- CLIA-waived regulatory framework

- Strong emphasis on digital health and remote monitoring

Impact:

Pharmacies, urgent-care centers, and retail clinics rapidly expanded their POC offerings.

Europe

Market Dynamics:

Europe emphasizes clinical reliability and evidence-based adoption. The introduction of the In Vitro Diagnostic Regulation (IVDR) has raised compliance requirements for POC devices.

Government Initiatives:

- National screening programs

- Digital health strategies

- Harmonized regulatory pathways

Impact:

High-quality standards drive innovation but increase development costs.

Asia-Pacific (APAC)

Market Dynamics:

APAC is experiencing the fastest growth, driven by large populations, expanding healthcare access, and growing awareness of early diagnosis.

Government Initiatives:

- India’s Ayushman Bharat program (primary healthcare strengthening)

- National TB and HIV testing initiatives

- Subsidized POC testing instruments for public clinics

- China’s policies supporting domestic diagnostic manufacturing

Impact:

Mass adoption of POC technologies, particularly for infectious diseases and maternal/child health.

Latin America

Market Dynamics:

Economic variability but strong demand for affordable POC tests, especially for infectious diseases like dengue, Zika, and HIV.

Government Initiatives:

- Public-health screening programs

- Rural diagnostics outreach

- Partnerships with global donors

Impact:

POC testing often fills critical gaps where laboratory access is limited.

Middle East & Africa

Market Dynamics:

Significant need for low-cost, robust POC devices in rural and remote areas.

Government Initiatives:

- HIV, malaria, and TB control strategies

- Deployment of POC maternal-care screening

- International donor support

Impact:

POC diagnostics dramatically improve access, early detection, and disease surveillance.

What’s Next for the POC Diagnostics Market?

- Expanded integration with AI and decision-support tools

- More at-home molecular devices

- Growth in wearable-POC hybrid systems

- Greater public sector partnerships

- Increased role of pharmacies as decentralized diagnostic hubs

- Product portfolio optimization and strategic M&A among major companies

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generative AI Market Revenue, Global Presence, and Strategic Insights by 2034