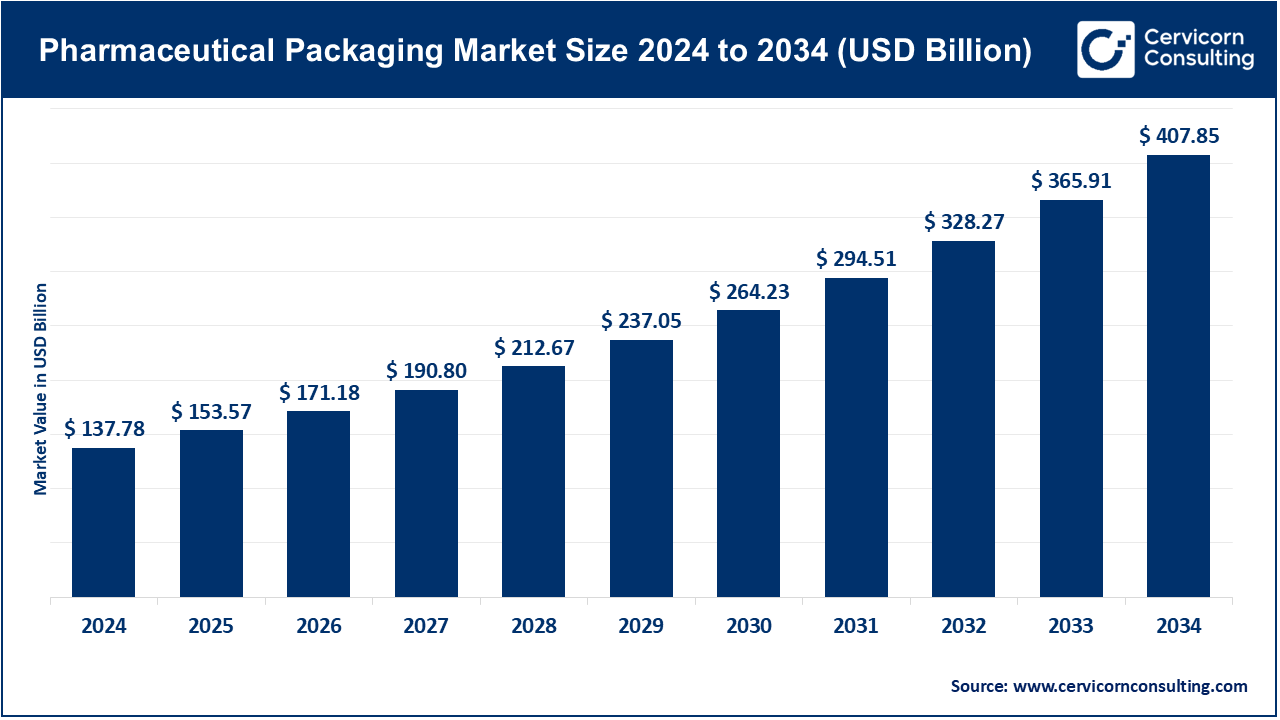

Pharmaceutical Packaging Market Revenue, Global Presence, and Strategic Insights by 2034

Pharmaceutical Packaging Market Size

What is the pharmaceutical packaging market?

The pharmaceutical packaging market comprises materials, components and finished packaging solutions designed specifically for medicines and medical devices. It includes primary packaging (vials, ampoules, syringes, blister packs, bottles), secondary packaging (cartons, multipacks), tertiary packaging (palletization, transport packaging), closures and components (droppers, pumps, dispensing systems), as well as specialty services such as serialization/track-and-trace, tamper-evidence, cold-chain packaging and smart/connected packaging systems. This market covers packaging manufacturers, contract packagers and technology providers whose products protect drug integrity, enable dosing, and secure supply chains.

Pharmaceutical packaging market — Growth Factors

The pharmaceutical packaging market is expanding rapidly due to a convergence of drivers: rising global pharmaceutical production and consumption (especially in biologics and injectables), stricter regulatory requirements for serialization and anti-counterfeiting (driving investment in track-and-trace systems), expanding demand for cold-chain solutions for temperature-sensitive therapies, the surge in personalized and patient-centric packaging that improves adherence, and sustainability pressures pushing converters and pharma companies to adopt recyclable or lower-carbon materials. Additionally, consolidation in the packaging industry (large M&A deals), digitalization (smart packaging, IoT tags), and growth in emerging markets—all supported by government healthcare investments and pandemic-era resilience planning—are creating both incremental volume and premium value opportunities across packaging formats.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2746

Why pharmaceutical packaging is important

- Product protection and stability — Packaging preserves drug potency and sterility, protects against moisture, oxygen and light, and enables safe transport (including cold-chain).

- Patient safety and adherence — Unit-dose packaging, clear labeling and child-resistant / senior-friendly closures reduce dosing errors and accidental ingestions.

- Regulatory compliance & supply-chain security — Serialization and tamper-evident features help prevent counterfeit medicines and meet laws such as DSCSA (U.S.) and evolving EU regulations.

- Brand and liability protection — Packaging reduces recall risk, protects reputation and supports pharmacovigilance via lot tracking.

- Sustainability & cost management — Material choices and lightweighting affect logistics costs and environmental footprint; pharma companies are being pushed to demonstrate circularity plans.

Pharmaceutical Packaging Market — Top Companies (profile snapshot for each requested company)

1. Amcor plc

Specialization: Flexible packaging, rigid containers, specialty cartons and closures for healthcare and consumer markets.

Key Focus Areas: Sustainable packaging solutions (recyclable mono-materials), flexible film technology, specialty cartons and healthcare closures; scale through M&A.

Notable Features: Large global footprint; R&D in sustainable films and barrier technologies.

2024 Revenue: Amcor reported fiscal 2024 net sales of about $13.64 billion.

Market Share / Global Presence: Global — operations across Americas, EMEA and APAC; notable scale in flexible and rigid plastics. Amcor’s acquisition of Berry Global (announced in 2024) signals a material increase in market share and capability.

2. Berry Global, Inc.

Specialization: Rigid and flexible plastic packaging, closures, specialty packaging and engineered containers used across pharma, healthcare, consumer and industrial sectors.

Key Focus Areas: High-volume rigid packaging, medical containers, barrier solutions and contract manufacturing for healthcare customers.

Notable Features: Strong North American manufacturing base and broad product mix; historically a major independent maker of closures and vials.

2024 Revenue: Berry reported fiscal 2024 net sales of ~$12.3 billion.

Market Share / Global Presence: Large U.S. footprint and global operations; the announced deal to combine with Amcor in late-2024/2025 was intended to create a packaging powerhouse with combined, multi-category capabilities.

3. Gerresheimer AG

Specialization: Primary glass packaging (vials, cartridges, ampoules), plastic containers, injection devices and drug-delivery systems.

Key Focus Areas: High-precision glass vials for injectables, cartridges and autoinjector components; expansion to meet demand from GLP-1 and other injectable therapies.

Notable Features: Strong technical expertise in pharma glass and drug-delivery devices; capacity expansions in Europe, U.S. and Mexico targeting booming injectable markets (e.g., obesity/GLP-1 drugs).

2024 Revenue: Gerresheimer reported ~€1.99 billion in sales in 2024.

Market Share / Global Presence: Global — production sites in Europe, the Americas and Asia; strong position in vials and parenteral primary packaging.

4. SCHOTT AG (SCHOTT Pharma)

Specialization: Specialty glass, tubular and molded glass for pharma (vials, syringes, cartridges), primary packaging and high-value pharmaceutical components; also pharma OEM solutions via SCHOTT Pharma.

Key Focus Areas: High-quality glass vials for injectables, siliconization and advanced barrier solutions; sustainability commitments for climate-neutral production.

Notable Features: Strong engineering heritage in specialty glass, emphasis on quality for sensitive biologics.

2024 Revenue: SCHOTT reported ~€2.8 billion in group sales for fiscal 2024; SCHOTT Pharma showed record growth within the group.

Market Share / Global Presence: Broad global operations, significant presence in Europe and production sites worldwide serving pharma, biotech and device customers.

5. AptarGroup, Inc.

Specialization: Drug-delivery systems (pumps, metered-dose devices, inhalation systems), closures and specialty dispensing solutions for pharma, biotech and consumer health.

Key Focus Areas: Metered-dose inhalers, nasal pumps, parenteral delivery components, patient-centric dispensing systems and connected/digital dosing solutions.

Notable Features: Strong innovation pipeline in drug-delivery devices and patient adherence technologies; often works closely with drug developers in device-drug co-development.

2024 Revenue: Aptar reported ~$3.58 billion in sales for the year ended December 31, 2024.

Market Share / Global Presence: Global — presence across North America, Europe and APAC with a mix of device manufacturing and technical services for pharma customers.

Leading trends and their impact

1. Serialization, traceability and anti-counterfeiting

Global regulation (DSCSA in the U.S., EU directives and regional track-and-trace initiatives) is forcing widespread adoption of serialized labeling, tamper-evidence and digital verification systems. The impact: increased demand for secure labeling, RFID/2D barcoding hardware and software, and new service revenue for supply-chain validation.

2. Shift to injectables and biologics (cold chain)

The growth of biologics, mAbs and GLP-1 therapeutics increases demand for cold-chain packaging, specialized vials, cartridges and syringe systems. Packaging partners who can ensure cold-chain integrity and aseptic primary packaging are seeing outsized growth. Gerresheimer and SCHOTT have specifically called out opportunities from obesity/GLP-1 drugs.

3. Sustainability and circularity

Regulatory and customer pressure is pushing pharma to reduce single-use plastics, increase recyclability, and report Scope 3 emissions. Packaging suppliers are investing in recyclable mono-materials, PCR content, and life-cycle analysis tools — shifting the cost/value equation for materials.

4. Smart packaging and patient adherence tech

Embedded electronics, NFC tags, connected caps and smart blisters are emerging as a growth tier — useful for adherence monitoring, temperature alerts and remote patient support. These add functionality and data services to packaging, creating recurring revenue possibilities.

5. Consolidation among packaging players

Large strategic M&A (e.g., Amcor’s announced acquisition of Berry) is reshaping capacity maps and R&D investment levels; consolidated players can offer end-to-end solutions, larger global footprints and greater pricing power.

Impact summary: these trends are shifting the market from low-margin commodity packaging to higher-margin, technology-enabled, service-oriented solutions — benefiting manufacturers that combine material innovation, device know-how and digital services.

Successful examples from around the world

- Pfizer and blister pack use in Africa: Targeted packaging initiatives that tailor dosage form and pack size to local supply-chain realities (e.g., blister packs for antimalarials) have reduced wastage and improved therapy adherence in resource-constrained settings.

- Gerresheimer & GLP-1 supply: Gerresheimer publicly linked capacity expansions and product lines (cartridges, pens) to the booming GLP-1/weight-loss drug market — an example of aligning packaging innovation and scale with a therapeutic surge.

- SCHOTT’s high-value pharma glass solutions: SCHOTT’s Pharma business delivered record margins and growth by focusing on high-value solutions (specialty glass vials and components) and investing in manufacturing tailored to biologics.

- Serialization rollout in the U.S. and EU: Companies investing early in serialization hardware/software have reduced recall scope, improved counterfeit detection and won long-term supplier contracts with major pharma customers.

Global regional analysis — Government initiatives and policies shaping the market

North America (U.S., Canada)

- Regulatory push for serialization and track & trace (DSCSA): The Drug Supply Chain Security Act in the U.S. creates phased serialization and verification requirements that have driven investment in line-level printing, aggregation, and software services. This creates recurring demand for tamper-evident labels and track-and-trace providers.

- Incentives for advanced manufacturing & local resilience: Federal grants and programs supporting advanced manufacturing (including cold-chain and sterile fill/finish) increase demand for local packaging partners capable of meeting aseptic standards.

Europe (EU + UK)

- Green Deal and sustainability regulation: EU environmental policy is tightening lifecycle and waste requirements, creating demand for recyclable alternatives and lower-emission packaging solutions. Pharma players in Europe face stronger expectations on packaging recyclability and extended producer responsibility planning.

- Falsified Medicines Directive (FMD): Serialization and safety features requirements under FMD affect packaging design and supplier qualification.

Asia-Pacific (China, India, Japan, South Korea, SEA)

- Rapid growth of domestic pharma & biosimilars: Fast-growing pharma production in India and China increases demand for primary packaging locally, encouraging global players to expand manufacturing footprints in the region. Governments in some markets are incentivizing local manufacturing and vaccine readiness, indirectly stimulating packaging investments.

- Regulatory harmonization: Regional regulators are speeding up harmonization and raising standards for serialization and cold-chain handling.

Latin America, Middle East & Africa

- Access & supply chain resilience initiatives: Government programs to improve vaccine distribution and essential medicines stockpiles are driving investments in cold-chain and robust tertiary packaging solutions. In some African markets, packaging strategies (unit dose and blister) have demonstrably reduced waste and loss.

Policy drivers & examples that matter to packaging players

- DSCSA enforcement (U.S.) — pushes investment in serialized barcodes, unit-level traceability and verification platforms.

- EU Green Deal & circular economy actions — require companies to reduce packaging waste and report progress, accelerating demand for recyclable and lower-carbon materials.

- National manufacturing incentives & health security funds — many countries (U.S., EU member states, India) have post-pandemic incentives to build local manufacturing capacity; packaging suppliers who can supply sterile primary packaging and cold-chain solutions benefit directly.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Green Chemicals Market Growth Drivers, Trends, Key Players and Regional Insights by 2034