Pharmaceutical Intermediates Market Revenue, Trends, and Strategic Insights by 2035

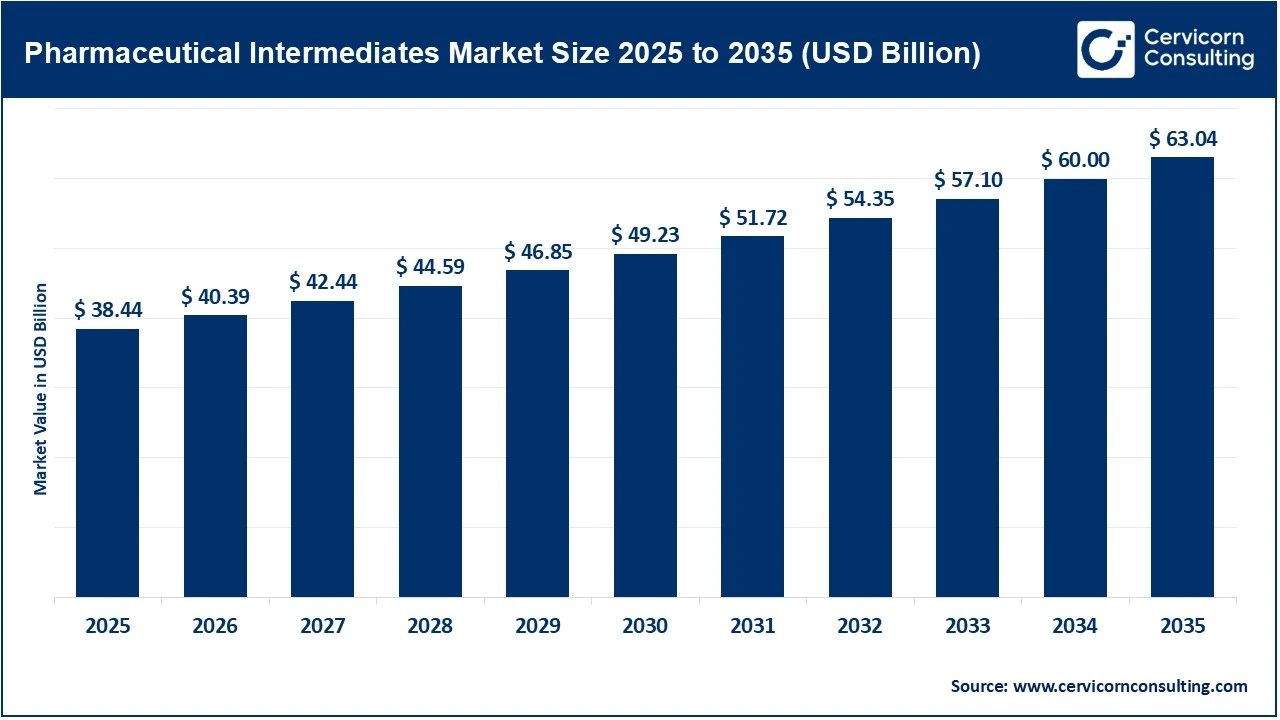

Pharmaceutical Intermediates Market Size

The global pharmaceutical intermediates market size was worth USD 38.44 billion in 2025 and is anticipated to expand to around USD 63.07 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% from 2026 to 2035.

What Is the Pharmaceutical Intermediates Market?

The pharmaceutical intermediates market refers to the global industry involved in the production, development, and supply of chemical compounds that serve as essential building blocks in the manufacturing of active pharmaceutical ingredients (APIs) and finished dosage drugs. Pharmaceutical intermediates are formed during various stages of chemical synthesis and play a critical role in determining the quality, efficacy, safety, and cost-effectiveness of pharmaceutical products. These intermediates can be bulk chemicals, specialty compounds, or advanced intermediates used in complex drug formulations, including small molecules, biologics, and specialty therapeutics. The market encompasses custom manufacturing organizations (CMOs), contract development and manufacturing organizations (CDMOs), and integrated pharmaceutical companies supplying intermediates to branded, generic, and biotech drug manufacturers worldwide.

Why Is the Pharmaceutical Intermediates Market Important?

The pharmaceutical intermediates market is a cornerstone of the global healthcare ecosystem because it ensures the uninterrupted production of life-saving medicines. As drug molecules become more complex, the demand for high-purity, regulatory-compliant intermediates has intensified. Pharmaceutical intermediates enable cost-efficient drug manufacturing, reduce time-to-market for new therapies, and ensure consistent drug quality across large-scale production. The market also supports innovation by allowing pharmaceutical companies to outsource complex chemical synthesis to specialized manufacturers with advanced capabilities, thereby focusing internal resources on research, clinical development, and commercialization. In addition, pharmaceutical intermediates are vital for meeting the growing global demand for generic drugs, biosimilars, and specialty medicines, particularly in emerging markets where affordability and access remain critical healthcare priorities.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2855

Pharmaceutical Intermediates Market Growth Factors

The growth of the pharmaceutical intermediates market is driven by the expanding global pharmaceutical industry, increasing prevalence of chronic and infectious diseases, rising demand for generic and specialty drugs, and the rapid growth of contract manufacturing and outsourcing models; advancements in chemical synthesis technologies, continuous manufacturing, and green chemistry; stringent regulatory requirements that favor high-quality and compliant intermediates; growing investments in biologics, oncology, and personalized medicine; supply chain diversification strategies adopted by pharmaceutical companies to reduce dependency on single geographies; and supportive government initiatives promoting domestic drug manufacturing and pharmaceutical self-reliance across major economies.

Company Profiles and Competitive Landscape

Lonza Group AG

Specialization:

Lonza Group AG is a global leader in pharmaceutical, biotechnology, and specialty chemical manufacturing, with a strong focus on custom intermediates, APIs, and advanced drug substances.

Key Focus Areas:

- High-potency intermediates

- Small molecule and biologics manufacturing

- Cell and gene therapy intermediates

- Regulatory-compliant custom synthesis

Notable Features:

Lonza is known for its vertically integrated CDMO model, strong regulatory track record, and advanced manufacturing infrastructure. The company emphasizes sustainability, digital manufacturing, and process optimization.

2024 Revenue:

Approximately USD 7–8 billion (company-wide)

Market Share:

Estimated mid-to-high single-digit share in the global pharmaceutical intermediates and CDMO segment

Global Presence:

Manufacturing and R&D facilities across Europe, North America, and Asia, serving global pharmaceutical and biotech clients.

WuXi AppTec Co., Ltd.

Specialization:

WuXi AppTec is a leading global CRDMO (Contract Research, Development, and Manufacturing Organization) offering end-to-end solutions for pharmaceutical intermediates and APIs.

Key Focus Areas:

- Custom synthesis of intermediates

- Small molecule drug development

- Process scale-up and optimization

- Integrated research-to-manufacturing services

Notable Features:

WuXi AppTec’s “Open Access” platform model allows pharmaceutical companies to seamlessly outsource intermediate production at different stages of drug development.

2024 Revenue:

Approximately USD 5–6 billion

Market Share:

Strong presence in the Asia-Pacific region with growing global influence

Global Presence:

Extensive operations in China, the United States, Europe, and emerging pharmaceutical hubs.

Thermo Fisher Scientific Inc.

Specialization:

Thermo Fisher Scientific provides pharmaceutical intermediates primarily through its pharma services and laboratory solutions divisions, supporting drug discovery and manufacturing.

Key Focus Areas:

- Specialty intermediates

- Analytical and process development

- Integrated pharma services

- Biopharmaceutical manufacturing support

Notable Features:

Thermo Fisher’s strength lies in combining manufacturing services with advanced analytical, regulatory, and logistics capabilities.

2024 Revenue:

Approximately USD 42–44 billion (company-wide)

Market Share:

Moderate but influential share due to integrated service offerings

Global Presence:

Operations in over 50 countries with strong footprints in North America, Europe, and Asia-Pacific.

Cambrex Corporation

Specialization:

Cambrex specializes in small molecule APIs and pharmaceutical intermediates, particularly for branded and generic drugs.

Key Focus Areas:

- Custom intermediates synthesis

- High-potency compounds

- Early-stage drug development

- Process chemistry and scale-up

Notable Features:

Cambrex is recognized for its deep chemical expertise, strong regulatory compliance, and focus on high-value niche intermediates.

2024 Revenue:

Approximately USD 1 billion

Market Share:

Strong presence in specialized and high-potency intermediate segments

Global Presence:

Manufacturing sites across the United States and Europe with a growing global customer base.

Siegfried Holding AG

Specialization:

Siegfried Holding AG is a Switzerland-based CDMO focused on pharmaceutical intermediates, APIs, and finished dosage forms.

Key Focus Areas:

- Complex chemical synthesis

- Custom intermediates

- Lifecycle management of drug substances

- Regulatory-driven manufacturing

Notable Features:

Siegfried is known for long-term partnerships with pharmaceutical companies and expertise in late-stage and commercial-scale intermediates.

2024 Revenue:

Approximately USD 1.3–1.5 billion

Market Share:

Mid-sized player with strong European market penetration

Global Presence:

Facilities across Europe, North America, and Asia.

Leading Trends and Their Impact on the Pharmaceutical Intermediates Market

One of the most influential trends shaping the pharmaceutical intermediates market is the rapid expansion of outsourcing and CDMO partnerships, enabling pharmaceutical companies to reduce capital expenditure and accelerate drug development timelines. The adoption of green chemistry and sustainable manufacturing practices is transforming intermediate production by minimizing waste, improving energy efficiency, and meeting stricter environmental regulations. Continuous manufacturing and process intensification are improving yield consistency and scalability, while digitalization and automation are enhancing quality control and regulatory compliance. Additionally, the growing focus on biologics, oncology drugs, and personalized therapies is increasing demand for highly specialized and complex intermediates, pushing manufacturers to invest in advanced technologies and skilled talent.

Successful Examples of the Pharmaceutical Intermediates Market Around the World

In India, pharmaceutical intermediates manufacturers have successfully built large-scale, cost-efficient production ecosystems supporting global generic drug supply chains. China has emerged as a dominant player by leveraging advanced chemical synthesis capabilities and integrated manufacturing clusters. In Europe, companies specializing in high-potency and regulated intermediates have carved out premium niches by serving innovative drug developers. The United States has seen success through innovation-driven intermediates production, particularly for biologics and specialty drugs, supported by strong intellectual property frameworks and advanced R&D infrastructure.

Global Regional Analysis Including Government Initiatives and Policies Shaping the Market

North America

North America remains a key market due to strong pharmaceutical R&D, high drug consumption, and advanced manufacturing capabilities. Government initiatives supporting domestic drug manufacturing, supply chain resilience, and innovation funding have boosted investments in pharmaceutical intermediates. Regulatory agencies emphasize quality and compliance, favoring high-value intermediates production.

Europe

Europe is characterized by stringent regulatory standards, sustainability-driven manufacturing, and strong CDMO ecosystems. Government policies promoting green chemistry, carbon reduction, and advanced pharmaceutical manufacturing are shaping intermediate production strategies. Countries such as Switzerland, Germany, and Ireland serve as major hubs.

Asia-Pacific

Asia-Pacific dominates global volume production, driven by cost advantages, skilled labor, and government-backed pharmaceutical manufacturing initiatives. India’s production-linked incentive schemes and China’s industrial infrastructure investments have significantly strengthened intermediate supply chains.

Latin America

Latin America is witnessing gradual growth, supported by expanding healthcare access and domestic drug manufacturing initiatives. Governments are increasingly encouraging local pharmaceutical production to reduce import dependency.

Middle East & Africa

The region is emerging as a future growth market, supported by government investments in healthcare infrastructure, pharmaceutical manufacturing zones, and regulatory modernization aimed at attracting foreign investment.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Artificial Intelligence (AI) in Textile Market Revenue, Global Presence, and Strategic Insights by 2035