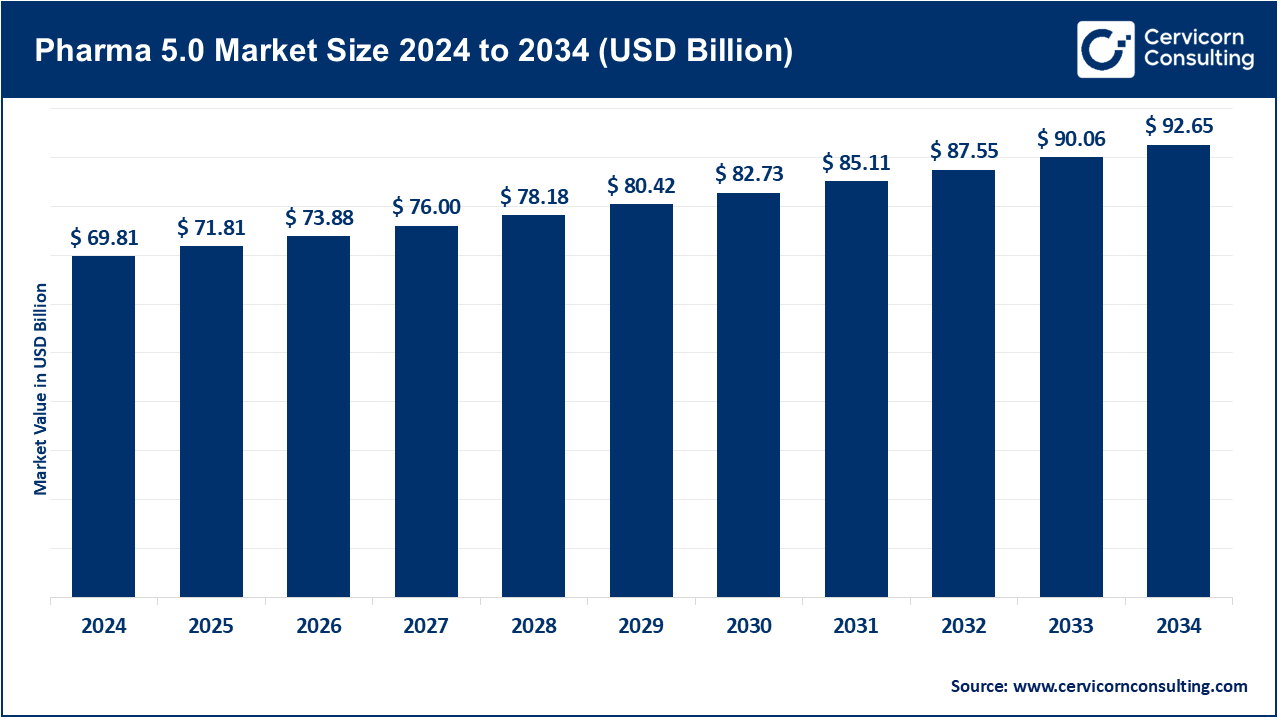

Pharma 5.0 Market Size to Reach USD 92.65 Billion by 2034

Pharma 5.0 Market Size

The global pharma 5.0 market size was worth USD 69.81 billion in 2024 and is anticipated to expand to around USD 92.65 billion by 2034, registering a compound annual growth rate (CAGR) of 29.68% from 2025 to 2034.

What is Pharma 5.0 Market?

Pharma 5.0 is the next evolution of the pharmaceutical industry, defined by the fusion of cutting-edge digital technologies and human-centric approaches to drug development, manufacturing, and patient care.

While Industry 4.0 emphasized automation and data-driven processes, Pharma 5.0 goes further by integrating Artificial Intelligence (AI), robotics, machine learning (ML), the Internet of Medical Things (IoMT), and personalized medicine with a renewed focus on human values, ethics, and sustainability. At its core, Pharma 5.0 aims to create a more responsive, adaptive, and patient-centered pharmaceutical ecosystem, focusing on real-time data analytics, decentralized clinical trials, precision therapy, and digital twin technology for drug development. The overarching goal is not just efficiency but the enhancement of public health outcomes, ethical access, and the personalization of care.

Why is Pharma 5.0 Important?

Pharma 5.0 addresses the critical gaps exposed during the COVID-19 pandemic—such as slow vaccine development cycles, inefficiencies in global supply chains, and the lack of real-time monitoring tools. By embedding AI-powered systems into R&D, it reduces time-to-market and improves accuracy in target identification and clinical trial design. Furthermore, its integration with blockchain enhances transparency in drug traceability, combating counterfeit drugs and increasing regulatory compliance. The human-centric angle ensures that digital solutions are tailored to healthcare providers and patients, increasing treatment adherence, patient satisfaction, and overall health outcomes. Pharma 5.0 is not only transforming drug discovery and manufacturing but is also redefining how pharmaceutical companies interact with patients and healthcare systems globally.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2663

Pharma 5.0 Market Growth Factors

The Pharma 5.0 market is experiencing robust growth due to the convergence of several dynamic factors including the accelerating adoption of artificial intelligence and machine learning in drug discovery and diagnostics, growing investment in digital healthcare infrastructure, rising demand for personalized and precision medicine, proliferation of wearable health devices and IoMT technologies, increasing regulatory encouragement for digital health innovations.

Also, the push for decentralized and virtual clinical trials, heightened awareness about patient-centric approaches post-pandemic, the expansion of 5G enabling faster healthcare data transmission, and the surging need for automated and adaptive pharmaceutical manufacturing systems to cope with global disruptions—all contributing to a CAGR and making Pharma 5.0 a transformative force in the healthcare landscape.

Top Companies in the Pharma 5.0 Market

1. Pfizer Inc.

- Specialization: Biopharmaceuticals, Vaccines, Oncology, Inflammation & Immunology

- Key Focus Areas: AI in drug development, Digital Clinical Trials, Smart Manufacturing

- Notable Features: Collaborated with AI firms like CytoReason and IBM Watson; implemented digital twin simulations in production

- 2024 Revenue: $60.2 billion

- Market Share: ~6.8%

- Global Presence: Over 175 countries, 90+ manufacturing sites

2. Novartis AG

- Specialization: Oncology, Neuroscience, Gene Therapy

- Key Focus Areas: AI-integrated research, Digital Therapeutics, Smart Factories

- Notable Features: Novartis AI Innovation Lab, partnerships with Microsoft and Biofourmis

- 2024 Revenue: $53.9 billion

- Market Share: ~6.1%

- Global Presence: Active in 155 countries

3. Roche Holding AG

- Specialization: Diagnostics, Oncology, Immunology

- Key Focus Areas: Companion Diagnostics, AI-Powered Pathology, Data-Driven Clinical Decisions

- Notable Features: Uses advanced analytics to tailor cancer therapies; integrates genomic data with digital pathology

- 2024 Revenue: $61.3 billion

- Market Share: ~6.9%

- Global Presence: 100+ countries

4. AstraZeneca

- Specialization: Oncology, Cardiovascular, Respiratory

- Key Focus Areas: AI-Augmented Drug Discovery, Real-Time Clinical Monitoring, Patient Engagement Platforms

- Notable Features: Use of BenevolentAI and iDIS (Intelligent Drug Discovery Platform)

- 2024 Revenue: $45.7 billion

- Market Share: ~5.2%

- Global Presence: Strong footprint in Europe, North America, Asia

5. Sanofi

- Specialization: Vaccines, Rare Diseases, Immunology

- Key Focus Areas: Industrial IoT, Bioinformatics, Predictive AI

- Notable Features: AI-powered supply chain forecasting, Blockchain-enabled product traceability

- 2024 Revenue: $42.5 billion

- Market Share: ~4.7%

- Global Presence: Operational in 90+ countries

Leading Trends and Their Impact

- AI in Drug Discovery: Reduces R&D cycles by predicting molecular interactions and simulating clinical outcomes.

- Decentralized Clinical Trials: Enable faster, more inclusive data collection with improved patient retention.

- Personalized Medicine: Leverages genomics and real-world data for tailored therapeutic responses.

- Industrial IoT: Transforms manufacturing through real-time monitoring and predictive analytics.

- Blockchain: Increases drug traceability and trust across global pharma supply chains.

- Digital Twins: Simulate clinical and manufacturing environments for optimization and accuracy.

- Virtual Health Assistants: Support adherence, patient education, and remote diagnostics.

Successful Examples of Pharma 5.0 Around the World

- Pfizer and BioNTech: Used AI and digital twins in record-time COVID-19 vaccine development.

- Novartis: AI-driven cardiovascular risk prediction tools integrated with wearable monitoring.

- Roche: Integrated Flatiron Health’s oncology data for personalized treatments.

- AstraZeneca: Conducted virtual cardiovascular trials with successful patient engagement.

- Sanofi: Conducted real-world evidence trials in EU and U.S. via digital partners like Aetion.

Global and Regional Analysis

North America

- Market Share: ~39%

- Key Drivers: R&D leadership, FDA digital policy frameworks, venture capital flow

- Notable Policy: 21st Century Cures Act boosts digital integration and personalized medicine

Europe

- Market Share: ~28%

- Key Drivers: Government grants, EMA real-world data usage, stringent safety norms

- Notable Policy: Horizon Europe funding supports Pharma 5.0 pilots and scale-ups

Asia-Pacific

- Market Share: ~20%

- Key Drivers: High population, smart healthcare infrastructure growth, domestic innovation

- Notable Policy: India’s Digital Health Mission and China’s Healthy China 2030

Latin America

- Market Share: ~7%

- Key Drivers: Digitization, supply chain upgrades, virtual trials expansion

- Notable Policy: Brazil’s ANVISA drives track-and-trace and blockchain mandates

Middle East & Africa

- Market Share: ~6%

- Key Drivers: Public-private pharma ventures, growing medtech hubs

- Notable Policy: UAE Vision 2031 and Saudi Vision 2030 integrate smart pharma into national plans

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Insulin Pump Market Growth Outlook to 2034