Medical Supplies Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

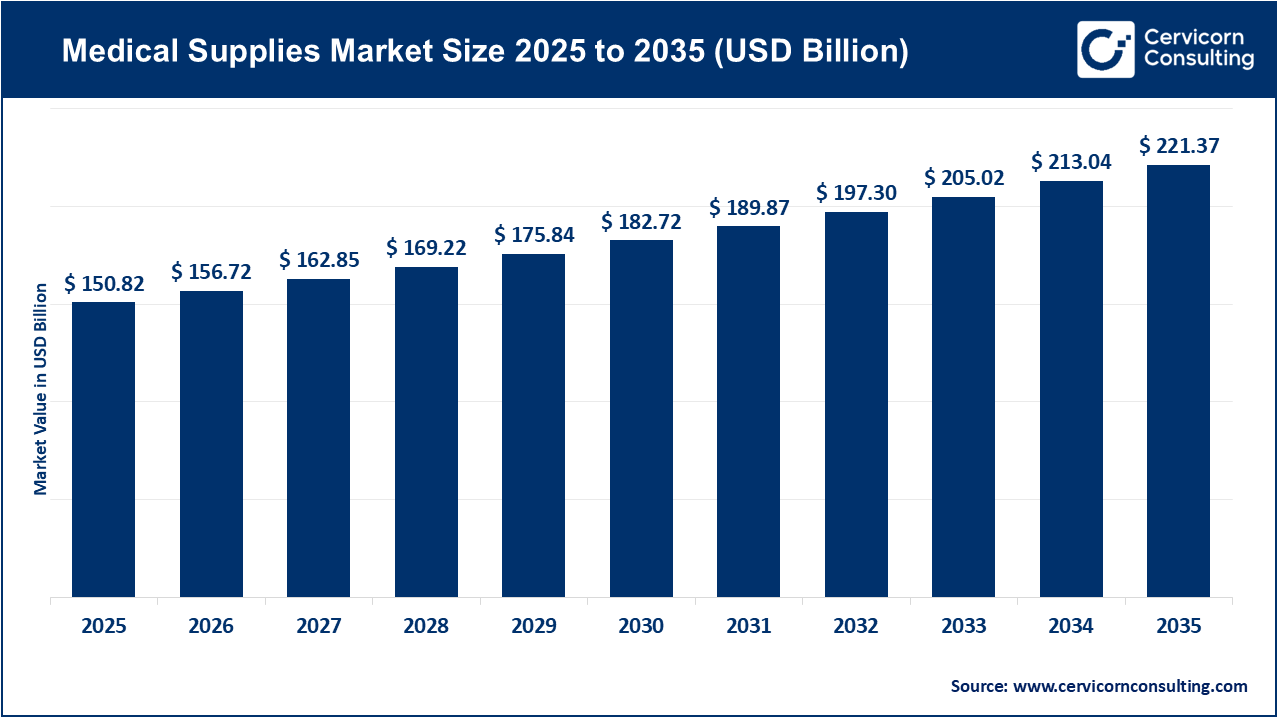

Medical Supplies Market Size

The global medical supplies market size was worth USD 150.82 billion in 2025 and is anticipated to expand to around USD 221.37 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% from 2026 to 2035.

What is the medical supplies market?

The medical supplies market comprises companies that design, manufacture or distribute disposable and reusable items essential for care delivery: syringes and needles, IV sets, surgical gloves and drapes, dressings, diagnostic reagents and test kits, catheters, infusion sets, and many other consumables. It overlaps with—but remains distinct from—the broader medical devices industry (which includes implanted devices and capital equipment). Medical supplies are typically high-volume consumables with lower per-item cost but critical importance in ensuring procedure quality, hygiene, and patient safety. These products support hospitals, outpatient clinics, long-term care, home-care services, and laboratories.

Why the medical supplies market is important

Medical supplies form the operational backbone of healthcare systems. They ensure sterile procedures, accurate diagnostics, effective wound management, safe medication delivery, and infection control. Without reliable access to these products, hospitals and clinics cannot maintain quality standards, procedural safety, or efficient patient throughput. Medical supplies also play a key role in the shift to outpatient and home-based care, as they enable portable diagnostic testing, remote patient monitoring, and simplified treatment kits for patients and caregivers. Market growth also drives job creation and innovation in material science, packaging, and process efficiency.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2840

Growth Factors

The medical supplies market is growing due to a combination of factors such as rising chronic disease prevalence, which increases long-term consumption of wound-care, monitoring, and diabetes-related supplies; aging populations that require more frequent procedures and long-term care; the global shift toward outpatient and home-care delivery models; heightened infection-control standards that expanded baseline demand for PPE and sterilization consumables; the rapid expansion of point-of-care and molecular diagnostics; innovations in materials such as antimicrobial coatings and biodegradable disposables; increasing healthcare access and infrastructure investment in emerging markets; and enhanced procurement systems like group purchasing organizations and digital procurement platforms that streamline supply chains and push for standardization. These forces collectively support strong, resilient demand across all supply categories.

Leading Companies — Profiles, Specialization, Key Focus Areas, Revenue & Global Presence

Abbott

Specialization: Abbott is a diversified healthcare manufacturer known for its strong diagnostics division, cardiovascular medical devices, diabetes management technologies, and nutritional products.

Key Focus Areas: Diagnostics platforms (including point-of-care and laboratory systems), diabetes monitoring systems, cardiovascular devices, and chronic-care technologies.

Notable Features: Abbott holds a strong presence in both routine and rapid diagnostics, has a high-growth diabetes technology portfolio, and continuously expands through R&D and strategic partnerships.

2024 Revenue: Approximately USD 42 billion (total corporate revenue), with around USD 19 billion from its medical devices segment.

Market Share: Based on comparable segment-level revenue, Abbott holds an estimated ~13% share of the global medical supplies/devices-related consumables category.

Global Presence: Operates in over 160 countries with deep penetration in North America, Europe, Asia-Pacific, and Latin America.

Cardinal Health, Inc.

Specialization: Cardinal Health is one of the largest global distributors of pharmaceuticals and medical products, serving hospitals, pharmacies, surgery centers, and home-care providers.

Key Focus Areas: Medical supply distribution, logistics and supply-chain services, at-home care solutions, and specialty medical products.

Notable Features: Highly advanced supply-chain network, strong sourcing capabilities, and a major role in standardizing supply access for large hospital systems.

2024 Revenue: About USD 226.8 billion in total company revenue; the Global Medical Products & Distribution segment generated approximately USD 12.4 billion.

Market Share: Estimated ~8.5% of the global medical supplies market (based on relevant segment revenue).

Global Presence: Strongest presence in North America, with expanding capabilities and partnerships internationally.

BD (Becton, Dickinson and Company)

Specialization: BD is a global leader in medical technology focusing on medication delivery devices, diagnostics, and life-science tools.

Key Focus Areas: Syringes, needles, infusion technologies, diagnostic reagents, laboratory automation, and interventional medical technologies.

Notable Features: BD dominates the global syringe and needle market and maintains a diversified portfolio across consumables, interventional devices, and lab equipment.

2024 Revenue: Approximately USD 20.2 billion, with the BD Medical segment accounting for nearly half of total revenue.

Market Share: Estimated ~6.9% of the global medical supplies market.

Global Presence: Extensive operations in North America, Europe, Asia-Pacific, and emerging markets, supported by a large-scale distribution and manufacturing network.

Johnson & Johnson (J&J)

Specialization: J&J is a diversified healthcare conglomerate with leadership positions in pharmaceuticals, consumer health, and MedTech (medical devices and diagnostics).

Key Focus Areas: Surgical technologies, orthopedic devices, cardiovascular systems, and advanced MedTech solutions.

Notable Features: Large global R&D footprint, integrated healthcare ecosystem, and heavy investment in robotic surgery and interventional cardiovascular technologies.

2024 Revenue: Total 2024 revenue was approximately USD 88.8 billion, with the MedTech segment generating over USD 30 billion.

Market Share: Estimated ~21.8% of the global medical supplies/devices-related consumables-focused market.

Global Presence: Operational in nearly every country, with dominant market share in the U.S. and Europe and strong growth momentum in Asia-Pacific.

Medtronic

Specialization: Medtronic is one of the world’s largest medical technology companies, providing advanced implantable devices, surgical tools, and chronic-care medical systems.

Key Focus Areas: Cardiac rhythm management, structural heart technologies, diabetes devices, neuromodulation, and surgical instrumentation.

Notable Features: Large installed base of cardiac and neuromodulation devices, recurring revenue through consumables and follow-up therapies, and strong partnerships with global health systems.

2024 Revenue: Approx. USD 32.36 billion.

Market Share: Estimated ~22.2% within device-related medical supplies and consumable-intensive medical technology categories.

Global Presence: Strong global operations spanning the U.S., Europe, China, India, and Latin America.

Leading Trends and Their Impact on the Medical Supplies Market

1. Shift Toward Outpatient & Home-Based Care

As more procedures transition from hospitals to ambulatory surgical centers and home-care environments, medical supplies must be simpler, safer, and more portable. This transition increases demand for single-use kits, wound-care products, portable diagnostic tools, and home infusion supplies.

2. Rise of Point-of-Care Diagnostics

Rapid tests, cartridge-based systems, and decentralized diagnostics are becoming standard in emergency rooms, clinics, and home settings. This boosts demand for test strips, cartridges, swabs, and reagent kits, particularly benefiting diagnostics-focused companies.

3. Strengthening of Global Supply Chains

Pandemic-era shortages highlighted vulnerabilities in the global supply chain. Governments and providers now emphasize local manufacturing, diversified sourcing, safety stock requirements, and advanced logistics technologies.

4. Sustainability in Healthcare

Waste reduction and environmentally safe materials are influencing purchasing decisions. Hospitals are adopting greener procurement policies, and manufacturers are developing recyclable plastics, biodegradable disposables, and lower-waste packaging.

5. Consolidated and Value-Based Procurement

Large purchasing organizations leverage bulk buying and long-term vendor contracts, forcing suppliers to deliver measurable cost and clinical outcome improvements. This has led to standardization across product lines and strong competition for preferred vendor status.

6. Digitalization of Procurement

E-procurement, automated inventory tracking, and AI-based forecasting reduce errors, control costs, and enhance supply continuity. Manufacturers and distributors are integrating digital catalogs, real-time tracking, and analytics-driven decision support.

Successful Examples of Medical Supplies Market Development Worldwide

United States

Large hospital systems that standardized their medical supplies—such as surgical drapes, infusion sets, and wound-care materials—reported improved procedure efficiency and reduced per-procedure costs. Value-based procurement across integrated delivery networks has also improved care outcomes and decreased wastage.

India

Government incentives for domestic production of medical disposables, PPE, and diagnostic supplies have increased national manufacturing capacity. This resulted in greater self-sufficiency and reduced reliance on imports during global disruptions.

Europe

Integrated care programs utilizing home-care kits, remote monitoring tools, and chronic-care consumables have shown significant reductions in hospital readmissions. Wound-care suppliers that partnered with national health systems saw accelerated adoption.

Africa & Southeast Asia

The rollout of low-cost, rapid diagnostic kits (for malaria, HIV, COVID-19) combined with training programs dramatically increased testing coverage in resource-limited settings. Suppliers offering robust supply-chain support gained strong long-term presence.

Global Regional Analysis — Government Initiatives & Policy Influence

North America

- Emphasis on advanced logistics, domestic manufacturing, and strategic stockpiling.

- Widespread use of group purchasing organizations (GPOs) that influence supplier selection.

- Tight regulatory standards promote high-quality products and strong competition.

Europe

- Strong sustainability-focused procurement standards.

- Public health systems use centralized tendering and reimbursement frameworks.

- Increasing regulatory requirements for traceability, sterility, and safety.

Asia-Pacific

- Fastest-growing market due to healthcare infrastructure expansion.

- Governments support domestic manufacturing, simplified regulatory pathways, and medical innovation.

- Large populations push high-volume consumable demand.

Latin America

- Gradual modernization of health systems increases demand for basic consumables.

- Public-private partnerships are improving supply reliability.

- Price-sensitive markets require affordable, durable products.

Middle East & Africa

- Government investment in healthcare modernization is accelerating.

- International aid programs support diagnostics, maternal health supplies, and basic consumables.

- Local distribution networks are developing rapidly to improve rural access.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Asset Lifecycle Management Market Growth Drivers, Trends, Key Players and Regional Insights by 2034