Medical Disposables Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Medical Disposables Market Size

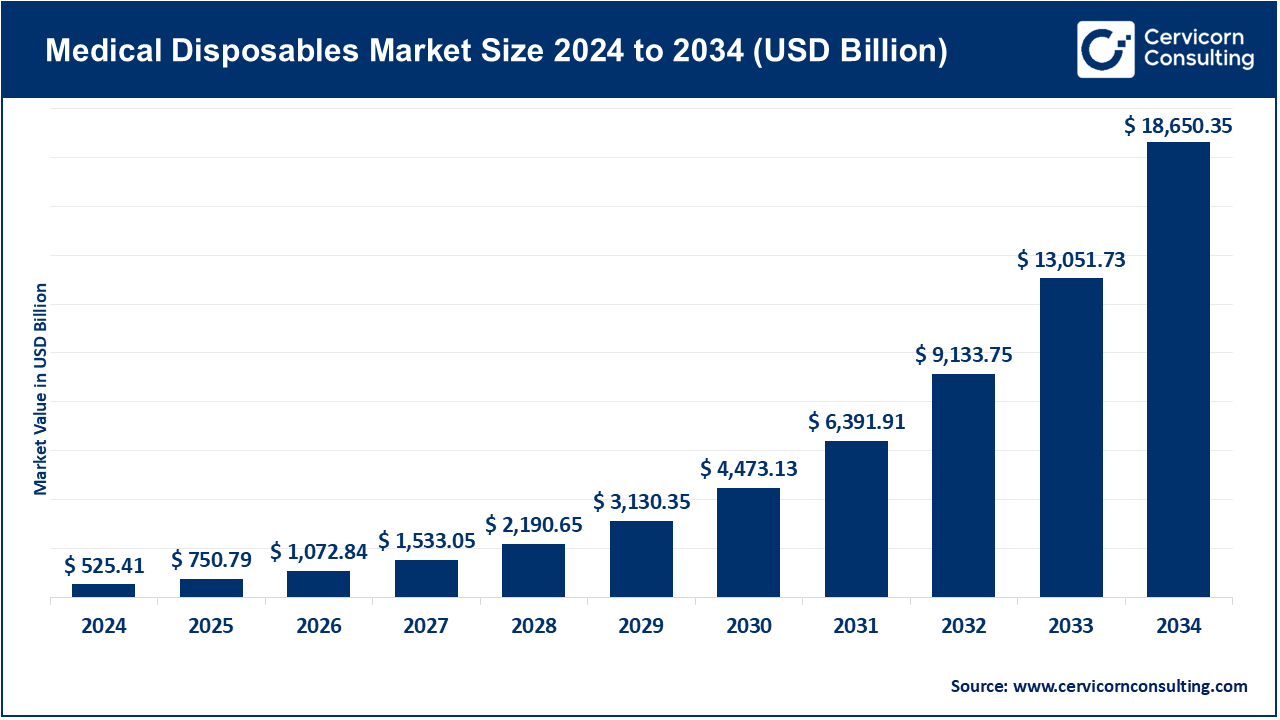

The global medical disposables market size was worth USD 525.41 billion in 2024 and is anticipated to expand to around USD 18,650.35 billion by 2034, registering a compound annual growth rate (CAGR) of 14.2% from 2025 to 2034.

Medical Disposables Market — Growth Factors

Growth in the medical disposables market is propelled by multiple intersecting forces: stronger global focus on infection prevention and control after COVID-19 and recurring healthcare-associated infection initiatives; rising procedural and diagnostic volumes (more surgeries, imaging, and point-of-care testing); expanding chronic-disease management that increases usage of single-use consumables (diabetes, oncology, renal care); demographic shifts and ageing populations in developed markets.

Rapid hospital and clinic expansion plus increasing healthcare spending in Asia-Pacific, Latin America, and parts of Africa; technological advances that make disposables safer and cheaper (better polymer materials, improved barrier properties, prefilled systems); supply-chain localization and reshoring after pandemic disruptions; cost pressures that favor efficient single-use kits and standardized disposables to reduce reprocessing costs; stricter regulatory oversight and guidance on single-use versus reprocessed devices (which clarifies market boundaries and creates opportunities for compliant suppliers); and growing private-pay and home-care markets which shift more consumable usage outside hospitals.

Together these factors drive steady unit volume growth even in mature markets while creating high-growth pockets in emerging economies and specialized disposables such as advanced wound dressings, prefilled syringes, and single-use endoscopic accessories.

What is the Medical Disposables Market?

The medical disposables market comprises products designed for single use or limited reuse that are discarded after a single patient encounter or procedure. Examples include examination and surgical gloves, syringes and needles, IV sets, catheter systems, wound-care dressings, surgical drapes, masks, gowns, swabs, test kits, and many ancillary consumables. Disposables may be sterile or non-sterile, and they serve clinical, diagnostic, infection-control, and logistical roles across care settings. Because most disposables are regulated as medical devices or supplies, manufacturers must meet quality and safety standards set by national regulators.

Why is the Medical Disposables Market Important?

Medical disposables are a frontline defense in patient safety and infection prevention. Single-use items dramatically reduce cross-contamination risk compared with reusable equipment that requires complex sterilization. Disposables also streamline workflows, reduce capital and reprocessing costs for facilities, and enable procedures in low-resource settings where sterilization infrastructure is limited. In addition, disposables support the decentralization of care—enabling safe home infusions, point-of-care testing, and outpatient surgeries—which lowers overall system costs and improves access. Finally, because disposables are recurring purchases, they form a consistent revenue base for suppliers and a predictable cost line for healthcare providers, making the market strategically important to both industry and public health planning.

Medical Disposables Market — Top Companies

Below are five leading companies that are major players in the global medical disposables and consumables space. For each company, the specialization, key focus areas, notable features, and 2024 revenue or best publicly available figure are outlined. Market share figures are inherently segment- and geography-specific; where exact percentages are not publicly reported, the company’s competitive position is described.

1) 3M

- Company: 3M Company (NYSE: MMM)

- Specialization: Broad industrial and healthcare portfolio—health-care disposables and supplies such as medical tapes, wound care, surgical drapes, sterilization solutions, personal protective equipment (PPE), filtration, and other hospital consumables.

- Key focus areas: Advanced wound care, infection prevention products, PPE, sterile packaging, and biopharma filtration.

- Notable features: Global R&D capacity, strong brand recognition in safety and infection prevention, diversified product mix spanning consumer, industrial, and healthcare markets.

- 2024 Revenue: Approximately $24.6 billion.

- Market position: A leading global supplier across multiple disposables categories (especially infection-prevention products and dressings).

- Global presence: Operations and sales worldwide with manufacturing and distribution networks across the Americas, EMEA, and Asia.

2) Becton, Dickinson and Company (BD)

- Company: Becton, Dickinson and Company (BDX)

- Specialization: Syringes, needles, infusion systems, diagnostic disposables, biosciences consumables, and medication-delivery devices.

- Key focus areas: Safety-engineered injection systems, prefilled syringes, point-of-care diagnostics, medication management, and infection prevention.

- Notable features: Strong position in injection and infusion consumables; significant OEM and hospital contracts; robust global logistics and training services.

- 2024 Revenue: Approximately $20.2 billion.

- Market position: One of the world’s largest suppliers of needles, syringes, and medication-delivery disposables.

- Global presence: Extensive manufacturing, R&D, and sales operations across North America, Europe, and Asia.

3) Cardinal Health, Inc.

- Company: Cardinal Health, Inc. (CAH)

- Specialization: Broad healthcare services and product distribution, including a major medical-surgical products business that supplies disposables to hospitals and health systems.

- Key focus areas: Medical-surgical distribution, sterile and non-sterile disposables, supply-chain services, and pharmaceutical distribution.

- Notable features: Extensive distribution scale; vertical integration into logistics and supply services.

- 2024 Revenue: Approximately $226.8 billion.

- Market position: A top distributor and supplier of disposables in the U.S. and global markets, with strong procurement and distribution channels.

- Global presence: Wide logistics network across North America and international operations in Europe, Asia, and other regions.

4) Medline Industries, LP

- Company: Medline Industries (privately held)

- Specialization: Medical-surgical products and consumables across a broad SKU base—gloves, gowns, wound care, examination supplies, and procedural kits.

- Key focus areas: Hospital consumables, private-label manufacturing, and supply-chain services for healthcare systems.

- Notable features: One of the largest privately held medical supply companies; massive product catalogue; strong private-label capabilities.

- 2024 Revenue: Estimated around $20–21 billion.

- Market position: One of the largest global suppliers of medical-surgical disposables, competing closely with Cardinal Health and other major distributors.

- Global presence: Manufacturing, distribution, and sales operations primarily in North America with expanding international reach.

5) Smith & Nephew plc

- Company: Smith+Nephew (LSE: SN)

- Specialization: Advanced wound care, orthopaedic disposables, single-use surgical instruments, and sports medicine consumables.

- Key focus areas: Advanced wound dressings, single-use surgical instruments, arthroscopy disposables, and regenerative products.

- Notable features: Strong product portfolio in advanced wound care and orthopaedics; innovation in wound dressings and biologic consumables.

- 2024 Revenue: Approximately $5.81 billion.

- Market position: Global leader in advanced wound care and specialty disposables.

- Global presence: Operations in about 100 countries with multiple manufacturing sites and distribution channels worldwide.

Leading Trends and Their Impact

- Infection Prevention and Stricter Standards:

Governments and health systems have intensified infection-prevention protocols, driving demand for sterile single-use gowns, gloves, and drapes. Certified suppliers benefit as hospitals prioritize validated high-quality products. - Prefilled and Safety-Engineered Devices:

The adoption of prefilled syringes and needle-free systems continues to grow. These reduce needlestick injuries and medication errors, boosting safety for both patients and clinicians. - Supply-Chain Resilience and Localization:

Post-pandemic strategies emphasize local manufacturing of critical consumables to avoid supply disruptions. Countries are incentivizing domestic production of PPE and sterile disposables, improving resilience. - Sustainability and Eco-Friendly Innovation:

Environmental concerns are driving manufacturers to explore biodegradable materials and recyclable packaging while maintaining sterility and performance standards. Circular economy initiatives are gradually emerging in mature markets. - Decentralized Care and Home Health Expansion:

With the rise of telemedicine and home care, disposable medical products for self-administration—such as injection pens and portable catheters—are in higher demand. This trend increases total market volume and creates opportunities for specialized design. - Value-Based Procurement and Product Bundling:

Hospitals increasingly opt for bundled kits and procedure packs that include all required disposables for specific surgeries. This improves efficiency, reduces waste, and allows suppliers to compete on service value rather than just price.

Successful Examples Around the World

- United States:

Hospitals widely adopted safety syringes and prefilled systems to reduce occupational injuries and dosing errors. Companies such as BD and 3M have been instrumental in supporting national safety initiatives. - India:

The country significantly expanded domestic production of PPE, gloves, and masks after COVID-19. National infection-control guidelines and the “Make in India” policy support local manufacturers and strengthen the healthcare supply chain. - Europe:

Implementation of new medical device regulations improved traceability and safety compliance for single-use devices. These reforms have led hospitals to invest more heavily in certified disposable products rather than risk noncompliant reprocessing. - Low- and Middle-Income Countries:

International partnerships, often supported by WHO programs, have enhanced access to essential single-use items like sterile gloves and syringes, contributing to safer surgical and maternal care.

Global Regional Analysis — Government Initiatives and Policies

North America

- Drivers: High healthcare expenditure, sophisticated hospital networks, and adoption of safety technologies.

- Policies: The U.S. FDA’s regulation of reprocessed single-use devices and CDC’s infection-control guidelines influence procurement standards. Canada promotes hospital accreditation programs emphasizing sterile disposable usage.

Europe

- Drivers: Strong regulatory framework and sustainability priorities.

- Policies: The European Union’s Medical Device Regulation (MDR) and national infection-control mandates enforce strict compliance, improving overall product quality. Government tenders favor suppliers meeting eco-friendly and safety standards.

Asia-Pacific

- Drivers: Fastest-growing region due to healthcare infrastructure expansion and government-backed manufacturing incentives.

- Policies: Countries such as China, India, Japan, and South Korea promote domestic production of critical medical supplies. National programs emphasize affordability and local innovation while aligning with global infection-control norms.

Latin America

- Drivers: Rapid healthcare modernization, growing middle-class demand, and public health initiatives.

- Policies: Regional governments implement import duty reductions for essential medical devices and consumables, boosting accessibility and competitiveness of foreign suppliers.

Middle East & Africa

- Drivers: Expanding healthcare facilities, increasing investment in public hospitals, and international aid programs.

- Policies: Public procurement reforms, national quality standards, and partnerships with WHO and UNICEF for essential disposable supplies are strengthening healthcare readiness.

Market Landscape and Future Outlook

The global medical disposables market encompasses a vast and complex range of products, from commodity items like gloves and masks to high-value advanced wound dressings and prefilled systems. While mature markets such as North America and Europe remain dominant in terms of revenue, the fastest growth is observed in Asia-Pacific, where infrastructure development and healthcare investment are accelerating adoption.

The top-tier players—3M, BD, Cardinal Health, Medline Industries, and Smith & Nephew—dominate through scale, diversified portfolios, and advanced manufacturing capabilities. Their combined strengths include global logistics, robust regulatory compliance, and continuous innovation in material science and product design. Medium and small manufacturers continue to thrive in niche categories such as specialty catheters, diagnostic consumables, and eco-friendly disposables.

Future growth will depend on balancing infection-control effectiveness with sustainability, leveraging automation in manufacturing, and adapting to shifting procurement models emphasizing value and traceability. Governments are expected to play a larger role through policies promoting domestic manufacturing and stringent safety oversight.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Mobility Market Revenue, Global Presence, and Strategic Insights by 2034