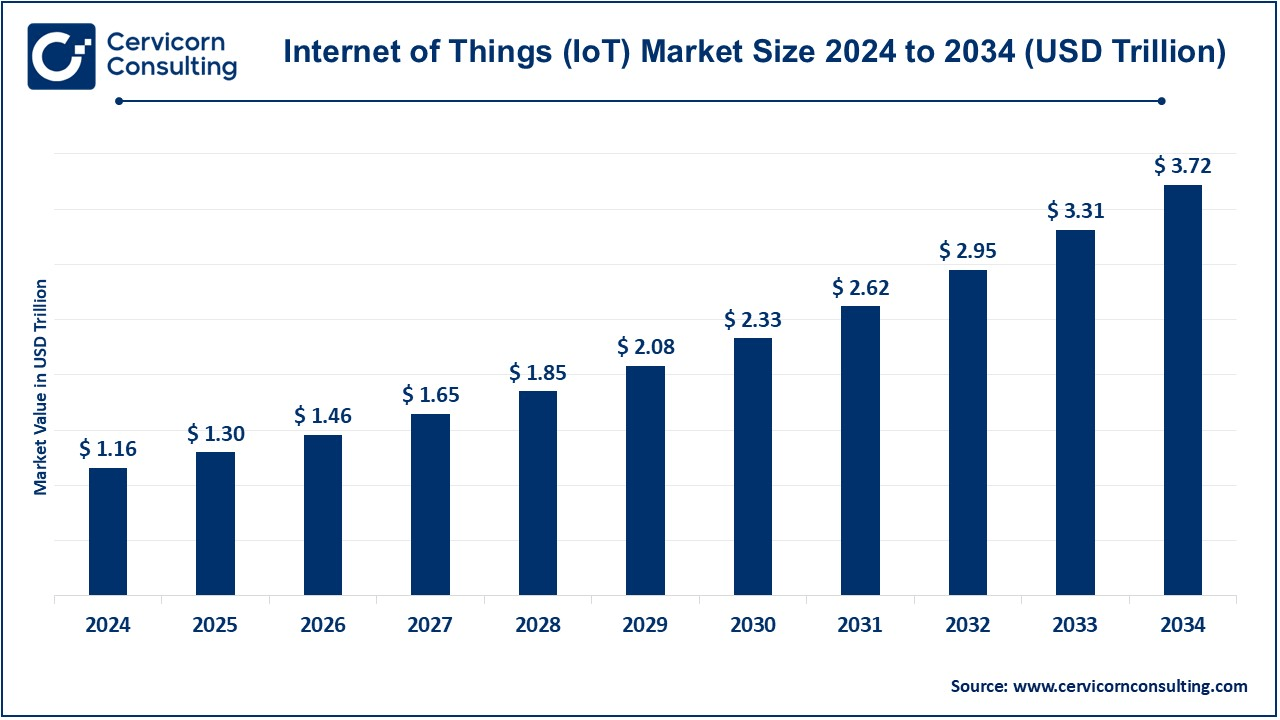

IoT Market Expansion From USD 1.16 Trillion in 2024 to USD 3.72 Trillion by 2034

IoT Market Size

The global IoT market size was worth USD 1.16 trillion in 2024 and is anticipated to expand to around USD 3.72 trillion by 2034, registering a compound annual growth rate (CAGR) of 12.35% from 2025 to 2034.

What Is the IoT Market?

The Internet of Things (IoT) market encompasses the ecosystem involved in designing, manufacturing, deploying, and servicing Internet-connected devices and platforms—ranging from sensors, wearables, industrial systems, and smart-home gadgets, to cloud-based and edge computing architectures that gather, analyze, and act upon data. These interconnected “things” communicate in real time, turning raw data into actionable insights. Players include device manufacturers, connectivity providers, platform and middleware firms, analytics developers, integrators, and managed-service providers.

Why Is the IoT Market Important?

The importance of IoT stems from its capacity to connect physical assets to digital networks, enabling real‑time visibility, improved decision-making, predictive maintenance, lower operational costs, and new revenue models across industries. Whether optimizing energy usage in smart buildings, tracking supply chain assets, enhancing patient outcomes via remote health monitoring, or enabling smarter factories, IoT is at the core of digital transformation. The number of IoT devices is expected to surpass 30 billion by 2025. Meanwhile, the global IoT market size surged from approximately USD 956 billion in 2023 and is projected to reach over USD 5 trillion by 2032. Indeed, IoT connects businesses, economies, and societies, creating the foundational infrastructure for AI, smart cities, Industry 4.0, and sustainable development.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2583

IoT Market Growth Factors

The IoT market’s explosive growth is driven by accelerated 5G adoption and edge computing to support real-time data processing, falling hardware costs, rising demand for automation, AI/ML–powered analytics, blockchain-enabled security, and surging investments in smart city initiatives and industrial digitization. The COVID‑19 pandemic further amplified demand for remote solutions in healthcare, logistics, and manufacturing. Moreover, government support across regions via infrastructure funding, smart city programs, and cybersecurity standards is accelerating IoT adoption. These forces collectively fuel a projected triple-digit growth trajectory that brings new capabilities, value chains, and digital ecosystems to fruition.

Top IoT Companies: Profiles & Market Position

1. Siemens AG

- Specialization: Industrial automation, smart infrastructure, IoT platforms.

- Key Focus Areas: Industrial IoT (Industry 4.0), MindSphere cloud OS, smart building systems, digital twin technology.

- Notable Features: Global leader in industrial IoT, backed by a robust ecosystem of automation hardware and software, cloud services (MindSphere), and system integrators.

- 2024 Revenue: ~€75.9 billion (total revenue).

- Market Share: Among top 5 global IoT firms, especially in industrial and infrastructure verticals.

- Global Presence: Operates in ~190 countries; strong influence in Europe, North America, and Asia-Pacific.

2. SAP SE

- Specialization: IoT-enabled business applications, analytics, ERP integration.

- Key Focus Areas: Enterprise-grade IoT solutions integrated with SAP S/4HANA; supply chain, manufacturing optimization, and asset intelligence.

- Notable Features: Combines IoT with enterprise workflows; deployable on-premise, hybrid, or cloud.

- 2024 Revenue: €34.2 billion.

- Market Share: Leadership in enterprise IoT and asset management; among top 10 globally.

- Global Presence: HQ in Germany; strong footprint across EMEA, Americas, and Asia.

3. Qualcomm Technologies, Inc.

- Specialization: Chipsets and connectivity modules for IoT devices.

- Key Focus Areas: QCS/QCM platforms, 5G-enabled IoT systems, edge AI solutions.

- Notable Features: Leading fabless supplier of IoT chips; designs supporting 5G, Wi-Fi 7, and low-power connectivity.

- 2024 Revenue: $11.7 billion from chipset segment; strong contribution from IoT & auto.

- Market Share: Leading position in IoT application/baseband processors.

- Global Presence: US-based with supply chains, R&D centers in Asia and Europe.

4. PTC Inc.

- Specialization: Industrial IoT platforms, augmented reality, PLM.

- Key Focus Areas: ThingWorx industrial IoT platform, integration with Creo CAD and Windchill PLM.

- Notable Features: Enables rapid application development, AR-driven maintenance, digital twins.

- 2024 Revenue: Estimated ~$1.7 billion.

- Market Share: Among top leaders in industrial IoT software.

- Global Presence: Based in Boston, with global reach across industrial hubs.

5. Oracle Corporation

- Specialization: Cloud-based IoT data platforms and analytics.

- Key Focus Areas: IoT Cloud Application, Analytics Cloud, secure device management.

- Notable Features: Enterprise-grade reliability, OCI compatibility, integration with ERP/CRM systems.

- 2024 Revenue: $52.5 billion (total revenue).

- Market Share: Key player in cloud IoT platforms for enterprises.

- Global Presence: Oracle Cloud available in 50+ regions; widely used across all major industries.

Leading Trends & Their Impact

1. 5G & Edge Computing

The rollout of 5G enables ultra-low latency and massive IoT connectivity. Edge computing, often co-deployed with IoT systems, supports real-time analytics, improved privacy, and reduced cloud reliance.

2. AI/ML-Enabled IoT

Embedding AI or ML at the edge and cloud levels helps automate decision-making—anticipating maintenance needs or enabling autonomous systems. AI-enabled IoT is becoming vital in manufacturing, healthcare, and autonomous systems.

3. IoT Security & Blockchain

Rising concerns over data breaches are driving secure-by-design IoT architectures. Blockchain is being piloted for tamper-proof device authentication and secure data transactions.

4. Digital Twins & AR/VR

Virtual replicas of physical machinery enhance simulation and maintenance. Solutions from Siemens and PTC streamline monitoring, asset lifecycle, and service models based on AR/VR.

5. Smart Cities & Sustainability

Nationwide initiatives—India’s ‘Digital India’, China’s ‘Made In China 2025’, Japan’s ‘Society 5.0’—are accelerating the deployment of smart transportation, energy, and utilities.

Successful IoT Use Cases Around the World

- Myriota, Australia:

Uses nanosatellites to send sensor data from remote farms, mines, and defense sites—highlighting global IoT’s reach. A $50M investment is expected to support connectivity expansion for sensors beyond standard networks. - Siemens & IBM Partnership:

Co-developed digital‑twin systems for sustainable product lifecycles—melding IoT, cloud, and analytics. - Cisco & ROSHN (Saudi Arabia):

Rolling out smart building IoT systems in partnership—enhancing energy management and occupant comfort. - PTC and ServiceMax:

Merged IoT with field service via predictive maintenance and AR, improving service efficiency and reducing costs. - Qualcomm’s 2023 IoT chip releases:

Integrated AI processing and Wi‑Fi 7 into IoT processors—driving next-gen edge devices.

Regional Analysis & Government Support

| Region | Notable Industries | Key Initiatives & Policies |

|---|---|---|

| North America | Manufacturing, smart cities, healthcare, automotive | US released IoT cybersecurity labeling program; dominant sector share (~42% in 2023). |

| Europe | Industry 4.0, energy, mobility | GDPR-inspired IoT data privacy; EU Smart Cities contracts; Germany & UK investing in smart infrastructure. |

| Asia-Pacific | Smart cities, manufacturing, agriculture | Chinese “Made in China 2025”, Japan’s “Society 5.0,” India’s “Digital India”; APAC ~29% market share and growing. |

| Latin America | Agriculture, urban infrastructure | National smart city pilots; tech partnerships for IoT deployments. |

| MEA | Infrastructure, energy monitoring | Saudi/Cisco smart building deals; UAE & Oman leverage IoT in smart-city verticals. |

| Africa | Agriculture, utilities | Support from World Bank and digital development aid; nascent but growing IoT ecosystems. |

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI Agents Market Growth, Trends, Top Players, and Global Outlook (2025–2034)