India Specialty Chemicals Market USD 96.73 Bn Opportunity by 2034

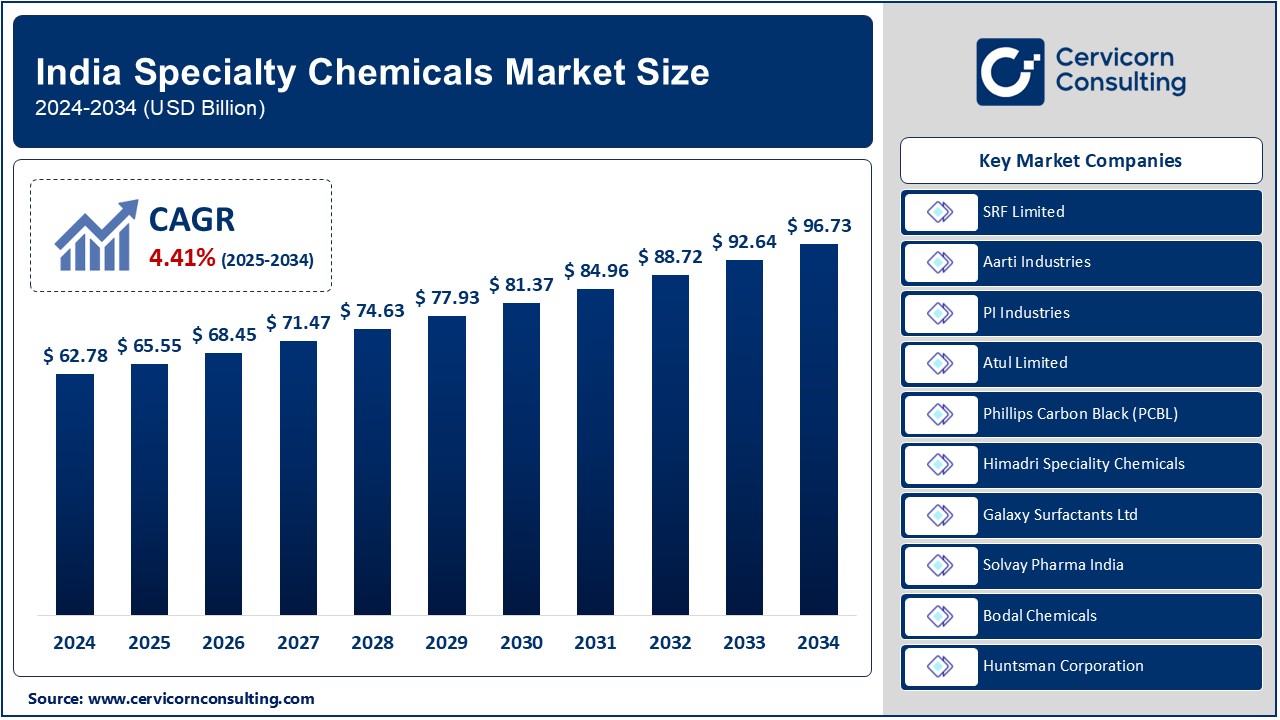

India Specialty Chemicals Market Size

The India specialty chemicals market was worth USD 62.78 billion in 2024 and is anticipated to expand to around USD 96.73 billion by 2034, registering a compound annual growth rate (CAGR) of 4.41% from 2025 to 2034.

Growth Factors Driving the India Specialty Chemicals Market

The India specialty chemicals market is witnessing robust growth due to several factors, including rapid industrialization, increasing demand for high-performance materials in sectors like agriculture, automotive, and construction, rising export opportunities, a growing focus on sustainable and eco-friendly solutions, and supportive government initiatives like the Production Linked Incentive (PLI) scheme. Additionally, India’s cost-competitive manufacturing capabilities and expanding penetration of specialty chemicals into niche applications are propelling the market’s expansion.

What is the India Specialty Chemicals Market?

The India specialty chemicals market encompasses the production and supply of chemicals tailored for specific applications and industries. Unlike commodity chemicals, specialty chemicals are characterized by their unique formulations and functionalities, which cater to precise end-user needs. These chemicals find applications in diverse industries such as agriculture, pharmaceuticals, textiles, construction, personal care, automotive, and electronics. Examples include agrochemicals, construction chemicals, surfactants, electronic chemicals, flavors, and fragrances. Their customized nature differentiates them from bulk chemicals and underscores their high-value proposition.

Why is it Important?

Specialty chemicals are vital for improving efficiency, productivity, and performance across a broad spectrum of industries. In agriculture, they help boost crop yield and offer pest protection; in construction, they enhance durability and material performance; and in personal care, they enable innovative skincare and haircare solutions. The specialty chemicals market in India holds strategic importance as it supports domestic manufacturing, reduces dependency on imports, creates employment, drives innovation, and positions India as a key player in the global supply chain. Furthermore, it contributes significantly to export revenues, reinforcing India’s economic growth.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2543

India Specialty Chemicals Market Top Companies

SRF Limited

- Specialization: Fluorochemicals, packaging films, and technical textiles

- Key Focus Areas: Agrochemicals, industrial chemicals, and refrigerants

- Notable Features: Dominant player in the fluorochemicals market with strong R&D capabilities

- 2024 Revenue (approx.): $2.5 billion

- Market Share (approx.): 12%

- Global Presence: Established presence in Asia-Pacific, North America, and Europe

Aarti Industries

- Specialization: Benzene-based derivatives and pharmaceuticals

- Key Focus Areas: Agrochemicals, personal care, polymers, and dyes

- Notable Features: Known for integrated manufacturing processes and a diverse product portfolio

- 2024 Revenue (approx.): $1.7 billion

- Market Share (approx.): 8%

- Global Presence: Exports to over 60 countries, including the USA and EU

PI Industries

- Specialization: Agrochemicals and fine chemicals

- Key Focus Areas: Custom synthesis and contract manufacturing (CRAMS)

- Notable Features: Strong collaborations with global agrochemical giants

- 2024 Revenue (approx.): $1.4 billion

- Market Share (approx.): 7%

- Global Presence: Well-established in North America, Europe, and Japan

Atul Limited

- Specialization: Bulk and specialty chemicals, crop protection, and pharmaceuticals

- Key Focus Areas: Polymers, aromatics, and dyes

- Notable Features: Extensive vertical integration and sustainability initiatives

- 2024 Revenue (approx.): $1.2 billion

- Market Share (approx.): 6%

- Global Presence: Exporting to over 90 countries globally

Phillips Carbon Black Limited (PCBL)

- Specialization: Carbon black for rubber, plastics, and inks

- Key Focus Areas: Automotive applications and specialty grades

- Notable Features: Leader in carbon black production in India with a focus on green initiatives

- 2024 Revenue (approx.): $850 million

- Market Share (approx.): 5%

- Global Presence: Strong export network across Europe, Asia, and the Americas

Leading Trends and Their Impact

1. Sustainability and Green Chemistry

The push toward eco-friendly solutions is a dominant trend in the specialty chemicals market. Companies are increasingly investing in biodegradable products, renewable feedstocks, and energy-efficient processes. For example, SRF Limited’s focus on sustainable refrigerants aligns with global environmental regulations, giving it a competitive edge.

2. Shift to High-Value Niches

As companies move beyond traditional markets, the focus is shifting toward high-margin, value-added segments like electronic chemicals and specialty polymers. Aarti Industries’ foray into pharmaceutical intermediates and PI Industries’ leadership in custom synthesis exemplify this trend.

3. Rise of Contract Manufacturing

The increasing reliance on contract research and manufacturing services (CRAMS) is driving growth, with Indian companies emerging as preferred partners for global firms. PI Industries is a leader in CRAMS, offering expertise and cost advantages.

4. Digitalization and Automation

The adoption of Industry 4.0 technologies, such as AI, IoT, and big data analytics, is revolutionizing operations. This has enhanced product quality, reduced wastage, and improved supply chain efficiency across the industry.

5. Regional Diversification

To mitigate risks and meet the growing demand in emerging markets, companies are diversifying their geographic reach. Atul Limited’s expansion into Africa and Southeast Asia reflects this approach.

Successful Examples of India Specialty Chemicals Market

SRF Limited’s Fluorochemicals

SRF’s fluorochemical products are internationally recognized for their application in refrigeration and air conditioning. Its adherence to stringent environmental standards has earned it a preferred supplier status in Europe and North America.

PI Industries’ Custom Synthesis

PI Industries has established itself as a reliable partner for global agrochemical giants like BASF and Syngenta, showcasing India’s ability to produce high-value specialty chemicals through custom synthesis.

Aarti Industries’ Benzene Derivatives

With a strong presence in the USA and EU markets, Aarti Industries is a key supplier of benzene derivatives for the pharmaceutical and polymer sectors, underscoring India’s competitiveness.

Atul Limited’s Aromatics

Atul’s aromatics have gained global recognition in the personal care industry, emphasizing India’s capacity to meet international quality standards.

PCBL’s Carbon Black

Phillips Carbon Black’s focus on specialty grades for high-performance tires has attracted global automotive players, highlighting the potential of Indian specialty chemicals in export markets.

Government Initiatives and Policies Shaping the Market

1. Production Linked Incentive (PLI) Scheme

The PLI scheme aims to bolster domestic manufacturing by offering financial incentives for the production of specialty chemicals. This initiative has encouraged investments and reduced dependency on imports.

2. Make in India Initiative

The Make in India initiative fosters foreign investments and boosts indigenous manufacturing capabilities, benefiting the specialty chemicals sector.

3. Environmental Regulations

Stringent environmental norms are driving the adoption of green chemistry and innovative waste management solutions. This has positioned Indian companies as sustainable partners in the global market.

4. Export Incentives

Government incentives, such as reduced export duties and simplified compliance procedures, have strengthened India’s position as a leading exporter of specialty chemicals.

5. Research and Development Support

Grants and funding for R&D in advanced chemicals and materials have enabled Indian companies to innovate and compete in high-value niches.

Regional Analysis

North India

Gujarat and Rajasthan have emerged as key hubs for specialty chemicals due to their proximity to raw materials and strong industrial infrastructure. Government-backed chemical parks and tax incentives are further driving growth in this region.

Western India

Maharashtra and Gujarat dominate the market, contributing significantly to production and exports. The Dahej Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) in Gujarat exemplifies how government support can create thriving industrial clusters.

Southern India

Tamil Nadu and Andhra Pradesh are becoming emerging centers for specialty chemicals, bolstered by investments in industrial corridors and business-friendly policies.

Eastern India

Though less developed, Eastern India is witnessing steady growth in agrochemicals and mining chemicals, leveraging its agricultural and mineral resources.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Powder Coatings Market Growth, Trends, and Insights to 2033