Implantable Medical Devices Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Implantable Medical Devices Market Size

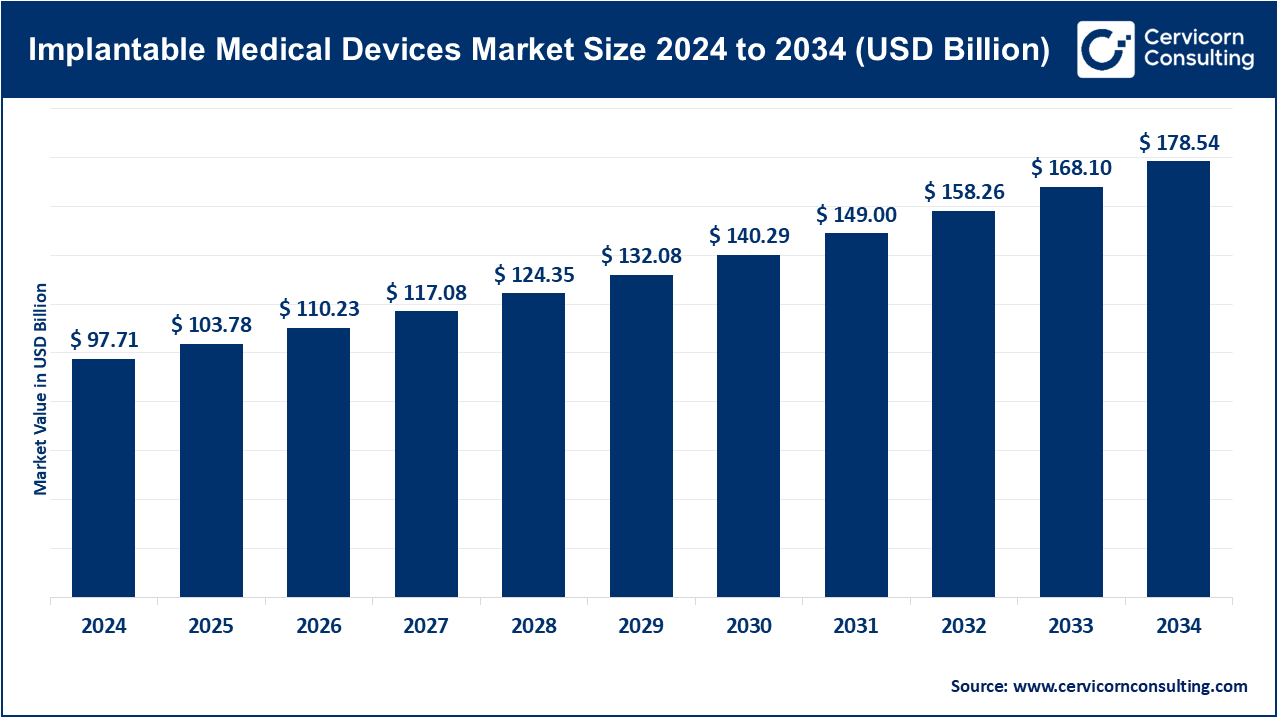

The global implantable medical devices market size was worth USD 97.71 billion in 2024 and is anticipated to expand to around USD 178.54 billion by 2034, registering a compound annual growth rate (CAGR) of 6.21% from 2025 to 2034.

What is the Implantable Medical Devices Market?

The implantable medical devices market comprises medical devices designed to be placed inside the human body, either temporarily or permanently, to restore, replace, augment, or monitor physiological functions. This broad category includes cardiac rhythm management devices (pacemakers, defibrillators), neurostimulation systems (spinal cord stimulators, deep brain stimulators), cochlear and auditory implants, implantable continuous glucose monitors, orthopedic implants (joint replacements, spinal implants), ophthalmic implants (intraocular lenses, glaucoma implants), vascular stents and grafts, and various other implantables used across surgical specialties.

In 2024, the global implantable medical devices market was estimated to be valued between USD 131 billion and USD 141 billion, depending on methodology and scope. The industry is on a steady growth trajectory driven by an aging population, rising chronic disease prevalence, and continuous innovation in biomaterials, device miniaturization, and remote monitoring technologies.

Implantable Medical Devices Market — Growth Factors

The implantable medical devices market is expanding due to multiple converging factors. The aging global population and the increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, hearing loss, and musculoskeletal conditions are major demand drivers. Advances in biomaterials, 3D printing, and miniaturization have made implantables safer, more effective, and longer-lasting. The integration of digital health technologies—including wireless telemetry, mobile applications, and AI-driven remote monitoring—has expanded the functionality and patient engagement of implantable devices.

Furthermore, supportive regulatory frameworks such as the FDA’s Breakthrough Device Program and favorable reimbursement structures in developed economies are accelerating adoption. Increased R&D investment, mergers and acquisitions, and the growing presence of manufacturing capabilities in emerging markets are also propelling global growth. Collectively, these factors are driving strong mid- to high-single-digit CAGR across the implantables sector during 2024–2030.

Why Is the Implantable Devices Market Important?

Implantable devices play a pivotal role in modern healthcare by providing long-term, often life-saving solutions that enhance both longevity and quality of life. From pacemakers that prevent cardiac arrest to cochlear implants restoring hearing, and orthopedic implants restoring mobility, these devices significantly improve clinical outcomes and patient well-being. Implantables also reduce the need for recurrent hospitalizations and invasive procedures, thus improving healthcare system efficiency. Economically, they form one of the most profitable and technologically advanced segments in the medical device industry, generating consistent revenue from device sales, associated consumables, and service contracts. Their integration with digital monitoring and telemedicine solutions further cements their role in the future of precision and personalized healthcare.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2774

Implantable Medical Devices Market — Top Company Profiles

Below is a detailed look at the leading companies in the implantable medical devices market, covering their specialization, focus areas, key features, revenue performance, market share, and global footprint.

1) Abbott Laboratories

Specialization:

Abbott is a global leader in medical devices, particularly cardiac rhythm management (pacemakers, ICDs), structural heart therapies (transcatheter valves), and diabetes care (implantable and sensor-based glucose monitoring systems).

Key Focus Areas:

Cardiology, electrophysiology, vascular closure devices, and continuous glucose monitoring.

Notable Features:

Abbott emphasizes miniaturized and connected implantables, integrating device data with remote monitoring platforms for enhanced patient management.

2024 Revenue:

Total company revenue was approximately USD 42 billion in 2024, with the Medical Devices segment contributing around USD 19 billion.

Market Share:

Abbott holds a leading position in cardiac rhythm management and structural heart implants, commanding a substantial share of the implantable devices market globally.

Global Presence:

Operates in over 160 countries with major manufacturing and R&D centers in North America, Europe, and Asia-Pacific.

2) Alcon

Specialization:

Alcon focuses on ophthalmic implantables, including intraocular lenses (IOLs), glaucoma drainage implants, and surgical equipment for cataract and refractive procedures.

Key Focus Areas:

Premium IOLs (multifocal, toric, extended depth-of-focus), cataract surgery systems, and advanced surgical visualization platforms.

Notable Features:

Leader in premium intraocular lens technology, integrating advanced materials and optical designs for better visual outcomes.

2024 Revenue:

Reported global revenue of USD 9.8 billion in 2024.

Market Share:

One of the largest global players in ophthalmic implantables, particularly in the cataract and refractive surgery markets.

Global Presence:

Extensive operations in North America, Europe, and Japan, with expanding reach in emerging markets such as India, Brazil, and China.

3) Cochlear Limited

Specialization:

Cochlear is the world leader in implantable hearing solutions, offering cochlear implants and bone-anchored hearing systems that restore auditory function for patients with severe-to-profound hearing loss.

Key Focus Areas:

Cochlear implants (Nucleus systems), bone conduction implants, sound processors, and digital hearing rehabilitation solutions.

Notable Features:

Renowned for innovation in sound processing algorithms, device longevity, and seamless integration with digital hearing aids and smartphones.

2024 Revenue:

Generated approximately USD 2.26 billion in 2024, showing strong growth driven by global implant adoption and service revenue.

Market Share:

Dominant player in the global cochlear implant market, holding the highest share in most developed regions.

Global Presence:

Headquartered in Sydney, Australia, with distribution, R&D, and clinical partnerships spanning over 180 countries.

4) Fresenius Medical Care

Specialization:

Fresenius specializes in renal care solutions, including dialysis equipment and vascular access technologies—vital components in long-term implantable care ecosystems.

Key Focus Areas:

Hemodialysis machines, catheters, vascular access implants, and integrated renal care services.

Notable Features:

Vertically integrated business model combining devices, consumables, and healthcare services, enabling end-to-end chronic kidney disease management.

2024 Revenue:

Group revenue stood at approximately EUR 21.5 billion in 2024.

Market Share:

Market leader in dialysis and vascular access devices, holding a significant global share in the renal implantables segment.

Global Presence:

Operates in more than 120 countries, with a strong network of dialysis centers and manufacturing hubs in Europe, North America, and Asia.

5) GE HealthCare

Specialization:

GE HealthCare provides imaging, monitoring, and interventional technologies that support implantable device procedures and diagnostics, although it is not a direct manufacturer of implantables.

Key Focus Areas:

Imaging systems, interventional cardiology, electrophysiology tools, and AI-driven healthcare analytics.

Notable Features:

Integrates advanced imaging and data analytics to enhance precision during implant surgeries and improve patient outcomes.

2024 Revenue:

Reported total revenue of USD 19.7 billion in 2024.

Market Share:

While not a top implantable device manufacturer, GE holds a vital enabling role in imaging and surgical guidance technologies used in implant procedures worldwide.

Global Presence:

Extensive global network of hospitals, clinics, and medical equipment providers across 170 countries.

Leading Trends and Their Impact

1. Miniaturization and Battery Innovation

Implantable devices are becoming smaller, lighter, and more energy-efficient. Advances in battery technology and wireless recharging extend device lifespan and reduce the need for replacements, particularly in pacemakers and neurostimulators. This trend enhances patient comfort and decreases surgical risk.

2. Remote Monitoring and Digital Integration

Implantables are increasingly connected through wireless telemetry and mobile applications, allowing real-time data sharing between patients and physicians. This connectivity improves disease management, reduces hospital visits, and facilitates predictive care through AI-based alerts.

3. AI and Predictive Analytics

Artificial intelligence is transforming device programming, diagnostics, and follow-up care. Machine learning algorithms analyze device data to optimize therapy parameters and predict device failure, thereby improving patient safety and outcomes.

4. Regulatory Acceleration and Compliance

Streamlined regulatory pathways like the FDA’s Breakthrough Devices Program and accelerated approval in markets like Japan and China are encouraging faster product launches. However, stringent post-market surveillance and data requirements under the EU MDR have increased compliance complexity and costs.

5. Regional Manufacturing and Supply Chain Localization

Governments are encouraging domestic production of medical devices to reduce import dependency. India’s National Medical Device Policy 2023 and China’s emphasis on indigenous innovation are prime examples. These initiatives are reshaping global supply chains and creating opportunities for local manufacturers.

6. Convergence of Disciplines

Implantable devices are increasingly integrating drug delivery, biologics, and sensors to create multifunctional therapeutic systems. This convergence enhances treatment precision and personalization but also introduces new regulatory and engineering challenges.

Overall Impact:

These trends are pushing implantable devices toward smarter, safer, and longer-lasting designs. They are also transforming business models—shifting from one-time device sales to recurring service and data-driven ecosystems.

Successful Examples of Implantable Medical Devices Worldwide

- Cochlear Implants (Cochlear Limited):

These devices have revolutionized hearing restoration for people with severe hearing loss. Cochlear’s Nucleus systems are recognized globally for providing natural sound perception and supporting speech development in children. - Leadless Pacemakers (Abbott Laboratories):

These miniature pacemakers eliminate the need for leads and surgical pockets, reducing complications and recovery times while improving comfort and longevity. - Intraocular Lenses (Alcon):

Alcon’s premium intraocular lenses, including multifocal and toric variants, have improved the quality of life for millions of cataract patients, enabling clear vision across multiple focal distances. - Implantable Continuous Glucose Monitors (Eversense, Senseonics):

Long-term implantable glucose sensors provide accurate continuous glucose data for up to a year, enhancing diabetes management and patient compliance. - Neurostimulators for Chronic Pain (Medtronic, Abbott):

Spinal cord and deep brain stimulators are successfully treating chronic pain, Parkinson’s disease, and epilepsy, demonstrating how electrical therapy can replace or reduce drug dependence.

Global and Regional Analysis — Government Initiatives and Policies Shaping the Market

North America

The United States remains the largest market for implantable medical devices due to advanced healthcare infrastructure, high disease prevalence, and robust reimbursement systems. The FDA’s Breakthrough Devices Program and faster review timelines for high-need innovations have encouraged R&D investment. In Canada, the government’s emphasis on digital health and connected devices supports market expansion and clinical data integration.

Europe

Europe’s Medical Device Regulation (MDR) has redefined device approval processes, particularly for high-risk Class III implantables. While it increases clinical evidence and patient safety standards, it has also led to higher compliance costs and longer certification timelines. European governments are simultaneously investing in health technology assessments and digital device registries to improve post-market surveillance.

Asia-Pacific

- China: The Chinese government has implemented policies to accelerate domestic innovation and approval of implantable devices through the National Medical Products Administration (NMPA). Domestic manufacturers are receiving support for R&D and GMP certification, driving rapid market expansion.

- India: The National Medical Devices Policy 2023 and the Production-Linked Incentive (PLI) Scheme are boosting local manufacturing and exports. Medical device parks in states like Gujarat, Tamil Nadu, and Telangana are attracting both domestic and foreign investors.

- Japan & South Korea: These markets are leaders in adopting advanced implantables, supported by well-structured reimbursement systems and government funding for aging population healthcare needs.

Latin America

Countries such as Brazil and Mexico are growing markets for cardiac and orthopedic implants, supported by gradual improvements in healthcare access and private sector investment. Regulatory reforms and free-trade agreements are attracting global players to establish regional production and distribution centers.

Middle East & Africa

The Middle East is investing heavily in healthcare infrastructure, with countries like Saudi Arabia and the UAE promoting localization of medical device manufacturing. Africa, while still an emerging market, is benefiting from donor programs and regional partnerships to expand access to surgical and implantable solutions.

Key Government and Policy Drivers Globally

- Regulatory Streamlining: Programs like the FDA Breakthrough Device Designation and Japan’s fast-track approvals encourage faster access to novel implantables.

- Manufacturing Incentives: India’s PLI schemes and China’s domestic standards aim to enhance local capacity and reduce dependency on imports.

- Public-Private Partnerships: Governments are collaborating with private firms to build medtech parks and innovation hubs, fostering R&D ecosystems.

- Digital Health Policies: Integration of remote monitoring and AI analytics into national healthcare systems is expanding reimbursement coverage for connected implantables.

- Healthcare Infrastructure Investments: Massive spending in post-pandemic recovery packages across regions is indirectly fueling demand for implantable technologies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI Inference Market Growth Drivers, Trends, Key Players and Regional Insights by 2034