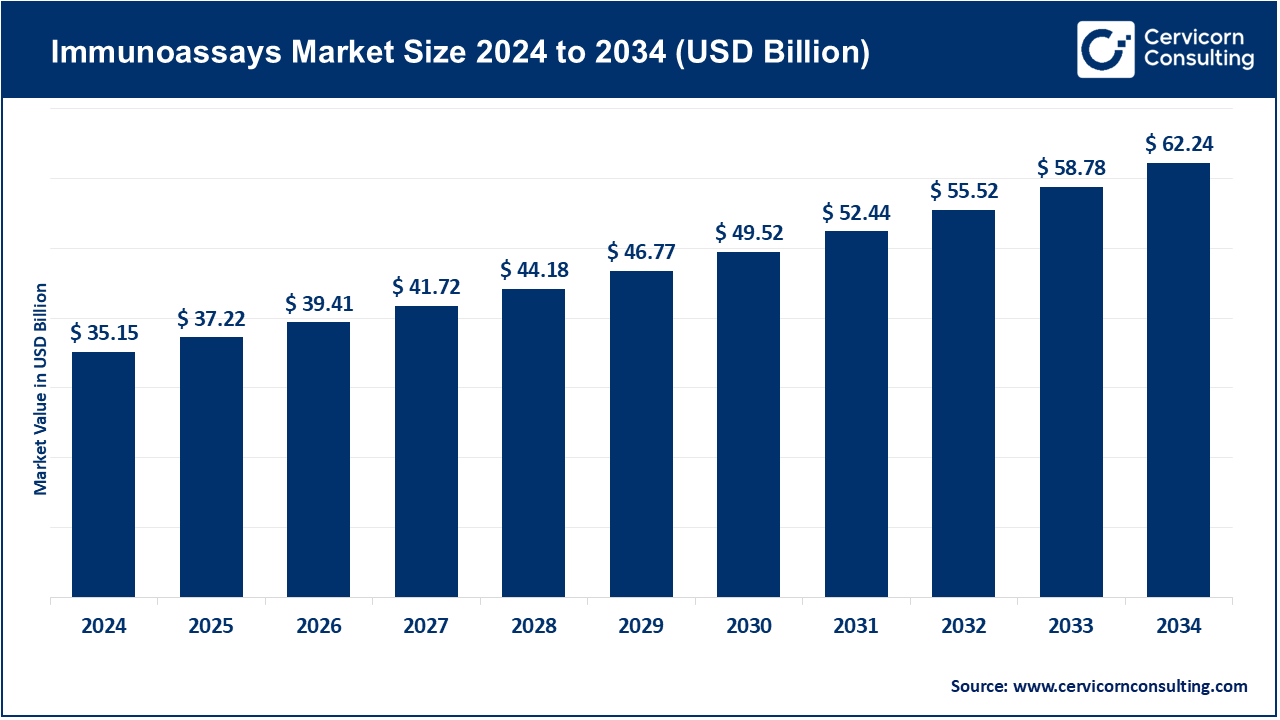

Immunoassays Market Growth Drivers, Key Players, Trends and Regional Insights by 2034

Immunoassays Market Size

Immunoassays Market — Growth Factors

The growth of the immunoassays market is being propelled by a combination of demographic, technological, and healthcare system factors. The global aging population is increasing the prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, which require continuous biomarker monitoring through immunoassays. Rising investment in early cancer detection and biomarker-driven therapies has created sustained demand for highly sensitive and specific assays. Expansion of infectious-disease surveillance and post-pandemic preparedness programs further fuels adoption.

Additionally, innovations in assay sensitivity, multiplexing, and automation have enhanced throughput, reduced turnaround times, and expanded applications to point-of-care (POC) settings. Growth in emerging markets, supported by improvements in hospital infrastructure and laboratory networks, has widened accessibility to diagnostic tools. Government funding, favorable reimbursement frameworks, and evolving regulatory pathways have also accelerated adoption, collectively driving steady market expansion and continuous R&D investment in new assay formats and detection technologies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2765

What Is the Immunoassays Market?

Immunoassays are diagnostic and analytical tests based on the specific binding interaction between an antigen and an antibody. They are used to detect and quantify substances such as hormones, proteins, drugs, infectious agents, and antibodies in biological samples. Common formats include enzyme-linked immunosorbent assays (ELISA), chemiluminescent immunoassays (CLIA), fluorescent immunoassays, lateral-flow assays (LFAs), and multiplex bead or microarray assays.

The immunoassays market encompasses the production, distribution, and servicing of instruments (analyzers, readers, incubators), reagents and kits (antibodies, conjugates, calibrators, and controls), consumables, and software systems that support immunodiagnostic workflows. It caters to hospitals, diagnostic laboratories, research institutions, biotechnology firms, pharmaceutical developers, and point-of-care testing sites. The market’s diversity and recurring reagent demand make it one of the most profitable and resilient sectors in the diagnostic industry.

Why Is the Immunoassays Market Important?

Immunoassays are essential to modern clinical diagnostics because they enable accurate, early, and cost-effective detection of diseases and biological markers. These assays underpin decisions in areas such as infectious-disease management, hormone monitoring, cancer screening, cardiac diagnostics, allergy testing, and therapeutic-drug monitoring. Their high sensitivity and specificity make them indispensable for screening large populations and for guiding patient treatment.

In hospital and reference laboratory settings, fully automated immunoassay analyzers process thousands of samples daily, generating fast and reproducible results that improve workflow efficiency. In decentralized care, rapid immunoassay-based POC kits bring testing closer to patients, supporting faster clinical decisions and better healthcare outcomes. For public-health agencies, immunoassays play a vital role in disease surveillance, vaccination monitoring, and epidemic preparedness. In research and pharmaceutical development, they accelerate biomarker discovery and drug-response analysis. Overall, immunoassays represent a cornerstone technology that bridges clinical diagnostics, biotechnology, and life-science research.

Immunoassays Market — Top Companies

Abbott

Specialization: Abbott is one of the largest global diagnostic companies, known for its integrated portfolio of immunoassay systems and reagents. Its flagship Alinity and ARCHITECT analyzer families serve both hospital and reference laboratories.

Key Focus Areas: High-throughput immunoassay systems for infectious diseases, cardiac biomarkers, metabolic and oncology markers, and thyroid testing; reagent manufacturing and consumable supply; point-of-care diagnostic solutions.

Notable Features: Broad installed base of analyzers worldwide, scalable laboratory automation, and a strong reagent-revenue model supported by long-term contracts.

2024 Revenue: Approximately USD 40.1 billion (company level). The diagnostics division, which includes immunoassays, represents a significant share.

Global Presence: Abbott operates in more than 160 countries, maintaining major production and service centers across North America, Europe, Asia-Pacific, and Latin America.

Becton, Dickinson and Company (BD)

Specialization: BD is a diversified medical-technology company supplying devices, laboratory instruments, and diagnostic systems that complement immunoassay workflows.

Key Focus Areas: Laboratory automation, sample preparation, and molecular and immunodiagnostic integration.

Notable Features: Robust global distribution network and hospital relationships; leadership in specimen-management solutions that enhance immunoassay reliability.

2024 Revenue: Around USD 20.2 billion (company level).

Global Presence: BD’s diagnostic and laboratory products are used in hospitals and labs worldwide, with strong footprints in North America, Europe, and Asia.

Beckman Coulter, Inc. (Danaher Corporation)

Specialization: Beckman Coulter specializes in automated chemistry and immunoassay analyzers, reagents, and laboratory automation solutions.

Key Focus Areas: Central laboratory immunoassay platforms (Access, UniCel), clinical chemistry integration, and digital workflow optimization.

Notable Features: Longstanding clinical diagnostics heritage, scalable automation, and continuous product innovation under Danaher’s diagnostics segment.

2024 Revenue: Parent company Danaher Corporation reported roughly USD 23.9 billion in total revenue for 2024.

Global Presence: Beckman Coulter products are widely installed in hospitals, core laboratories, and reference centers across all major global regions.

bioMérieux

Specialization: bioMérieux focuses on infectious-disease diagnostics, microbiology, and immunodiagnostics.

Key Focus Areas: Immunoassays for bacterial and viral infections, microbiology systems, and rapid tests for critical care and sepsis markers.

Notable Features: Strong R&D in infectious-disease detection, combination of molecular and immuno platforms, and extensive distributor network.

2024 Revenue: Approximately €4.0 billion.

Global Presence: bioMérieux operates in more than 160 countries with manufacturing sites in Europe, the U.S., and Asia, and a solid presence in hospital laboratories and public-health programs.

Bio-Rad Laboratories, Inc.

Specialization: Bio-Rad operates in both life-science research and clinical diagnostics, providing immunoassay kits, reagents, and quality-control systems.

Key Focus Areas: ELISA kits, multiplex immunoassays, autoimmune disease diagnostics, infectious-disease assays, and clinical quality-control materials.

Notable Features: Balanced business model across research and clinical markets; innovation in multiplex technology and assay validation.

2024 Revenue: Around USD 2.6 billion.

Global Presence: Bio-Rad serves customers in more than 150 countries, supported by regional subsidiaries and distributors throughout North America, Europe, and Asia-Pacific.

Leading Trends and Their Impact

- Multiplex and High-Plex Immunoassays:

Multiplex assays allow simultaneous measurement of multiple biomarkers within a single sample, improving efficiency and data richness. This is transforming oncology, immunology, and personalized medicine by enabling complex biomarker panels and companion diagnostics. - Automation and High-Throughput Testing:

Automation has become a defining feature of modern immunoassay platforms. Fully automated CLIA and ELISA analyzers reduce manual handling, enhance reproducibility, and increase sample throughput — especially valuable for high-volume hospital labs and reference centers. - Point-of-Care Immunoassays:

Portable lateral-flow and handheld chemiluminescent devices bring immunodiagnostics closer to patients, supporting remote or decentralized healthcare models. These systems shorten turnaround time and improve healthcare delivery in resource-limited settings. - AI and Digital Integration:

Artificial intelligence and cloud-based analytics are increasingly applied to immunoassay data interpretation, helping detect patterns across multiple biomarkers. This supports precision diagnostics and long-term disease monitoring. - Companion Diagnostics and Oncology Applications:

Immunoassays are key tools in precision oncology for detecting tumor markers or measuring therapy response. Collaborations between diagnostics firms and pharmaceutical companies have led to more co-developed companion tests, aligning diagnostic innovation with targeted-drug approvals. - Regulatory Harmonization and Quality Standards:

Implementation of the EU In-Vitro Diagnostic Regulation (IVDR) and similar policies worldwide has elevated quality and evidence requirements. Although this lengthens approval timelines, it enhances clinical trust and global product safety. - Expansion in Emerging Markets:

Asia-Pacific, Latin America, and the Middle East & Africa are witnessing rapid healthcare infrastructure growth. Multinational companies are localizing production, forming joint ventures, and developing cost-efficient assays to cater to these markets.

Successful Examples of Immunoassays Worldwide

- HIV and Hepatitis Screening Programs:

Large-scale immunoassay-based screening for HIV and Hepatitis B/C in blood banks and prenatal programs has drastically reduced transmission rates and improved early detection outcomes worldwide. - Newborn Screening Panels:

Immunoassays for metabolic and hormonal disorders (such as congenital hypothyroidism) have become standard practice in many countries, enabling early interventions and reducing long-term complications. - COVID-19 Antibody and Antigen Testing:

During the COVID-19 pandemic, immunoassay-based antigen and serology tests played a vital role in infection surveillance, vaccine efficacy studies, and decentralized community testing. - Cardiac Troponin Assays:

High-sensitivity cardiac troponin immunoassays have revolutionized emergency-room diagnostics, allowing rapid detection of myocardial infarction and guiding immediate treatment decisions. - Oncology Marker Programs:

Central laboratories around the world rely on immunoassays for tumor markers like PSA, CEA, and CA-125, supporting early cancer screening and treatment monitoring.

These case studies demonstrate the crucial role of immunoassays in clinical decision-making, public health, and patient management globally.

Global Regional Analysis — Government Initiatives and Policies

North America

Drivers: High healthcare spending, advanced diagnostic infrastructure, strong reimbursement frameworks, and large private laboratory networks drive robust immunoassay adoption.

Policies and Initiatives:

- The Centers for Medicare & Medicaid Services (CMS) and the U.S. Food and Drug Administration (FDA) regulate reimbursement and device approval, shaping market entry.

- Federal funding through the Centers for Disease Control and Prevention (CDC) supports infectious-disease testing and surveillance programs.

- Ongoing investments in precision medicine encourage integration of immunoassays into genomic and proteomic workflows.

Impact: Rapid adoption of new assays, a favorable environment for automation and POC innovations, and continuous R&D funding from both public and private sectors.

Europe

Drivers: Universal healthcare systems and strong preventive-care policies sustain high testing volumes across the continent.

Policies and Initiatives:

- Implementation of the In Vitro Diagnostic Regulation (IVDR) mandates stringent validation and clinical-performance evidence.

- Government-funded screening programs for cancer, hepatitis, and infectious diseases drive recurring test demand.

- European reference networks promote standardization and data sharing across borders.

Impact: Emphasis on product quality, traceability, and compliance with new regulatory standards, favoring established suppliers with robust documentation and quality systems.

Asia-Pacific

Drivers: Rapid economic growth, rising middle-class healthcare demand, expanding hospital networks, and increased government spending on diagnostics.

Policies and Initiatives:

- China’s National Medical Products Administration (NMPA) reforms accelerate regulatory approvals and support local manufacturing.

- India’s National Health Mission and Ayushman Bharat schemes enhance access to diagnostics at primary-care levels.

- Japan emphasizes precision diagnostics integration through national health-insurance programs.

Impact: The region is the fastest-growing market for immunoassays, with a surge in both centralized laboratories and decentralized testing facilities. Multinational firms are investing heavily in local production and technology transfer to meet demand.

Latin America

Drivers: Expanding healthcare access and government-led infectious-disease control initiatives.

Policies and Initiatives:

- National screening programs for HIV, hepatitis, and cervical cancer rely heavily on immunoassay testing.

- Procurement reforms and regional collaborations (such as PAHO) aim to improve supply chains for diagnostic reagents.

Impact: Despite economic constraints, Latin America remains a promising region for low-cost, rapid immunoassay systems, especially in Brazil, Mexico, Chile, and Argentina.

Middle East & Africa

Drivers: Strengthening healthcare infrastructure, growing awareness of early diagnosis, and increasing donor-funded public-health programs.

Policies and Initiatives:

- Gulf Cooperation Council (GCC) countries are investing in diagnostic automation and laboratory accreditation.

- African Union and WHO partnerships focus on expanding laboratory networks for HIV, malaria, and tuberculosis surveillance.

Impact: Gradual growth with emphasis on affordability and supply reliability; partnerships with NGOs and international organizations remain key for market penetration.

Government and Policy Themes Shaping the Market Globally

- Post-Pandemic Diagnostics Capacity Building:

Governments worldwide are investing in laboratory upgrades and stockpiling diagnostic reagents to strengthen preparedness for emerging infectious diseases. - Regulatory Modernization:

Stricter performance standards under new regulations (FDA modernization, EU IVDR, NMPA reforms) increase product reliability but raise entry barriers for small manufacturers. - Screening and Prevention Programs:

Expanded national cancer, hepatitis, HIV, and newborn-screening initiatives sustain long-term demand for immunoassays. - Local Manufacturing Incentives:

Many governments are encouraging domestic production through tax breaks, subsidies, or procurement preferences, reshaping supply chains and global trade flows. - Value-Based Reimbursement Models:

Reimbursement increasingly depends on demonstrated clinical utility and outcomes data, prompting diagnostic companies to invest in clinical-validation studies.

How Market Leaders Are Responding

- Platform Economics:

Major diagnostic companies focus on instrument placement strategies coupled with long-term reagent supply agreements, ensuring steady recurring revenue streams. - Mergers and Acquisitions:

Large corporations continue to acquire specialized assay developers or digital-diagnostic firms to expand assay menus and technological capabilities. - Localization and Partnerships:

To comply with local regulations and reduce logistics costs, global players are building regional manufacturing hubs and partnering with local distributors. - Investment in Multiplex and POC Solutions:

Companies are channeling R&D toward multi-analyte systems and miniaturized platforms suitable for decentralized testing environments.

Key Takeaways for Stakeholders

- Laboratories and Hospitals: Should focus on automation compatibility, reagent-supply stability, and total cost of ownership when selecting immunoassay platforms.

- Diagnostic Manufacturers: Need to prioritize multiplex development, regulatory compliance, and emerging-market partnerships.

- Policy Makers and Health Authorities: Should strengthen national laboratory infrastructures, ensure stable reagent supply chains, and align reimbursement policies with proven diagnostic outcomes.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Compressor Market Growth Drivers, Key Players, Trends, and Regional Insights by 2034