Hydrogen Valve Market Trends, Growth, Innovations, and Insights by 2034

Hydrogen Valve Market Growth

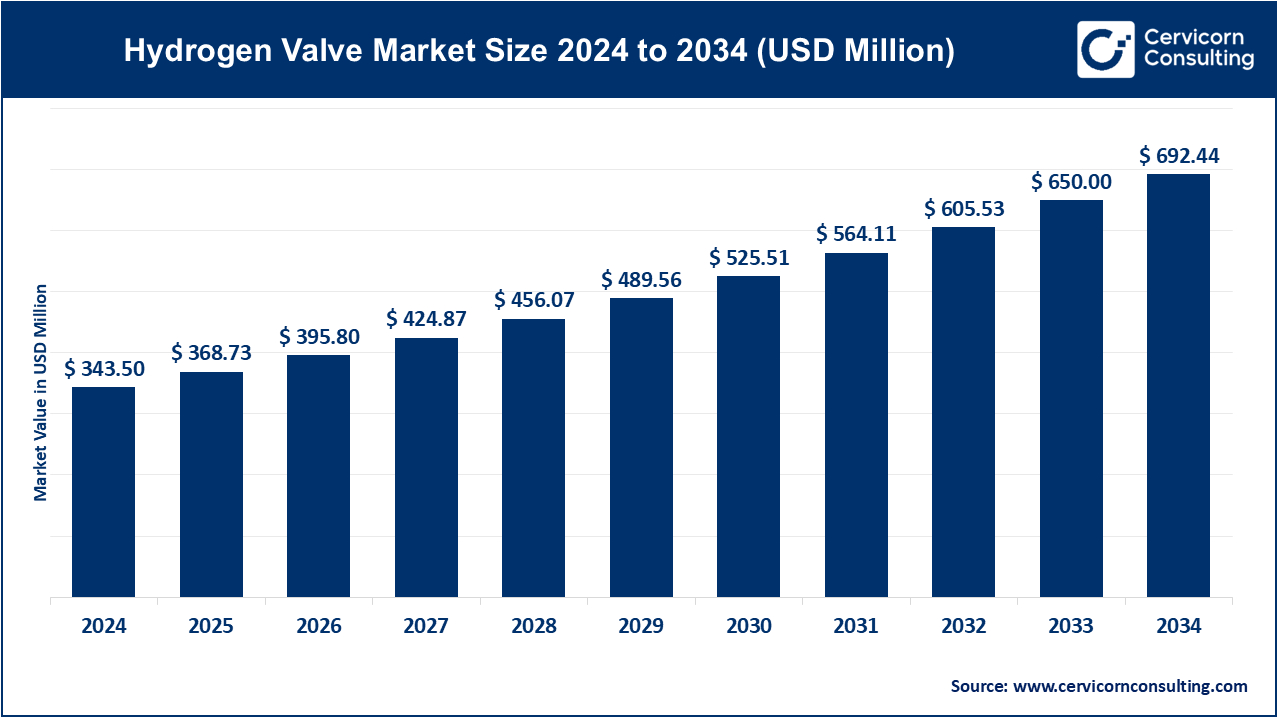

The hydrogen valve market is projected to grow significantly, with its value estimated to reach USD 692.44 million by 2034, reflecting a compound annual growth rate (CAGR) of 7.34% from its current valuation of USD 343.50 million in 2024.

What are the emerging trends in the hydrogen valve market?

Advancements in Valve Materials

- Enhanced Durability: Manufacturers are innovating with advanced materials such as high-grade stainless steel and carbon composites to ensure valves withstand the extreme pressures and temperatures of hydrogen systems.

- Hydrogen Embrittlement Resistance: New materials and coatings are being developed to combat hydrogen embrittlement, a key challenge for components in hydrogen storage and transport.

Integration with Green Hydrogen Projects

- Renewable Energy Synergy: The increasing deployment of hydrogen valves in green hydrogen projects driven by renewable energy sources like wind and solar is a major trend. These valves play a crucial role in regulating hydrogen flow in production and distribution networks.

- Global Green Hydrogen Push: Countries like Germany, Australia, and Japan are investing heavily in green hydrogen, with dedicated hydrogen infrastructure projects integrating advanced valve technologies.

Cost Reduction Initiatives

Technological Innovations

- Automation and Smart Valves: The adoption of smart valves with IoT capabilities allows real-time monitoring and remote control, reducing operational costs and enhancing safety.

- Modular Designs: Modular valve designs are gaining popularity, as they streamline maintenance and reduce downtime, further lowering overall system costs.

Government Incentives

- Subsidies and Grants: Governments are offering financial incentives for hydrogen infrastructure development, promoting the adoption of advanced valve systems. For instance, the EU has allocated €30 billion for hydrogen technology advancements by 2030.

- Standardization Efforts: International bodies are working on standardizing hydrogen valve specifications, which simplifies manufacturing and reduces costs for producers.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2438

Integration with Hydrogen Ecosystems

Support for Hydrogen Refueling Stations (HRS)

- Expanding Networks: With over 5,000 hydrogen refueling stations expected worldwide by 2030, valves are pivotal in managing high-pressure hydrogen delivery.

- Focus on Efficiency: Innovations in valve technology are reducing energy losses and ensuring faster refueling times, critical for the adoption of hydrogen fuel cell vehicles.

Hydrogen-Powered Applications

- Industrial Usage: Hydrogen valves are increasingly deployed in industries like steel production, ammonia manufacturing, and power generation, where hydrogen is used as a feedstock or energy source.

- Mobility Sector: The growing adoption of hydrogen-powered vehicles, trains, and even aviation is driving demand for high-performance valves tailored for these applications.

Regulatory and Policy Frameworks

Incentives for Hydrogen Infrastructure

- Policy Support: Many countries have launched hydrogen strategies that include provisions for robust infrastructure, including valves. For example, the U.S. Infrastructure Bill allocates $9.5 billion for clean hydrogen initiatives.

- Safety Standards: Governments are enforcing stringent safety standards for hydrogen valves to ensure reliability and mitigate risks, boosting market trust.

Focus on Decarbonization

- Net-Zero Goals: Hydrogen technology, supported by advanced valve systems, aligns with global decarbonization targets, particularly in energy-intensive sectors.

- Carbon Capture Integration: Hydrogen projects combined with carbon capture and storage (CCS) are increasingly incorporating valves designed to handle both hydrogen and CO2 streams.

What strategies are leading companies in the hydrogen valve market using to expand their operations?

Strategic Partnerships and Collaborations

- Joint Ventures: Companies like Flowserve and Hydrogenious have partnered to develop advanced hydrogen handling solutions, leveraging each other’s expertise to capture new market opportunities.

- Collaborative R&D: Partnerships between valve manufacturers and research institutions are accelerating innovation, particularly in hydrogen-specific designs.

Technological Innovation and R&D Investments

- Smart Valve Development: Companies are investing in digital solutions, including sensors and AI-driven analytics, to create predictive maintenance systems for hydrogen valves.

- Cryogenic Valve Innovation: To meet the demands of liquid hydrogen applications, manufacturers are developing cryogenic valves that can operate reliably at extremely low temperatures.

Market Expansion Initiatives

- Pilot Projects: Leading companies are actively participating in pilot projects for hydrogen storage and distribution, validating their technologies and showcasing capabilities to potential clients.

- Targeting Emerging Markets: With significant investments in hydrogen infrastructure in regions like Asia-Pacific and the Middle East, companies are expanding their presence to tap into these high-growth markets.

Which regions are leading in the adoption of hydrogen valves?

North America

- United States: The U.S. is driving hydrogen infrastructure growth with initiatives like the Department of Energy’s Hydrogen Shot program, aiming to reduce hydrogen costs to $1 per kilogram by 2030.

- Canada: Canada’s Hydrogen Strategy highlights investments in clean hydrogen technologies, including advanced valves for storage and transportation systems.

Europe

- Germany: As part of its National Hydrogen Strategy, Germany is deploying hydrogen infrastructure at scale, integrating advanced valve technologies for storage and refueling applications.

- France: Investments in hydrogen mobility, including hydrogen-powered trains, are increasing the demand for high-performance valve solutions.

Asia-Pacific

- China: As the world’s largest producer of hydrogen, China is advancing its hydrogen economy with substantial investments in refueling infrastructure, where valves are critical components.

- Japan: A pioneer in hydrogen technology, Japan is focusing on expanding its hydrogen supply chain, creating opportunities for valve manufacturers.

Middle East

- Saudi Arabia: With the NEOM project and plans for the world’s largest green hydrogen plant, Saudi Arabia is emerging as a key player in the hydrogen valve market.

- UAE: The UAE is investing in hydrogen export capabilities, driving demand for valves suited to large-scale hydrogen storage and transport.