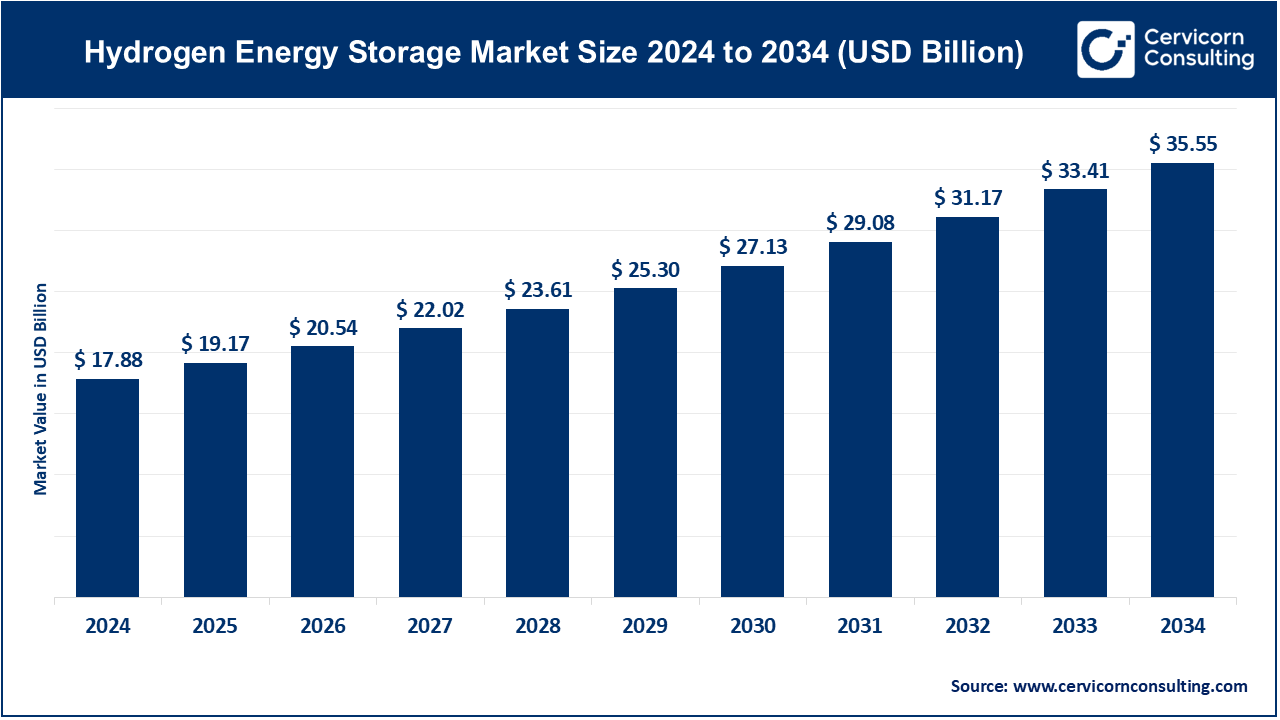

Hydrogen Energy Storage Market Forecast From USD 17.88 Bn in 2024 to USD 35.55 Bn by 2034

Hydrogen Energy Storage Market Size

The global hydrogen energy storage market was valued at USD 17.88 billion in 2024 and is expected to grow to approximately USD 35.55 billion by 2034, with a compound annual growth rate (CAGR) of 7.19% from 2025 to 2034.

What is the Hydrogen Energy Storage Market?

The hydrogen energy storage market refers to the infrastructure, technologies, and systems designed to store hydrogen as a medium for energy storage. Hydrogen can be stored in various forms, such as gas, liquid, or within chemical compounds, and serves as a versatile energy carrier. The market encompasses the production, compression, liquefaction, storage, and distribution of hydrogen for use in power generation, transportation, industrial applications, and backup energy systems.

Why is Hydrogen Energy Storage Important?

Hydrogen energy storage is crucial for the transition to a sustainable energy future. It offers a high-energy-density solution to store excess renewable energy generated from sources like wind and solar, helping stabilize power grids and enhance energy resilience. Moreover, hydrogen can decarbonize sectors that are challenging to electrify, such as heavy industry and long-haul transportation. As a clean energy vector, it supports global efforts to reduce greenhouse gas emissions and achieve net-zero targets.

Growth Factors Driving the Hydrogen Energy Storage Market

The hydrogen energy storage market is experiencing rapid growth due to several factors, including:

- Renewable Energy Integration: The rising deployment of wind and solar power necessitates efficient energy storage solutions to address intermittency issues.

- Decarbonization Goals: Governments and industries are investing heavily in hydrogen technologies to achieve climate targets and reduce carbon footprints.

- Technological Advancements: Innovations in electrolysis, storage materials, and fuel cell technology are improving efficiency and reducing costs.

- Supportive Policies and Investments: Subsidies, tax incentives, and strategic funding initiatives are boosting the development of hydrogen infrastructure globally.

- Growing Demand for Green Hydrogen: Increasing interest in hydrogen produced through renewable energy (green hydrogen) is driving investments and collaborations.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2343

Global Hydrogen Energy Storage Market Top Companies

Air Liquide

- Specialization: Industrial gases and hydrogen solutions.

- Key Focus Areas: Hydrogen liquefaction, storage, and fuel cell infrastructure.

- Notable Features: Air Liquide operates large-scale hydrogen production and storage facilities globally.

- 2024 Revenue (approx.): $30 billion.

- Market Share (approx.): 15%.

- Global Presence: Europe, North America, Asia-Pacific, and Middle East.

Linde plc

- Specialization: Industrial gases and engineering.

- Key Focus Areas: Hydrogen production, storage systems, and transportation solutions.

- Notable Features: Leader in hydrogen liquefaction and high-pressure storage.

- 2024 Revenue (approx.): $33 billion.

- Market Share (approx.): 17%.

- Global Presence: Extensive presence across Americas, Europe, Asia, and Africa.

Nel ASA

- Specialization: Hydrogen production and fueling.

- Key Focus Areas: Electrolyzers and hydrogen refueling stations.

- Notable Features: Pioneer in renewable hydrogen production technologies.

- 2024 Revenue (approx.): $110 million.

- Market Share (approx.): 5%.

- Global Presence: Europe, North America, Asia-Pacific.

ITM Power

- Specialization: Electrolyzers and energy storage.

- Key Focus Areas: PEM electrolyzers and integrated hydrogen solutions.

- Notable Features: Focus on green hydrogen production.

- 2024 Revenue (approx.): $70 million.

- Market Share (approx.): 4%.

- Global Presence: Primarily Europe, expanding into North America and Asia.

Cummins Inc.

- Specialization: Hydrogen fuel cells and electrolyzers.

- Key Focus Areas: Fuel cell technology and renewable hydrogen solutions.

- Notable Features: Extensive expertise in heavy-duty applications and mobility.

- 2024 Revenue (approx.): $28 billion.

- Market Share (approx.): 14%.

- Global Presence: Global reach with significant operations in the Americas, Europe, and Asia.

Leading Trends and Their Impact on the Market

- Green Hydrogen Development:

- Trend: The shift toward producing hydrogen using renewable energy (green hydrogen) is accelerating.

- Impact: Reduces carbon footprint and attracts substantial investment, driving innovation in electrolysis technology.

- Scaling Up Hydrogen Infrastructure:

- Trend: Expansion of hydrogen pipelines, storage tanks, and refueling stations.

- Impact: Enhances the accessibility and adoption of hydrogen across multiple sectors.

- Cost Reduction in Electrolyzers:

- Trend: Innovations in electrolyzer manufacturing and materials are lowering costs.

- Impact: Makes hydrogen production more economical, boosting market growth.

- Sector Coupling:

- Trend: Integration of hydrogen with other energy systems like electric grids and heating.

- Impact: Creates a more flexible and interconnected energy network.

- Global Collaborations:

- Trend: Partnerships among governments, private companies, and research institutions.

- Impact: Facilitates knowledge sharing and accelerates large-scale projects.

Successful Examples of Hydrogen Energy Storage Around the World

- HyBalance Project (Denmark):

- A pilot project utilizing hydrogen storage to balance renewable energy in the grid.

- Demonstrated the feasibility of green hydrogen for industrial and transportation applications.

- H2Haul Project (Europe):

- Focuses on deploying hydrogen-powered heavy-duty vehicles.

- Includes large-scale hydrogen storage to support logistics operations.

- Kawasaki Hydrogen Road (Japan):

- Developed a hydrogen supply chain with large-scale storage and transportation solutions.

- Supports decarbonization efforts in industries and power generation.

- Port of Rotterdam (Netherlands):

- A hub for hydrogen storage and distribution, integrating renewable energy and industrial uses.

- Aims to become a leading hydrogen trading hub in Europe.

- Hydrogen Energy Storage and Utilization Project (Australia):

- Combines solar energy with hydrogen production and storage for grid stability.

- Supports remote communities with renewable energy solutions.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- Key Policies:

- The U.S. Department of Energy’s Hydrogen Shot initiative aims to reduce green hydrogen costs to $1 per kilogram by 2030.

- Canada’s Hydrogen Strategy focuses on large-scale deployment of hydrogen technologies.

- Government Support:

- Tax incentives for hydrogen production and storage.

- Funding for research and pilot projects.

- Market Dynamics:

- Significant investment in hydrogen infrastructure and fuel cell vehicles.

- Major projects include the development of hydrogen hubs.

Europe

- Key Policies:

- The European Green Deal targets carbon neutrality by 2050, with hydrogen playing a central role.

- Hydrogen Strategy for a Climate-Neutral Europe focuses on scaling green hydrogen.

- Government Support:

- Subsidies for electrolyzer projects and storage facilities.

- Partnerships with private players to establish hydrogen valleys.

- Market Dynamics:

- Strong leadership in green hydrogen technologies.

- Collaborative projects like HyDeploy and H2Future.

Asia-Pacific

- Key Policies:

- Japan’s Basic Hydrogen Strategy aims to establish a hydrogen-based society.

- China’s 14th Five-Year Plan includes significant investments in hydrogen.

- Government Support:

- Grants for hydrogen infrastructure development.

- Investments in research and development of fuel cells and storage systems.

- Market Dynamics:

- Rapid growth in hydrogen-powered transportation and industrial applications.

- Pioneering large-scale hydrogen projects like Kawasaki’s hydrogen supply chain.

Middle East & Africa

- Key Policies:

- Focus on leveraging abundant solar and wind resources for green hydrogen production.

- Initiatives like Saudi Arabia’s NEOM project.

- Government Support:

- Investments in renewable hydrogen facilities and export capabilities.

- Market Dynamics:

- Emergence as a leading exporter of green hydrogen.

- Partnerships with European countries for hydrogen supply chains.

Latin America

- Key Policies:

- Chile’s National Green Hydrogen Strategy targets low-cost green hydrogen production.

- Brazil’s emphasis on hydrogen as part of its energy mix.

- Government Support:

- Subsidies for renewable energy projects.

- Collaborations with global players to develop hydrogen technologies.

- Market Dynamics:

- Potential to become a competitive player in green hydrogen due to renewable energy resources.

- Pilot projects integrating hydrogen into industrial processes.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Nuclear Fusion Market Growth, Innovations, and Future Outlook (2024-2033)