Home Healthcare Market Growth Projections and Key Developments (2025-2034)

Home Healthcare Market Overview

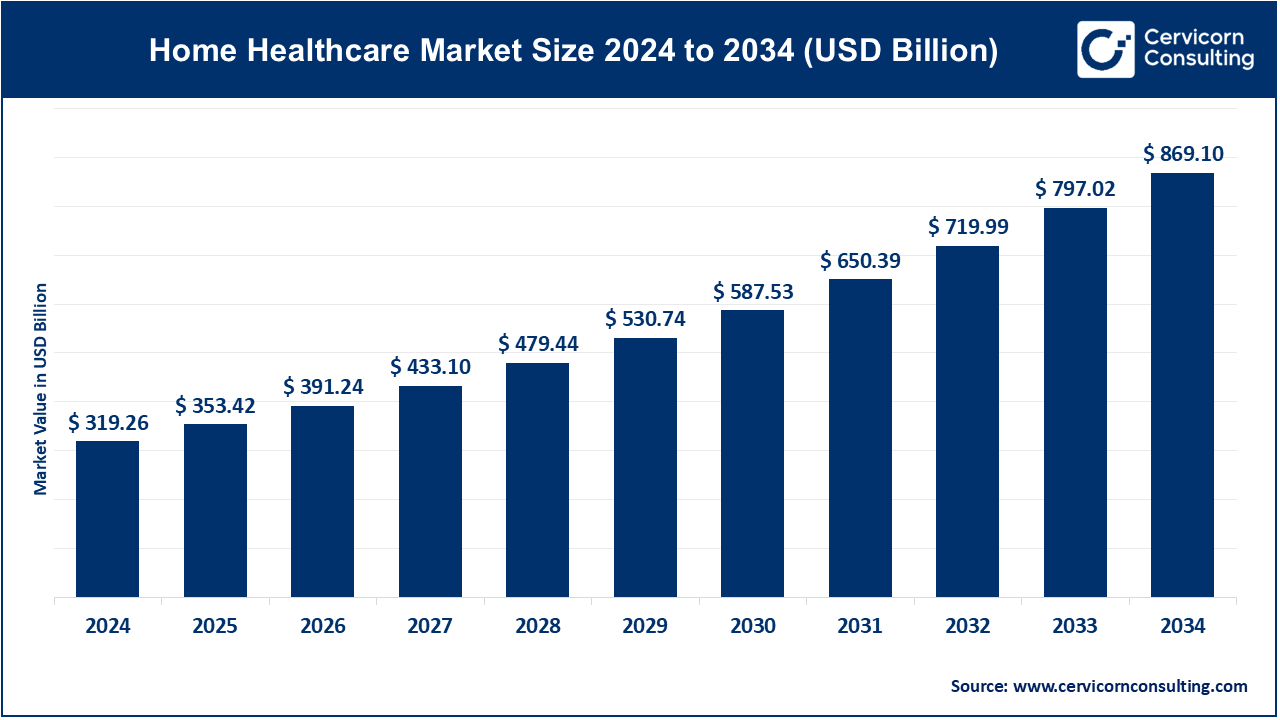

The global home healthcare market was valued at USD 319.26 billion in 2024 and is projected to grow to approximately USD 869.10 billion by 2034, with a compound annual growth rate (CAGR) of 10.7% from 2025 to 2034.

The home healthcare market is driven by factors such as an aging global population, a rise in chronic diseases, advancements in medical technology, increased awareness of home healthcare services, and a shift toward value-based care models. Government policies promoting home healthcare, coupled with a preference for in-home treatment over hospitalization due to cost and comfort, also fuel market growth.

Understanding the Home Healthcare Market

The home healthcare market encompasses a wide range of medical and non-medical services delivered directly to patients in their homes. These services include skilled nursing care, physical therapy, occupational therapy, speech therapy, and assistance with daily living activities. Home healthcare aims to provide comprehensive care for individuals recovering from illnesses, managing chronic diseases, or needing palliative care in the comfort of their homes.

Why is the Home Healthcare Market Important?

Home healthcare is pivotal because it offers personalized, patient-centered care that improves quality of life while reducing the burden on hospitals and long-term care facilities. By enabling patients to receive treatment in their own homes, this market supports better health outcomes, cost-efficiency, and a sense of independence for patients and their families. This approach also helps address the growing global demand for healthcare services driven by aging populations and the prevalence of chronic diseases.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2342

Global Home Healthcare Market Top Companies

Amedisys, Inc.

- Specialization: Skilled nursing, physical therapy, hospice care

- Key Focus Areas: Chronic care management, hospice services

- Notable Features: Proprietary predictive analytics for patient care

- 2024 Revenue (approx.): $2.2 billion

- Market Share (approx.): 10%

- Global Presence: Primarily North America

Bayada Home Health Care

- Specialization: Pediatric and adult nursing, rehabilitation, hospice

- Key Focus Areas: Personalized care plans, skilled nursing

- Notable Features: Focus on education and training for caregivers

- 2024 Revenue (approx.): $1.6 billion

- Market Share (approx.): 8%

- Global Presence: United States, with expanding international operations

LHC Group, Inc.

- Specialization: Post-acute care, home health, and hospice

- Key Focus Areas: Collaboration with hospitals for value-based care

- Notable Features: Integrated care networks

- 2024 Revenue (approx.): $2.5 billion

- Market Share (approx.): 12%

- Global Presence: United States, with localized operations

Encompass Health Corporation

- Specialization: Rehabilitation, home health, and hospice

- Key Focus Areas: Rehabilitation-driven home healthcare services

- Notable Features: Technology-enabled care coordination

- 2024 Revenue (approx.): $4.1 billion

- Market Share (approx.): 18%

- Global Presence: Strong presence across the U.S.

Kindred at Home (Part of Humana Inc.)

- Specialization: Home health, hospice, personal care services

- Key Focus Areas: Geriatric care, chronic disease management

- Notable Features: Integration with Humana’s insurance network

- 2024 Revenue (approx.): $3.8 billion

- Market Share (approx.): 16%

- Global Presence: United States

Leading Trends and Their Impact

1. Telehealth Integration

Advances in telemedicine allow healthcare providers to monitor patients remotely, conduct virtual consultations, and deliver care without the need for physical visits. This trend enhances accessibility and reduces operational costs.

2. Artificial Intelligence (AI) and Predictive Analytics

AI-driven solutions enable personalized care planning and early detection of health risks. Predictive analytics help in managing chronic diseases and preventing hospital readmissions.

3. Value-Based Care Models

Shifting from fee-for-service to value-based care encourages providers to focus on quality outcomes, driving innovation and efficiency in home healthcare delivery.

4. Wearable and IoT Devices

Connected devices such as smartwatches and health trackers provide real-time data, empowering patients and caregivers to manage health conditions proactively.

5. Workforce Development and Training

Increasing investment in caregiver education ensures high-quality care delivery, addressing the demand for skilled professionals in the sector.

Successful Examples of Home Healthcare Worldwide

Japan’s Aging Population Solutions

Japan has implemented technology-driven home healthcare solutions, such as robotic companions for elderly care and remote monitoring systems to support its aging population. Companies like Panasonic have been at the forefront of these innovations.

Germany’s Integrated Care Networks

Germany’s healthcare system integrates home healthcare with primary care providers, ensuring seamless service delivery. Companies like Helios have implemented comprehensive care models.

U.S.-Based Medicare Home Health Programs

Medicare’s support for home healthcare in the U.S. has significantly expanded access to services, particularly for seniors and individuals with chronic illnesses. Providers like Kindred at Home have benefited from this initiative.

India’s Cost-Effective Home Healthcare Models

Startups like Portea Medical offer affordable home healthcare services, addressing the needs of middle-income families while leveraging telemedicine and on-demand care models.

Regional Analysis: Government Initiatives and Policies

1. North America

Governments in the U.S. and Canada have been proactive in promoting home healthcare through policies such as reimbursements for home-based services and telehealth expansion. The U.S. Centers for Medicare & Medicaid Services (CMS) has been a key driver, encouraging home health providers to adopt value-based care models.

2. Europe

Countries like Germany, the UK, and France have implemented policies supporting home healthcare to alleviate the burden on hospitals. For example, Germany’s healthcare system incentivizes integrated care, while the UK’s National Health Service (NHS) funds home-based care initiatives.

3. Asia-Pacific

Emerging economies like India and China are witnessing rapid growth in home healthcare services, supported by government initiatives to improve healthcare infrastructure. India’s National Health Mission promotes community-based healthcare, while China’s Healthy China 2030 plan includes provisions for home-based care services.

4. Latin America

In countries like Brazil and Mexico, home healthcare is gaining traction due to public-private partnerships and increasing awareness of cost-effective care alternatives. Government programs such as Brazil’s “Better at Home” initiative emphasize in-home care delivery.

5. Middle East and Africa

Governments in the Middle East are investing in home healthcare as part of broader healthcare system reforms. For instance, the UAE has introduced policies to integrate telemedicine into home healthcare services, while South Africa is focusing on improving access to care in rural areas.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Compounding Pharmacies Market Trends, Growth, and Forecast (2024-2033)