High Potency APIs Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

High Potency APIs Market Size

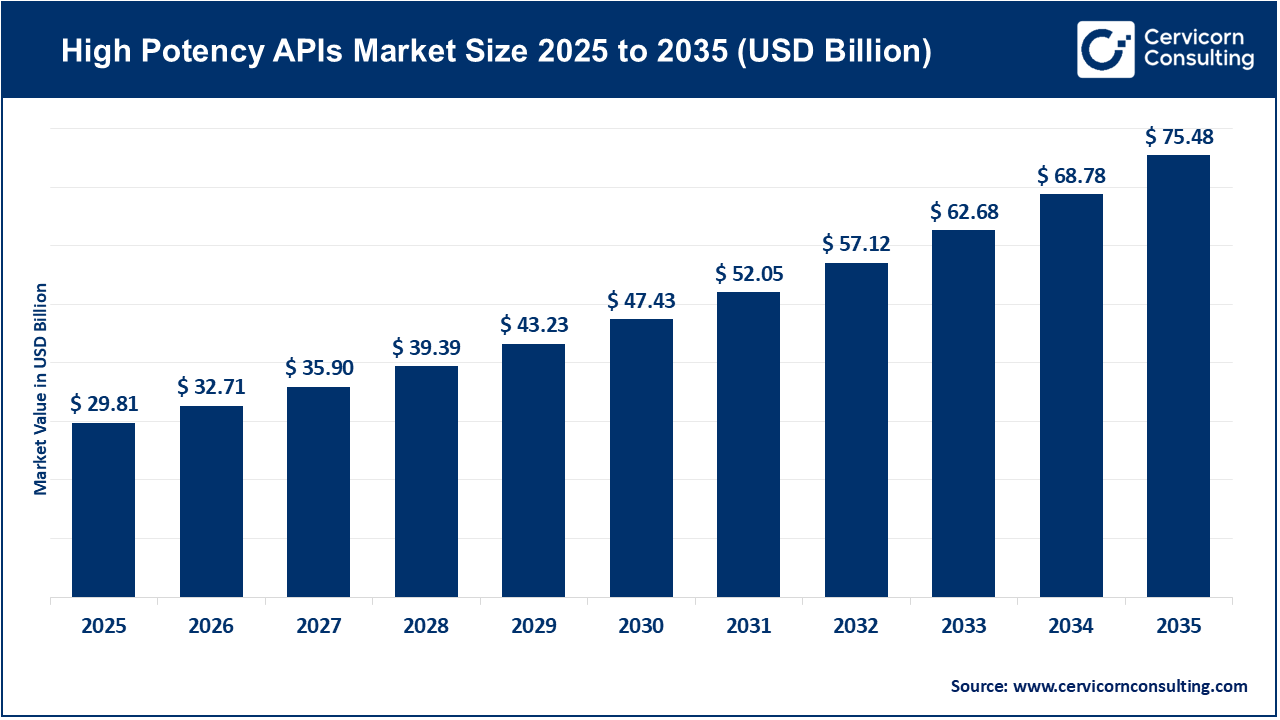

The global high potency APIs market size was worth USD 29.81 billion in 2025 and is anticipated to expand to around USD 75.48 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% from 2026 to 2035.

Growth Factors

The high-potency active pharmaceutical ingredients (HP-APIs) market is experiencing strong growth due to the rising prevalence of cancer and chronic diseases, increased demand for targeted and precision therapies, and the expansion of highly potent drug pipelines across oncology, immunology, and hormonal treatments. Pharmaceutical companies are increasingly outsourcing HP-API manufacturing to specialized contract development and manufacturing organizations (CDMOs) to mitigate safety risks, reduce capital investment, and access advanced containment technologies. Stringent regulatory requirements related to occupational exposure and cross-contamination control are also encouraging investment in specialized facilities, which raises barriers to entry and enhances market value.

Additionally, advances in containment systems, isolators, and analytical technologies, along with the growing adoption of antibody-drug conjugates (ADCs) and personalized medicines, are accelerating demand for HP-APIs worldwide, supported further by supply-chain diversification and manufacturing localization initiatives.

Get a Free Sample: https://www.cervicornconsulting.com/high-potency-apis-market

What Is the High-Potency APIs Market?

The high-potency APIs market comprises pharmaceutical ingredients that exhibit biological activity at very low doses, typically in microgram or nanogram ranges. These APIs require specialized handling, containment, and manufacturing processes due to their high toxicity or pharmacological potency. HP-APIs are commonly used in oncology drugs, hormone therapies, immunosuppressants, and certain neurological and cardiovascular medications. The market includes both in-house manufacturing by large pharmaceutical companies and outsourced production through specialized CDMOs. It also encompasses analytical testing, quality assurance, packaging, storage, and transportation services designed specifically for highly potent compounds.

Why Is the High-Potency APIs Market Important?

The importance of the HP-APIs market lies in its critical role in enabling the development and commercialization of advanced, life-saving therapies. Many modern drugs, particularly targeted cancer treatments and precision medicines, rely on HP-APIs to deliver efficacy with minimal dosing. Proper manufacturing of HP-APIs ensures patient safety, regulatory compliance, and consistent drug quality while protecting workers and preventing cross-contamination. For pharmaceutical companies, access to reliable HP-API supply reduces development timelines, improves scalability, and lowers operational risk. From a healthcare perspective, a robust HP-API market supports innovation, drug availability, and global health outcomes.

Company Profiles

Pfizer, Inc.

- Specialization: Global biopharmaceutical company with strong capabilities in small molecules, biologics, vaccines, and specialty medicines

- Key Focus Areas: Oncology, immunology, cardiovascular diseases, and metabolic disorders

- Notable Features: Extensive global manufacturing network, strong R&D investment, and strategic partnerships for complex and high-potency manufacturing

- 2024 Revenue: USD 63.6 billion

- Global Presence: Operations across North America, Europe, Asia-Pacific, Latin America, and Africa

F. Hoffmann-La Roche Ltd. (Roche)

- Specialization: Pharmaceuticals and diagnostics with a dominant position in oncology

- Key Focus Areas: Targeted cancer therapies, biologics, and precision medicines

- Notable Features: Integrated diagnostics-pharma model and advanced manufacturing capabilities for highly potent compounds

- 2024 Revenue: CHF 60.5 billion

- Global Presence: Strong presence in Europe, the Americas, and Asia-Pacific

Sanofi S.A.

- Specialization: Global biopharmaceutical company spanning vaccines, specialty care, and general medicines

- Key Focus Areas: Oncology, immunology, rare diseases, and vaccines

- Notable Features: Strategic shift toward high-value specialty therapeutics and increased outsourcing for HP-API manufacturing

- 2024 Revenue: EUR 41.1 billion

- Global Presence: Manufacturing and R&D sites across Europe, North America, Asia, and Latin America

Bristol-Myers Squibb Company

- Specialization: Innovative biopharmaceutical company focused on serious diseases

- Key Focus Areas: Oncology, immunology, cardiovascular, and hematology

- Notable Features: Strong oncology pipeline with multiple highly potent compounds and reliance on specialized CDMO partnerships

- 2024 Revenue: USD 48.3 billion

- Global Presence: Commercial and manufacturing footprint across the Americas, Europe, and Asia

Bayer AG

- Specialization: Life science company with pharmaceuticals, consumer health, and crop science divisions

- Key Focus Areas: Specialty pharmaceuticals and complex chemical synthesis

- Notable Features: Deep chemical process expertise suitable for high-potency and hazardous compounds

- 2024 Revenue: EUR 46.6 billion

- Global Presence: Strong manufacturing base in Europe, North America, and Asia

Leading Trends and Their Impact

One of the most prominent trends shaping the HP-API market is the growing reliance on specialized CDMOs. As manufacturing complexity and regulatory scrutiny increase, pharmaceutical companies prefer outsourcing to reduce capital burden and operational risk. Another major trend is the continued dominance of oncology drug development, which significantly boosts demand for cytotoxic and highly potent compounds. Technological advancements in containment systems, such as isolators and closed-loop manufacturing, are improving worker safety and product quality but also increasing entry barriers.

Regulatory agencies worldwide are enforcing stricter guidelines for HP-API handling, further driving investment in compliant facilities. Supply-chain resilience initiatives are encouraging near-shoring and geographic diversification of HP-API manufacturing. Additionally, the rapid growth of antibody-drug conjugates is creating niche demand for ultra-potent payload APIs and specialized conjugation expertise. Digitalization and advanced analytics are also improving process control, batch consistency, and regulatory approval timelines.

Successful Examples of the High-Potency APIs Market Worldwide

In North America and Europe, specialized CDMOs have established dedicated HP-API manufacturing hubs equipped with advanced containment and analytical systems, successfully securing long-term commercial contracts for oncology drugs. India has emerged as a key global supplier by upgrading traditional API manufacturing capabilities to meet high-potency and regulatory standards, becoming a preferred destination for both clinical and commercial HP-API production. Japan has demonstrated success through precision manufacturing and high safety standards, particularly in producing ADC payloads and cytotoxic APIs. Large pharmaceutical companies, such as Roche, also exemplify success through selective vertical integration of HP-API manufacturing for strategic oncology products.

Global Regional Analysis Including Government Initiatives and Policies

North America

Governments in the United States and Canada are actively supporting domestic pharmaceutical manufacturing to reduce dependency on imports. Regulatory authorities enforce strict occupational safety and GMP standards for HP-API production, encouraging investment in advanced facilities. Financial incentives and public-private partnerships are strengthening regional manufacturing capacity.

Europe

European countries emphasize pharmaceutical sovereignty, innovation, and high regulatory standards. Government-supported R&D programs and industrial funding initiatives promote advanced manufacturing, including HP-APIs. Strict environmental and safety regulations raise production costs but also ensure high quality and global competitiveness.

Asia-Pacific

Countries such as India, China, Japan, South Korea, and Singapore are expanding HP-API manufacturing through policy support, infrastructure development, and regulatory upgrades. India, in particular, benefits from government incentives aimed at boosting pharmaceutical exports and domestic manufacturing. Japan and South Korea focus on high-precision and specialty HP-API production.

Latin America and Africa

These regions are gradually strengthening pharmaceutical manufacturing through localization initiatives and international partnerships. While HP-API production remains limited, government efforts to improve healthcare access and essential drug availability may encourage future investment and technology transfer.

Cross-Regional Policy Themes

Globally, governments are prioritizing pharmaceutical supply-chain resilience, workforce training in GMP and containment practices, environmental compliance, and trade policies that encourage local manufacturing. These initiatives collectively shape investment patterns, capacity expansion, and long-term growth of the high-potency APIs market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Powertrain Market Growth Drivers, Trends, Key Players and Regional Insights by 2034