Floating Solar Panels Market Revenue, Global Presence, and Strategic Insights by 2034

Floating Solar Panels Market Size

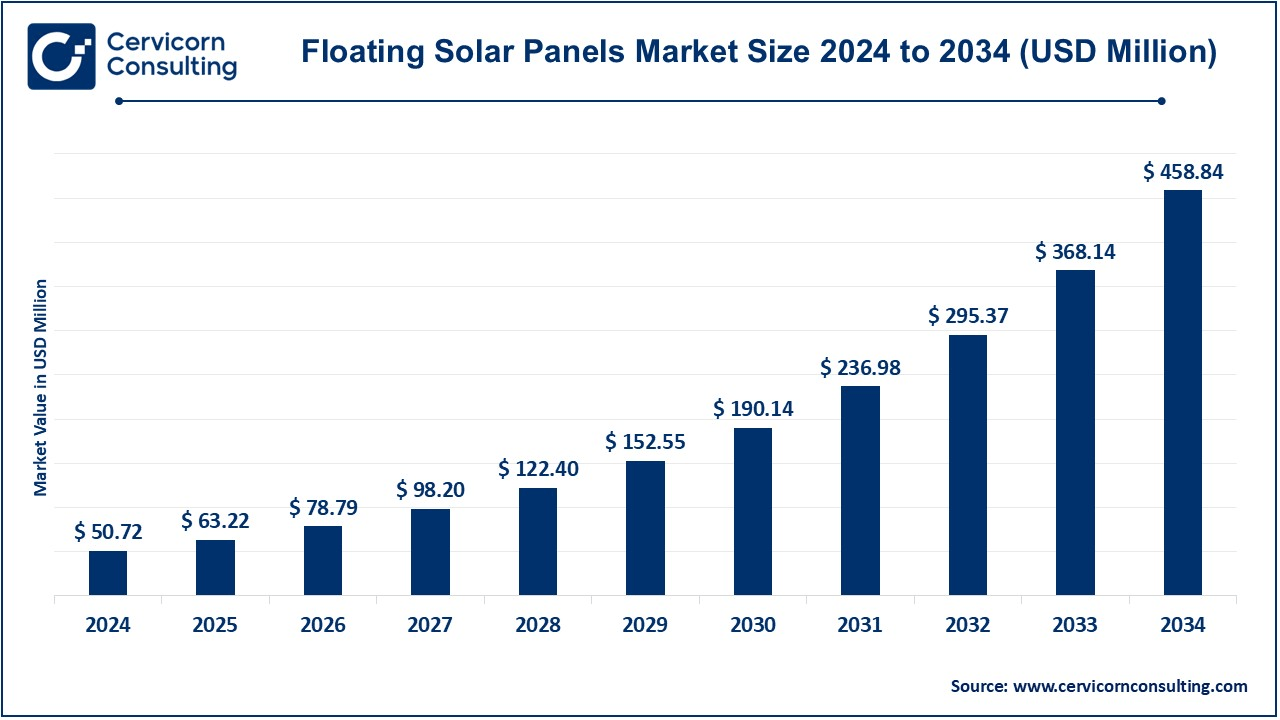

The global floating solar panels market size was worth USD 50.72 million in 2024 and is anticipated to expand to around USD 458.84 million by 2034, registering a compound annual growth rate (CAGR) of 24.63% from 2025 to 2034.

Floating Solar Panels Market Growth Factors

The floating solar market is expanding due to multiple interlinked forces: the surging global demand for clean electricity, falling photovoltaic (PV) costs, and limited land availability in densely populated regions, which make water-based installations more practical. FPV systems also benefit from higher module efficiency due to lower temperatures over water surfaces, while reducing evaporation and improving water quality. Advances in float design, anchoring, and corrosion-resistant materials are driving down lifecycle costs.

In parallel, hybridization with hydropower plants and integration with energy storage systems increase energy output and grid stability. Supportive government policies, renewable energy targets, and clearer permitting processes in key markets like Japan, China, and India are spurring large-scale adoption. Finally, innovative business models, including utility partnerships and independent power producer (IPP) projects, along with financing from green funds and development banks, are transforming FPV into a mature and investable renewable energy sector.

What Is the Floating Solar Panels Market?

The floating solar panels market covers all technologies, products, and services involved in deploying photovoltaic panels on floating platforms over water bodies instead of land. It encompasses PV modules, floating platforms, mooring systems, inverters, underwater cables, and balance-of-system components. These installations vary from small rural reservoirs and water tanks to massive utility-scale floating solar farms spanning hundreds of megawatts. The market includes equipment manufacturers, EPC (engineering, procurement, construction) contractors, O&M service providers, and financiers involved in developing and maintaining FPV installations.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2580

Why Floating Solar Panels Are Important

Floating solar systems address one of the biggest challenges in renewable deployment—land scarcity. By utilizing water surfaces such as reservoirs, irrigation ponds, or hydropower lakes, FPV allows for solar energy generation without competing for agricultural or urban land. The cooler ambient temperatures above water enhance PV module efficiency, leading to higher power output. Additionally, the panels act as a shade, reducing evaporation losses and limiting algal growth, providing dual benefits for water resource management. In hydropower plants, co-locating floating solar installations maximizes asset utilization and balances generation during dry or low-flow periods. For governments, FPV represents a sustainable, space-efficient approach to expanding renewable capacity, while investors benefit from attractive returns supported by stable policy frameworks.

Floating Solar Panels Market Top Companies

KYOCERA Corporation

Specialization: Kyocera is a diversified Japanese electronics and industrial conglomerate with a strong presence in solar technology. It was one of the first major players to develop floating solar farms.

Key Focus Areas: Utility-scale floating PV projects, durable float design, and resilient energy solutions for Japan’s climate conditions.

Notable Features: Kyocera’s Yamakura Dam floating solar power plant (13.7 MW) was among the world’s largest when commissioned, showcasing the long-term reliability of FPV technology in harsh weather.

2024 Revenue: Approximately USD 13.3 billion (company-wide).

Market Share: Recognized as a pioneer and leader in Japan’s floating solar segment.

Global Presence: Operates across Asia, North America, and Europe, with solar projects in over 20 countries.

Trina Solar

Specialization: Trina Solar is a global leader in PV manufacturing, known for high-efficiency modules and smart solar solutions. The company supplies panels and integrated systems for both land-based and floating solar farms.

Key Focus Areas: Utility-scale PV systems, storage integration, and digital energy platforms.

Notable Features: Trina’s modules are widely used in floating projects worldwide due to their high conversion efficiency and durability.

2024 Revenue: Around USD 16 billion in 2023 and USD 6 billion in the first half of 2024.

Market Share: One of the largest global module suppliers, with strong market influence in FPV component supply.

Global Presence: Operations in over 100 countries, with strong markets in Asia, Europe, and the Americas.

Yellow Tropus Pvt. Ltd

Specialization: Yellow Tropus is an Indian engineering and renewable energy company involved in solar EPC services, including floating solar installations.

Key Focus Areas: Mid-scale floating solar projects, customized engineering, and local project deployment.

Notable Features: Known for project design and construction expertise tailored to India’s climatic and regulatory conditions.

2024 Revenue: Not publicly disclosed (privately held company).

Market Share: Focused primarily on India’s emerging FPV segment.

Global Presence: Domestic operations with project capabilities across several Indian states.

Wuxi Suntech Power Co., Ltd.

Specialization: Suntech is a renowned Chinese PV module manufacturer with decades of experience in solar cell and panel production. The company provides modules for both land-based and floating solar farms.

Key Focus Areas: High-efficiency PV modules, FPV-compatible systems, and international export markets.

Notable Features: Suntech’s panels are designed for high durability in humid and aquatic environments, ideal for floating applications.

2024 Revenue: Estimated around USD 45 million for listed entities; larger group revenue may vary depending on subsidiary structure.

Market Share: Moderate, primarily as a module supplier to FPV developers in Asia.

Global Presence: Broad international network spanning Asia, Europe, and emerging markets.

Yingli Solar

Specialization: Yingli Solar (Yingli Green Energy) is one of China’s largest solar manufacturers, active in module production and solar farm development.

Key Focus Areas: Utility-scale solar systems, module innovation, and renewable project development.

Notable Features: Involved in several Chinese floating solar pilot projects, particularly on former coal-mining lakes.

2024 Revenue: Approximately 1.8 billion RMB (varies by entity within the Yingli group).

Market Share: Strong presence in China’s solar manufacturing ecosystem, with growing FPV participation.

Global Presence: Active in over 90 countries, with a strong domestic base in China.

Leading Trends and Their Impact

1. Hybridization with Hydropower and Energy Storage

Pairing floating solar with hydropower reservoirs enables shared infrastructure such as transmission lines and substations, reducing costs. It also balances seasonal water flow variability, providing consistent renewable output. Adding battery energy storage further enhances grid reliability.

2. Material and Design Innovation

New float materials, double-glass modules, and corrosion-resistant anchoring systems have improved FPV durability and performance. These innovations lower maintenance costs and increase lifespan, making projects more financially viable.

3. Land-Use Optimization

Countries facing land constraints view FPV as an effective solution. By deploying solar on existing water bodies, governments and utilities can expand capacity without displacing agricultural or urban land, which accelerates permitting and community acceptance.

4. Policy and Regulatory Support

Governments worldwide are incorporating FPV into renewable energy roadmaps. Early adopters like Japan and India have established clear guidelines, while others, including China and European nations, are crafting frameworks for environmental and safety compliance.

5. Financing and Business Models

FPV’s growing maturity has attracted investors and green finance institutions. Independent power producers, water utilities, and public-private partnerships are increasingly driving large-scale FPV development, supported by long-term power purchase agreements (PPAs).

Successful Examples Around the World

Yamakura Dam, Japan

Developed by Kyocera TCL Solar, the 13.7 MW Yamakura Dam project is one of the world’s first large-scale floating solar plants. It has proven durable against typhoons while improving reservoir water quality and reducing evaporation.

China’s Large Reservoir FPV Projects

China leads the world in FPV capacity with dozens of installations across Anhui, Zhejiang, and Shandong provinces. Many of these projects are built on reclaimed mining lakes or hydropower reservoirs, demonstrating large-scale scalability.

India’s Reservoir-Based FPV Projects

India’s renewable expansion strategy includes FPV installations on irrigation tanks and dams. Projects in states like Odisha, Maharashtra, and Andhra Pradesh are helping utilities meet renewable purchase obligations while conserving water resources.

Europe’s Water Utility Pilots

Countries such as the United Kingdom, France, and the Netherlands have developed FPV systems on reservoirs and water treatment plants. These projects highlight environmental co-benefits, including lower evaporation and limited visual impact compared to land-based systems.

Southeast Asia and Emerging Regions

Thailand, Indonesia, and Vietnam have embraced FPV as part of broader clean energy plans. The Sirindhorn Dam project in Thailand, one of the largest hybrid hydro-solar plants globally, demonstrates the economic and technical advantages of co-located FPV installations.

Global Regional Analysis and Government Initiatives

Asia-Pacific

This region dominates global FPV deployment.

- China: Provincial governments are promoting FPV to optimize water resource use and expand renewable generation without consuming land. Pilot programs include incentives for nearshore ocean FPV projects.

- Japan: Strong governmental support and established standards for floating solar design have encouraged municipal and private sector adoption.

- India: The Ministry of New and Renewable Energy (MNRE) supports FPV projects through policy frameworks, tenders, and viability gap funding. Multiple state-level agencies are collaborating to allocate reservoirs and irrigation tanks for FPV development.

- Southeast Asia: Thailand’s Electricity Generating Authority (EGAT) is pursuing multiple hydro-FPV hybrid projects, while Vietnam and Indonesia are preparing guidelines for large-scale installations.

Europe

European countries are integrating FPV into renewable expansion plans, emphasizing environmental sustainability.

- The United Kingdom’s solar strategy encourages water utilities to adopt FPV systems.

- The Netherlands has piloted projects on inland lakes, emphasizing innovation in mooring and environmental monitoring.

- France and Germany are including FPV within renewable auction schemes, incentivizing innovation and biodiversity protection.

North America

The United States is gradually adopting FPV, mainly at municipal and industrial water bodies. State and utility-level initiatives are driving small and mid-scale deployments. The U.S. Bureau of Reclamation and Department of Energy are studying FPV’s feasibility on federal reservoirs, potentially unlocking future capacity.

Latin America

Countries like Brazil and Chile are exploring FPV integration with hydropower facilities. Large water reservoirs used for hydroelectric generation provide a natural platform for co-located solar systems, offering increased generation without additional land use.

Middle East and Africa

Regions with high solar irradiation and water scarcity, such as the UAE, Egypt, and South Africa, view FPV as a dual-purpose solution for energy generation and water conservation. Pilot programs supported by international financial institutions are paving the way for broader adoption.

Policy and Permitting Frameworks

- Water Resource Coordination: Successful FPV deployment depends on collaboration between energy ministries, water management authorities, and local governments. Clear protocols for reservoir usage rights are essential.

- Environmental Safeguards: Most countries require environmental impact assessments to ensure minimal disruption to aquatic ecosystems. Limitations are often placed on the percentage of reservoir coverage allowed.

- Grid Integration: Policymakers are improving clarity on FPV’s inclusion in renewable tenders and capacity auctions. Streamlined interconnection rules reduce project delays.

- Standardization: International bodies such as the IEC are developing technical standards for FPV components and safety, enhancing investor confidence and global scalability.

The Future of Floating Solar

Floating solar panels are transitioning from a niche innovation to a mainstream renewable energy solution. As technology improves and costs continue to decline, FPV will likely play a central role in helping nations achieve net-zero emissions targets while optimizing their land and water resources. The combination of sustainable energy generation, water conservation, and grid flexibility makes FPV one of the most promising renewable technologies of the next decade.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Single-Use Bioprocessing Market Growth Drivers, Trends, Key Players and Regional Insights by 2034