Extended Reality Market Trends, Growth Drivers and Leading Companies 2024

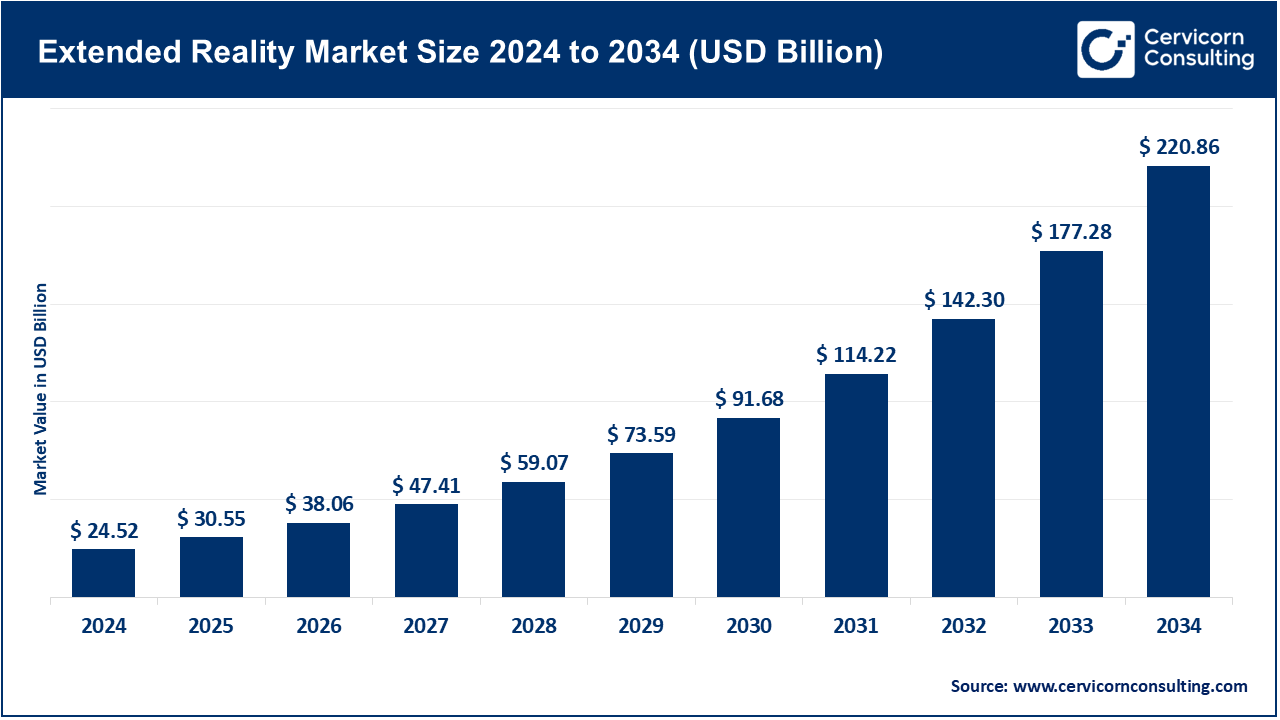

Extended Reality Market Size

What is the Extended Reality Market?

Extended Reality (XR) is a collective term for Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR). It refers to technologies that merge physical and digital environments, enabling immersive, spatial, and interactive experiences. XR applications range from fully virtual gaming environments to augmented overlays that assist technicians during machine maintenance, as well as mixed-reality platforms for collaborative holographic meetings. The XR market covers hardware (headsets, smart glasses, sensors), software (platforms, SDKs, and content creation tools), services (enterprise deployment, integration, and training), and enabling infrastructure (cloud computing, 5G, and spatial mapping technologies).

Extended Reality Market Growth Factors

The XR market is growing rapidly due to multiple drivers: improved hardware performance with lighter headsets and high-resolution displays, declining device costs, and better developer ecosystems. Enterprise adoption in healthcare, logistics, training, and manufacturing is rising as XR reduces errors and accelerates learning. The convergence of 5G and cloud rendering minimizes latency, enhancing real-time experiences. Strong investments from major technology companies expand developer ecosystems and push XR adoption forward. Additionally, governments are supporting XR within digital transformation and Industry 4.0 programs, while new business models like XR-as-a-Service and subscription-based virtual commerce improve accessibility and ROI. Collectively, these technological, economic, and policy forces are shaping a strong growth trajectory for the global XR market.

Why the Extended Reality Market is Important

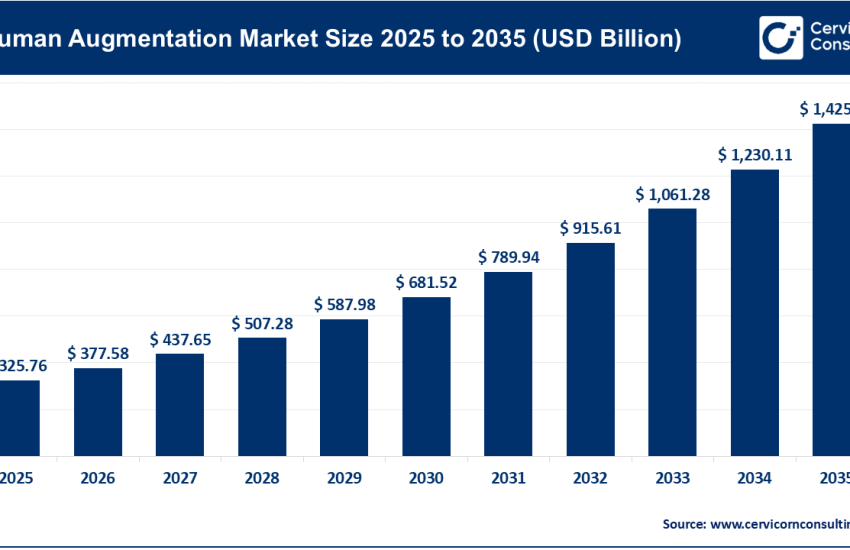

Extended Reality is not just about entertainment—it is reshaping the way individuals and businesses interact with digital information. XR can streamline design and prototyping, reduce training costs, and improve operational accuracy in industries such as healthcare, manufacturing, and logistics. For consumers, XR enhances gaming, shopping, and communication with immersive experiences. Beyond these applications, XR is also considered a critical stepping stone toward the future of spatial computing, where humans and AI agents collaborate within blended physical-digital environments. This makes XR a foundational technology with long-term strategic significance.

Top Companies in the Extended Reality Market

Accenture

Specialization: Consulting and enterprise XR deployment.

Key Focus Areas: XR strategy, integration, training, and large-scale adoption projects.

Notable Features: Industry-specific accelerators, global consulting expertise, ability to combine XR with cloud and AI for digital transformation.

2024 Revenue: Approximately USD 65 billion.

Market Position: A leader in XR services and enterprise integration.

Global Presence: Worldwide delivery centers and operations supporting clients in North America, Europe, and Asia-Pacific.

Apple Inc.

Specialization: Consumer and enterprise XR hardware and ecosystem services.

Key Focus Areas: Premium XR experiences through the Apple Vision Pro, developer ecosystem integration, and spatial computing.

Notable Features: Hardware-software synergy, premium device quality, seamless integration across Apple products, and a strong developer ecosystem.

2024 Revenue: Approximately USD 391 billion.

Market Position: A premium device leader influencing standards in spatial computing.

Global Presence: Strong global presence with major markets in North America, Europe, and Asia-Pacific.

Google (Alphabet Inc.)

Specialization: AR platforms and developer tools, cloud infrastructure for XR.

Key Focus Areas: ARCore for Android devices, AR integration into Google services like Maps and Search, and spatial computing research.

Notable Features: Wide reach via Android, advanced computer vision and AI, and extensive cloud services for XR backends.

2024 Revenue: Approximately USD 350 billion.

Market Position: A critical enabler of mobile AR, particularly through ARCore and Android ecosystem.

Global Presence: Global reach via Android, Google Cloud, and a large developer ecosystem.

HTC Corporation

Specialization: VR hardware and enterprise XR solutions.

Key Focus Areas: Vive VR headsets, enterprise services through Vive Business, and high-performance immersive experiences.

Notable Features: Modular headset designs, strong reputation in professional and enterprise VR segments, early leadership in VR innovation.

2024 Revenue: Approximately NT$ 3.08 billion.

Market Position: A niche but influential VR hardware player, particularly in enterprise and professional markets.

Global Presence: Headquartered in Taiwan with strong markets in Asia, North America, and Europe.

Meta Platforms, Inc.

Specialization: Consumer and enterprise XR hardware and platform development.

Key Focus Areas: Meta Quest line of headsets, Reality Labs R&D, and social XR experiences.

Notable Features: Market-leading consumer VR headset shipments, strong ecosystem with developer and content support, and significant investments in long-term XR research.

2024 Revenue: Approximately USD 164.5 billion.

Market Position: Leading in consumer VR adoption and a major driver of XR ecosystem development.

Global Presence: Worldwide distribution with a strong base in North America, Europe, and expanding into Asia-Pacific.

Leading Trends and Their Impact

- AI + XR Convergence: Integrating generative AI with XR enhances content creation, contextual overlays, and intelligent assistants. This reduces costs and speeds up enterprise adoption.

- Affordable Headsets and Device Diversification: With new models across consumer and enterprise segments, XR hardware is becoming more accessible, widening the market.

- Enterprise XR Adoption: Sectors such as healthcare, automotive, and manufacturing are moving from pilot programs to full-scale deployments.

- Cloud Rendering and 5G Networks: These technologies reduce latency and hardware requirements, making XR devices lighter, more affordable, and more capable.

- Content Ecosystems: XR app marketplaces and social platforms strengthen developer and user engagement, reinforcing network effects.

- Privacy and Regulation: Spatial data collection raises privacy concerns, leading to stronger compliance requirements that shape procurement.

- Standards and Interoperability: Industry efforts to standardize XR formats make experiences more cross-platform, reducing vendor lock-in.

Successful XR Examples Around the World

- Healthcare: Hospitals use VR for surgical training and AR for remote guidance, reducing error rates and improving skill development.

- Manufacturing: AR headsets assist technicians in assembly lines, cutting downtime and errors. German and Japanese firms have integrated AR into Industry 4.0 programs.

- Education: Universities and museums in Europe and Australia use XR to bring history and science to life with immersive exhibits.

- Retail: AR-powered “try-before-you-buy” apps are used by global retailers to reduce returns and increase customer satisfaction.

- Entertainment: Virtual concerts, gaming, and social VR platforms demonstrate new monetization models for creators.

These examples illustrate how XR is delivering measurable impact across industries.

Regional Analysis — Government Initiatives and Policies

North America

North America is the largest XR market, led by the United States, where major tech companies and startups drive innovation. Government investments in defense, healthcare, and workforce training programs accelerate enterprise adoption. Policies also emphasize privacy and safety standards for XR data.

Europe

The European Union promotes XR through digital transformation and Industry 4.0 strategies. Strict data privacy regulations like GDPR shape XR adoption. Countries like Germany, France, and the Nordics invest heavily in XR for healthcare, manufacturing, and education.

Asia-Pacific

Asia-Pacific is experiencing strong growth in XR adoption, with China, Japan, and South Korea leading device development and enterprise deployment. China dominates consumer AR applications, while Japan and Korea focus on industrial uses. India is emerging as a fast-growing XR developer hub.

Middle East and Africa

MEA countries are using XR in smart city projects, oil and gas industries, and government-led education initiatives. Adoption remains at a slower pace compared to other regions, but targeted public-sector investment is rising.

Latin America

XR adoption is expanding in education and training, although economic constraints limit large-scale deployments. Brazil and Mexico are emerging markets for XR pilots in retail and healthcare.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Polyethylene Glycol (PEG) Market Revenue, Global Presence, and Strategic Insights by 2034