Epoxy Resin Market Growth Drivers, Key Companies, Trends and Regional Insights by 2034

Epoxy Resin Market Size

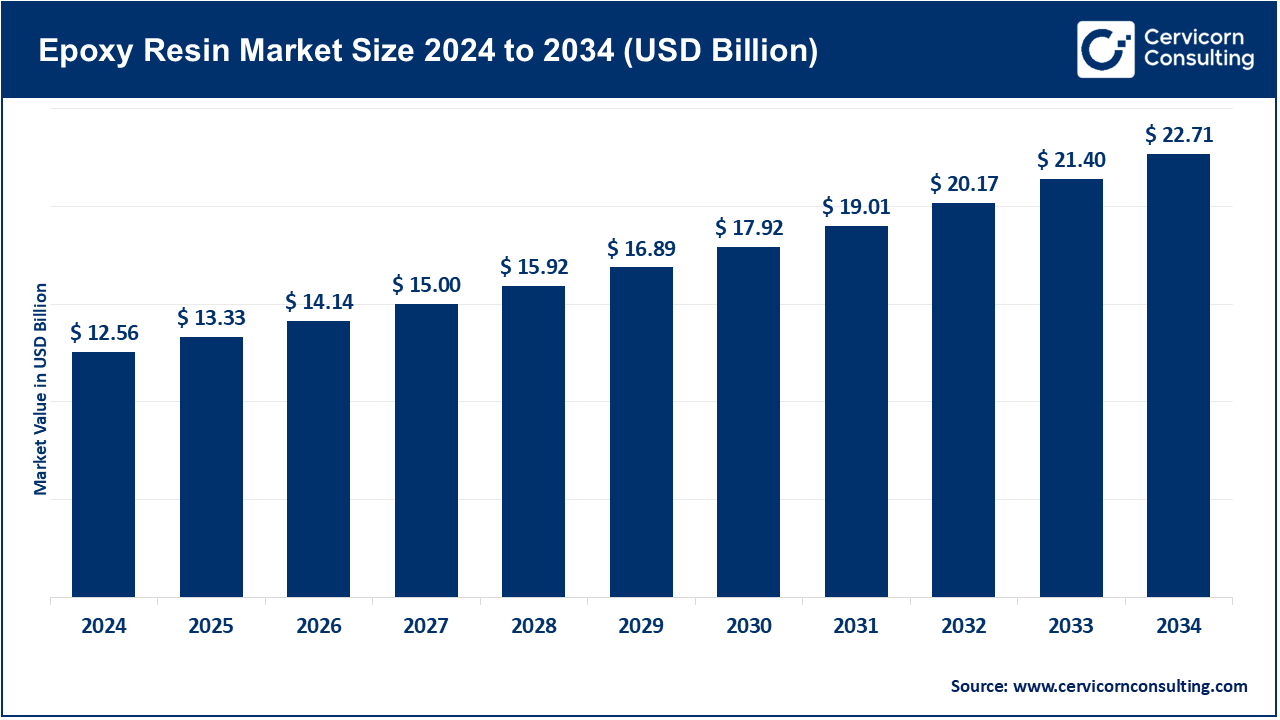

The global epoxy resin market size was worth USD 12.56 billion in 2024 and is anticipated to expand to around USD 22.71 billion by 2034, registering a compound annual growth rate (CAGR) of 6.1% from 2025 to 2034.

Epoxy Resin Market Growth Factors

The epoxy resin market is being driven by a mix of demand-side and supply-side forces: growing construction and infrastructure projects

(repair, protective coatings and civil composites), rapid expansion of wind-turbine blade manufacturing and other renewable-energy

applications, rising consumption in electronics and semiconductor packaging where epoxy’s thermal/electrical properties are essential,

and increased use in automotive lightweighting and advanced composites. On the supply side, improving production capacities in Asia,

strategic mergers and acquisitions bringing scale to specialty epoxy operations, and research into bio-based and low-VOC formulations

are accelerating uptake — while price volatility of feedstocks (bisphenol A, epichlorohydrin), regulations on hazardous intermediates,

and customer preference for sustainable chemistries are simultaneously reshaping product portfolios and route-to-market decisions.

What is the epoxy resin market?

The epoxy resin market covers producers and suppliers of epoxy monomers and prepolymers, formulated epoxy systems, and value-added cured

systems sold into end-use markets such as coatings, adhesives, composites, electrical/electronics encapsulation, flooring, tooling, and

laminates. Market measurement can be reported either by revenue (USD) or by tonnage (metric tons) and is segmented by product type

(bisphenol-A epoxy, novolac, aliphatic, cycloaliphatic, glycidyl amine resins), by application, and by geography. Recent industry

reports put the global market in the low-to-mid-teens billion USD range (2023–2025 baseline) with steady mid-single-digit to ~6% CAGR

forecasts to the end of the decade — projections vary by methodology, but the consensus is steady growth tied to electrification, renewable

energy, and industrial rebuilding.

Why is epoxy important?

Epoxy resins are prized because they combine excellent mechanical strength, adhesive performance, chemical and heat resistance, and

electrical insulation. That makes them uniquely suited for:

- Durable protective coatings (bridges, storage tanks)

- Structural composites (wind blades, aerospace and automotive parts)

- High-reliability electronic encapsulation (PCB laminates, underfills, potting)

- High-grade adhesives used in demanding bonding applications

Their performance-to-weight advantages are central to decarbonization strategies (lighter vehicles and longer, stronger wind blades),

while their electrical and thermal properties are critical to the miniaturization and reliability of modern electronics. In short: epoxy

is often the enabler material — invisible in the final product but critical to performance, longevity, and safety.

Epoxy Resin Market — Top Companies (profiles)

Olin Corporation

Specialization: Chlor-alkali chemicals, vinyls and a dedicated Epoxy business supplying base epoxy resins and formulated epoxy systems.

Key focus areas: Industrial coatings, adhesives, composite and chemical intermediates; sustainability and decarbonization in operations.

Notable features: Reports epoxy as a distinct segment with a global manufacturing footprint and integrated supply.

2024 revenue: Approximately USD 6.5 billion total; epoxy business accounted for roughly 20% of sales.

Market presence: Global operations with strong presence in North America, Europe, and Asia.

DIC Corporation

Specialization: Specialty chemicals, pigments, printing inks, and performance resins including epoxy.

Key focus areas: High-performance coatings, electronic materials, and specialty resin formulations.

Notable features: Large Japan-based R&D and worldwide production.

2024 revenue: Around JPY 1,071.1 billion (currency conversion affects USD equivalent).

Market presence: Strong presence in Asia with global outreach.

China Petrochemical & Chemical Corporation (Sinopec)

Specialization: Integrated oil, gas, and chemicals with substantial epoxy-related intermediates.

Key focus areas: Feedstock integration, large-scale chemicals production, downstream specialty chemicals.

Notable features: Key influencer of feedstock pricing and supply in Asia.

2024 revenue: Multi-hundred-billion RMB revenues across operations.

Market presence: Dominant in China, strong export capabilities.

Nan Ya Plastics Corporation

Specialization: Broad polymer and chemical portfolio including epoxy resins.

Key focus areas: Electronics materials, industrial resins, packaging, and integrated petrochemicals.

Notable features: Part of Formosa Plastics Group; vertically integrated.

2024 revenue: Multi-billion USD scale based on group reporting.

Market presence: Major supplier across Asia with export reach.

Hexion Inc. (now Westlake Epoxy)

Specialization: Thermoset resins (epoxy, phenolic) before acquisition by Westlake.

Key focus areas: Specialty resins for composites, coatings, adhesives.

Notable features: Acquisition strengthened Westlake’s epoxy capabilities.

2024 revenue: Westlake reported USD 12.1 billion consolidated; epoxy segment historically worth ~USD 1.5 billion.

Market presence: Strong in Europe, North America, and Asia.

Leading trends and their impact

- Renewables & wind-blade composites: Rising demand for high-performance epoxy systems for longer, more efficient wind blades is spurring investment in R&D and manufacturing scale.

- Electrification and electronics miniaturization: Growth in EV battery systems and semiconductor packaging is pushing demand for advanced epoxy encapsulants with enhanced properties.

- Sustainability & bio-based epoxies: Regulatory and consumer pressures are accelerating the shift toward low-VOC, bio-derived epoxy chemistries.

- Consolidation & vertical integration: Strategic acquisitions and integration are strengthening supply chain control and global service capabilities.

- Regulation & feedstock volatility: Price swings for bisphenol-A and epichlorohydrin and environmental compliance costs are influencing supplier strategies.

Impact: These forces are driving the industry toward specialty, higher-margin products and innovation-led competition.

Successful examples of epoxy resin use worldwide

- Wind energy blades: Europe and China lead in producing epoxy-based composite blades, enhancing efficiency and lifespan.

- Electronics encapsulation: East Asian manufacturers use epoxy underfills and potting compounds to improve chip reliability and thermal management.

- Bridge and infrastructure coatings: Protective epoxy coatings extend the life of steel and concrete in North America and Europe.

- Aerospace & automotive composites: Epoxy matrix resins reduce weight and improve strength in high-performance transport applications.

Global Regional Analysis — Government Initiatives and Policies

Asia-Pacific

Asia-Pacific is the largest demand hub due to industrialization, electronics manufacturing, and wind energy projects. China’s renewable energy

expansion and industrial incentives are fueling epoxy demand; local production expansions and policy support for domestic chemical capacity

also shape supply dynamics.

North America

Infrastructure bills and EV incentives increase epoxy usage in construction and transportation. Regulatory oversight under updated chemical

frameworks and state laws pushes suppliers to develop sustainable formulations and invest in compliance.

Europe

Offshore wind investments and strict chemical regulation are shaping epoxy innovation toward eco-friendly alternatives. Green transition policies

promote lightweight composites in transport and sustainable construction materials.

Latin America, Middle East & Africa

Demand is driven by infrastructure and industrial growth. Government-backed projects create regional opportunities, though large-scale

production capacity remains concentrated in Asia, Europe and North America.

Notes on market sizing and capacity

Market research houses report global epoxy resin market values in the low-to-mid-teens billion USD in the 2023–2025 period, with forecasts

toward the low-to-mid-20s billion by around 2030–2034 depending on methodology; tonnage forecasts predict mid-single-digit CAGR growth,

with a noticeable swing toward specialty and bio-based segments. These metrics underscore a stable, industrially critical market rather than

a hyper-volatile commodity.

Practical implications for suppliers, buyers and investors

- Suppliers: Prioritize application engineering capabilities (wind, electronics, coatings), sustainability roadmaps (bio-alternatives, low VOC), and supply-chain resilience for feedstocks.

- Buyers (OEMs & fabricators): Favor suppliers who guarantee quality, consistency and regulatory compliance across regions and who offer product support for scaling production.

- Investors: Opportunities exist in specialty resin producers, value-added formulators, and players enabling sustainable chemistries; consolidation highlights strategic value in acquiring technical portfolios and global footprint.