Enterprise Artificial Intelligence Market Key Players, Trends, and Regional Insights by 2034

Enterprise Artificial Intelligence Market Size

Enterprise AI Market — Growth Factors

The enterprise AI market is expanding rapidly due to converging trends: enterprises are collecting exponentially more data and require

AI to derive timely insights; cloud and AI-as-a-service models lower adoption barriers, enabling companies of all sizes to experiment

and scale; the arrival of foundation models and generative AI drives demand for verticalized and fine-tuned solutions; improvements in

AI-optimized hardware (GPUs, TPUs, and custom accelerators) make large-scale training and inference more accessible; regulatory and

sustainability programs encourage AI applications for compliance, risk management, and energy optimization; and intense vendor investment,

partnerships, and M&A activity are consolidating capabilities—together producing strong double-digit compound annual growth expectations

in many market studies and pushing AI from pilots into mission-critical enterprise systems.

What is the Enterprise AI Market?

The enterprise AI market consists of platforms, software, services, and hardware sold to corporate customers to build, deploy, and

operate AI systems. Key components include: enterprise AI platforms (development and orchestration), pre-built AI applications (vertical

solutions for finance, healthcare, retail, manufacturing), AI infrastructure (on-prem servers, cloud GPUs, hybrid solutions), consulting

and systems integration services, and model monitoring and governance tools (MLOps). Deployment models vary — public cloud, private

cloud, on-premises, and hybrid/edge — depending on data privacy, latency, and regulatory requirements. Buyers range from small teams

using AutoML tools to global enterprises integrating custom foundation models into core product lines.

Why Enterprise AI Matters

Enterprise AI transforms how organizations operate and compete. It enables automation of repetitive processes, improves forecasting and

planning through predictive analytics, personalizes customer interactions at scale, and enhances decision-making with prescriptive insights.

Beyond operational efficiency, AI enables new product capabilities (intelligent assistants, automated document processing, anomaly detection)

and can unlock revenue through better customer segmentation and dynamic pricing. Importantly, enterprise AI helps organizations manage risk,

detect fraud, comply with regulations, and optimize resource use—making it a strategic enabler for both growth and resilience.

Enterprise Artificial Intelligence Market Top Companies

Below are concise profiles of five leading firms active in enterprise AI, focusing on specialization, strategic priorities, distinguishing features,

2024 financial context (where public), market footprint, and relevance to enterprise deployments.

Alphabet Inc. (Google Cloud & Google AI)

- Specialization: Cloud infrastructure, platform AI services, large-scale foundation models and multimodal AI.

- Key Focus Areas: Scalable AI services for enterprises, multimodal models, AI-enhanced search and knowledge management, and industry solutions for healthcare, media, and finance.

- Notable Features: Extensive global data center footprint, leading research labs, strong developer ecosystems, and integrated AI tooling that spans managed services and APIs.

- 2024 Context: Google Cloud continued to expand AI-enabled services and infrastructure investments; overall Alphabet investment and capital spend on cloud and AI infrastructure remained a major corporate priority in 2024.

- Global Presence: Worldwide — strong in North America, Europe, and Asia-Pacific with a growing enterprise customer base.

Amazon Web Services (AWS)

- Specialization: Cloud infrastructure and AI-as-a-service with broad enterprise integration.

- Key Focus Areas: Managed AI services, generative AI features embedded in cloud offerings, high-scale model hosting, and industry partnerships.

- Notable Features: Largest global cloud footprint, rich catalog of AI services and managed tooling, and deep enterprise relationships across verticals.

- 2024 Context: AWS sustained strong enterprise revenues and continued to expand AI-specific services and custom silicon partnerships for optimized inference.

- Global Presence: Extensive global coverage with data centers and availability zones across continents, strong enterprise adoption.

C3.ai, Inc.

- Specialization: Enterprise AI applications and platform for complex, industry-specific use cases (energy, utilities, manufacturing, defense).

- Key Focus Areas: Subscription-based SaaS solutions, federated deployments, rapid verticalization of AI, and large-scale systems integration for enterprise clients.

- Notable Features: Strong focus on enterprise-grade security and scalability, significant presence in government and regulated industries, and a business model with a high subscription revenue mix.

- 2024 Revenue: C3.ai reported continued year-over-year subscription growth and expanded enterprise deployments during 2024.

- Global Presence: North America and international partnerships; recognized in sectors that require hardened, compliant AI solutions.

DataRobot, Inc.

- Specialization: Automated machine learning (AutoML), MLOps, and end-to-end model lifecycle management for enterprises.

- Key Focus Areas: Democratizing AI for business users, model explainability and governance, rapid model deployment, and operationalization of analytics at scale.

- Notable Features: Strong product emphasis on model transparency, business-focused tooling, and integrations with major cloud platforms and data sources.

- 2024 Revenue: Privately held with selective public disclosures; recognized as a leading AutoML and MLOps vendor in enterprise rankings.

- Global Presence: Global client base spanning finance, healthcare, retail, and manufacturing.

Hewlett Packard Enterprise (HPE)

- Specialization: AI-optimized hardware, hybrid cloud offerings, and enterprise IT infrastructure.

- Key Focus Areas: AI servers and appliances, GreenLake hybrid cloud consumption model, and partnerships for AI software stacks.

- Notable Features: Provides turnkey infrastructure for latency-sensitive workloads, strong channel partnerships, and a focus on sovereign and regulated deployments.

- 2024 Revenue: HPE reported significant enterprise revenue driven by infrastructure sales, with AI systems a fast-growing sub-segment.

- Global Presence: Strong enterprise footprint globally, with particular strength in hybrid deployment scenarios.

Leading Trends and Their Impact

- Foundation Models & Generative AI: Enterprises adopt and fine-tune large multimodal models for domain-specific use cases, accelerating investment in model governance and customization.

- AI-as-a-Service & Cloud Adoption: Managed services and cloud-native AI make it easier for organizations to pilot and scale AI without heavy up-front infrastructure costs.

- AutoML & MLOps: Tools that automate model building, validation, deployment, and monitoring reduce time-to-value and democratize model development across business teams.

- Hybrid & Edge AI: Data sovereignty, latency, and regulatory constraints make hybrid and edge deployments critical in finance, healthcare, and manufacturing.

- Responsible & Explainable AI: Regulatory scrutiny and ethical imperatives push enterprises to incorporate transparency, bias mitigation, and auditability into AI lifecycles.

- AI-Optimized Hardware: Demand for GPUs, accelerators, and AI servers grows as inference and training workloads become central to enterprise compute plans.

Impact Summary: These trends collectively move enterprise AI from experimental pilots to embedded capabilities in core operations, rewarding vendors that combine robust infrastructure, sector expertise, governance tooling, and flexible deployment options.

Successful Examples of Enterprise AI Around the World

- Government Modernization: Enterprise AI platforms have been used to automate logistics, supply chain visibility, and predictive maintenance in government agencies and defense contractors.

- Financial Services: Banks and insurance firms use AI for fraud detection, risk scoring, customer personalization, and claims automation, improving both cost efficiency and customer experience.

- Healthcare: Hospitals and life sciences companies deploy AI for medical imaging analysis, demand forecasting, clinical trial matching, and operational optimization.

- Manufacturing & Energy: Predictive maintenance, yield optimization, and energy usage optimization have delivered measurable savings and uptime improvements in factories and utilities.

- Retail & E-commerce: Recommendation engines, inventory optimization, demand forecasting, and dynamic pricing powered by enterprise AI boost revenue and margin.

Enterprise Artificial Intelligence Market Regional Analysis

North America

North America remains a leading adopter of enterprise AI, driven by private-sector R&D, venture investment, and public initiatives. Government programs fund AI research, infrastructure, and workforce development, while enterprise procurement prioritizes secure, auditable AI systems. State and federal discussions on AI governance influence corporate compliance strategies.

Europe

Europe emphasizes responsible and regulated AI. Policy frameworks and funding mechanisms encourage trustworthy AI, data protection, and investments in AI infrastructure. Enterprises operating in Europe are increasingly prioritizing explainability, privacy-by-design, and compliance with regional standards, which shapes vendor roadmaps and product features.

Asia-Pacific

Asia-Pacific exhibits fast-growing enterprise AI adoption, driven by large-scale digital transformation in China, India, South Korea, Japan, and Southeast Asia. National AI strategies, public-private partnerships, and heavy investment in cloud and semiconductor capabilities accelerate enterprise implementation. India and several ASEAN nations also prioritize AI for public services and inclusion programs.

Latin America

Latin America is an emerging market for enterprise AI with rapid adoption in banking, telecom, and retail. Regional initiatives focus on digital transformation, with governments and large enterprises investing in AI pilots for public health, fiscal transparency, and service delivery improvement.

Middle East & Africa

The Middle East has prioritized national AI strategies and sovereign cloud infrastructures, while parts of Africa are leapfrogging with AI-enabled solutions for mobile finance, agriculture, and public services. Investment in data centers and digital skills is rising, creating pockets of rapid enterprise AI adoption.

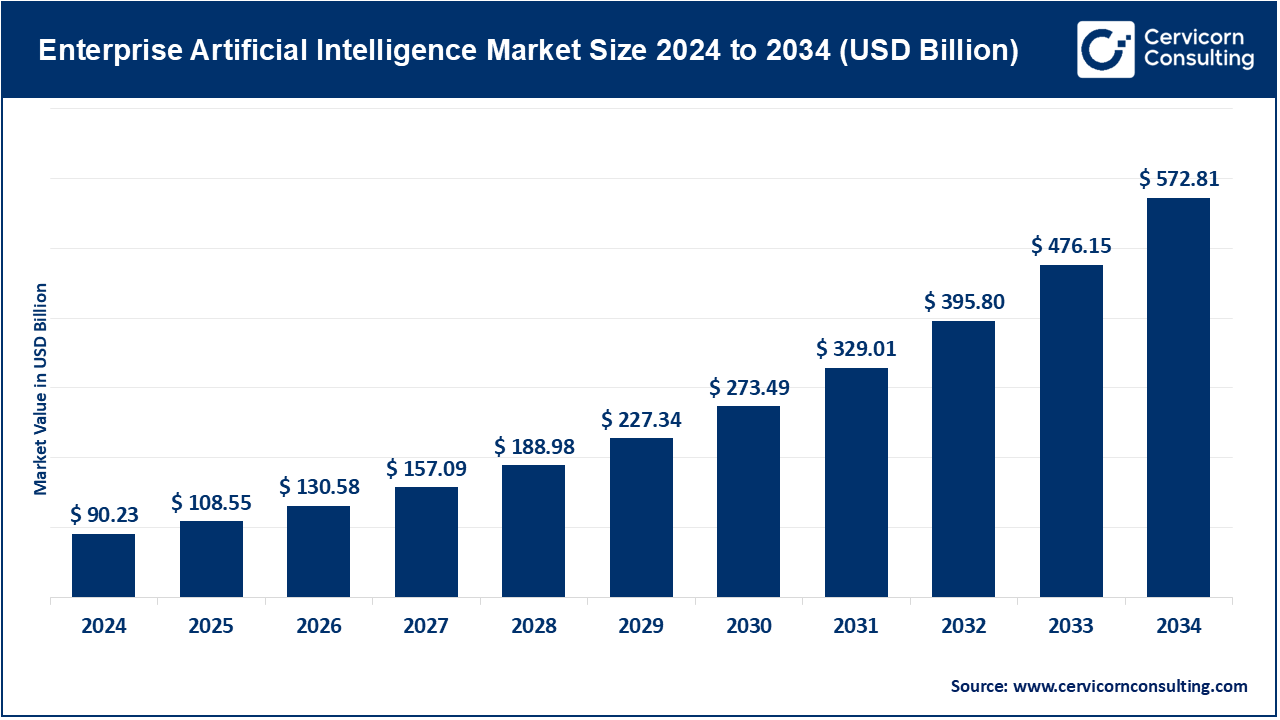

Enterprise Artificial Intelligence Market Investment Context

While estimates vary by source and definition, the enterprise AI market is commonly measured in tens of billions of dollars for 2024, with projections pointing to strong multi-year growth as AI moves into mission-critical enterprise functions. Investment flows include private equity, corporate R&D budgets, cloud provider capital expenditures, and government funding aimed at AI infrastructure, chips, and skills development.

Implications for Stakeholders

- For CIOs & CTOs: Prioritize hybrid architectures, governance frameworks, and vendor ecosystems that support compliance, data locality, and scalable model operations.

- For Vendors: Differentiate through vertical expertise, managed services, explainability tools, and hybrid deployment support.

- For Regulators & Policymakers: Balance innovation with safeguards — adopt standards for auditability, fairness, and data protection while supporting infrastructure investment.

- For Investors: Seek exposure to infrastructure providers, MLOps leaders, vertical AI SaaS vendors, and companies enabling responsible AI and hybrid deployments.