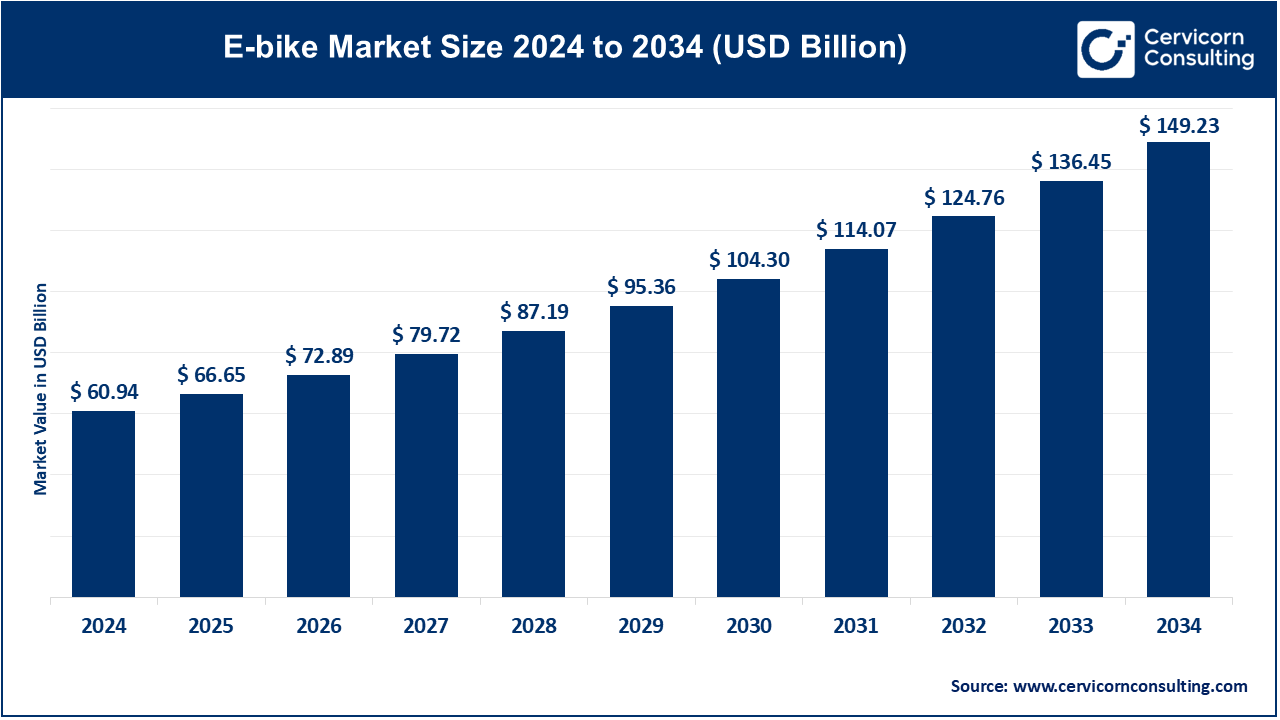

E-Bike Market Size to Hit USD 149.23 Billion by 2034

E-Bike Market Size

The global e-bike market size was worth USD 60.94 billion in 2024 and is anticipated to expand to around USD 149.23 billion by 2034, registering a compound annual growth rate (CAGR) of 9.36% from 2025 to 2034.

What is the E-Bike Market?

The E-bike market refers to the global industry encompassing the manufacturing, sales, and services related to electric bicycles—pedal-powered two-wheelers integrated with an electric motor and battery to assist propulsion. E-bikes are classified into different categories based on their speed capabilities and assistance level, including pedal-assist (pedelecs), throttle-powered, and speed pedelecs. This market also covers the development of related technologies such as battery systems, electric drive units, connectivity modules, and smart mobility applications.

Why is the E-Bike Market Important?

The importance of the E-bike market spans several dimensions—environmental sustainability, urban mobility, health benefits, and economic growth. E-bikes are seen as a sustainable solution to reduce carbon emissions from the transportation sector. They also alleviate urban traffic congestion, provide a viable last-mile transit option, and improve public health by encouraging physical activity. Furthermore, the industry stimulates economic opportunities through jobs in manufacturing, sales, and after-service sectors.

From a macroeconomic standpoint, the E-bike market plays a pivotal role in the transition to green mobility under global climate action frameworks like the Paris Agreement and Net Zero Emissions (NZE) targets. As electric bicycles bridge the gap between traditional bicycles and full-scale electric vehicles, their adoption supports the broader electrification of transport.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2652

E-Bike Market Growth Factors

The E-bike market is driven by a confluence of factors, including growing environmental concerns, rising fuel costs, urbanization, traffic congestion, government incentives for electric mobility, advancements in battery technology, and increasing consumer awareness about health and fitness. Moreover, the integration of IoT and smart features like GPS, theft protection, and mobile connectivity has elevated user experience. Shared micromobility models, particularly in Asia-Pacific and Europe, have boosted demand, while e-commerce platforms and direct-to-consumer strategies are making E-bikes more accessible. These dynamics, coupled with corporate investments and R&D in lightweight materials, drive sustained global market expansion.

Top Companies in the E-Bike Market

1. Giant Manufacturing Co. Ltd.

- Specialization: High-performance electric bicycles across commuter, road, mountain, and urban categories.

- Key Focus Areas: Lightweight frames, integrated motors, proprietary EnergyPak battery systems.

- Notable Features: Hybrid Cycling Technology, SyncDrive motors co-developed with Yamaha.

- 2024 Revenue: Estimated at $3.8 billion (total revenue, ~30% from E-bikes).

- Market Share: ~11% of global E-bike market.

- Global Presence: Over 50 countries across North America, Europe, and Asia-Pacific.

2. Yadea Group Holdings Ltd.

- Specialization: E-scooters and E-bikes focused on mass urban transportation.

- Key Focus Areas: High-volume production, lithium-ion battery innovation, affordable urban mobility.

- Notable Features: Yadea G5 and Y1S Smart E-bikes with mobile app integration and IoT.

- 2024 Revenue: Estimated at $5.6 billion (E-bikes contributing significantly).

- Market Share: ~13% of global E-bike market.

- Global Presence: Strong footprint in China, Southeast Asia, and growing in Europe and Latin America.

3. Pedego Electric Bikes

- Specialization: Premium E-bikes targeted at recreational and lifestyle users.

- Key Focus Areas: Customization, comfort, retro design, and service-oriented retail model.

- Notable Features: Throttle and pedal assist, 5-year warranty, dealer support network.

- 2024 Revenue: Estimated at $120 million.

- Market Share: ~1.2% of North American E-bike market.

- Global Presence: Primarily in the U.S., Canada, and select parts of Europe and Australia.

4. Merida Industry Co. Ltd.

- Specialization: High-performance mountain and commuter E-bikes.

- Key Focus Areas: Lightweight alloy frames, Shimano motor integration, competitive pricing.

- Notable Features: eOne-Sixty and eSpresso series known for reliability and off-road capability.

- 2024 Revenue: Estimated at $1.6 billion (with 20–25% from E-bikes).

- Market Share: ~5% of global E-bike market.

- Global Presence: Strong in Europe, particularly Germany, Austria, and Switzerland.

5. Trek Bicycle Corporation

- Specialization: Advanced technology E-bikes for urban and adventure use.

- Key Focus Areas: Sustainability, connected mobility, safety features, design.

- Notable Features: Bosch-powered motors, integrated lighting, anti-theft systems.

- 2024 Revenue: Estimated at $2.3 billion (with ~$600 million from E-bikes).

- Market Share: ~6% of North American and European market.

- Global Presence: Extensive in U.S., Europe, and expanding in Asia-Pacific.

Leading Trends and Their Impact

1. Battery Innovation and Range Extension

- Impact: Advances in lithium-ion and solid-state batteries have significantly increased range, reduced charging time, and enhanced battery life. This trend directly addresses consumer range anxiety and supports long-distance commuting.

2. Integration of Smart Technologies

- Impact: Features such as mobile app syncing, GPS navigation, theft detection, and real-time analytics are increasingly embedded in E-bikes, offering better user experience and safety.

3. Sustainability and Eco-conscious Consumerism

- Impact: As consumers opt for eco-friendly modes of transport, E-bikes have emerged as the vehicle of choice, pushing manufacturers to adopt recyclable materials and energy-efficient production methods.

4. Shared E-Bike Services

- Impact: The rise of bike-sharing platforms such as Lime, Jump (Uber), and Bolt has increased public access to E-bikes, especially in dense urban environments, boosting market penetration.

5. Modular and Customizable Designs

- Impact: Modular E-bikes allow consumers to add cargo baskets, child seats, or range extenders, making E-bikes more versatile for different lifestyle needs.

Successful E-Bike Market Examples Around the World

Netherlands

- Nearly half of all new bicycles sold are electric, supported by cycling-first infrastructure and favorable tax policies.

- Municipal subsidies and investment in E-bike parking and charging stations drive usage.

Germany

- Germany remains one of the largest E-bike markets in Europe with over 2.1 million units sold in 2023, aided by environmental incentives and a robust cycling culture.

China

- With over 350 million E-bikes in use, China dominates the global E-bike ecosystem.

- Urban air quality regulations and low-cost electric mobility have fueled demand, especially in Tier 1 and Tier 2 cities.

United States

- E-bike sales surged over 70% YoY between 2022 and 2024, largely driven by recreational riders and urban commuters.

- Cities like New York and San Francisco have invested in dedicated E-bike lanes and public subsidy programs.

India

- Though still emerging, India has seen strong growth in tier-1 cities with the adoption of E-bikes as an affordable alternative to motorcycles and cars, especially in delivery logistics.

Global and Regional Analysis with Government Initiatives

North America

- Market Size: USD 6.64 billion (2024).

- Drivers: Government incentives (e.g., California’s E-Bike Affordability Program), increased urban biking infrastructure, and rising fuel prices.

- Key Initiatives: Federal tax credits up to 30% for E-bike purchases, smart city transport plans, and investment in bike lanes.

Europe

- Market Size: USD 18.10 billion (2024).

- Drivers: Environmental goals under the European Green Deal, high fuel costs, and strong cycling culture.

- Policies: E-bike subsidy programs in Germany (€400 per unit), France, and the Netherlands; integration into public transport; VAT exemptions.

Asia-Pacific

- Market Size: USD 36.20 billion (2024), led by China, Japan, and South Korea.

- Drivers: Dense urbanization, government support for electric mobility, rising e-commerce and food delivery sectors.

- Policies: China’s Electric Bicycle Safety Technical Specification (GB 17761-2018) to standardize production, and subsidies under NEV (New Energy Vehicle) initiatives.

Latin America

- Drivers: Growing interest in micro-mobility, low-cost mobility needs, and sustainable tourism.

- Policies: Bogotá’s bicycle-friendly urban planning, Brazil’s import tax reforms on E-bike components.

Middle East & Africa

- Drivers: Rising fuel costs, government vision programs (e.g., Saudi Vision 2030), and expansion of green infrastructure.

- Policies: Pilot E-bike sharing schemes in UAE and Egypt, clean transport subsidies under the Green Middle East Initiative.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Refurbished E-Bike Market Size, Growth Factors, and Global Outlook to 2034