Digital Therapeutics Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

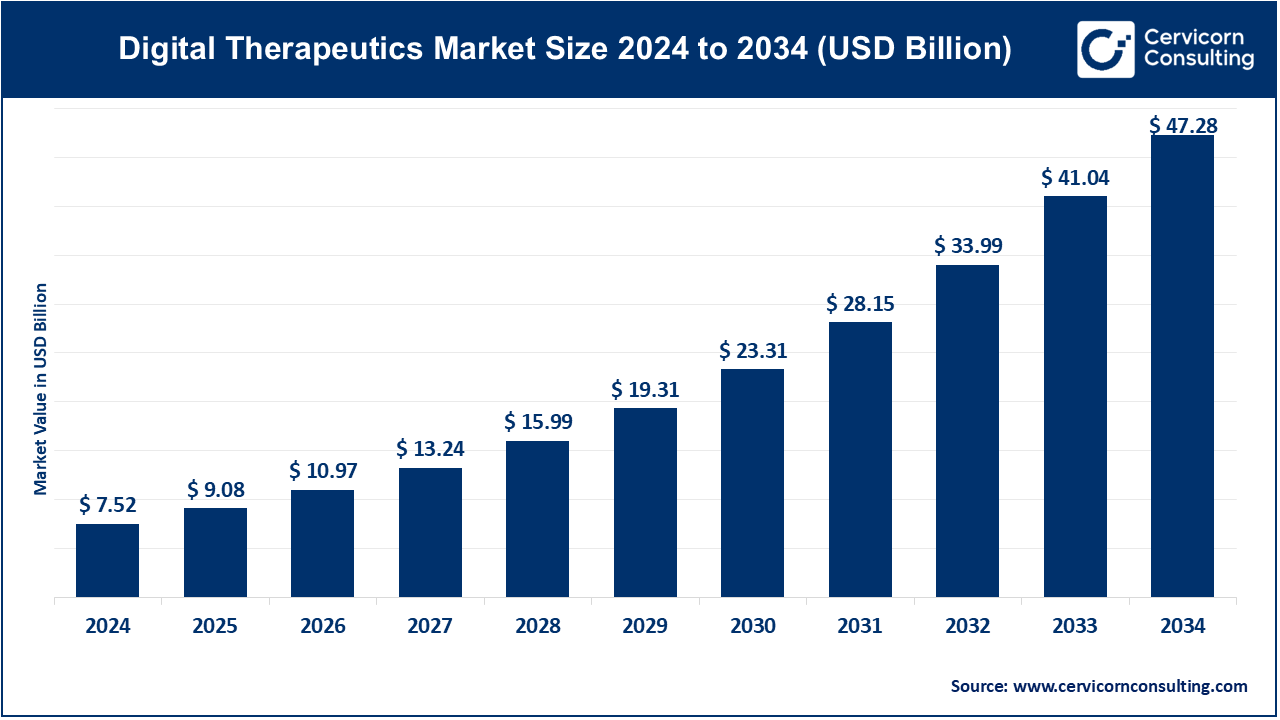

Digital Therapeutics Market Size

The global digital therapeutics market size was worth USD 7.52 billion in 2024 and is anticipated to expand to around USD 47.28 billion by 2034, registering a compound annual growth rate (CAGR) of 20.18% from 2025 to 2034.

What Is the Digital Therapeutics Market?

The digital therapeutics market encompasses companies that develop software-based medical interventions designed to deliver evidence-based therapeutic outcomes. These solutions may be used independently or alongside traditional medical treatments such as pharmaceuticals or medical devices. A DTx solution typically includes behavior-change science, remote monitoring, algorithm-driven personalization, clinical content modules, and outcome-measurement capabilities.

The market includes products that are prescription-based (Prescription Digital Therapeutics, or PDTs), regulated as Software as a Medical Device (SaMD), or clinically validated non-prescription programs targeting conditions such as diabetes, insomnia, hypertension, obesity, depression, anxiety, and substance use disorder.

The digital therapeutics market is driven by clinical validation, payer reimbursement adoption, integration into healthcare workflows, expansion through employers and insurers, and growing patient acceptance.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2419

Why Digital Therapeutics Are Important

Digital therapeutics play a critical role in modern healthcare due to several reasons:

1. Scalable Access to Care

DTx enables continuous care delivery outside clinical settings, reaching rural, remote, and underserved populations. This is especially vital for mental health, chronic disease management, and lifestyle modification programs.

2. Cost Reduction and Value-Based Care Alignment

DTx can reduce hospitalizations, prevent disease progression, and decrease emergency care utilization. Their ability to generate real-time outcome data makes them ideal for payers adopting value-based healthcare models.

3. Personalization and Continuous Monitoring

Advanced data analytics, AI, and connected devices enable personalized treatment paths, improving adherence and outcomes.

4. Clinically Validated and Regulated

DTx products undergo clinical trials and regulatory reviews, ensuring efficacy and safety comparable to traditional therapeutics.

5. Integration with Medical Devices and EHR Systems

DTx solutions can sync with wearables, sensors, glucose monitors, and cardiac implants, allowing providers to make timely, data-driven decisions.

Digital Therapeutics Market — Growth Factors

The digital therapeutics market is experiencing robust growth fueled by rising global chronic disease prevalence, increasing healthcare digitization, the need for scalable mental health interventions, growing smartphone and wearable adoption, expanding payer reimbursement frameworks, stronger clinical evidence from randomized trials, favorable regulatory pathways for software as a medical device, increasing patient and provider acceptance of remote care, integration of DTx programs into employer wellness initiatives, and government-led digital health strategies that reinforce virtual care delivery — all of which collectively push demand for evidence-based, technology-enabled therapeutic solutions.

Company Profiles

1. Fitbit Health Solutions (Google / Fitbit)

Specialization:

Wearable technology integrated with digital health platforms, wellness programs, and enterprise health solutions.

Key Focus Areas:

- Remote monitoring and fitness tracking

- Activity analytics and health coaching

- Chronic disease support modules

- Employer and insurer wellness programs

Notable Features:

- Massive global wearable user base

- Seamless integration with smartphones and Google’s ecosystem

- Population health management capabilities

2024 Revenue:

Google does not publicly separate Fitbit Health Solutions revenue; estimates indicate Fitbit’s broader ecosystem has historically generated near or above the billion-dollar range globally, though enterprise-specific revenue is undisclosed.

Market Share & Global Presence:

A major player in wearable-driven health programs with strong global penetration across North America, Europe, Asia-Pacific, and corporate wellness markets.

2. 2MORROW, Inc.

Specialization:

Digital behavioral health and evidence-driven therapeutic programs.

Key Focus Areas:

- Smoking cessation

- Weight management

- Chronic disease behavior modification

- Perioperative behavioral programs

Notable Features:

- Strong behavioral science foundation

- Recognized clinical programs for public health agencies

- Mobile-first intervention design

2024 Revenue:

As a privately held company, 2024 revenue figures are not publicly disclosed.

Market Share & Global Presence:

Operates primarily in the U.S. with selective global partnerships; widely adopted in employer health and public health initiatives.

3. Medtronic Plc.

Specialization:

Global medical technology leadership with digital health, device-connected software, and remote monitoring solutions.

Key Focus Areas:

- Diabetes management (insulin pumps, CGMs)

- Cardiac rhythm monitoring

- Neurological disorders

- Integrated remote patient monitoring platforms

Notable Features:

- Large installed base of medical devices

- Advanced analytics-driven care pathways

- Strong regulatory experience and hospital partnerships

2024 Revenue:

Medtronic reported global revenue exceeding USD 32 billion in FY2024.

Market Share & Global Presence:

One of the largest global medtech companies operating in over 150 countries. Major influence in DTx-adjacent categories due to device–software integration.

4. Livongo Health, Inc. (Teladoc Health, Inc.)

Specialization:

Comprehensive chronic condition management through connected devices, coaching, analytics, and virtual clinical services.

Key Focus Areas:

- Diabetes

- Hypertension

- Weight management

- Behavioral health and telemedicine integrations

Notable Features:

- High engagement rates

- Data-driven, real-time health insights

- Strong value-based care outcomes

2024 Revenue:

Under Teladoc Health, total 2024 revenue was approximately USD 2.56 billion. Livongo figures are not broken out separately.

Market Share & Global Presence:

Significant share of the chronic-care digital health sector with presence across North America, Europe, and parts of Asia.

5. Pear Therapeutics, Inc.

Specialization:

Pioneering prescription digital therapeutics (PDTs) for behavioral health and neurological conditions.

Key Focus Areas:

- Substance use disorder

- Opioid use disorder

- Insomnia

- Mental and behavioral health PDT pipelines

Notable Features:

- FDA-authorized PDTs

- PearConnect™ commercial distribution platform

- Emphasis on regulatory-grade clinical trials

2024 Revenue:

Publicly released revenue figures for 2024 are limited and not widely disclosed. Historically, revenue reflected early-stage commercialization.

Market Share & Global Presence:

One of the earliest PDT innovators with U.S. focus and selective international outreach.

Leading Trends and Their Impact

1. Growth of Regulatory Frameworks for Digital Health

Regulatory bodies are increasingly defining clear pathways for DTx approval, enabling more products to enter the market with recognized standards of safety and efficacy.

Impact:

Higher payer trust, increased adoption, more predictable commercialization timelines.

2. Integration of Wearables and Medical Devices

Device-software ecosystems are becoming more common, particularly in diabetes and cardiac care.

Impact:

Enhanced personalization and real-time monitoring but increased demand for cybersecurity and interoperability.

3. Value-Based Care and Outcome-Driven Adoption

Payers are shifting toward models that reward measurable health outcomes. DTx provides quantifiable data ideal for these models.

Impact:

DTx adoption is rising among insurers, employers, and hospital networks.

4. Advances in AI and Adaptive Personalization

AI-driven personalization enables tailored treatment experiences, dynamic content delivery, and early detection of health issues.

Impact:

Higher user engagement, improved therapeutic outcomes, and increased attractiveness to payers.

5. Expansion in Mental Health and Behavioral Therapy

CBT-based digital therapeutics are in high demand due to global mental health shortages.

Impact:

Mental health remains the fastest-growing segment of the DTx industry.

6. Consolidation and Partnerships in the Industry

Large healthcare companies and insurers are acquiring or partnering with DTx providers.

Impact:

Greater scalability and global reach but more competition for emerging startups.

Successful Examples of Digital Therapeutics Worldwide

1. Chronic Disease Management (U.S.)

Digital programs combining glucose meters or blood pressure monitors with coaching have demonstrated significant reductions in hospitalizations and improved disease control.

2. Mental Health Interventions (Global)

CBT-based DTx programs for insomnia, anxiety, and depression have produced clinically meaningful improvements and strong adherence rates.

3. Prescription Digital Therapeutics (U.S. and Europe)

Prescription products for substance use disorder, opioid dependency, and chronic insomnia have gained regulatory authorization and payer-level adoption.

4. Wearable-Integrated Enterprise Health Programs (Global)

Fitbit-powered corporate wellness and population health programs show broad engagement and support prevention objectives.

5. Device-Connected Diabetes Ecosystems (North America and Europe)

Medtronic’s closed-loop and semi-automated systems, integrated with digital coaching, show improved HbA1c levels and reduced risk events.

Global Regional Analysis — Government Initiatives and Policies

North America

United States

- FDA has established clear Software as a Medical Device (SaMD) guidelines.

- CMS is expanding reimbursement codes for remote monitoring and behavioral health.

- Increasing payer willingness to adopt DTx for chronic and mental health conditions.

Canada

- Strong national digital health policies and telemedicine reimbursement support.

- Provincial pilots integrating DTx into chronic disease and behavioral health pathways.

Europe

European Union

- EU MDR regulations enhance safety and clinical validation standards.

- EU digital health strategies foster SaMD frameworks and cross-border digital solutions.

Germany (DiGA Program)

- The world’s most advanced digital health reimbursement program.

- Allows fast-track approval for digital apps that demonstrate positive healthcare effects.

Nordics

- High digital literacy and national digital health systems facilitate rapid DTx adoption.

Asia-Pacific

India

- National digital health ecosystem initiatives promote telemedicine and digitized records.

- Growing private market for DTx in diabetes, wellness, and mental health.

China

- Major investment in AI-driven healthcare.

- Integration of mobile health platforms with hospital systems accelerating DTx adoption.

Japan & South Korea

- Favorable regulatory guidelines for SaMD.

- Strong adoption of wearable-driven health management programs.

Latin America

- Brazil, Mexico, and Chile are modernizing telehealth policies.

- Public–private partnerships drive early DTx adoption, especially in diabetes and mental health.

Middle East & Africa

- Gulf Cooperation Council countries are adopting digital health strategies focused on chronic disease prevention.

- Infrastructure improvements and national health digitization programs create opportunities for DTx expansion.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Buy Now Pay Later Market Growth Drivers, Trends, Key Players and Regional Insights by 2034