Corporate Wellness Market Revenue, Global Presence, and Strategic Insights by 2035

Corporate Wellness Market Size

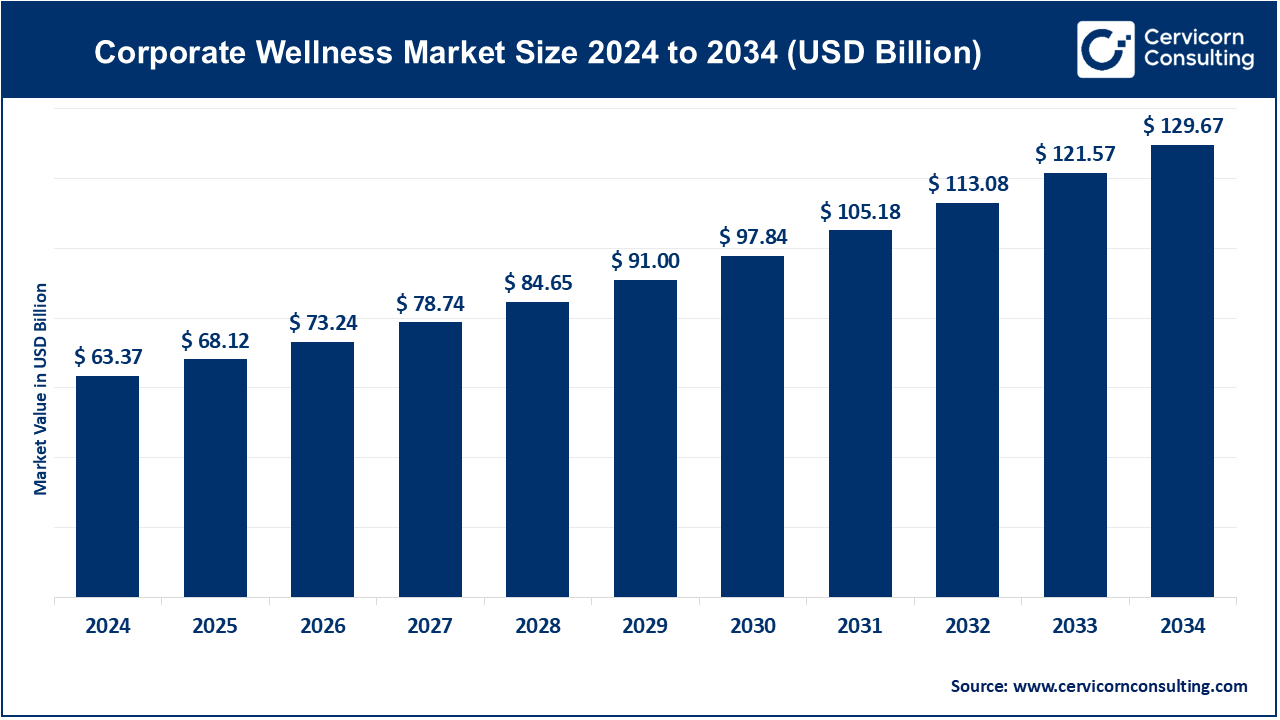

The global corporate wellness market size was worth USD 63.37 billion in 2024 and is anticipated to expand to around USD 129.67 billion by 2034, registering a compound annual growth rate (CAGR) of 7.42% from 2025 to 2034.

What Is the Corporate Wellness Market?

The corporate wellness market, also known as the workplace or employee wellness market, refers to the ecosystem of products, services, and programs that employers use to promote and maintain the physical, mental, and emotional health of their workforce. These programs often include health risk assessments (HRAs), biometric screenings, fitness and nutrition coaching, stress-management resources, mental health counseling (such as Employee Assistance Programs, or EAPs), preventive health check-ups, and wellness platforms (web / mobile) that track and incentivize healthy behaviors. Recently, the market has expanded to include financial wellness, sleep wellness, and other holistic well‑being domains.

Growth Factors

The corporate wellness market is being propelled by several intertwined growth factors: rising healthcare costs motivate employers to invest in preventative health to reduce long-term medical expenditures; a growing awareness of mental health and employee burnout has made stress management and emotional support core components of wellness strategies; technological innovation—including AI, wearables, and data analytics—enables personalized, scalable wellness interventions; demographic changes (aging workforce, chronic disease prevalence) drive demand for health‑risk assessments; and shifting workplace models (remote or hybrid work) push companies to adopt virtual wellness solutions to maintain engagement.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2366

Why Is the Corporate Wellness Market Important?

- For Employers: Corporate wellness programs help reduce absenteeism, lower healthcare costs, and improve productivity. When employees are healthier—physically and mentally—they tend to be more engaged, less prone to sick leave, and more focused at work.

- For Employees: These programs support preventive health, helping individuals identify risks early (via HRAs or screenings), manage stress, improve lifestyle behaviors, and access mental health resources. This contributes to higher quality of life, lower burnout, and better work–life balance.

- For Society / Healthcare Systems: Widespread adoption of wellness programs can relieve the burden on public health systems by reducing chronic disease incidence, improving population health, and encouraging preventative rather than reactive care.

- Strategic Differentiator: Offering robust wellness programs is increasingly a competitive differentiator in talent acquisition and retention. Many prospective employees consider well-being benefits when choosing where to work.

Corporate Wellness Market: Top Companies

Here are some of the key players in the corporate wellness market, along with their specializations, focus areas, and notable features. (Note: For some private companies, up-to-date revenue or detailed financials may not always be publicly disclosed.)

1. Virgin Pulse

- Specialization: Digital engagement platform, well-being‑as-a-service, behavior change, rewards and gamification.

- Key Focus Areas: Physical activity, health coaching, habit formation, preventive health, and social engagement.

- Notable Features: Highly configurable wellness platform that integrates with wearables, apps, and corporate benefits. Known for its strong behavioral science underpinning, and for deploying large-scale global wellness programs.

- 2024 Revenue / Market Share: While public revenue numbers are hard to find (Virgin Pulse is private), the company is regularly cited among market leaders in major global reports. Virgin Pulse holds a significant share of the corporate wellness platforms market (~14%).

- Global Presence: Virgin Pulse serves thousands of corporate clients across many geographies and is considered a global leader in digital wellness.

2. Wellness Corporate Solutions (WCS)

- Specialization: On-site wellness services, biometric screening, health coaching.

- Key Focus Areas: Biometric health screening, wellness coaching, health risk assessment, on-site wellness programs.

- Notable Features: Historically strong in physical, on‑site engagement; provided face-to-face health assessments and coaching in workplaces.

- 2024 Revenue / Market Share / Status: WCS was acquired by Labcorp in 2019. Because of that, it no longer reports independent revenue, and its prior business has been integrated into Labcorp’s broader health services.

- Global Presence: Primarily U.S.-based when active; its legacy continues under Labcorp’s employee health offerings.

3. Optum

- Specialization: Health care services, data analytics, integrated wellness and health benefits.

- Key Focus Areas: Population health, risk management, mental health, preventive care, telehealth, and value-based care.

- Notable Features: Optum is part of UnitedHealth Group, giving it deep connections to both insurance and care delivery. It leverages big data, predictive analytics, and care coordination to integrate wellness into broader healthcare benefits.

- 2024 Revenue / Market Share: Specific “corporate wellness” revenue is not typically broken out separately in public financials, but Optum is widely recognized as a key wellness‑solutions provider.

- Global Presence: Strong in the U.S.; through UnitedHealth it has a broad reach, though its wellness-specific business is more U.S.-centric compared to purely digital wellness startups.

4. Ceridian

- Specialization: Human capital management (HCM) software, payroll, HR, benefits, and wellness integration.

- Key Focus Areas: HR software platforms, employee engagement, benefits administration, wellness program integration.

- Notable Features: Ceridian’s HCM suite (Dayforce, etc.) allows companies to embed wellness into their HR workflows; wellness incentives, tracking, and reporting can be integrated into payroll or benefit disbursement.

- 2024 Revenue / Market Share: Ceridian is a publicly traded company, but its wellness-specific revenue is not usually separated in market reports.

- Global Presence: Ceridian has a global footprint, especially in North America and Europe, via its HR technology business.

5. LifeDojo

- Specialization: Digital behavior-change wellness programs, coaching, micro-learning, wellness challenges.

- Key Focus Areas: Habit formation, mental health, resilience training, stress management, micro-lessons, team-based wellness challenges.

- Notable Features: LifeDojo’s strength lies in its science-driven, psychologically grounded programs. It offers modular “journeys” (short, interactive programs) rather than one-size-fits-all.

- 2024 Revenue / Market Share: Precise revenue is not widely published, but LifeDojo is listed among the main competitors in multiple trend‑reports.

- Global Presence: Primarily U.S.-based, but serves many corporate clients; often co‑partners with larger wellness platforms or benefit providers.

Leading Trends in the Corporate Wellness Market and Their Impact

Several major trends are shaping the corporate wellness market in 2024 and beyond. Here are some of the most important, and how they’re impacting the industry:

- Digital-First Platforms and Virtual Delivery

With remote and hybrid work becoming more permanent, companies are increasingly adopting virtual wellness solutions. This includes wellness apps, telehealth counseling, digital coaching, and challenges. Virtual programs reduce the need for on-site infrastructure and scale more easily across geographies. - Integration of Technology & Wearables

AI, machine learning, and wearables are enabling highly personalized wellness journeys. Data collected from fitness trackers, mobile apps, and health assessments feed into algorithms that recommend tailored interventions (e.g., stress-reduction modules, nutrition coaching). - Holistic Wellness Approaches

Employers are moving beyond physical fitness to embrace comprehensive well‑being: mental health, financial wellness, sleep, social well-being, and purpose. This shift reflects a more mature understanding of what wellness means for employees and what contributes to productivity and satisfaction. - Data-Driven ROI and Outcome Measurement

There is growing demand from organizations to prove the return on investment (ROI) of wellness programs. Vendors now provide more sophisticated analytics and tracking (biometrics, cost savings, productivity metrics) to justify wellness budgets. - Preventive Health and Risk Assessment

Health Risk Assessments (HRAs) and biometric screenings continue to be foundational. Early detection of chronic risk factors (e.g., hypertension, obesity) helps companies design preventive programs, reducing long-term costs. - Mental Health Focus & Stress Management

Stress, burnout, and mental health issues are now central to wellness strategies. Many companies are embedding resilience training, EAPs, mindfulness, and therapy access into their wellness offerings. - Regulatory, Policy & Corporate Responsibility Influence

Governments and regulators in many regions are encouraging workplace health via tax incentives, occupational health standards, and wellness-focused labor laws. This pushes companies to adopt wellness more strategically. - Behavioral Economics & Engagement Techniques

Gamification, rewards, social challenges, micro-learning journeys, and behavioral nudges are being used more to sustain engagement. These techniques help maintain participation over long periods.

Successful Examples from Around the World

- Insta360 (China)

A Chinese tech company, Insta360, ran a “Million Yuan Weight Loss Challenge” where employees were incentivized to lose weight through wellness activities. The challenge offered a shared bonus pool, aligning individual health goals with company-wide engagement. - Global Multinational Digital Wellness (Virgin Pulse)

Virgin Pulse has worked with thousands of employers globally, deploying behavioral wellness programs, step challenges, and digital health journeys. Their platform is used across continents and language barriers, demonstrating how digital wellness can scale globally. - Large U.S. Corporations

Many large U.S.-based companies have adopted integrated wellness platforms combining onsite fitness, EAPs, HRAs, and health coaching. The model shows how wellness can be deeply embedded in HR and benefits systems to reduce healthcare costs and improve retention. - European Firms

In parts of Europe, where labor laws and corporate responsibility are strong, companies increasingly see wellness programs as part of compliance and employee protection frameworks. In some EU countries, wellness programs are tightly linked to occupational health policies.

Global Regional Analysis: Government Initiatives & Policies Shaping the Market

North America (USA & Canada)

- Market Dominance: North America accounted for roughly 40.3% of global corporate wellness revenue in 2024.

- Drivers & Policy: Rising healthcare costs (especially in the U.S.) encourage employers to invest in wellness. Government regulations and incentives for preventive health also boost wellness program uptake.

- Corporate Culture: Many U.S. corporations use wellness as a part of their total rewards strategy. On‑site clinics, fitness centers, and digital wellness apps are common.

Europe

- Market Presence: Europe is a significant region. Stringent labor laws and corporate responsibility frameworks push companies to adopt wellness programs.

- Government Influence: EU-level policies on occupational health, preventive care, and wellness are helping adoption. Countries such as the UK, Germany, and France are particularly active in wellness.

- Regulation & Support: European firms often align wellness programs with broader societal public-health goals, not just internal productivity.

Asia-Pacific (APAC)

- Growth Rate: This is one of the fastest-growing regions for corporate wellness. Strong CAGR for APAC wellness adoption is driven by digital wellness, health awareness, and urbanization.

- Key Markets: China, India, Japan are among major adopters. Expanding corporate sectors and rising healthcare demand fuel wellness program investments.

- Government Role: Some governments support wellness via national health missions, tax incentives, and workplace health policies. The changing workplace dynamic (hybrid/remote) in APAC also spurs digital wellness solutions.

Latin America, Middle East & Africa (LAMEA)

- Market Size & Potential: Smaller compared to North America or Europe but steadily expanding.

- Challenges & Drivers: Economic development, limited healthcare infrastructure in some markets, and rising corporate maturity drive opportunity, while cultural differences and regulatory variability present challenges.

- Government & Policy: Corporate wellness in some Middle Eastern countries is tied to national health strategies. In Latin America, preventive care and chronic disease prevention are major motivators.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Drug Discovery Market Revenue, Global Presence, and Strategic Insights by 2034