Cold Chain Market Growth Trends, Top Companies, and Regional Analysis 2025-2034

Cold Chain Market Overview

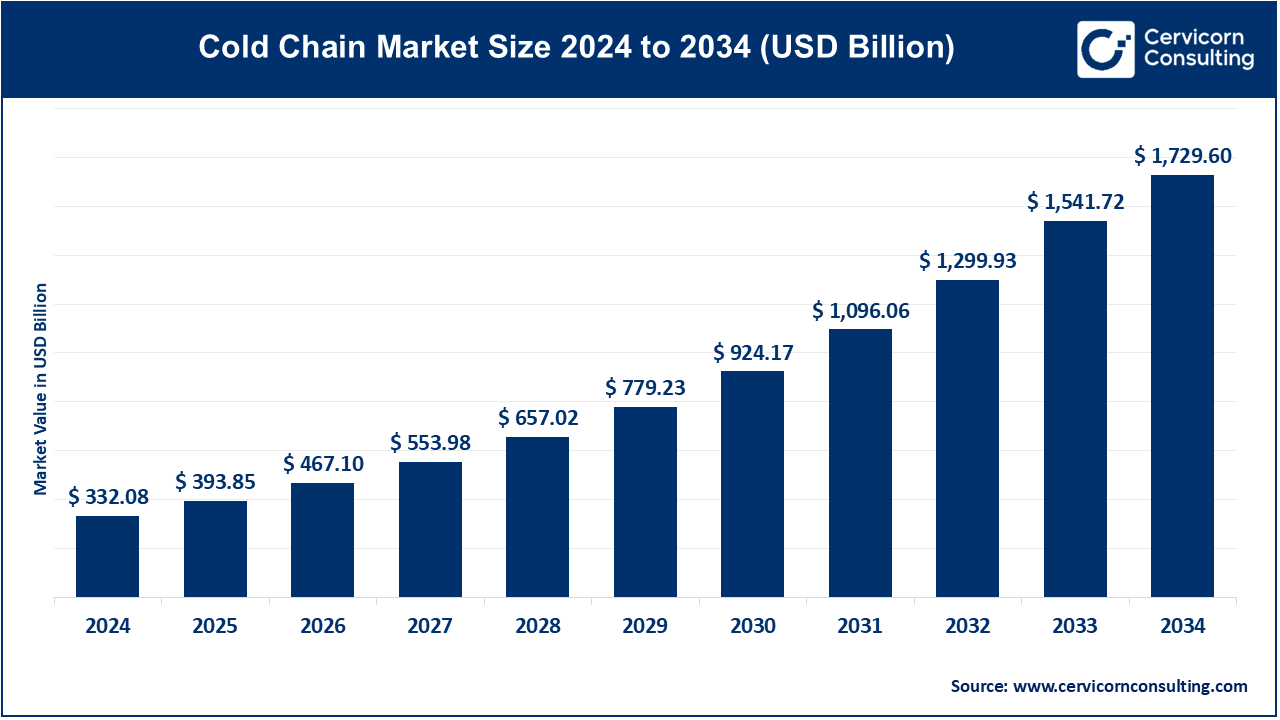

The global cold chain market was valued at USD 332.08 billion in 2024 and is projected to grow to approximately USD 1,729.60 billion by 2034, with a compound annual growth rate (CAGR) of 18.06% from 2025 to 2034. Several interrelated factors drive the growth of the market. Rising global demand for perishable goods, technological advancements in refrigeration and monitoring systems, increased investment in infrastructure, and the growth of online grocery and pharmaceutical delivery services are significant contributors. Additionally, stringent regulatory requirements and growing consumer awareness about food and drug safety are spurring innovation and adoption of cold chain solutions.

Understanding the Cold Chain Market

The cold chain market encompasses the infrastructure, technology, and processes designed to maintain and manage the transportation and storage of temperature-sensitive products across the supply chain. These products often include perishable food items, pharmaceuticals, chemicals, and other goods that require specific temperature conditions to preserve their integrity and safety. Cold chains utilize advanced refrigeration systems, insulated transport vehicles, and monitoring technologies to ensure seamless temperature control throughout the logistics journey.

Why is the Cold Chain Market Important?

The importance of the cold chain market lies in its critical role in global health, food security, and industrial supply chains. For instance, in the pharmaceutical industry, vaccines and biologics depend on an uninterrupted cold chain to remain effective. In food logistics, cold chains minimize waste, ensure compliance with safety standards, and enable the global trade of perishable goods. As consumers demand fresher, higher-quality products, and healthcare systems expand, the cold chain market continues to be indispensable.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2337

Global Cold Chain Market Top Companies

1. DHL Supply Chain

- Specialization: Comprehensive cold chain logistics solutions, including temperature-controlled warehousing and transportation.

- Key Focus Areas: Healthcare, food and beverage, and chemical industries.

- Notable Features: Advanced temperature monitoring, sustainable refrigeration solutions, and real-time tracking.

- 2024 Revenue (Approx.): $20 billion.

- Market Share (Approx.): 12%.

- Global Presence: Over 220 countries and territories.

2. Kuehne + Nagel International AG

- Specialization: End-to-end cold chain services, including air, sea, and road freight.

- Key Focus Areas: Pharmaceuticals and perishable food logistics.

- Notable Features: PharmaChain and FreshChain solutions tailored for healthcare and food industries, respectively.

- 2024 Revenue (Approx.): $17 billion.

- Market Share (Approx.): 10%.

- Global Presence: Operations in 100+ countries.

3. C.H. Robinson Worldwide, Inc.

- Specialization: Temperature-controlled transportation and supply chain consulting.

- Key Focus Areas: Food, beverages, and healthcare.

- Notable Features: Navisphere technology platform for real-time visibility and analytics.

- 2024 Revenue (Approx.): $16 billion.

- Market Share (Approx.): 8%.

- Global Presence: Offices in 39 countries.

4. XPO Logistics, Inc.

- Specialization: Supply chain solutions, including temperature-controlled transport.

- Key Focus Areas: Food and beverages, retail, and pharmaceuticals.

- Notable Features: State-of-the-art fleet with temperature monitoring and hybrid logistics solutions.

- 2024 Revenue (Approx.): $12 billion.

- Market Share (Approx.): 7%.

- Global Presence: Strong presence in North America and Europe.

5. DB Schenker

- Specialization: Integrated cold chain logistics for various industries.

- Key Focus Areas: Healthcare, retail, and agriculture.

- Notable Features: Eco-friendly cold storage facilities and AI-driven logistics planning.

- 2024 Revenue (Approx.): $14 billion.

- Market Share (Approx.): 9%.

- Global Presence: Services in 130+ countries.

Leading Trends and Their Impact

- Technological Advancements: IoT-enabled sensors and blockchain technology are transforming the cold chain market by enhancing real-time monitoring and transparency. These innovations reduce product spoilage, improve compliance, and optimize operational efficiency.

- Sustainability Initiatives: With increasing environmental concerns, companies are adopting eco-friendly refrigeration systems and alternative energy sources, significantly reducing their carbon footprint.

- E-commerce Growth: The rise of online grocery and pharmaceutical deliveries has escalated the demand for efficient cold chain logistics. Companies are expanding last-mile delivery capabilities to cater to consumer preferences for convenience and speed.

- Stringent Regulations: Governments worldwide are imposing stricter standards for cold chain operations, driving investments in quality control and compliance systems.

Successful Examples of Cold Chain Market Worldwide

- Pfizer-BioNTech COVID-19 Vaccine Distribution:

- Leveraging advanced cold chain logistics, Pfizer ensured the distribution of its vaccine, which required ultra-low temperatures, to over 120 countries during the pandemic.

- The deployment of GPS-enabled thermal shippers allowed precise tracking and temperature maintenance.

- Amazon Fresh:

- Amazon’s grocery delivery arm has implemented sophisticated cold chain processes to deliver fresh produce and perishables to consumers globally.

- The integration of AI and robotics in its warehouses ensures optimal temperature control and efficient operations.

- Nestlé’s Cold Chain Initiative:

- Nestlé partnered with logistics companies to develop sustainable cold chain solutions for its frozen and chilled products in emerging markets.

- The initiative reduced food waste and improved product availability.

Regional Analysis and Government Initiatives

North America:

- Key Drivers: Expansion of the healthcare sector, high demand for fresh food, and advanced infrastructure.

- Government Policies:

- The FDA’s Food Safety Modernization Act emphasizes the importance of cold chain compliance in food safety.

- Investments in research to improve cold storage efficiency.

Europe:

- Key Drivers: Growing pharmaceutical industry and stringent regulations for food safety.

- Government Policies:

- The EU’s Green Deal promotes the use of sustainable refrigeration technologies.

- Subsidies for companies adopting eco-friendly cold chain solutions.

Asia-Pacific:

- Key Drivers: Rapid urbanization, increasing disposable income, and rising demand for fresh produce and vaccines.

- Government Policies:

- India’s Ministry of Food Processing Industries offers financial support for cold chain infrastructure projects.

- China’s National Development and Reform Commission prioritizes cold chain logistics in its development plans.

Latin America:

- Key Drivers: Growth of the agriculture export sector and rising e-commerce penetration.

- Government Policies:

- Brazil’s initiatives to modernize cold chain logistics for meat and produce exports.

- Collaborative programs with international agencies to enhance cold storage capabilities.

Middle East and Africa:

- Key Drivers: Increasing investments in healthcare and food supply chain resilience.

- Government Policies:

- Saudi Arabia’s Vision 2030 focuses on infrastructure development, including cold chain systems.

- Support for public-private partnerships in the logistics sector.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Aircraft Market Growth, Companies, and Global Presence 2024 – 2033