Clinical Trials Market Key Drivers, Trends, Top Players, and Forecast 2025-2034

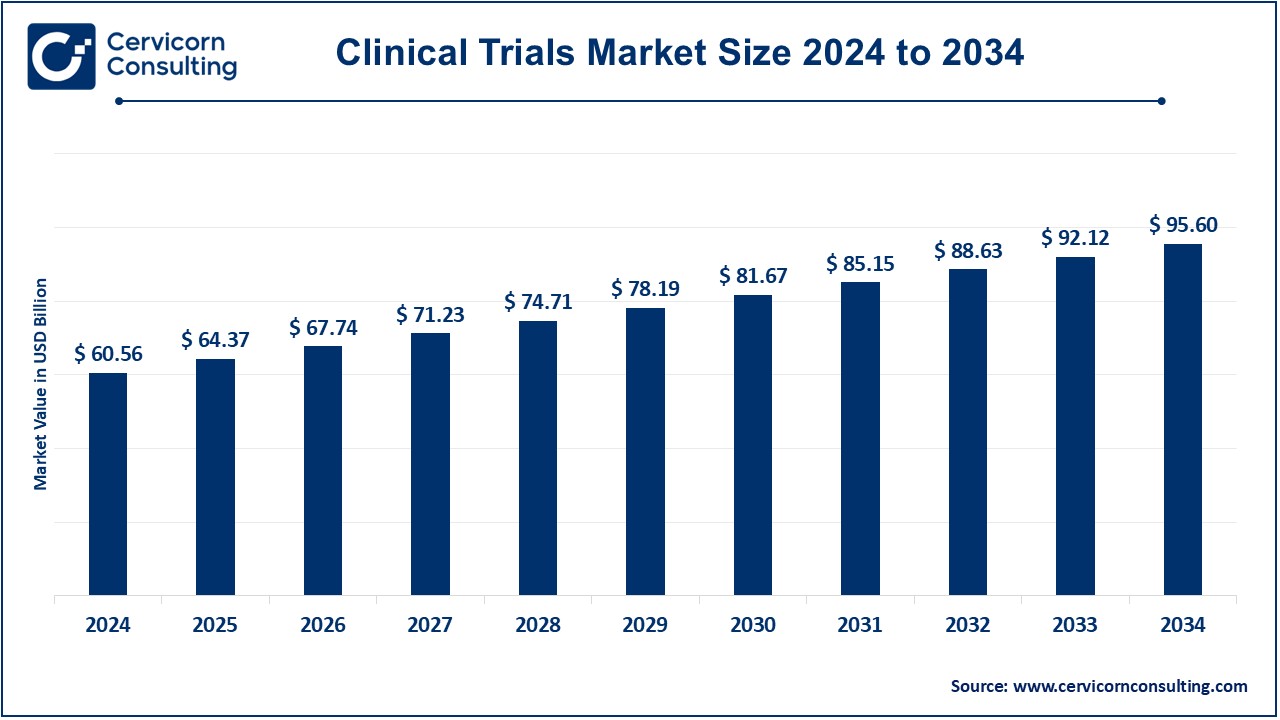

Clinical Trials Market Forecast

The global clinical trials market was estimated to be worth around USD 60.56 billion in 2024 and is expected to grow to USD 95.60 billion by 2034, with a compound annual growth rate (CAGR) of 4.67%.

What are the key drivers behind the growth of the clinical trials market?

IQVIA Holdings Inc.

- Specialization: Data analytics, healthcare technology, and clinical trials services.

- Key Focus Areas: Contract research, real-world evidence, patient recruitment, and AI-driven data solutions.

- Notable Features: Integration of advanced analytics, AI/ML in clinical trial design, and patient engagement platforms.

- 2023 Revenue (approx.): $15 billion.

- Market Share (approx.): 10–12%.

- Global Presence: Operates in over 100 countries.

PPD, Inc. (Part of Thermo Fisher Scientific)

- Specialization: Contract research services across Phase I–IV trials.

- Key Focus Areas: Laboratory services, clinical development, and patient-centric trials.

- Notable Features: Specialized expertise in biopharma solutions and decentralized trial capabilities.

- 2023 Revenue (approx.): $6.5 billion.

- Market Share (approx.): 6–8%.

- Global Presence: Strong presence in North America, Europe, and Asia-Pacific.

ICON plc

- Specialization: CRO services, specializing in oncology, rare diseases, and biosimilars.

- Key Focus Areas: Clinical trial management, data analytics, and adaptive trials.

- Notable Features: Expertise in digital and decentralized trials with significant use of wearables and telemedicine.

- 2023 Revenue (approx.): $7.7 billion.

- Market Share (approx.): 7–9%.

- Global Presence: Offices in over 40 countries.

Parexel International Corporation

- Specialization: Full-service CRO with a focus on biopharma, medical devices, and regulatory affairs.

- Key Focus Areas: Early-phase clinical trials, regulatory consulting, and patient-centric studies.

- Notable Features: Strong patient engagement strategies and technology-driven operational efficiencies.

- 2023 Revenue (approx.): $4 billion.

- Market Share (approx.): 4–6%.

- Global Presence: Strong foothold in North America, Europe, and emerging markets.

Covance Inc. (LabCorp Drug Development)

- Specialization: Drug development and clinical trial laboratory services.

- Key Focus Areas: Preclinical to post-market services, biomarker testing, and patient enrollment.

- Notable Features: Integrated diagnostics and clinical trial services with an emphasis on precision medicine.

- 2023 Revenue (approx.): $5 billion.

- Market Share (approx.): 5–7%.

- Global Presence: Present in over 60 countries.

Syneos Health, Inc.

- Specialization: Biopharmaceutical solutions and commercial outsourcing.

- Key Focus Areas: Clinical trials, commercialization, and behavioral insights.

- Notable Features: Strong integration of clinical and commercial services.

- 2023 Revenue (approx.): $5.2 billion.

- Market Share (approx.): 5–7%.

- Global Presence: Offices in 110 countries.

Medpace Holdings, Inc.

- Specialization: Full-service CRO with therapeutic expertise.

- Key Focus Areas: Oncology, cardiology, and metabolic diseases.

- Notable Features: Proprietary technology platform for real-time data access and trial management.

- 2023 Revenue (approx.): $1.7 billion.

- Market Share (approx.): 1–2%.

- Global Presence: Present in over 35 countries.

PRA Health Sciences, Inc. (Acquired by ICON plc)

- Specialization: CRO services with a focus on mobile and decentralized clinical trials.

- Key Focus Areas: Phase I–IV trials, data management, and eClinical solutions.

- Notable Features: Strong emphasis on mobile health technology.

- 2023 Revenue (approx.): Integrated with ICON’s revenue (~$7.7 billion).

- Market Share (approx.): Integrated with ICON’s share (~7–9%).

Charles River Laboratories International, Inc.

- Specialization: Preclinical and clinical laboratory services.

- Key Focus Areas: Drug discovery, safety assessment, and preclinical development.

- Notable Features: Extensive focus on non-clinical services and animal research models.

- 2023 Revenue (approx.): $4 billion.

- Market Share (approx.): 4–6%.

- Global Presence: Over 100 facilities worldwide.

WuXi AppTec Inc.

- Specialization: End-to-end biopharma R&D and manufacturing services.

- Key Focus Areas: Laboratory services, drug development, and clinical trial support.

- Notable Features: Global platform with extensive expertise in biologics and small molecules.

- 2023 Revenue (approx.): $5.3 billion.

- Market Share (approx.): 5–6%.

- Global Presence: Operations in China, the US, and Europe.

Worldwide Clinical Trials

- Specialization: CRO services with a focus on neuroscience, cardiovascular, and immune diseases.

- Key Focus Areas: Phase I–IV trials and bioanalytical services.

- Notable Features: Personalized approach and flexible trial management.

- 2023 Revenue (approx.): ~$750 million.

- Market Share (approx.): <1%.

- Global Presence: Offices in over 60 countries.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Microcarriers Market Growth & Key Trends by 2033