Chemical Intermediates Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

Chemical Intermediates Market Size

The global chemical intermediates market size was worth USD 152.72 billion in 2025 and is anticipated to expand to around USD 326.34 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2035.

Growth Factors

The chemical intermediates market is growing due to rapid expansion in downstream sectors (automotive, construction, pharmaceuticals, personal care and electronics), rising industrialization in Asia-Pacific, and increasing substitution of conventional materials with high-performance and sustainable alternatives. Additional growth drivers include fluctuating crude oil and feedstock prices that influence investment cycles, technological advancements in catalysis and continuous flow processes, the shift toward circular and bio-based feedstocks, rising environmental regulations pushing cleaner chemistries, and increased on-shoring of critical intermediates to enhance supply-chain resilience. These combined forces are accelerating product innovation, capacity expansion and global market diversification.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2837

What is the Chemical Intermediates Market?

The chemical intermediates market consists of companies that produce compounds used as transitional steps between raw materials and finished products. These intermediates may be commodity chemicals (high-volume inputs such as ethylene derivatives, alcohols, or aromatics), performance intermediates (mid-volume, specification-driven chemicals used in coatings, adhesives, resins), or specialty intermediates (low-volume, high-value molecules tailored to specific industries like pharma or electronics).

These intermediates undergo further processing, polymerization, synthesis or formulation to create finished items that reach consumers and industrial users. Without intermediates, the global chemical and manufacturing landscape would not exist in its current form, as they serve as the connective tissue linking feedstocks to advanced materials.

Why is the Chemical Intermediates Market Important?

The importance of the chemical intermediates market lies in its ability to influence production chains and industrial output across virtually every sector. These compounds determine product performance, manufacturing costs, supply chain stability and environmental compliance. They are central to innovations such as lightweight automotive materials, sustainable packaging, high-efficiency pharmaceuticals, electric vehicle battery electrolytes, semiconductor chemicals, and low-VOC coatings.

Furthermore:

- Supply chain reliability heavily depends on uninterrupted access to intermediates.

- Technological progress in healthcare, electronics and mobility relies on innovative intermediate molecules.

- Sustainability transitions depend on developing eco-friendly, bio-based or recyclable intermediates.

Thus, the chemical intermediates market is not only economically significant but strategically essential for global industries.

Chemical Intermediates Market — Top Companies

1. BASF

Specialization:

The world’s largest chemical producer, spanning basic chemicals, intermediates, plastics, performance materials and agricultural solutions.

Key Focus Areas:

High-performance intermediates for coatings, adhesives, plastics, surfactants and pharmaceuticals; leadership in catalysis and sustainable process technologies.

Notable Features:

A highly integrated production model (“Verbund”), global innovation hubs, strong commitment to decarbonization and circular feedstocks.

2024 Revenue:

Approximately €65.3 billion.

Market Share & Positioning:

A global top-tier supplier of commodity and specialty intermediates; leads in multiple sub-segments such as amines, diols, acids and specialty monomers.

Global Presence:

Manufacturing, R&D and sales operations in over 100 countries across Europe, North America, Asia-Pacific and Latin America.

2. SABIC

Specialization:

A major global petrochemical giant producing olefins, aromatics, polymers and large-scale chemical intermediates.

Key Focus Areas:

Cost-efficient production of commodity chemicals, expansion into specialty chemicals, sustainability initiatives and partnerships.

Notable Features:

Access to low-cost feedstocks in the Middle East; integrated production hubs supporting global export competitiveness.

2024 Revenue:

SAR 139.98 billion (about US$37.33 billion).

Market Share & Positioning:

One of the world’s largest petrochemical and intermediate producers, with strong influence in MEA, Asia and Europe.

Global Presence:

Technology centers and manufacturing across the Middle East, the Americas, Europe and Asia-Pacific.

3. LyondellBasell

Specialization:

A leading producer of olefins, polyolefins, propylene oxide, acetyls and various intermediates.

Key Focus Areas:

Olefins and derivatives, polymers, recycling technologies, and optimizing its asset portfolio for cost and productivity gains.

Notable Features:

One of the world’s largest licensors of polyolefin technologies; involved in chemical recycling and circular polymer initiatives.

2024 Revenue:

Approximately US$40.3 billion.

Market Share & Positioning:

A major global player in olefins and plastic intermediates; large share in North America and Europe.

Global Presence:

Manufacturing sites across the U.S., Europe, Latin America, Asia and the Middle East.

4. Dow

Specialization:

Combines materials science and chemical manufacturing across intermediates, coatings, packaging and silicones.

Key Focus Areas:

Coating materials, performance silicones, polyurethane intermediates, packaging resins and circularity-driven solutions.

Notable Features:

Leader in chemical recycling, low-carbon materials development, and high-performance formulations.

2024 Revenue:

Approximately US$43 billion.

Market Share & Positioning:

Prominent global supplier for construction, packaging, industrial, and consumer chemical intermediates.

Global Presence:

A vast manufacturing and distribution network across the Americas, Europe and Asia.

5. Arkema

Specialization:

A specialty chemicals leader focused on advanced intermediates, adhesives, high-performance polymers and niche chemical solutions.

Key Focus Areas:

Functional additives, UV-curing resins, performance polymers, electronics chemicals and sustainable materials.

Notable Features:

Portfolio strongly oriented toward high-margin specialty chemicals rather than commodity intermediates.

2024 Revenue:

Approximately €9.5 billion.

Market Share & Positioning:

A top specialty intermediates supplier globally, especially in adhesives, coatings and engineered materials.

Global Presence:

Operations in over 55 countries with strengths in Europe, North America and Asian growth markets.

Leading Trends and Their Market Impact

1. Decarbonization and Green Chemistry

Chemical producers are accelerating investments in renewable energy, green hydrogen, electrified reactors, carbon capture, and bio-based feedstocks. This increases operating costs in the short term but creates long-term advantages in meeting regulatory and consumer-driven sustainability requirements.

2. On-shoring and Supply Chain Diversification

Following global supply chain disruptions, many countries are incentivizing local production of key intermediates — especially those used in pharmaceuticals, semiconductors and advanced polymers. This trend promotes regional investment and reduces dependence on single-region suppliers.

3. Transition from Commodity to Specialty Intermediates

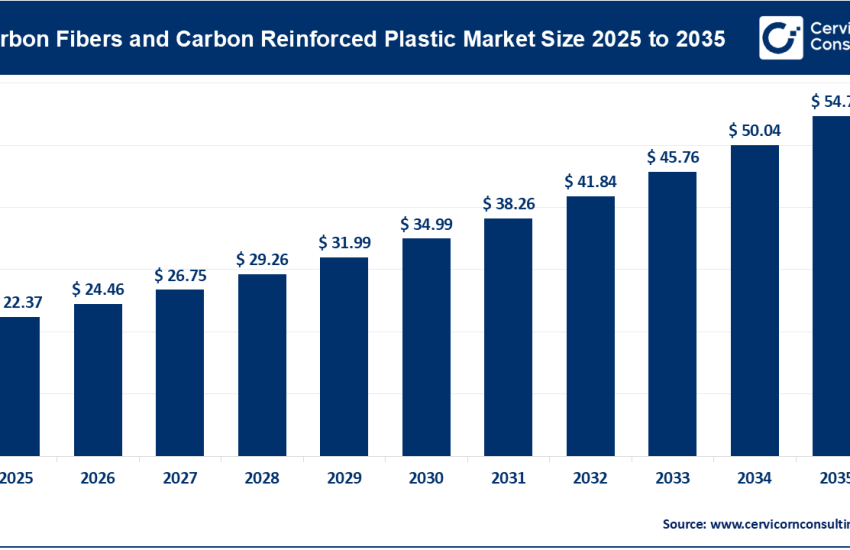

Producers are focusing on higher-value, specialized chemistries to escape the cyclicality of commodity chemicals. This includes adhesives, coatings intermediates, battery chemicals and high-performance polymers.

4. Circular Economy Integration

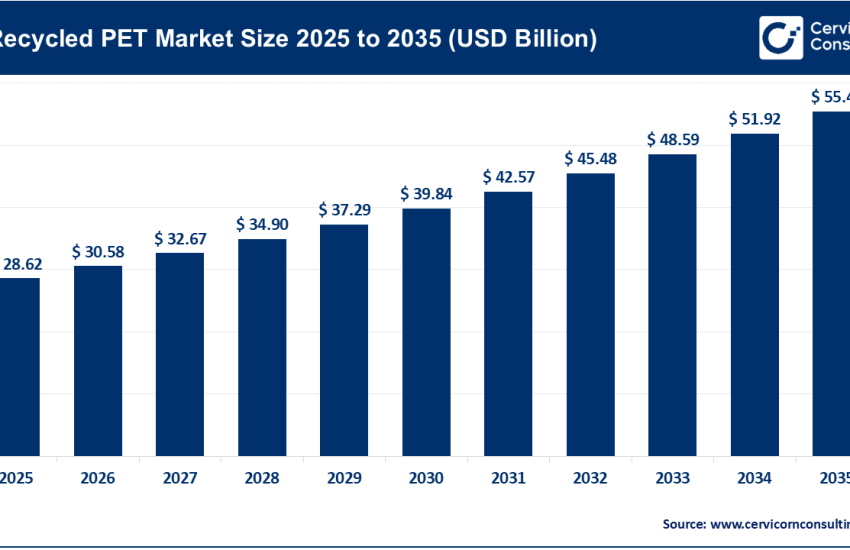

Growing emphasis on recycling and waste reduction is driving demand for intermediates compatible with recycled plastic streams, chemical recycling feedstocks and renewable raw materials.

5. Digitalization and Smart Manufacturing

Advanced analytics, AI-driven optimization, predictive maintenance and continuous processing enhance efficiency, reduce downtime and improve yield, transforming production economics for intermediates manufacturers.

6. Regulatory Pressures

Stricter environmental laws, toxicity restrictions and compliance protocols are influencing product portfolios, leading companies to invest in safer, low-emission intermediates and greener processes.

Successful Global Examples of Chemical Intermediates Value Chains

Middle East Integrated Petrochemical Complexes

Saudi Arabia’s large-scale petrochemical clusters demonstrate successful backward integration from gas/oil feedstocks to olefins, aromatics and intermediate derivatives, enabling highly cost-competitive exports.

Europe’s Shift to Specialty Intermediates

Companies like Arkema and BASF are transitioning from bulk chemicals to high-value specialty intermediates (adhesives, advanced polymers, coatings), supporting sectors such as automotive, aerospace and electronics.

United States Circular Polymer Expansion

Dow and other U.S. chemical majors are advancing chemical recycling facilities that convert waste plastics into intermediate feedstocks, improving sustainability and reducing dependence on virgin petrochemicals.

Asia-Pacific Battery & Electronics Chemicals Hub

China, South Korea and Japan dominate production of electronic-grade solvents, electrolyte intermediates and semiconductor chemicals — enabling rapid growth in EV batteries and microelectronics manufacturing.

Global Regional Analysis — Government Policies & Market Influence

Europe

Europe’s chemical industry is heavily shaped by environmental regulations such as the EU Chemical Strategy for Sustainability. These frameworks require safer chemicals, lifecycle transparency and reduced carbon emissions. As a result, European producers are investing significantly in sustainable intermediates, green feedstocks, energy-efficient processes and specialty chemicals R&D. The region is moving away from bulk chemicals due to high energy costs and regulatory pressure, instead emphasizing advanced and eco-friendly intermediates.

North America

The United States is advancing clean manufacturing and domestic production incentives through industrial and energy policies. Government initiatives supporting hydrogen, renewable energy, electrification and emissions reduction indirectly promote investment in cleaner chemical intermediate production. Additionally, federal incentives encourage domestic manufacturing of critical materials, reducing dependency on imports for essential intermediates used in pharmaceuticals, semiconductors and EV components.

Middle East

Middle Eastern economies continue capitalizing on abundant natural resources to expand integrated chemical complexes. National strategies prioritize downstream diversification, enabling these countries to evolve from basic petrochemical suppliers to producers of intermediates, polymers and specialty chemicals. Government-backed mega projects and public-private partnerships support the rapid expansion of intermediate capacity.

Asia-Pacific

China’s industrial policies emphasize strengthening domestic value chains, expanding chemical capacity and securing supply for electronics, batteries, pharmaceuticals and construction. India’s manufacturing initiatives support capacity building in specialty intermediates, while ASEAN nations are emerging as cost-effective production hubs due to improving infrastructure and investment incentives. APAC remains the fastest-growing region in chemical intermediates consumption and production.

Latin America & Africa

Government initiatives in Brazil, Mexico, South Africa and others aim to expand chemical value chains and enhance local processing rather than relying solely on raw material exports. Though infrastructure and investment constraints persist, these regions are gradually increasing their relevance in global intermediates supply.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Agriculture 4.0 Market Growth Drivers, Trends, Key Players and Regional Insights by 2034