Chemical Distribution Market Growth, Trends, Key Players, and Forecast by 2034

Chemical Distribution Market Overview

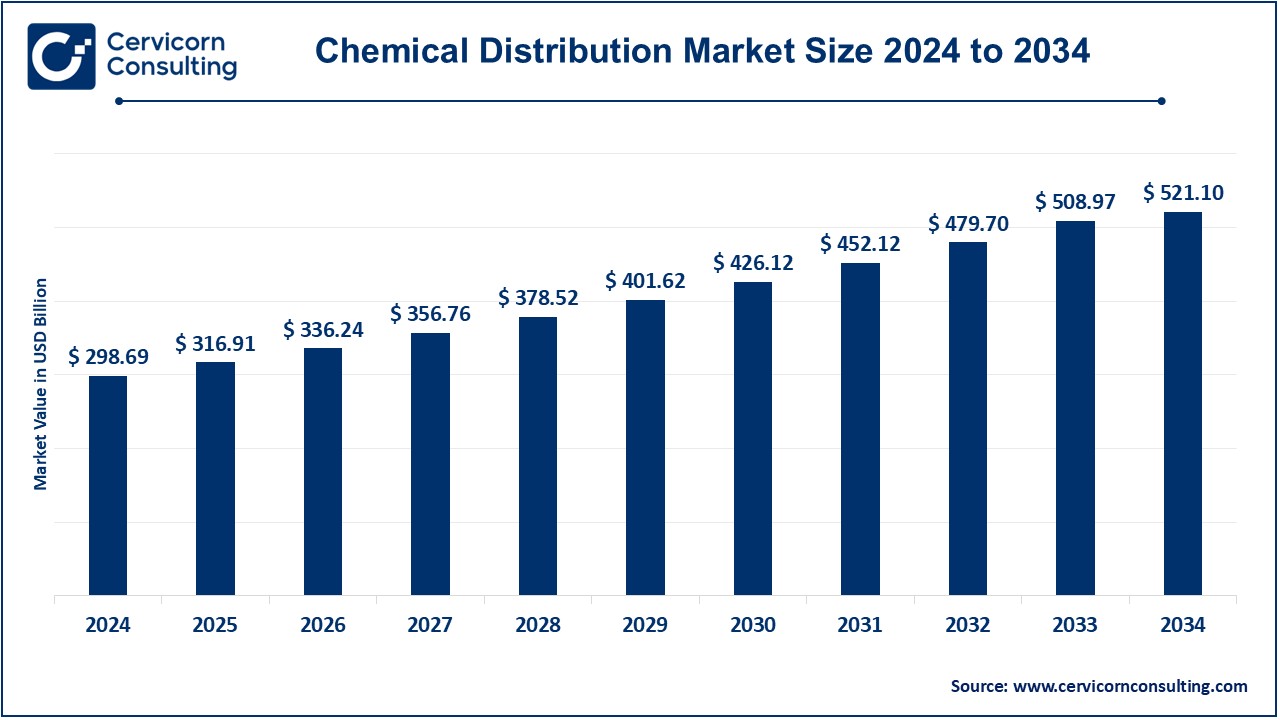

The global chemical distribution market was valued at an estimated USD 298.69 billion in 2024 and is expected to increase to USD 521.10 billion by 2034, with a compound annual growth rate (CAGR) of 5.72%. The growth of the chemical distribution market is primarily driven by increasing industrial demand across sectors such as pharmaceuticals, agriculture, food & beverage, and automotive. Key factors contributing to this growth include the rising need for specialized chemicals, advancements in sustainability and green chemistry, regulatory compliance requirements, and the growing trend of digitization and supply chain optimization.

Additionally, the expansion of emerging markets, particularly in Asia-Pacific, along with strategic mergers and acquisitions by leading players, is further fueling market growth. The market is also supported by a rising focus on value-added services like logistics, technical support, and custom chemical solutions.

What is the Chemical Distribution Market?

The chemical distribution market refers to the network of companies involved in the procurement, storage, and transportation of chemicals from manufacturers to end-users, along with providing essential value-added services like blending, packaging, technical support, and regulatory compliance. Chemical distributors serve as intermediaries between chemical producers and industrial users across a broad spectrum of sectors, including consumer goods, agriculture, healthcare, and manufacturing.

Chemical distributors operate at various stages of the supply chain, offering essential services like warehousing, technical sales, logistics, and regulatory assistance. These distributors specialize in chemicals such as specialty chemicals, commodity chemicals, and food additives, which are used in a wide range of applications. By providing these services, they ensure that chemicals reach their end-users safely, efficiently, and in compliance with industry regulations.

Why is the Chemical Distribution Market Important?

The chemical distribution market is a critical part of the global economy due to several factors:

- Industry Support: Chemical distributors support a wide range of industries by ensuring that chemicals are available in the right quantities and forms. From producing pharmaceuticals to food and beverage items, chemicals play a vital role in industrial production.

- Supply Chain Efficiency: Distributors facilitate the smooth functioning of global supply chains by ensuring that raw materials reach manufacturers in a timely manner. By providing logistics solutions, storage, and transport, they help optimize costs and reduce delays in the supply chain.

- Global Trade and Connectivity: The market fosters international trade, enabling manufacturers to access chemicals from different parts of the world. Distributors have established networks and expertise in managing complex logistics across borders.

- Regulatory Compliance: Chemical distributors ensure that their products comply with local and international regulatory standards. This is especially critical in industries such as pharmaceuticals, food, and agriculture, where regulations are strict, and safety standards must be met.

- Value-added Services: Beyond just supplying chemicals, distributors often provide additional services, such as custom blending, packaging, and technical expertise, which add value to the final product and improve product performance for end-users.]

Get a Free Sample: https://www.cervicornconsulting.com/sample/2314

Key Players in the Chemical Distribution Market

Several companies dominate the global chemical distribution market, offering an extensive range of products and services to meet the needs of various industries. Below are some of the leading companies in the market:

Brenntag SE

- Specialization: Brenntag is one of the largest chemical distributors globally, specializing in both industrial and specialty chemicals. It offers a broad range of services, including distribution, supply chain management, blending, and packaging.

- Key Focus Areas: The company focuses on chemicals for industries such as agriculture, automotive, food & beverage, pharmaceuticals, and consumer goods.

- Notable Features: Brenntag’s extensive global presence, with operations in over 70 countries, makes it one of the most important players in the chemical distribution market.

- 2023 Revenue (approx.): $22 billion

- Market Share (approx.): 6-8%

- Global Presence: Brenntag operates in North America, Europe, Latin America, and Asia-Pacific.

Univar Solutions Inc.

- Specialization: Univar Solutions is a leading global chemical and ingredients distributor, offering chemicals and related services for a variety of sectors such as agriculture, food, personal care, and pharmaceuticals.

- Key Focus Areas: The company provides value-added services such as technical support, regulatory compliance, and supply chain solutions.

- Notable Features: Univar Solutions is known for its strategic partnerships with leading manufacturers, enabling it to provide high-quality, innovative products to its clients.

- 2023 Revenue (approx.): $12 billion

- Market Share (approx.): 5-7%

- Global Presence: The company has a wide global footprint, with operations in over 100 countries.

IMCD N.V.

- Specialization: IMCD focuses on the distribution of specialty chemicals and food ingredients, emphasizing value-added services such as technical advice, logistics, and regulatory support.

- Key Focus Areas: The company serves industries like automotive, electronics, food & beverage, personal care, and pharmaceuticals.

- Notable Features: IMCD is recognized for its strong technical expertise and ability to customize solutions to meet specific customer needs.

- 2023 Revenue (approx.): $4 billion

- Market Share (approx.): 3-5%

- Global Presence: IMCD operates in more than 50 countries across Europe, the Americas, and Asia-Pacific.

Nexeo Solutions

- Specialization: Nexeo Solutions specializes in the distribution of chemicals and plastics, providing products for industrial and consumer applications.

- Key Focus Areas: It focuses on chemicals used in industries such as automotive, food, healthcare, and packaging.

- Notable Features: Nexeo Solutions offers a broad portfolio of chemical products with a strong focus on sustainability and environmentally friendly solutions.

- 2023 Revenue (approx.): $4 billion

- Market Share (approx.): 2-4%

- Global Presence: The company has a solid presence in North America and Europe, with expansion into the Asia-Pacific region.

Azelis Holdings S.A.

- Specialization: Azelis is a leading distributor of specialty chemicals and food ingredients, serving industries such as personal care, life sciences, and industrial chemicals.

- Key Focus Areas: The company focuses on offering tailored solutions to clients, with a strong emphasis on technical expertise and customer service.

- Notable Features: Azelis is known for its focus on sustainability and innovation, offering eco-friendly and high-performance chemical products.

- 2023 Revenue (approx.): $4.5 billion

- Market Share (approx.): 2-4%

- Global Presence: Azelis operates in over 45 countries worldwide, with a presence in Europe, North America, Asia, and Africa.

Leading Trends in the Chemical Distribution Market

The chemical distribution market is evolving, influenced by various global and regional trends. Key trends include:

1. Sustainability and Green Chemistry

- As sustainability becomes a central concern for industries worldwide, chemical distributors are increasingly focusing on offering environmentally friendly products and promoting green chemistry. This includes eco-friendly alternatives to traditional chemicals, along with the implementation of sustainable practices in operations and logistics.

2. Digitization and Automation

- Chemical distributors are adopting digital tools and automation to streamline operations, improve efficiency, and enhance customer service. The rise of e-commerce platforms and digital solutions enables easier access to chemicals and simplifies supply chain management.

3. Regulatory Compliance and Safety

- The demand for regulatory compliance and safety standards has increased, especially in the pharmaceutical and food sectors. Distributors are focusing on providing products that meet stringent international and local regulations, including REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and GHS (Globally Harmonized System of Classification and Labeling of Chemicals).

4. Mergers and Acquisitions

- The chemical distribution market has seen an increase in mergers and acquisitions as companies look to expand their global footprint, enhance their product portfolios, and achieve economies of scale. For example, Brenntag’s acquisition of Nexeo Solutions helped the company strengthen its position in North America and expand its specialty chemicals business.

5. Supply Chain Optimization

- With the global supply chain disruptions caused by the pandemic, chemical distributors have become more focused on optimizing supply chains. This includes implementing advanced supply chain management techniques and improving logistics to reduce lead times and avoid disruptions.

Regional Analysis of the Chemical Distribution Market

The chemical distribution market is highly globalized, but certain regions have distinct characteristics and dynamics. Key regional insights include:

1. North America

- North America is a significant player in the chemical distribution market, driven by the presence of key industrial sectors such as pharmaceuticals, agriculture, and automotive. Companies like Univar Solutions and Brenntag have a strong presence in the region. Government policies promoting sustainability and environmental regulations have also pushed chemical distributors to focus on greener chemicals and safety standards.

2. Europe

- Europe has a well-established chemical distribution market, with countries like Germany, France, and the UK being key players. The region’s emphasis on sustainability and stringent regulatory standards, such as REACH, has shaped the market. Companies such as IMCD and Azelis are significant distributors in the European market.

3. Asia-Pacific

- The Asia-Pacific region is the fastest-growing market for chemical distribution, driven by rapid industrialization and growing demand from emerging economies like China and India. The region’s diverse manufacturing sectors, including electronics, textiles, and automotive, create a high demand for chemicals. The market is also witnessing an increased focus on environmental regulations, with countries like Japan and South Korea pushing for eco-friendly solutions.

4. Latin America

- Latin America’s chemical distribution market is expanding due to increased industrial activities and growing demand for chemicals in agriculture, manufacturing, and food & beverage. The region is increasingly focusing on regulatory compliance, which is driving the demand for safer chemicals.

5. Middle East & Africa

- The Middle East and Africa have a significant presence in the chemical distribution market due to their oil and gas industries, which are a major source of petrochemicals. Companies are focusing on sustainability initiatives, improving supply chain efficiency, and meeting regulatory requirements in this region.

Government Initiatives and Policies Shaping the Market

Government policies play a significant role in shaping the chemical distribution market by promoting sustainability, regulating chemical safety, and fostering international trade. For instance:

- Sustainability Initiatives: Governments in Europe, North America, and Asia are enforcing stricter environmental regulations to promote green chemistry, recycling, and the reduction of hazardous chemicals.

- Safety Standards: Regulatory bodies like OSHA in the U.S. and REACH in Europe are enforcing safety standards, making it imperative for distributors to comply with the latest regulations in handling and distributing chemicals.

- Trade Policies: Trade agreements and tariffs impact chemical distribution, especially for cross-border trade. Policies that ease trade between regions boost the market’s global connectivity.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Materials Informatics Market Trends, Top Companies, and Insights 2024 – 2033