Breast Cancer Drugs Market Growth Trends, Size & Revenue Outlook 2025–2034

Breast Cancer Drugs Market Size

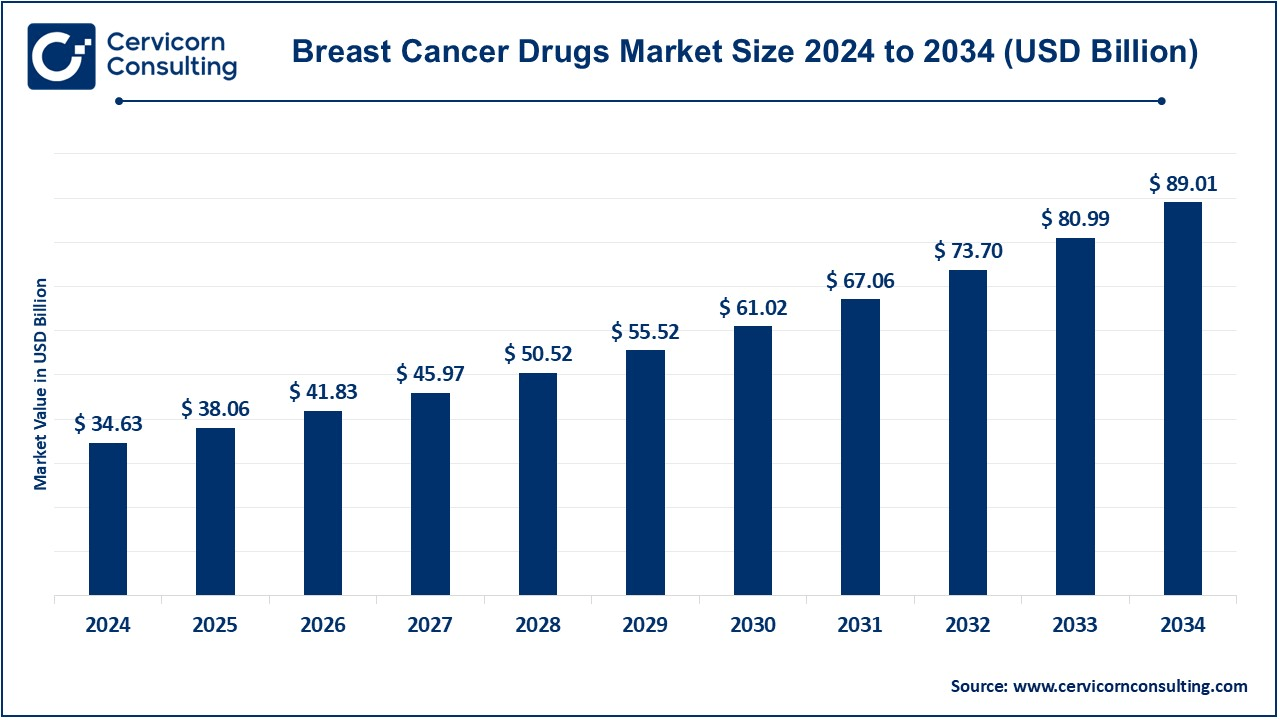

The global breast cancer drugs market size was worth USD 34.63 billion in 2024 and is anticipated to expand to around USD 89.01 billion by 2034, registering a compound annual growth rate (CAGR) of 9.90% from 2025 to 2034.

Breast Cancer Drugs Market Growth Factors

The breast cancer drugs market is fueled by several converging forces: rising global incidence due to aging populations and lifestyle changes; innovation in targeted therapies such as CDK4/6 inhibitors and antibody-drug conjugates (ADCs); approvals of novel drugs like Enhertu and Camizestrant; supportive government screening initiatives; a shift from inpatient to outpatient therapy; increasing uptake of biosimilars; and regulatory incentives that accelerate approval timelines. These dynamics are collectively driving a robust expansion in the market, which is projected to nearly double over the coming decade.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2572

What Is the Breast Cancer Drugs Market?

The breast cancer drugs market includes all pharmaceuticals developed for the treatment of breast cancer. This spans drug classes such as targeted therapies (e.g., HER2 inhibitors, CDK4/6 inhibitors), hormonal therapies (e.g., aromatase inhibitors), ADCs, immunotherapies, and chemotherapies. It covers R&D, clinical trials, manufacturing, regulatory approvals, and distribution through hospital and specialty pharmacies. Both global and regional pharmaceutical players contribute to this space, offering branded, generic, and biosimilar products.

Why Is the Market Important?

- Rising Disease Burden: Breast cancer is the most commonly diagnosed cancer among women globally, accounting for millions of new cases annually.

- Therapeutic Innovation: Recent drug innovations have significantly improved patient survival and quality of life.

- Economic Impact: The market generates tens of billions in revenue annually, supporting public and private investments.

- Healthcare Policy Influence: Drug access and affordability are influenced by national reimbursement programs and regulatory decisions.

- Advancing Research: The market is a hub for R&D collaboration, enabling continued innovation and precision medicine.

Market Size & Forecast

- The global breast cancer drugs market was valued at approximately USD 34.25 billion in 2024 and is expected to reach over USD 80 billion by 2033, reflecting an approximate CAGR of 8.9%.

- Other forecasts project the market reaching USD 90 billion by 2030, growing at 12–13% CAGR.

- By region: North America holds about 37–39% market share, followed by Europe with 25–30%. The Asia-Pacific region is the fastest growing, with countries like China and India experiencing growth rates of 9–16%.

Breast Cancer Drugs Market – Top Companies (2024 Snapshot)

| Company | Specialization | Focus Areas | Key Products | 2024 Revenue (Total) | Market Share (Est.) | Global Reach |

|---|---|---|---|---|---|---|

| Roche | HER2+, ADCs, Diagnostics | HER2-targeted therapy, oral SERD pipeline | Perjeta, Kadcyla, giredestrant | ~$68B | ~12% | Global |

| Novartis | CDK4/6 inhibitors | HR+/HER2– segment | Kisqali (ribociclib) | ~$50B+ | ~8% | Global |

| AstraZeneca | ADCs, SERDs | HER2-low, ER+ disease | Enhertu, Camizestrant | ~$54B | ~10% | Global |

| Eli Lilly | CDK4/6 inhibitors | Hormone-resistant disease | Verzenio (abemaciclib) | ~$30B | ~5% | Americas, Europe, Asia |

| Pfizer | CDK inhibitors, immuno-oncology | TNBC, HR+/HER2– | Ibrance, Trodelvy | ~$60B | ~8% | Global |

These companies together represent roughly 45–50% of global breast cancer drug revenue. Their dominance is due to robust product portfolios, international presence, and active R&D pipelines.

Leading Trends & Their Impact

- Antibody–Drug Conjugates (ADCs)

ADCs such as Enhertu and Kadcyla are among the fastest-growing drug classes, delivering cytotoxic agents directly to cancer cells with minimal off-target effects. - CDK4/6 Inhibitor Expansion

Oral CDK inhibitors like Ibrance, Kisqali, and Verzenio are now standard of care in HR+/HER2– disease, both in metastatic and early-stage settings. - Oral SERDs in Development

Next-generation selective estrogen receptor degraders such as giredestrant and Camizestrant aim to improve outcomes and convenience in ER+ breast cancer. - Personalized Medicine

Companion diagnostics and biomarker-driven drug selection are increasingly used to tailor treatment, improving outcomes and minimizing unnecessary side effects. - Triple-Negative Breast Cancer (TNBC) Advances

Immunotherapy and ADCs are transforming treatment options in this aggressive subtype with previously limited therapies. - Growth of Biosimilars

Biosimilars of trastuzumab and other agents have significantly lowered treatment costs and expanded access in developing and developed markets. - Regulatory and Pricing Pressures

Health technology assessment agencies and payer restrictions are shaping drug pricing and reimbursement decisions, particularly in Europe and Asia. - Geographic Expansion

The Asia-Pacific region—led by China and India—is emerging as a key growth frontier due to rising cancer awareness, healthcare investments, and local drug manufacturing.

Successful Examples Worldwide

- Enhertu: A HER2-directed ADC achieving rapid global uptake and approval in both HER2+ and HER2-low subtypes.

- Kisqali: Expanded to adjuvant HR+/HER2– breast cancer based on strong survival benefits.

- Trastuzumab Biosimilars: Widely adopted in North America, Europe, and emerging markets to drive down treatment costs.

- Camizestrant: An oral SERD showing strong progression-free survival in ER+ breast cancer clinical trials.

- Trodelvy: Approved for use in triple-negative breast cancer, offering new hope in late-stage settings.

Global Regional Analysis & Government Initiatives

North America

- Dominant market share driven by early adoption of new therapies, strong reimbursement infrastructure, and R&D leadership.

- High drug prices balanced by insurance coverage and patient-assistance programs.

- FDA fast-track approvals and national advocacy campaigns support innovation and access.

Europe

- Stringent health technology assessments impact pricing and market entry timelines.

- Wide adoption of biosimilars.

- National genomics programs and centralized drug procurement in countries like the UK and Germany support evidence-based access.

Asia-Pacific

- Fastest-growing regional market driven by increasing healthcare expenditure, cancer awareness campaigns, and local clinical trials.

- Government-led cancer detection and treatment programs expanding reach.

- India and China represent major growth engines, with strong generic manufacturing and regulatory modernization.

Latin America

- Modest market size but growing due to improving cancer care infrastructure in Brazil, Mexico, and Argentina.

- Government partnerships with global NGOs and pharma companies are expanding access to essential therapies.

Middle East & Africa

- Growth hindered by limited healthcare infrastructure but supported by increasing public-private partnerships.

- Gradual entry of biosimilars and global access programs helping reduce treatment gaps.

Conclusion

The breast cancer drugs market is undergoing a dynamic transformation. Innovative therapies such as ADCs, CDK inhibitors, and oral SERDs are improving outcomes and reshaping treatment standards. As precision medicine becomes mainstream, the role of diagnostics and biomarkers will only increase. With North America leading in market size, and Asia-Pacific driving growth, stakeholders across the pharmaceutical value chain—from R&D to access—must stay adaptive to regulatory, technological, and demographic shifts. Companies that can balance scientific innovation with affordability and global access will shape the next era of cancer care.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Healthcare CRM Market Projected to More Than Double by 2034