Brain-Computer Interface Market Revenue, Global Presence, and Strategic Insights by 2034

Brain-Computer Interface Market Size

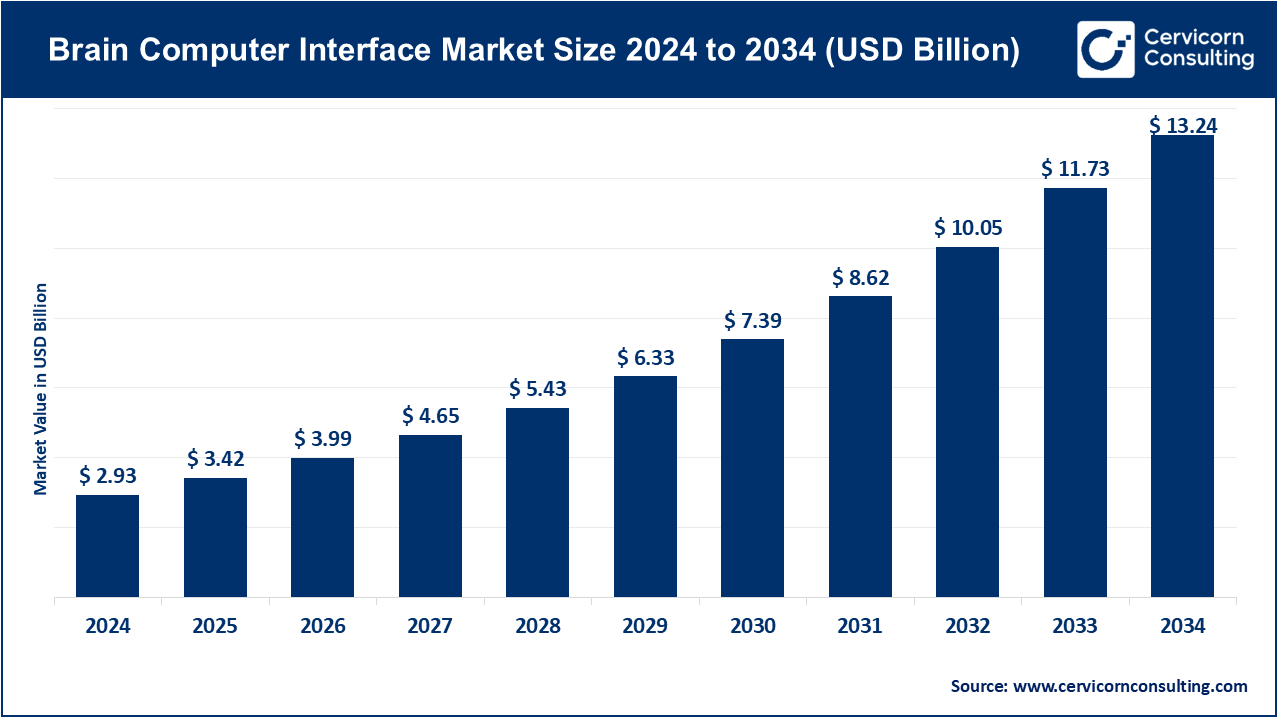

The global brain computer interface market size was worth USD 2.93 billion in 2024 and is anticipated to expand to around USD 13.24 billion by 2034, registering a compound annual growth rate (CAGR) of 16.28% from 2025 to 2034.

What Is the Brain-Computer Interface Market?

The brain-computer interface market covers the technologies, devices, software, and services that capture brain signals, interpret them using algorithms, and translate them into actionable outputs such as communication commands, robotic movement, neurofeedback, or stimulation. The market includes:

- Non-invasive BCIs: EEG headsets, fNIRS devices, wearable neural sensors, neurofeedback systems.

- Partially invasive BCIs: ECoG (electrocorticography) devices.

- Fully invasive BCIs: Implantable neural probes, microelectrode arrays, deep brain interaction systems.

- Software ecosystems: AI-based signal decoding platforms, neuroanalytics dashboards, cloud neurotech solutions.

- Clinical and research services: Hospital neurodiagnostics, rehabilitation centers, academic neuroengineering labs.

Users span hospitals, research institutes, medtech companies, defense organizations, gaming/wellness tech firms, prosthetics developers, and neurorehabilitation centers.

By 2024, the global BCI industry had already crossed the multi-billion-dollar threshold, driven by accelerating commercialization, expanding medical needs, and huge interest in neurotechnology from private investors and governments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2412

Why Is the BCI Market Important?

The BCI market is important for several key reasons:

1. Healthcare transformation

BCIs can help restore lost functions for individuals with paralysis, ALS, spinal cord injuries, stroke, or communication impairments. They enable:

- Mind-controlled prosthetics

- Neural-enabled communication

- Epilepsy monitoring

- Cognitive assessment

- Early detection of neurological disorders

This places BCIs among the most promising technologies in modern medicine.

2. Enhancing human capabilities

Outside healthcare, BCIs are opening new frontiers:

- Cognitive performance monitoring

- Immersive gaming and VR interaction

- Brain-based authentication

- Workflow optimization and fatigue monitoring

3. Research acceleration

Advanced BCI tools allow neuroscientists to gather high-resolution neural data, enabling breakthroughs in brain mapping, brain disorders, and neurotherapies.

4. Economic & industrial significance

BCI development involves medtech, semiconductors, biotech, AI, cloud platforms, robotics, and sensors — making it a growth engine for multiple sectors.

Brain-Computer Interface Market Growth Factors

The BCI market’s growth is driven by rising neurological disorders worldwide, growing demand for neurorehabilitation solutions, rapid advancements in electrode materials and neural sensing technology, breakthroughs in machine learning-based signal decoding, increased government and private investment in neurotechnology, expanding adoption of non-invasive BCIs for consumer and enterprise applications, growing availability of clinical trial data validating safety and efficacy, miniaturization of sensors enabling wearable BCIs, integration with robotics and prosthetics, and supportive regulatory pathways for neuromodulation and neural monitoring devices. Together, these factors are significantly accelerating clinical translation, commercialization, and widespread adoption across healthcare, research, and consumer sectors.

Top Companies in the Brain-Computer Interface Market

1. Compumedics Ltd

Specialization:

Neurodiagnostic and sleep diagnostic systems, including EEG, MEG, and clinical monitoring tools.

Key Focus Areas:

Clinical EEG systems, magnetoencephalography, sleep diagnostics, cloud-based neurodiagnostic SaaS platforms.

Notable Features:

- High-end hospital-grade systems

- Strong presence in neurology departments and sleep labs

- Integrated neurodiagnostic software suite

2024 Revenue:

Approximately AUD 49.7 million (group revenue).

Market Position:

Recognized leader in clinical EEG and sleep diagnostics; strong adoption in hospitals and research.

Global Presence:

Operations across Australia, Europe, the U.S., Asia-Pacific, and Latin America.

2. g.tec Medical Engineering GmbH

Specialization:

Advanced BCI solutions for research and clinical applications.

Key Focus Areas:

Real-time neural decoding, invasive and non-invasive BCI systems, neurorehabilitation, closed-loop stimulation technologies.

Notable Features:

- Modular BCI systems widely used in neuroscience research

- Biofeedback and motor recovery applications

- Industry-leading research-grade toolkits

2024 Revenue:

Privately held; revenues estimated in the small-to-mid multi-million range.

Market Position:

A leading research-focused neurotechnology provider with strong scientific credibility.

Global Presence:

Headquartered in Austria with distribution channels across Europe, North America, and Asia.

3. Natus Medical Inc.

Specialization:

Neurodiagnostics, newborn care, EEG/EMG/ICP monitoring, and NICU technologies.

Key Focus Areas:

Epilepsy monitoring, neurological diagnostics, newborn screening, hospital-grade EEG systems.

Notable Features:

- Large installed base in global hospitals

- Comprehensive neurodiagnostic portfolio

- Strong clinical software integrations

2024 Revenue:

Hundreds of millions in total revenue; BCI-related segments not disclosed separately.

Market Position:

One of the most established clinical neurodiagnostics companies globally.

Global Presence:

Extensive operations throughout the U.S., Europe, China, and emerging markets.

4. Medtronic plc

Specialization:

Global medical technology leader with deep expertise in neuromodulation and neuroscience.

Key Focus Areas:

Deep brain stimulation (DBS), implantable neurostimulation devices, neurological disease therapies.

Notable Features:

- Among the largest medical device companies in the world

- Industry leadership in implantable neural interfaces

- Millions of patients treated with Medtronic neurotech systems

2024 Revenue:

Neuroscience segment alone: approx. USD 9.4 billion (segment revenue).

Market Position:

Dominant clinical neurotech provider; foundational infrastructure for invasive BCI-related technologies.

Global Presence:

Truly global — North America, Europe, APAC, Latin America, Middle East, and Africa.

5. Advanced Brain Monitoring Inc. (ABM)

Specialization:

Portable EEG systems, cognitive monitoring, ambulatory neural assessment tools.

Key Focus Areas:

Sleep research, neurocognitive assessment, mobile EEG, fatigue monitoring, cognitive health research tools.

Notable Features:

- Lightweight, wearable EEG systems

- Strong presence in applied neuroscience and human performance studies

- Used in both clinical and commercial research environments

2024 Revenue:

Estimated at around USD ~8 million annually.

Market Position:

Small but highly specialized neurotech provider with strong R&D credentials.

Global Presence:

U.S.-based with customers across academia, research institutes, and global neuroscience programs.

Leading Trends in the Brain-Computer Interface Market and Their Impact

1. Transition from Lab Demonstrations to Clinical Use

BCIs are rapidly moving into formal clinical trials for communication, motor restoration, and sensory feedback. This significantly increases validation and regulatory readiness.

2. Growth in Non-Invasive Consumer BCIs

Improved EEG sensors and AI-driven algorithms have enabled:

- Meditation/wellness headsets

- Focus/attention trackers

- Brain-controlled games

- Digital therapeutics

This trend increases market size and familiarity among general users.

3. Advances in Material Science & Microelectronics

Flexible electrodes, neural mesh systems, nano-coated probes, and ultra-low-power chips are enabling safer implants and higher signal quality.

4. AI & Machine Learning Integration

Neural decoding accuracy is improving dramatically thanks to deep learning, enabling faster and more reliable command interpretation.

5. Increased Regulatory and Ethical Frameworks

Governments and medical agencies are developing guidelines on:

- Neural data privacy

- Long-term implant safety

- Informed consent

- BCI clinical trial management

This adds discipline and trust to the commercial ecosystem.

Impact:

These trends collectively speed up commercialization, increase consumer and clinical acceptance, and broaden the addressable market while reinforcing the need for responsible neurotechnology governance.

Successful Examples of BCIs Around the World

Clinical Successes

- Paralyzed individuals controlling robotic arms through implanted microelectrode arrays.

- ALS patients using non-invasive EEG-based communication systems.

- Stroke patients regaining motor function through BCI-driven neurorehabilitation.

Neuroprosthetics & Neuromodulation

- Deep brain stimulation systems improving mobility for Parkinson’s disease patients.

- Epilepsy management systems using brain-signal-driven stimulation patterns.

Hospital Neurodiagnostics

- EEG and MEG systems from Compumedics and Natus deployed globally in epilepsy centers and sleep labs.

Industry/Enterprise Applications

- EEG-based fatigue monitoring for industrial safety.

- Cognitive workload assessment in aviation and defense research labs.

Together, these real-world deployments illustrate the broad value of BCIs beyond experimental demos.

Global & Regional Brain-Computer Interface Market Analysis

United States

The U.S. leads in BCI innovation thanks to:

- The NIH BRAIN Initiative

- Strong venture funding

- Presence of top universities and medtech companies

- Mature FDA regulatory pathways

Policies encourage neuroscience research, human trials, and innovation in neurotherapeutics.

Europe (EU + UK)

Europe is characterized by:

- Horizon Europe grants

- National neuroscience initiatives

- Emphasis on ethics, safety, and responsible innovation

- Strong presence of neurodiagnostic manufacturers and research labs

Countries such as Germany, France, the UK, Switzerland, and the Netherlands invest heavily in clinical neurotechnology.

China

China has positioned neurotechnology as a strategic industry, with:

- National guidelines promoting brain science

- Fast-moving industrial policy

- Significant funding for BCI startups and R&D centers

- Rapid trial expansion in medical and non-medical BCIs

China’s large patient population and centralized policy framework help accelerate adoption.

Japan, South Korea, Singapore & APAC

Key strengths include:

- Advanced robotics integration

- High healthcare technology adoption

- National interest in neurorehabilitation and ageing populations

- Growing private-sector neurotech investments

Japan’s robotics leadership makes it a strong candidate for BCI-robotics integration.

Middle East & Latin America

These regions are emerging markets increasingly investing in:

- High-end hospital neurodiagnostics

- Medical tourism

- Research collaborations with Western institutions

Growth is moderate but accelerating as healthcare modernization increases.

Additional Market Challenges

Technical challenges

- Long-term electrode durability

- Noise reduction in non-invasive sensing

- Real-time decoding latency

Regulatory hurdles

- Complex approval process for implantable devices

- Need for long-term safety and efficacy data

Ethical considerations

- Privacy of neural data

- Risk-benefit analysis for elective uses

- Inequitable access to advanced neurotechnology

Commercial obstacles

- High R&D costs

- Limited reimbursement pathways

- Slow clinical adoption cycles

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Point-of-Care Diagnostics Market Growth Drivers, Trends, Key Players and Regional Insights by 2034